Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest

Description

How to fill out Pennsylvania Renunciation And Disclaimer Of Real Property Interest?

Obtaining verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It is an online collection of over 85,000 legal forms for both personal and business needs, covering various real-life situations.

All the documents are accurately classified by usage area and jurisdiction, making the search for the Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest as simple as pie.

Maintaining organized paperwork in accordance with legal requirements is critically important. Leverage the US Legal Forms library to always have essential document templates readily available for any necessities!

- Ensure you examine the Preview mode and form description.

- Verify that you have selected the correct document that fulfills your needs and complies with your local jurisdictional standards.

- Search for an alternative template if necessary.

- If you spot any discrepancy, make use of the Search tab above to find the accurate one.

- If it meets your requirements, proceed to the next step.

Form popularity

FAQ

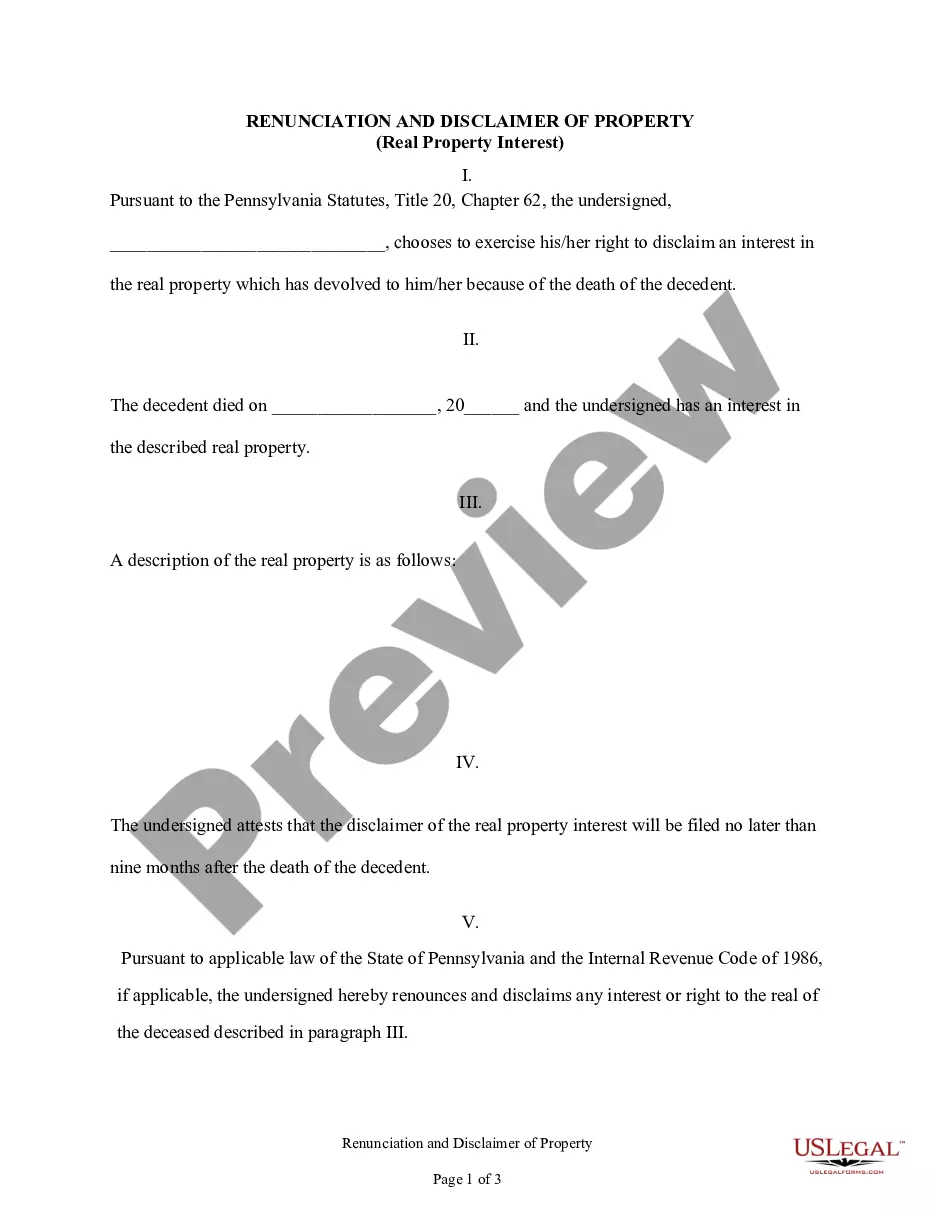

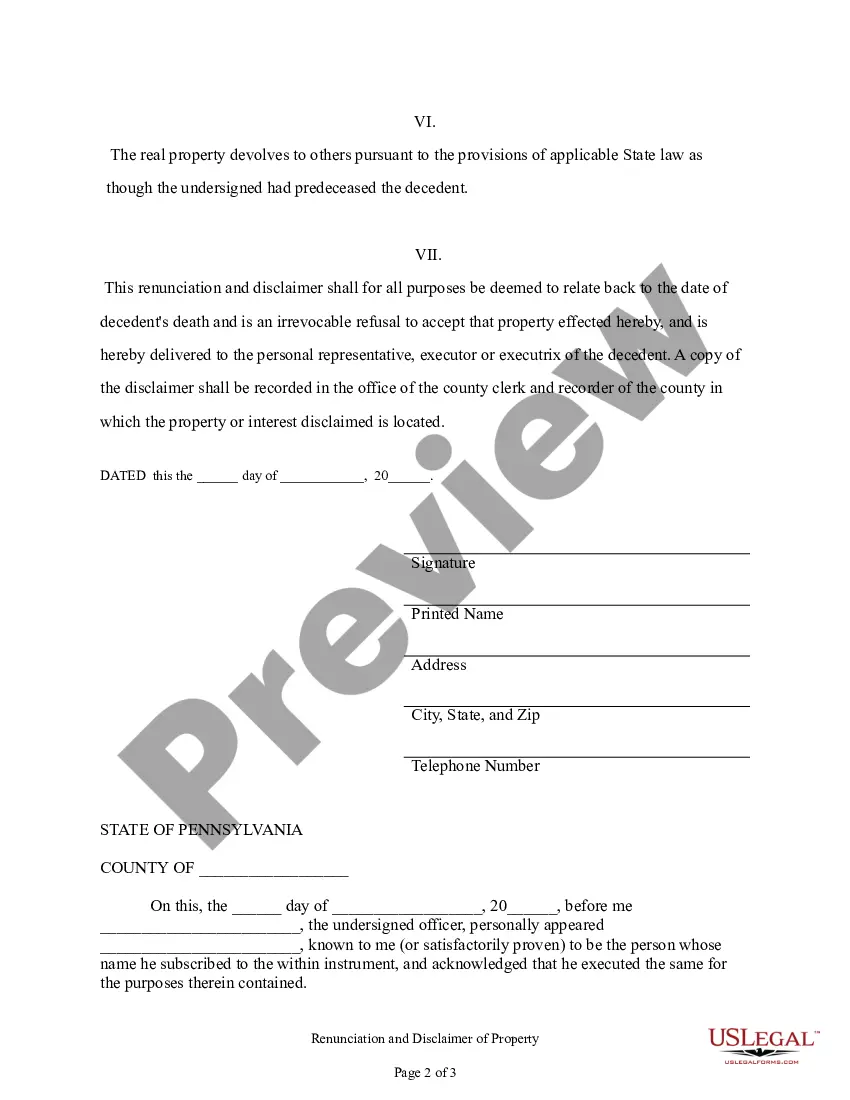

To fill out a renunciation form in Pennsylvania, you should include your name, the decedent's name, and the specific property you are renouncing. Ensure that the form adheres to the legal format required by Pennsylvania law, as proper documentation is crucial. For guidance and access to templates, USLegalForms offers valuable resources to help you complete your Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest form accurately.

A beneficiary in Pennsylvania typically has nine months to disclaim an inheritance after the decedent's death. This period allows beneficiaries sufficient time to evaluate their options and potential impacts on their financial situation. If you're uncertain about the implications of your decision, consider seeking legal advice to navigate your Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest carefully.

