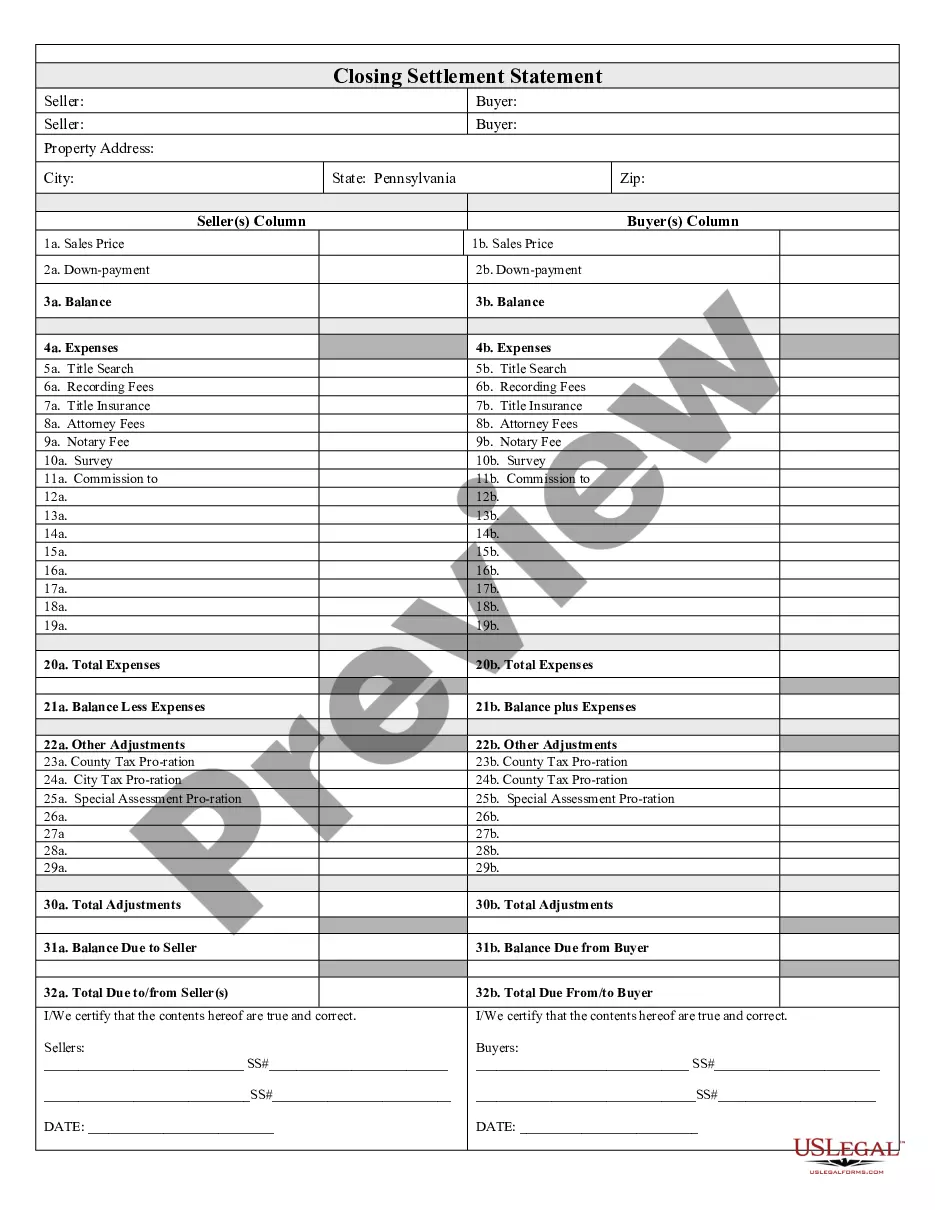

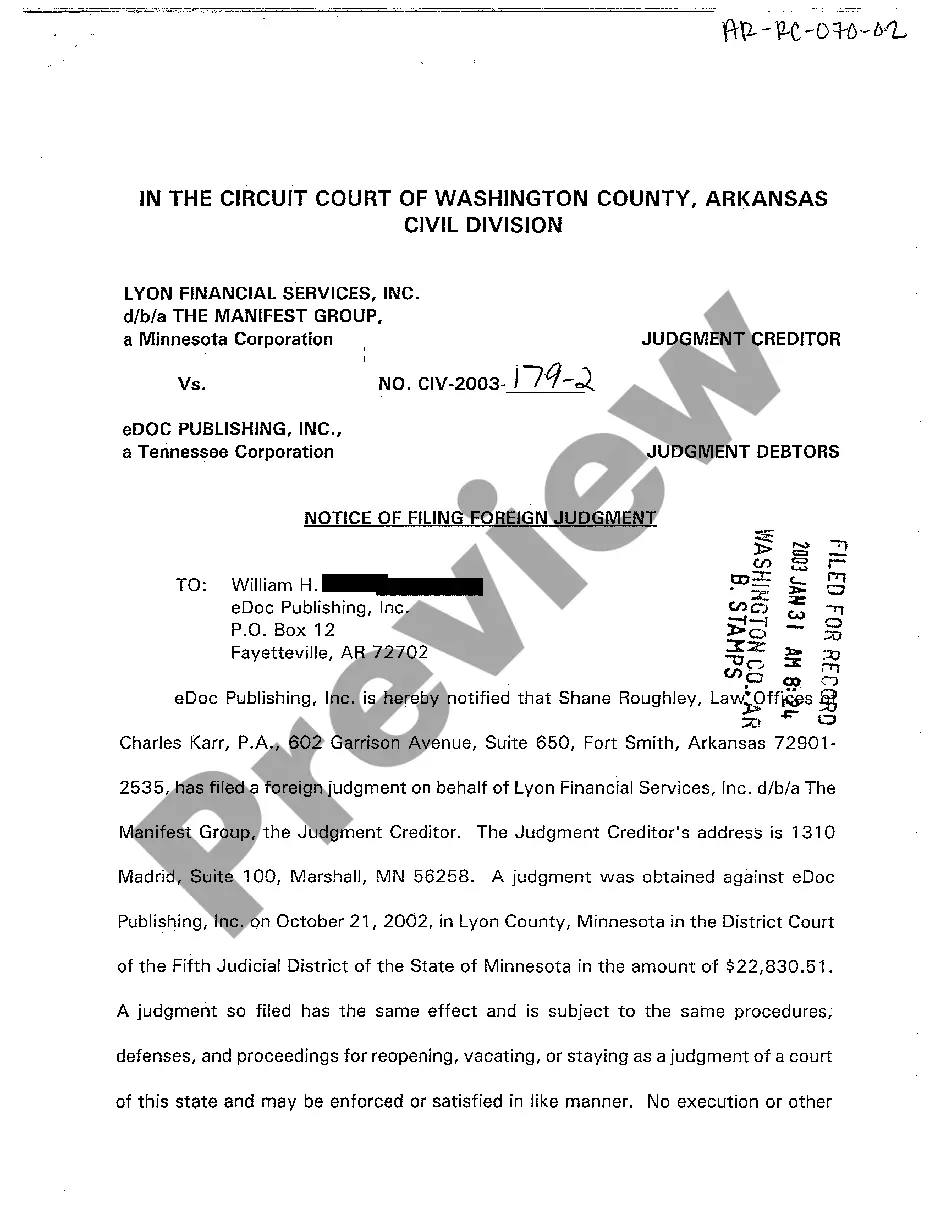

Philadelphia Pennsylvania Closing Statement

Description

