Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Pennsylvania Quitclaim Deed From Husband And Wife To LLC?

If you are in search of a pertinent template, it’s challenging to locate a more suitable location than the US Legal Forms site – one of the most comprehensive online collections.

Here you can discover thousands of template examples for business and personal use categorized by type and state, or keywords.

With our sophisticated search feature, obtaining the latest Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to LLC is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration.

Obtain the document. Choose the file format and save it to your computer.

- Moreover, the validity of each record is confirmed by a group of experienced attorneys who routinely assess the templates on our platform and refresh them according to the most recent state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to LLC is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the guidelines below.

- Ensure you have accessed the template you require. Review its details and use the Preview option to examine its content. If it doesn’t fulfill your requirements, utilize the Search field at the top of the screen to find the correct document.

- Confirm your choice. Click the Buy now button. Next, select the desired pricing plan and provide the information needed to create an account.

Form popularity

FAQ

Individuals often choose to place their property in an LLC to protect their personal assets from liabilities related to the property. This structure can also provide potential tax benefits and facilitate smoother ownership transfers. Moreover, an Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to LLC can simplify estate planning. By utilizing platforms like uslegalforms, you can easily manage this transition, ensuring all legal requirements are met.

Yes, you can quitclaim your property to your LLC. This action involves preparing a quitclaim deed that transfers ownership from you as an individual to your LLC. Once the deed is executed and recorded, your property is officially under the LLC's name. This process can provide liability protection for your personal assets, but consider consulting a legal expert for guidance.

While there are benefits to holding property in an LLC, there are also some disadvantages to consider, such as potential additional taxation at both the corporate and individual levels. Additionally, you may face more complex regulations and paperwork. These factors can be burdensome, especially compared to individual ownership. Always weigh these considerations if you're thinking of an Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to LLC.

Removing property from an LLC typically involves transferring the title back to the individual owner. You usually need to prepare a new deed that reflects this transfer. Once the deed is drafted and duly signed, it must be recorded with the county recorder’s office—this makes the change official. It is advisable to seek assistance from professionals, like those available at uslegalforms, for a seamless transition.

