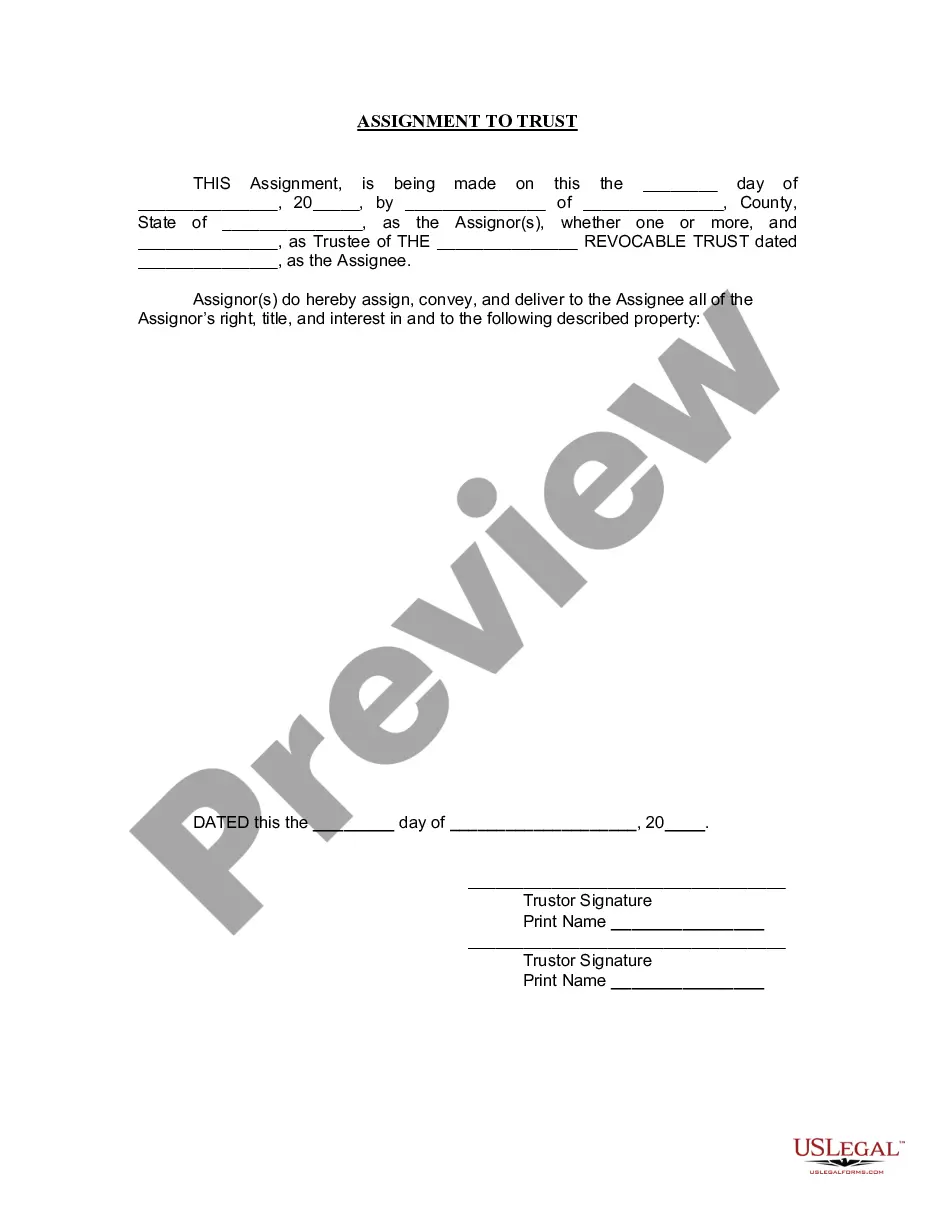

Philadelphia Pennsylvania Assignment to Living Trust

Description

How to fill out Pennsylvania Assignment To Living Trust?

Utilize the US Legal Forms and gain immediate access to whichever document you require.

Our user-friendly platform with a vast collection of templates enables you to locate and acquire nearly any document example you need.

You can download, complete, and authenticate the Philadelphia Pennsylvania Assignment to Living Trust in just a few minutes rather than spending hours searching the Internet for a suitable template.

Employing our library is an excellent method to enhance the security of your document filing.

If you haven’t created an account yet, follow the steps below.

Locate the template you require. Verify that it is the document you were seeking: check its title and description, and use the Preview feature if available. If not, use the Search field to find the right one.

- Our qualified attorneys routinely evaluate all the documents to ensure that the templates are suitable for a specific locale and conform to current laws and regulations.

- How can you access the Philadelphia Pennsylvania Assignment to Living Trust.

- If you possess a subscription, simply sign in to your account. The Download option will be active on all the documents you view.