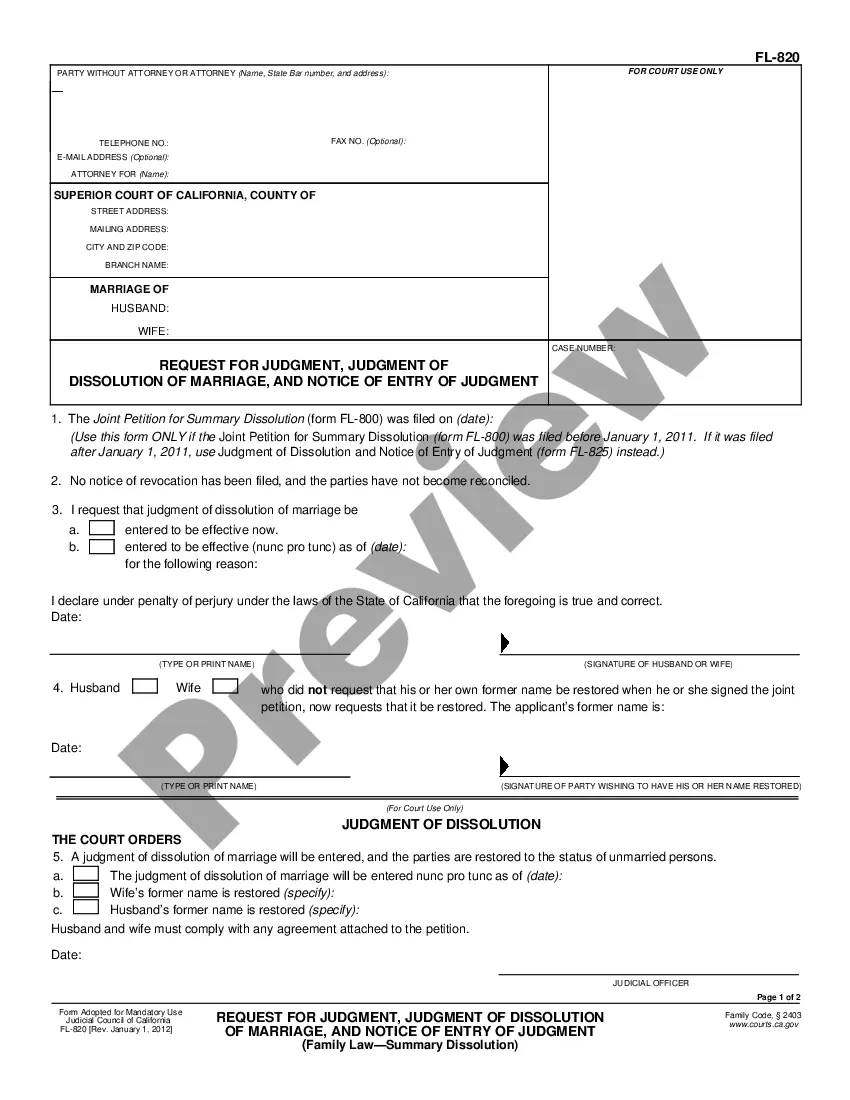

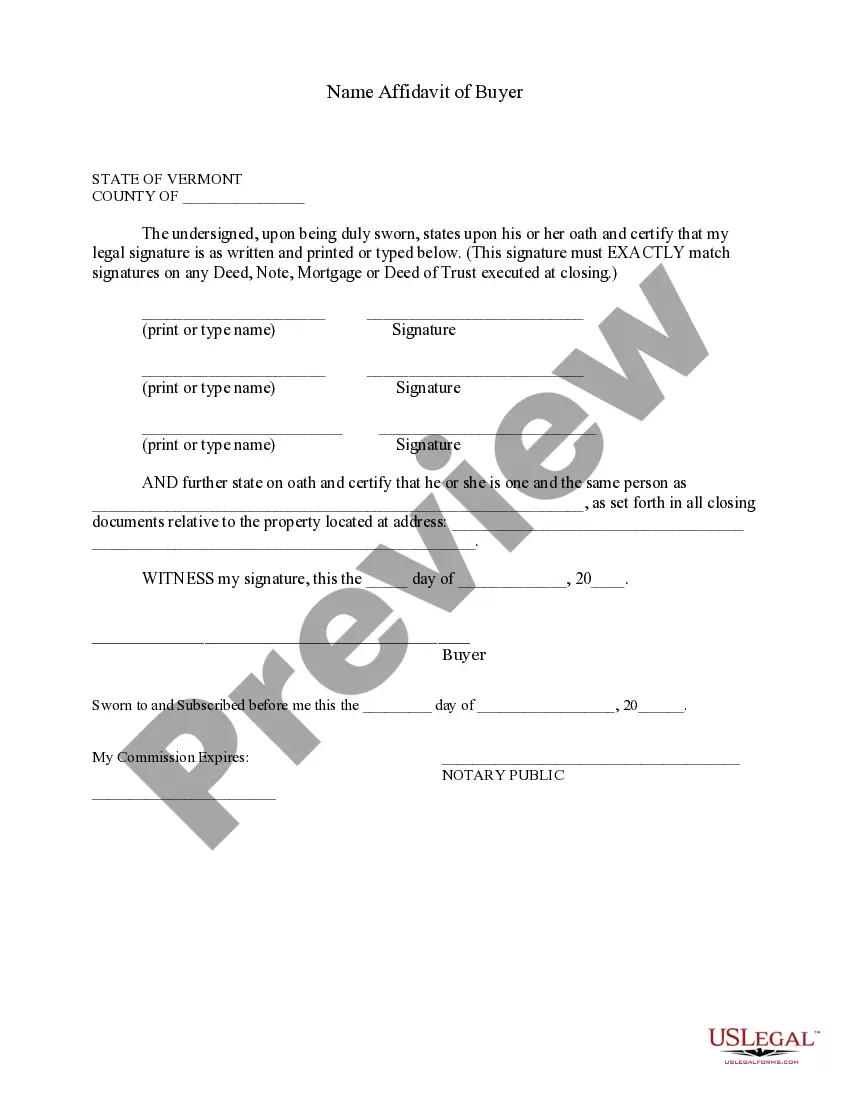

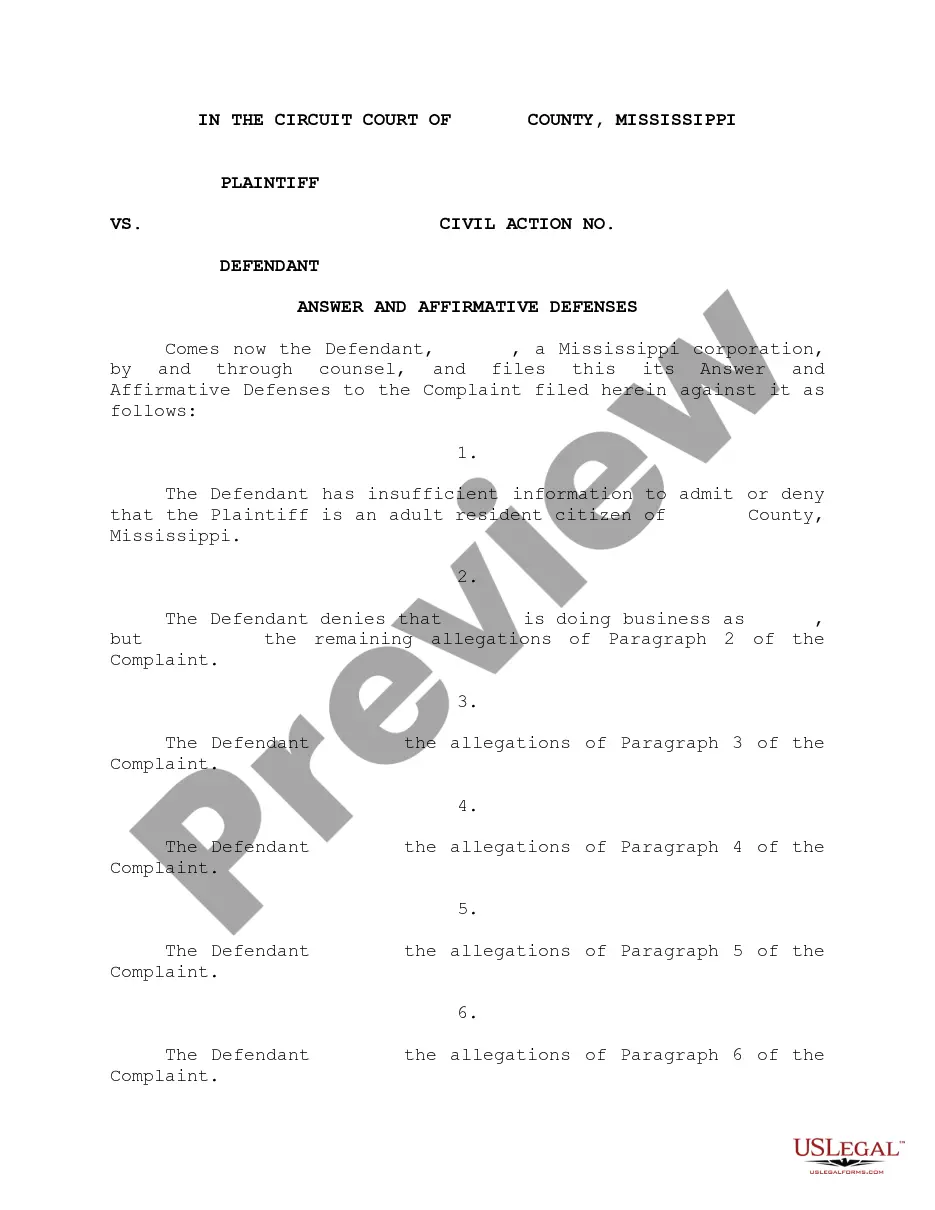

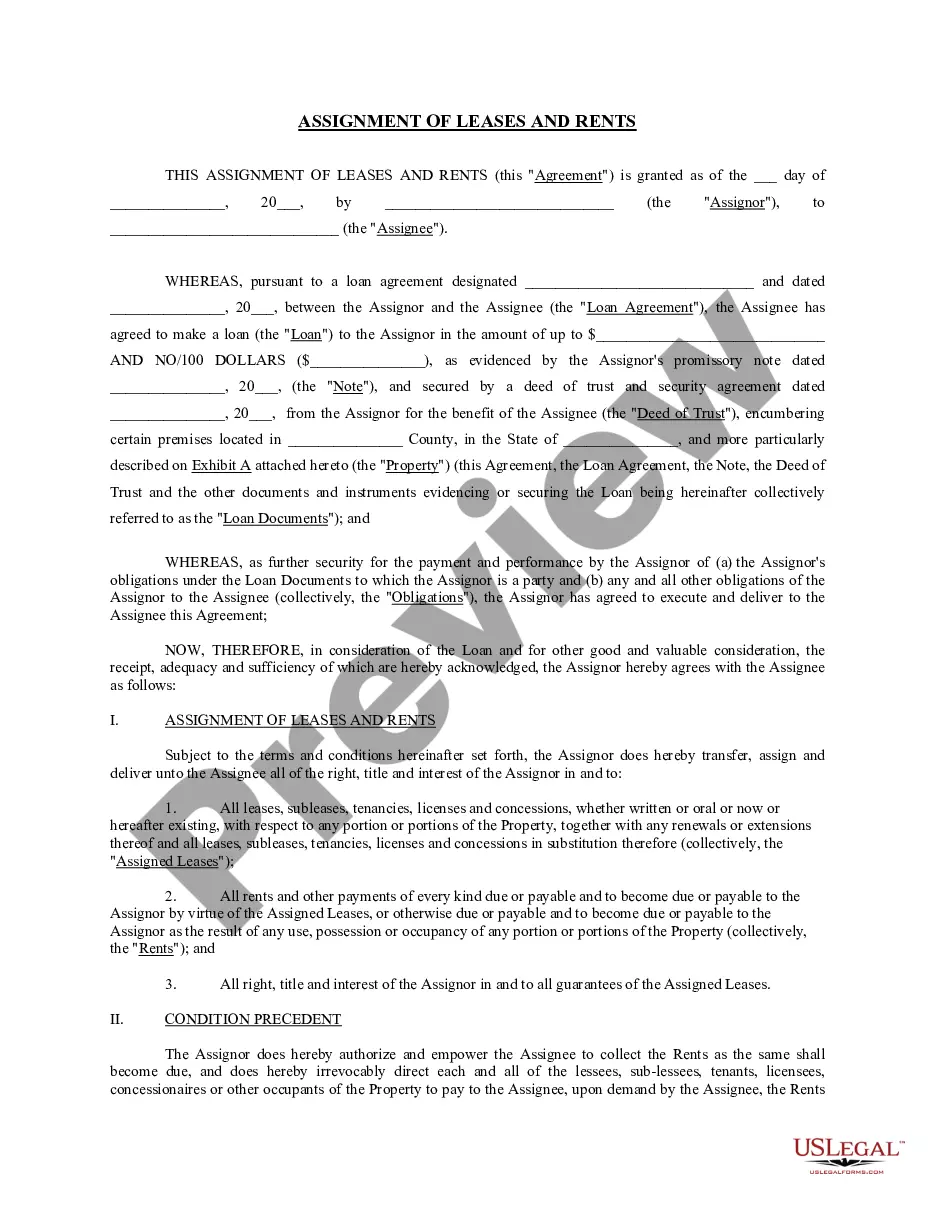

How to fill out Pennsylvania Closing Statement?

We consistently strive to mitigate or avert legal complications when handling intricate legal or financial situations.

To achieve this, we seek legal remedies that are often quite costly.

However, not every legal issue is equally complicated.

Many of them can be addressed by us without professional assistance.

Utilize US Legal Forms whenever you require the Philadelphia Pennsylvania Closing Statement or any other document swiftly and securely. Just Log In to your account and select the Get button beside it. If you misplace the document, you can always re-download it in the My documents section.

