Illinois Collection Letter by Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

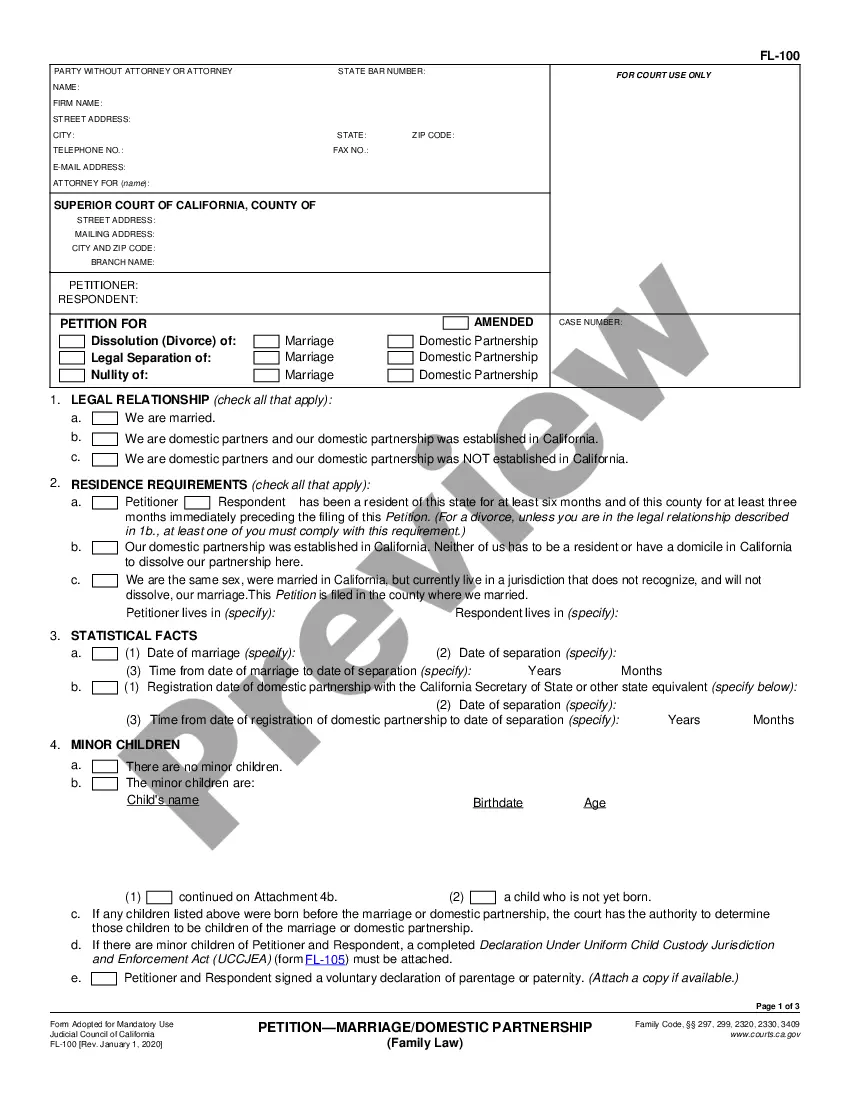

How to fill out Illinois Collection Letter By Contractor?

Searching for Illinois Collection Letter by Contractor forms and completing them can be challenging.

To conserve significant time, money, and effort, use US Legal Forms to locate the appropriate sample specifically for your state in just a few clicks.

Our legal experts prepare all documents, so you merely need to fill them out. It's truly that straightforward.

You can now print the Illinois Collection Letter by Contractor template or complete it using any online editor. No worries about making errors, as your template can be used, sent, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to save the document.

- All your saved templates are stored in My documents and are accessible at any time for future use.

- If you haven't subscribed yet, you should sign up.

- Review our comprehensive instructions on how to obtain the Illinois Collection Letter by Contractor form in minutes.

- To acquire a valid form, verify its legitimacy for your state.

- Examine the form using the Preview feature (if available).

- If there’s a description, read it to grasp the details.

- Click on the Buy Now button if you found what you're looking for.

- Choose your plan on the pricing page and create your account.

- Indicate whether you prefer to pay by card or via PayPal.

- Download the form in your preferred format.