- Furthermore, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

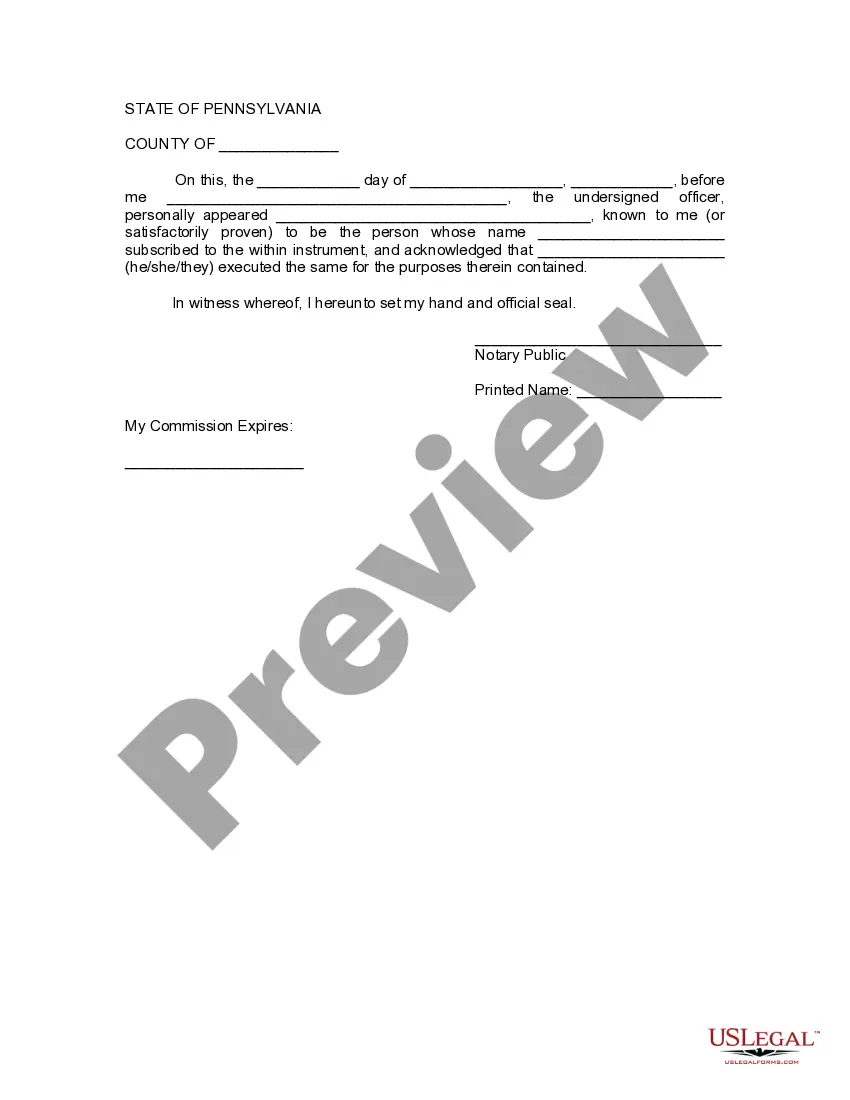

Filling out trust paperwork for a Philadelphia Pennsylvania Assignment to Living Trust can seem daunting, but it is straightforward when you know the steps. First, gather all necessary information about your assets and beneficiaries. Next, utilize a reliable resource like US Legal Forms, which provides templates and guidance tailored to Pennsylvania laws. Finally, carefully review your completed paperwork to ensure accuracy before signing and notarizing the documents.

Setting up a living trust in Pennsylvania is a straightforward process that begins with choosing to create a trust document. You will need to clearly outline the terms of the Philadelphia Pennsylvania Assignment to Living Trust, detailing how your assets should be managed and distributed. After drafting the trust document, you should fund the trust by transferring your properties and assets into it. Using the uslegalforms platform can simplify this process, as it provides easy-to-follow templates and resources tailored to Philadelphia residents.

Considering a Philadelphia Pennsylvania Assignment to Living Trust can be a very wise decision for your parents. Trusts can help protect assets, streamline the transfer process, and reduce estate taxes. However, it's important to evaluate their unique financial situation and intentions. Engaging with professionals from uslegalforms can provide tailored strategies that align with their needs, making the process significantly easier.

A family trust can sometimes lead to complex tax scenarios, especially if the trust generates income. Furthermore, if not properly managed, it can become susceptible to disputes among family members. It’s essential to structure a Philadelphia Pennsylvania Assignment to Living Trust correctly to mitigate these issues and facilitate smooth transitions among family assets. Consulting a professional can greatly aid in avoiding these common pitfalls.

One of the biggest mistakes parents often make is failing to communicate their intentions clearly with their beneficiaries when establishing a trust fund. Without open dialogue, heirs may misunderstand the purpose of the trust, leading to resentment and confusion later on. It is crucial to ensure everyone understands the Philadelphia Pennsylvania Assignment to Living Trust and its benefits for family cohesion. Setting clear guidelines can help avoid conflicts down the road.

While a Philadelphia Pennsylvania Assignment to Living Trust offers many advantages, it can have downsides. One potential issue includes the initial setup costs, which might be higher compared to other estate planning methods. Additionally, you might face restrictions on accessing your assets if the trust terms are not designed with flexibility in mind. However, weighing these factors against the long-term benefits can help you make a more informed decision.

Many people mistakenly believe trusts are bad due to misconceptions about costs and complexities. In reality, a Philadelphia Pennsylvania Assignment to Living Trust can simplify estate management and avoid lengthy probate processes. Trusts actually provide control over your assets, ensuring they are distributed according to your wishes. When properly established, trusts serve as a beneficial tool for many families.