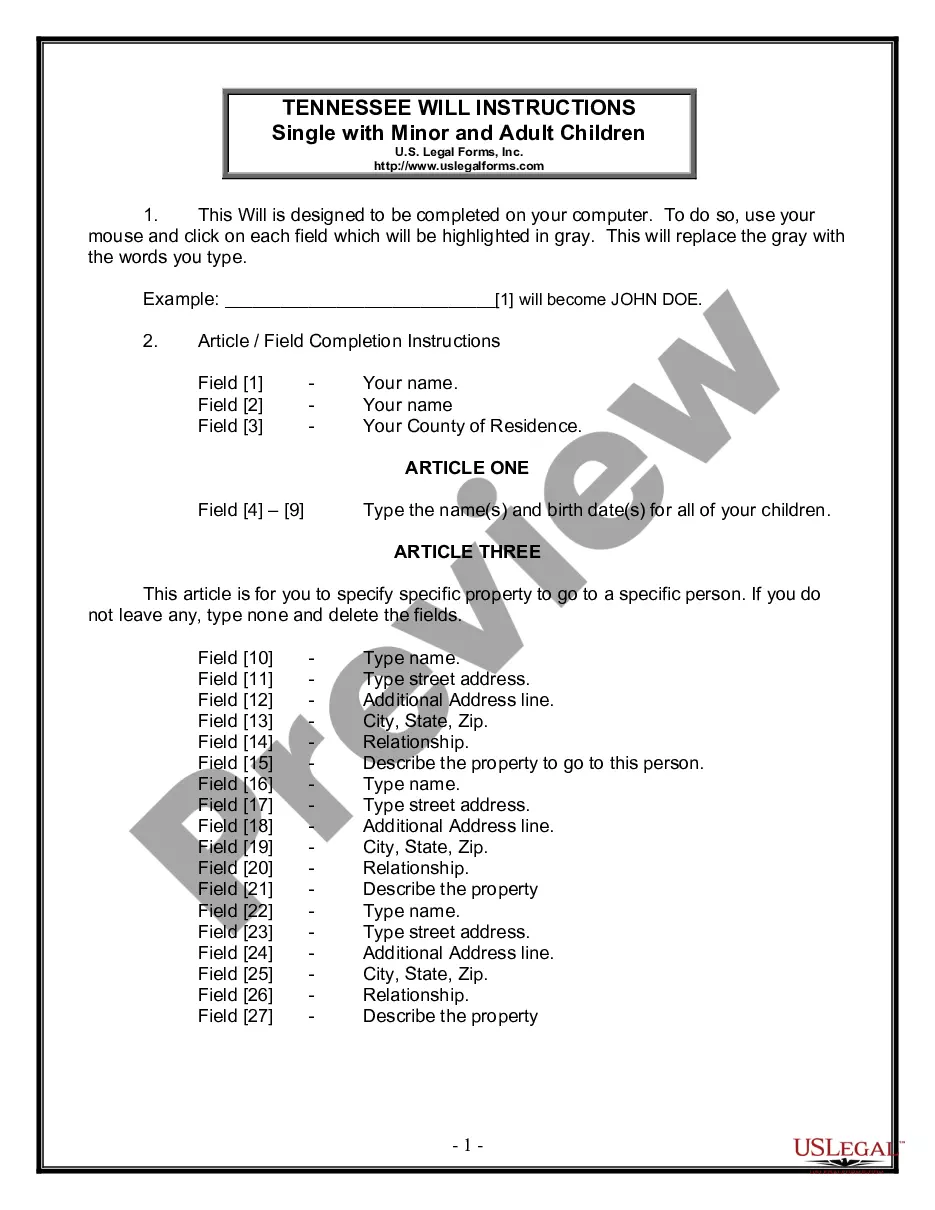

- US Legal Forms is an online repository of current do-it-yourself legal documents encompassing a range of items from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our platform empowers you to manage your affairs independently, eliminating the need for attorney services.

- We provide access to legal document templates that are not always readily available to the public.

- Our templates are tailored to specific states and areas, thereby greatly simplifying the search process.

Form popularity

FAQ

How much are closing costs in Philadelphia? Buyers should expect to pay between four and six percent of their purchase price for closing costs when purchasing a home in Philadelphia. Yes, this sounds like a lot, but it is very common for closing costs to be high in major metropolitan cities.