Form popularity

FAQ

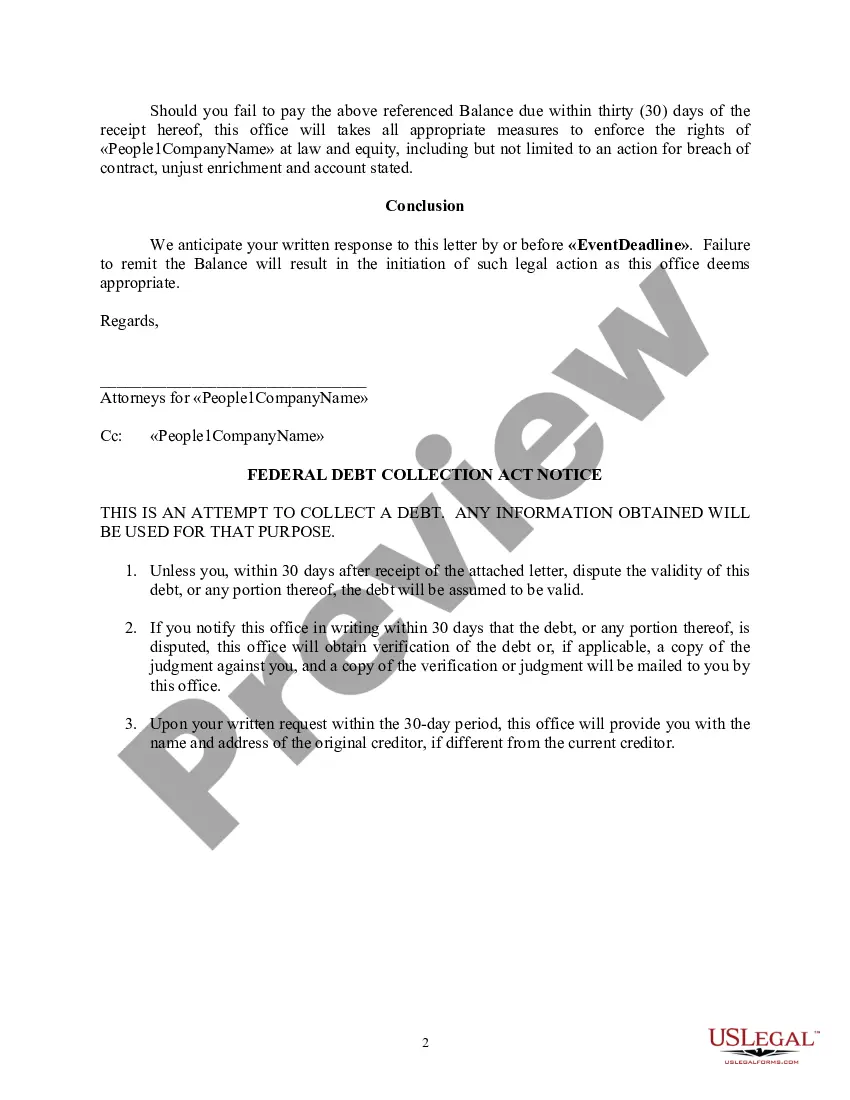

Receiving an Illinois Collection Letter by Contractor from the Illinois Department of Revenue typically indicates that there are outstanding tax obligations related to your business activities. This letter serves as a formal notification, and it may outline the specific amounts due, along with any penalties that have accrued. It's important to address this matter promptly to avoid further complications. Using platforms like US Legal Forms can help you navigate the necessary procedures and documentation required to resolve this issue effectively.

In Illinois, the Statute of Limitations on debt ranges from 5 years to 10 years. Some debt collection agencies buy old debts, out the Statute of Limitation period for pennies on the dollar from the original creditor in order to collect what they can.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

You'll get notices and possibly calls seeking payment. At some point, usually after 180 days, the creditor such as a credit card company, bank or medical provider gives up on trying to collect. The original creditor may then sell the debt to a collections agency to recoup losses.

The statute of limitations in Illinois is five years for open accounts for debt collections and oral contracts and ten years for written contracts. The good news is that the debts are time-barred and you can't be sued for them.

According to Georg Finder, an independent credit evaluator, a contractor can indeed send your account to a collection firm, even when you have voiced your concerns with his work. However, that doesn't mean you should give in and pay. You can and should defend yourself against bills for shoddy workmanship.