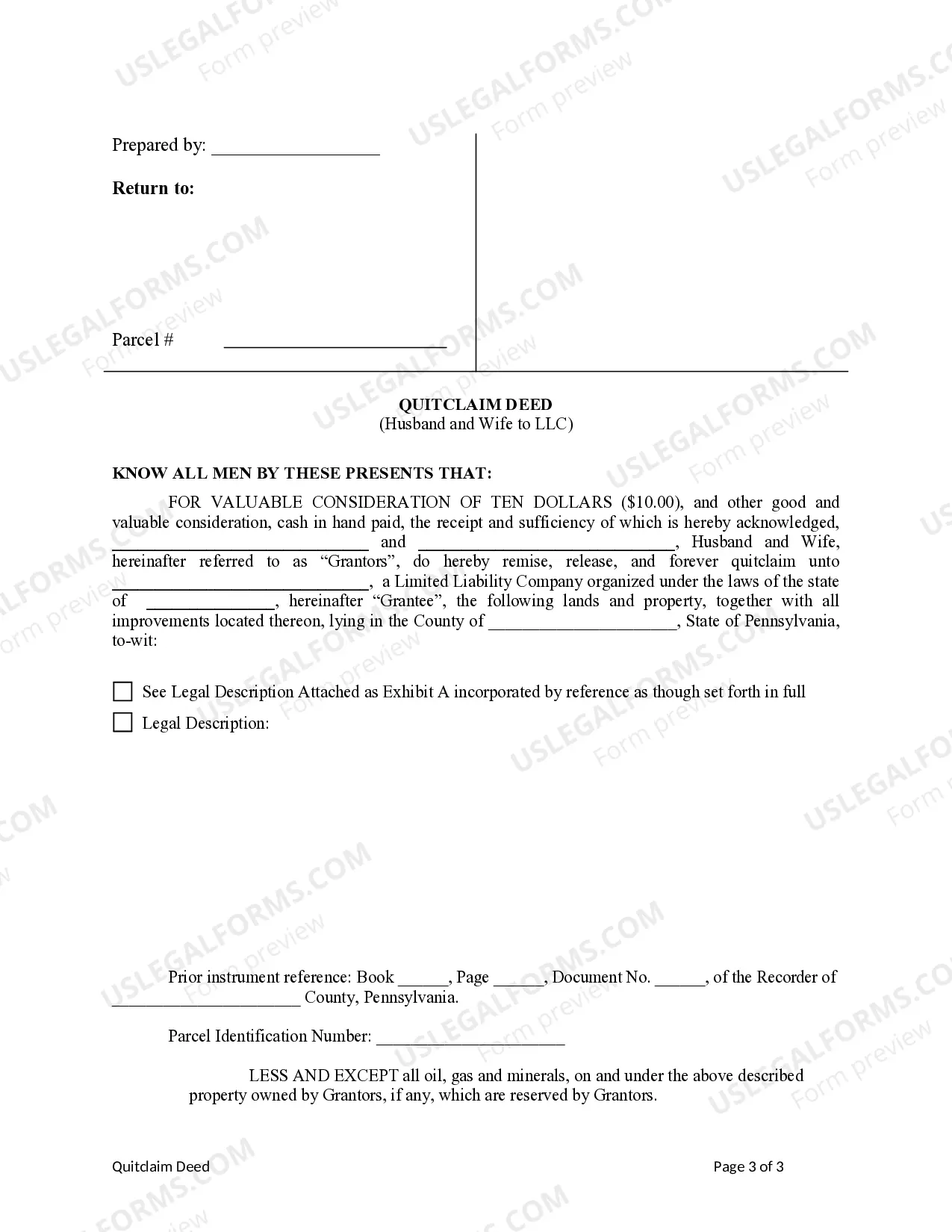

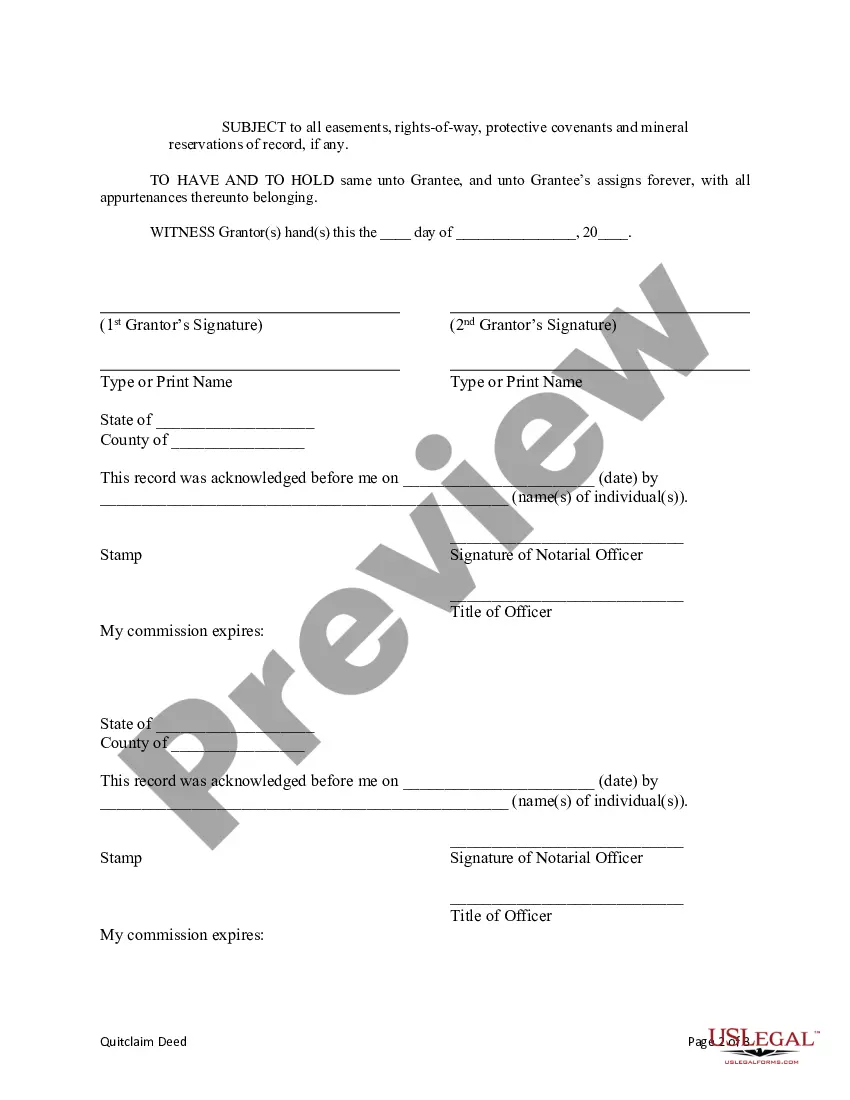

In Pennsylvania, a quitclaim deed must include specific elements such as a clear description of the property, the names of the grantor and grantee, and the signature of the grantor. It is also essential that the deed be notarized to ensure its validity. When considering an Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to LLC, consulting a legal expert can help you navigate these requirements smoothly.

To add your spouse to your deed in Pennsylvania, you will need to create a new deed that includes both of your names. This process typically involves completing a quitclaim deed form. After you complete the form, sign it before a notary, and then record it at the county recorder's office. This action effectively reflects your joint ownership in the property.

One major drawback of a quitclaim deed is that it does not provide any warranty regarding the property title. This means the grantee receives no assurances about any outstanding liens or claims, potentially leading to legal issues later. Additionally, if you are using an Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to LLC, be aware that any liabilities linked to the property may transfer to the LLC, which could pose risks to your business. Understanding these factors can help you make informed decisions.

Yes, you can create a quitclaim deed yourself, but this requires attention to detail and adherence to local laws. You must ensure that all necessary information is included and that the document is properly executed. For an Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to LLC, consider using uslegalforms to guide you through the process and ensure accuracy, which can save you from future legal complications.

To perform a quitclaim deed in NY, you need to create a document that includes the names of the parties involved, the property description, and the statement of transfer. Once you have this information, fill out the form and have it signed in front of a notary public. After notarization, you must file the deed with the county clerk's office where the property is located. If you're considering an Allegheny Pennsylvania Quitclaim Deed from Husband and Wife to LLC, ensure you follow any specific local regulations.

The primary beneficiaries of a quitclaim deed are individuals wishing to transfer property without the complexities of traditional sales. In Allegheny, Pennsylvania, a couple transferring property to an LLC can benefit by minimizing personal liability and simplifying the management of property. Additionally, using a quitclaim deed can streamline trust transfers of property or amicable estate settlements, making it a versatile tool for owners. Consider using US Legal Forms to access optimized quitclaim deed templates that ensure you can capture these benefits effectively.