Philadelphia Pennsylvania Individual Credit Application

Description

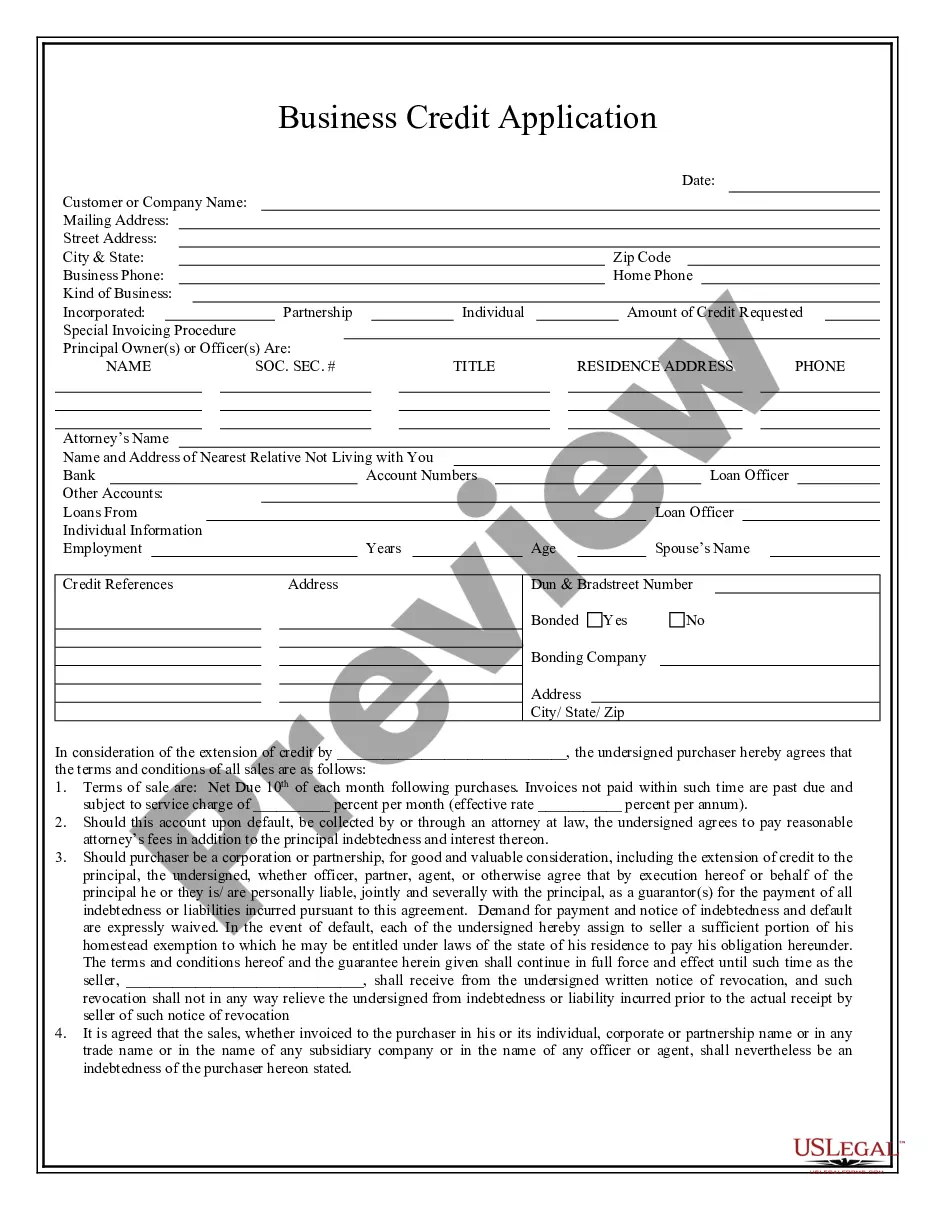

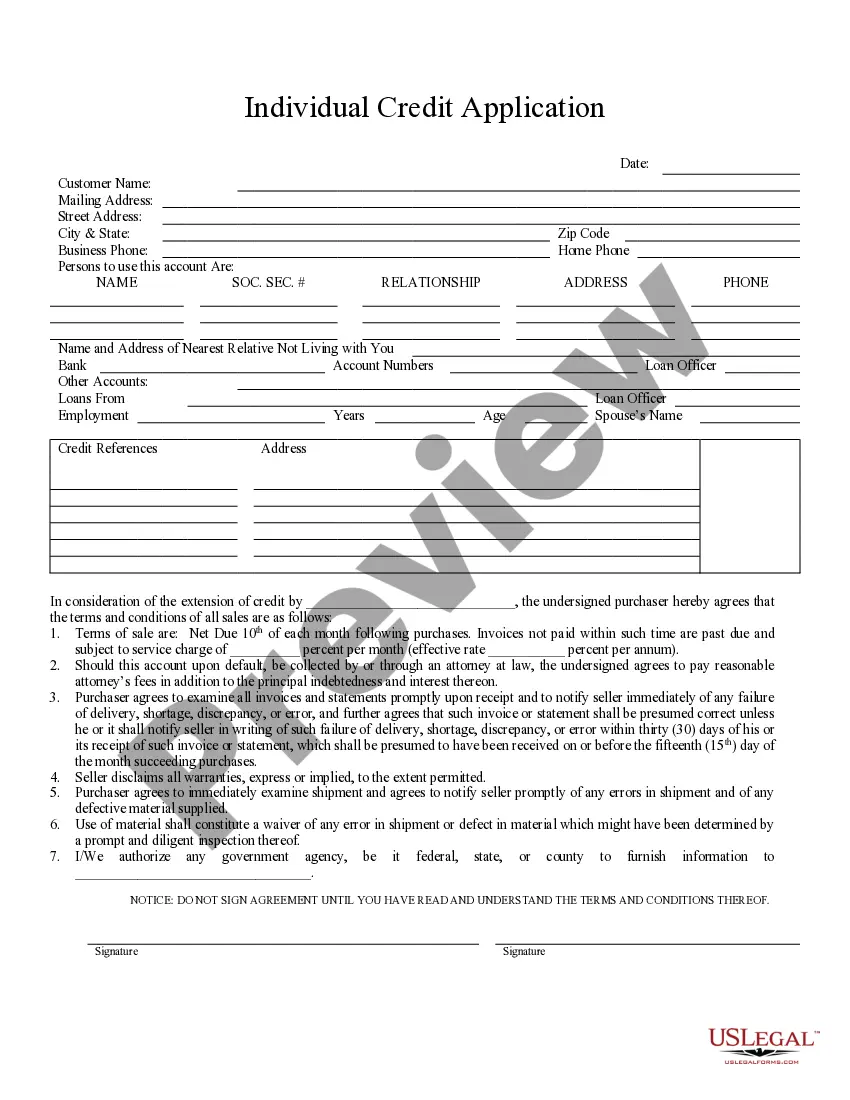

How to fill out Pennsylvania Individual Credit Application?

Finding authorized templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents for both personal and professional purposes and various real-world scenarios.

All the files are appropriately categorized by usage area and jurisdiction, making the search for the Philadelphia Pennsylvania Individual Credit Application as straightforward as 123.

Provide your credit card information or opt for your PayPal account to complete the payment for the service.

- Review the Preview mode and document description.

- Ensure you’ve chosen the correct one that aligns with your needs and complies with your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To become a member of PenFed, you need to meet eligibility criteria that often include military affiliation or family connections. You can also join if you live in certain areas or are employed by select organizations. Once you fulfill these requirements, you can easily complete your Philadelphia Pennsylvania Individual Credit Application and start enjoying the financial benefits that PenFed offers.

Eligibility for the Philadelphia Federal Credit Union (PFCU) typically includes individuals who live, work, or worship in the city of Philadelphia. Additionally, family members of existing members may also apply. Joining PFCU provides access to competitive financial products that can support your financial goals, such as when filling out a Philadelphia Pennsylvania Individual Credit Application.

Not everyone can join a credit union; eligibility generally depends on membership criteria set by each institution. Many credit unions serve specific communities, professions, or organizations. If you meet the requirements, you can benefit from favorable terms on your financial products and services, including those related to a Philadelphia Pennsylvania Individual Credit Application.

Businesses operating in Philadelphia must file the Philadelphia Business Income and Receipts Tax (BIRT) if they earn income within city limits. Even if you're a sole proprietor, you must comply with this requirement. Filing is essential for maintaining good standing in the city and accessing various financial opportunities, including those related to a Philadelphia Pennsylvania Individual Credit Application.