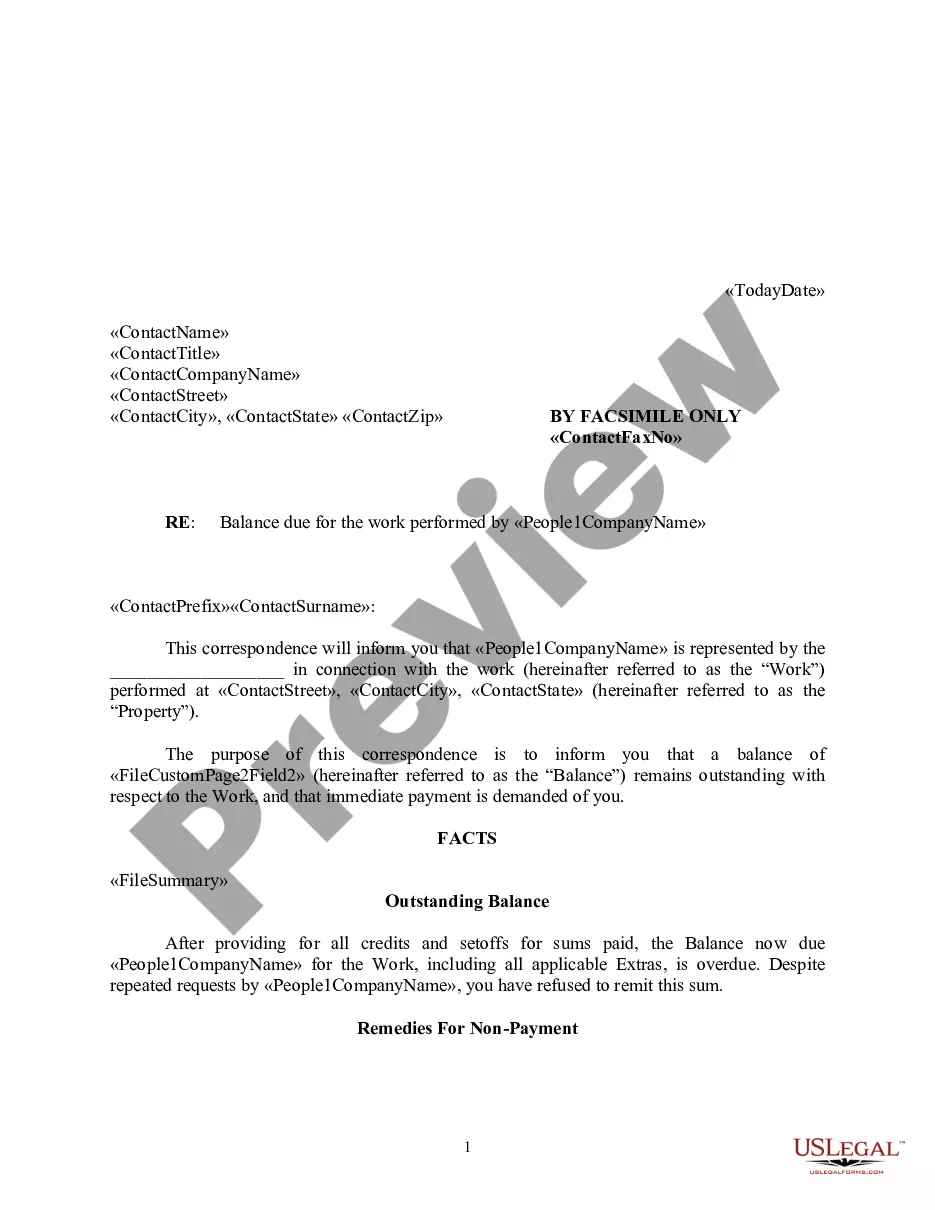

Reference the products or services that were purchased. Make it very clear what you did for your client and how much it costs. Maintain a friendly but firm tone. Remind the payee of their contract or agreement with you. Offer multiple ways the payee can take action. Add a personal touch. Give them a new deadline.

There is no statute of limitations on how long a creditor can attempt to collect an unpaid debt, but there is a deadline for when they can still use litigation to receive a court judgment against the debtor.Creditors can request methods of enforcing the court order, such as wage garnishment.

The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.

Here's some basic information you should write down anytime you speak with a debt collector: date and time of the phone call, the name of the collector you spoke to, name and address of collection agency, the amount you allegedly owe, the name of the original creditor, and everything discussed in the phone call.