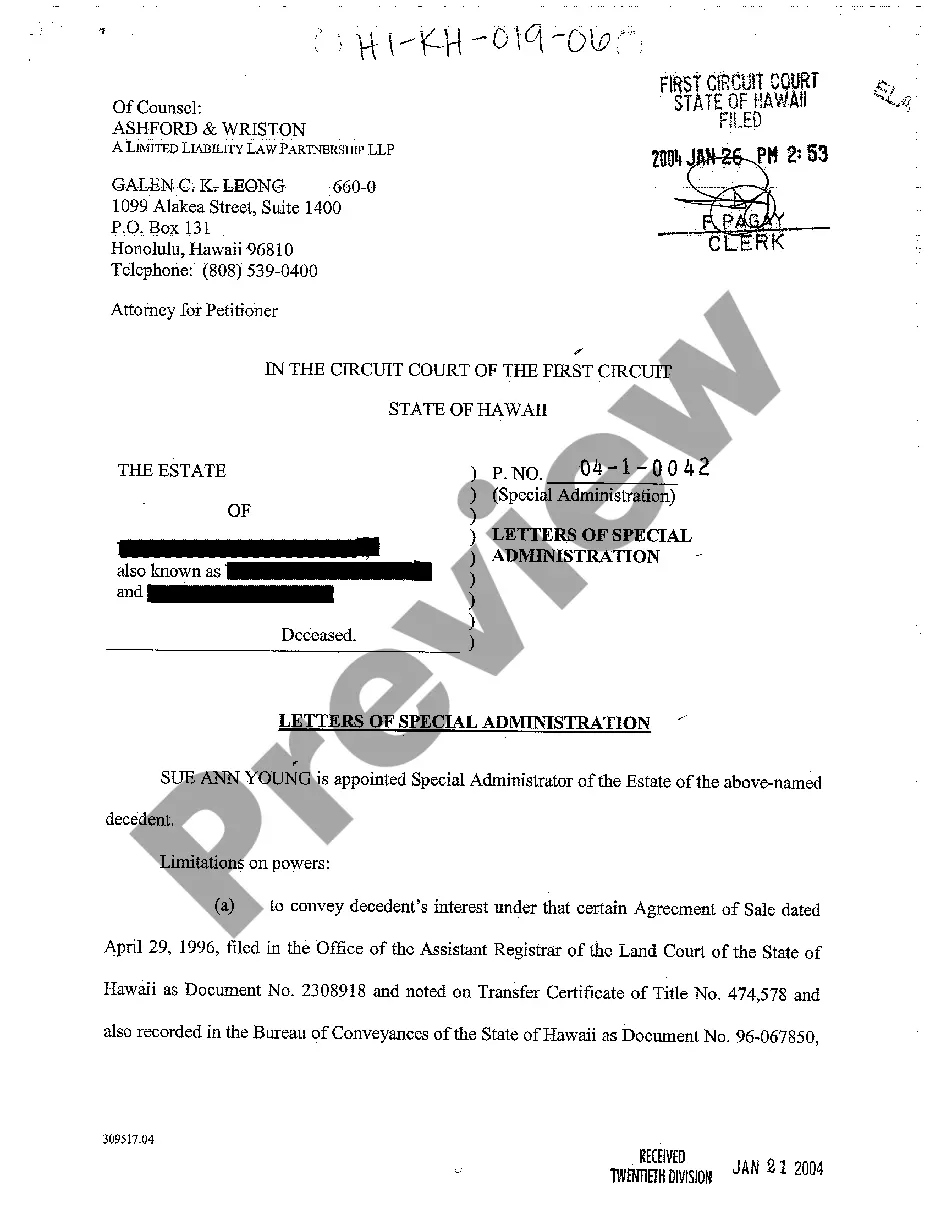

The Court also considered Alabama cases stating that while ?there are certain benefits? from recording certain real property transactions, ?Alabama has no law which requires a mortgagee to record his mortgage.? To the contrary, the Court noted that Alabama law recognizes that a ?deed that is unrecorded is good between

§ 33-412. B. Such unrecorded instruments, as between the parties and their heirs, and as to all subsequent purchasers with notice thereof, or without valuable consideration, shall be valid and binding.

Oklahoma deeds require the following: Upon delivery of the signed and notarized deed to the grantee, the deed becomes effective and is a legally binding document. The deed must be recorded with the county register to notify all third parties that the grantor has released all claims to the property to another individual.

Deeds must be recorded to be fully enforceable against future claims under the New Jersey Recording Act. Recording occurs by filing copies in the county where the property sits.

How can I obtain information on a property/copy of my deed? You may research or request a copy of a property in our public Reference Room located in City Hall, Room 154. Copies of deeds are $2.00 per page.

SECTION 30-7-90. Notice of unrecorded instrument. No possession of real property described in any instrument of writing required by law to be recorded shall operate as notice of such instrument.

Deeds usually do not take effect as to creditors and subsequent purchasers without notice until the instrument is recorded. Thus, unrecorded deeds may be void as to all subsequent creditors and subsequent purchasers without notice until they are filed for record.

Buying or selling a home in Philly doesn't end with paying closing costs, attorney fees, or real estate agent commissions. There's also a 3.27% Philadelphia Realty Transfer Tax to take care of, in addition to a 1% tax from the Commonwealth.

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.