The minimum income needed to qualify for the Earned Income Credit varies depending on your filing status and number of qualifying children. You must earn at least a nominal amount, but the specific qualifying thresholds can change annually. Be sure to consult the Philadelphia Pennsylvania Individual Credit Application for the latest figures and eligibility requirements.

Generally, to qualify for the Earned Income Credit (EIC), you must have earned income. Although there may be exceptions, such as certain disability income, having no earned income typically disqualifies you. It's important to evaluate your situation through the lens of the Philadelphia Pennsylvania Individual Credit Application for accurate guidance.

While you do not necessarily need to earn $2,500 to qualify for the Child Tax Credit, this income level can help unlock the credit's full benefits. If your income is below this threshold, your eligibility might be limited. For clarity, reviewing the Philadelphia Pennsylvania Individual Credit Application can be beneficial.

To file the Business Income and Receipts Tax (BIRT) in Philadelphia, you'll need to gather your business financial records and complete the designated forms. You can file online through the city's revenue website or submit paper forms by mail. For efficiency, the Philadelphia Pennsylvania Individual Credit Application provides resources to help you navigate this process.

Several factors can disqualify you from receiving the Earned Income Credit. Common disqualifiers include having investment income over the limit, not maintaining a qualifying child, or filing taxes without a valid Social Security number. To better understand your eligibility, consider reviewing the Philadelphia Pennsylvania Individual Credit Application guidelines.

You must file the Philadelphia Net Profits Tax (NPT) if you operate a business in the city or if you earn income from self-employment. This includes sole proprietors, partners, and S corporation shareholders. Utilizing the Philadelphia Pennsylvania Individual Credit Application can simplify the filing process for your NPT.