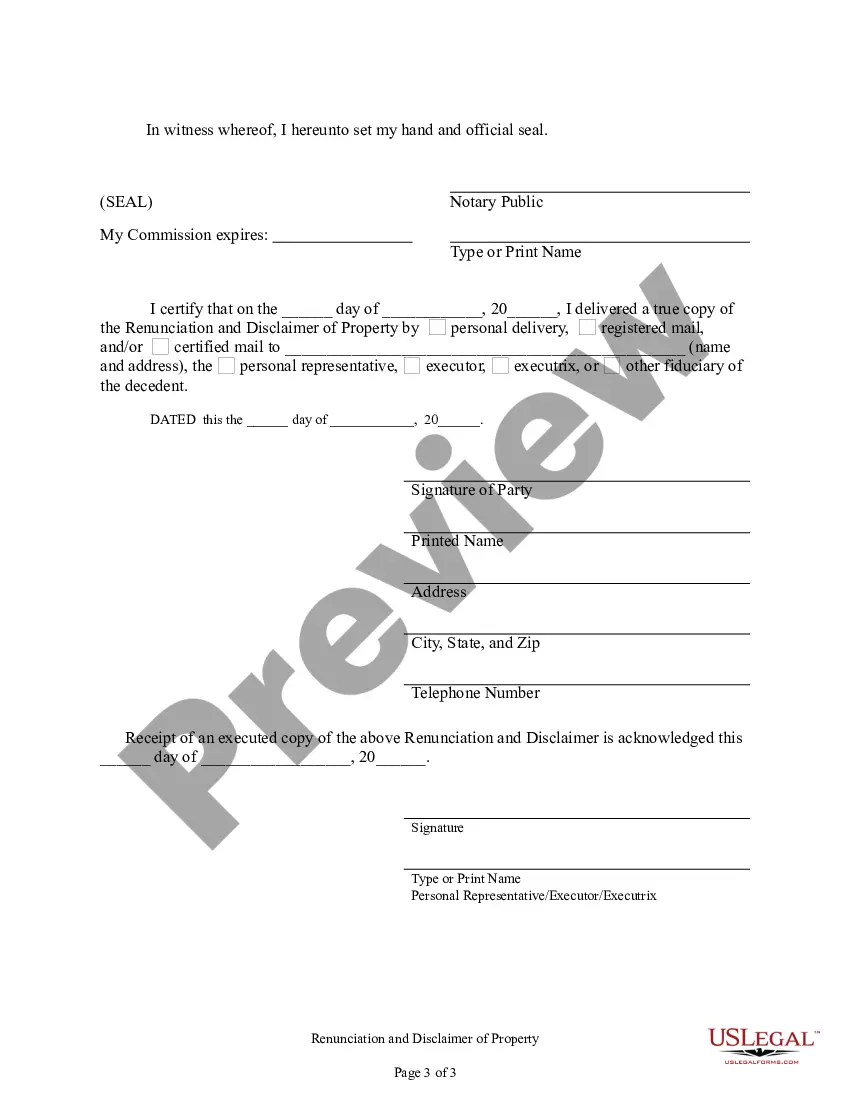

To disclaim an inheritance in Pennsylvania, you must file a written disclaimer with the appropriate probate court. The disclaimer should clearly identify the property and state your intent to renounce it, following specific legal guidelines. Utilizing resources like USLegalForms can provide you with the necessary forms and instructions to complete your Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest accurately.

In Pennsylvania, you usually have nine months to disclaim an inheritance after the decedent's death. It’s crucial to remember that this timeline can affect your financial responsibilities and opportunities. Missing this deadline will mean you must accept the inheritance, possibly complicating your financial situation. Take action quickly if you're considering the Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest.

Renunciation and disclaimer involve formally rejecting an inheritance or interest in an estate. This process allows individuals to refuse property, typically due to financial reasons or personal circumstances. In Allegheny, Pennsylvania, this can significantly impact taxes and inheritances. Understanding these concepts is crucial for effective management of your Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest.

In Allegheny, Pennsylvania, the time limit for filing a disclaimer is typically nine months from the decedent's death. This period allows you to carefully consider whether to accept or reject your interest in the property. If you delay beyond this timeframe, you may permanently lose the opportunity to disclaim your interest. Therefore, it's essential to make a timely decision regarding your Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest.

The process to disclaim an inheritance involves several key steps in Pennsylvania. First, you must draft a formal disclaimer and submit it to the probate court. Ensure that your disclaimer includes all necessary details, such as property identification and your intent to renounce. For assistance and clarity, exploring services like USLegalForms can provide you with templates and guidance tailored to the Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest.

To refuse an inheritance in Pennsylvania, you must file a renunciation form with the probate court. This form should clearly express your decision to disclaim your share of the property. It's crucial to act promptly, as there are time limits involved, and utilizing resources from USLegalForms can ensure that your renunciation is executed correctly and efficiently.

To write a disclaimer of inheritance sample in Allegheny Pennsylvania, you should include your name, the description of the property, and your intent to renounce the inheritance. Clearly state that you are refusing your interest in the property and ensure the document is signed and dated. Using a template or guidance from platforms like USLegalForms can greatly simplify the process and help ensure that all necessary components are included.

To renounce an executor in Pennsylvania, you need to prepare a written statement declaring your intention to do so. This document should clearly express your wish to renounce your role and must be signed and dated. You then file this statement with the local register of wills in the county where the estate is being probated. Utilizing resources from US Legal Forms can streamline this process, especially when dealing with the complexities related to the Allegheny Pennsylvania Renunciation And Disclaimer of Real Property Interest.