This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust

Description

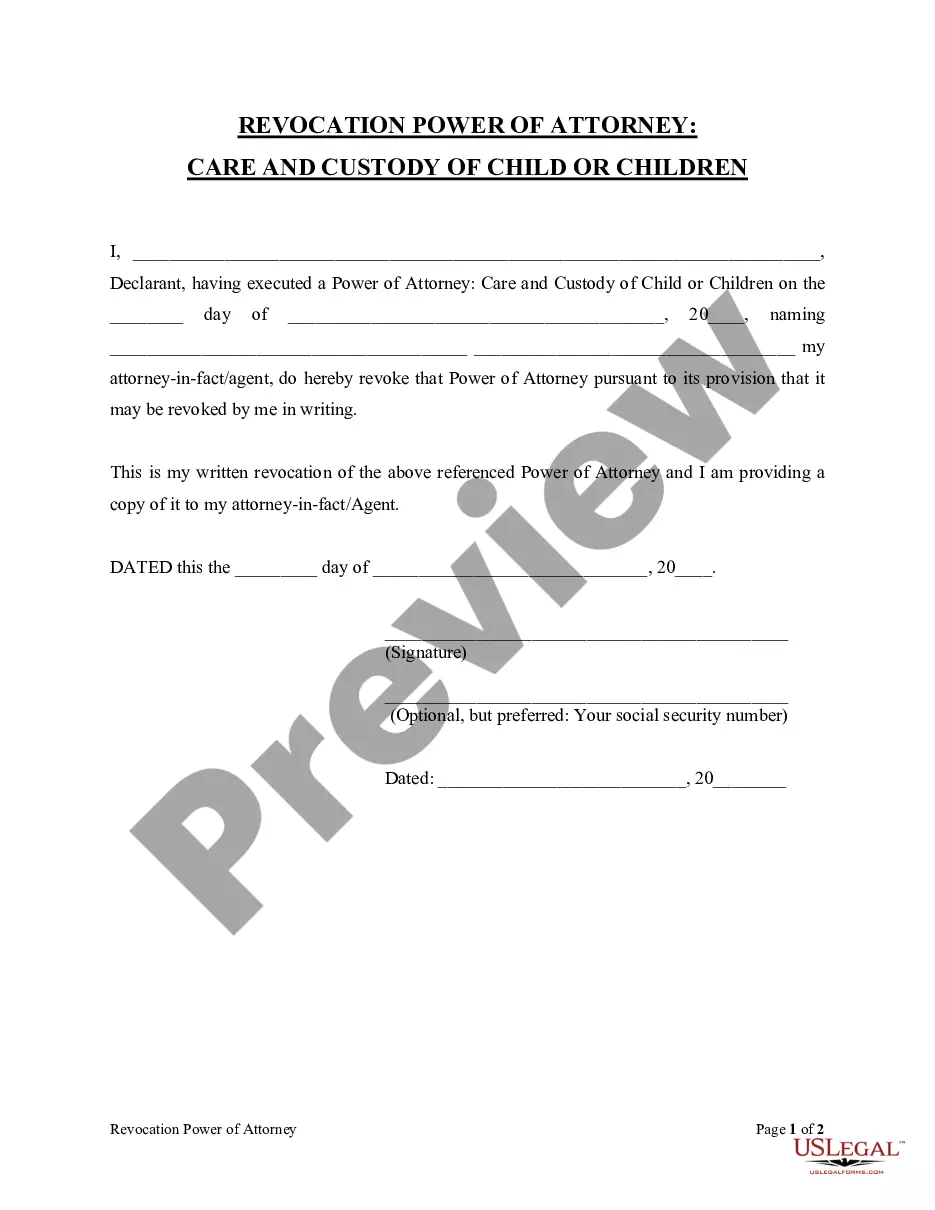

How to fill out Pennsylvania Quitclaim Deed From A Trust To A Trust?

Regardless of social or professional standing, completing legal documents is a regrettable requirement in today’s society.

Frequently, it’s nearly unfeasible for individuals lacking legal training to generate such paperwork independently, primarily due to the intricate terminology and legal nuances involved.

This is where US Legal Forms proves to be beneficial.

Ensure the document you’ve found is appropriate for your region since the regulations of one state or area do not apply to another state or area.

Review the document and read a brief description (if available) of circumstances wherein the document may be utilized. If the form you selected does not fulfill your requirements, you can start anew and look for the necessary document.

- Our platform provides an extensive assortment of over 85,000 ready-to-use state-specific forms applicable to virtually any legal matter.

- US Legal Forms also serves as an excellent tool for assistants or legal advisors looking to save time by utilizing our DIY documents.

- Regardless of whether you need the Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust or any other document suitable for your state or region, everything is available through US Legal Forms.

- Here’s how to obtain the Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust in minutes using our dependable platform.

- If you are already a member, proceed to Log In to your account to access the needed form.

- However, if you are unfamiliar with our collection, make sure to follow these steps prior to obtaining the Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust.

Form popularity

FAQ

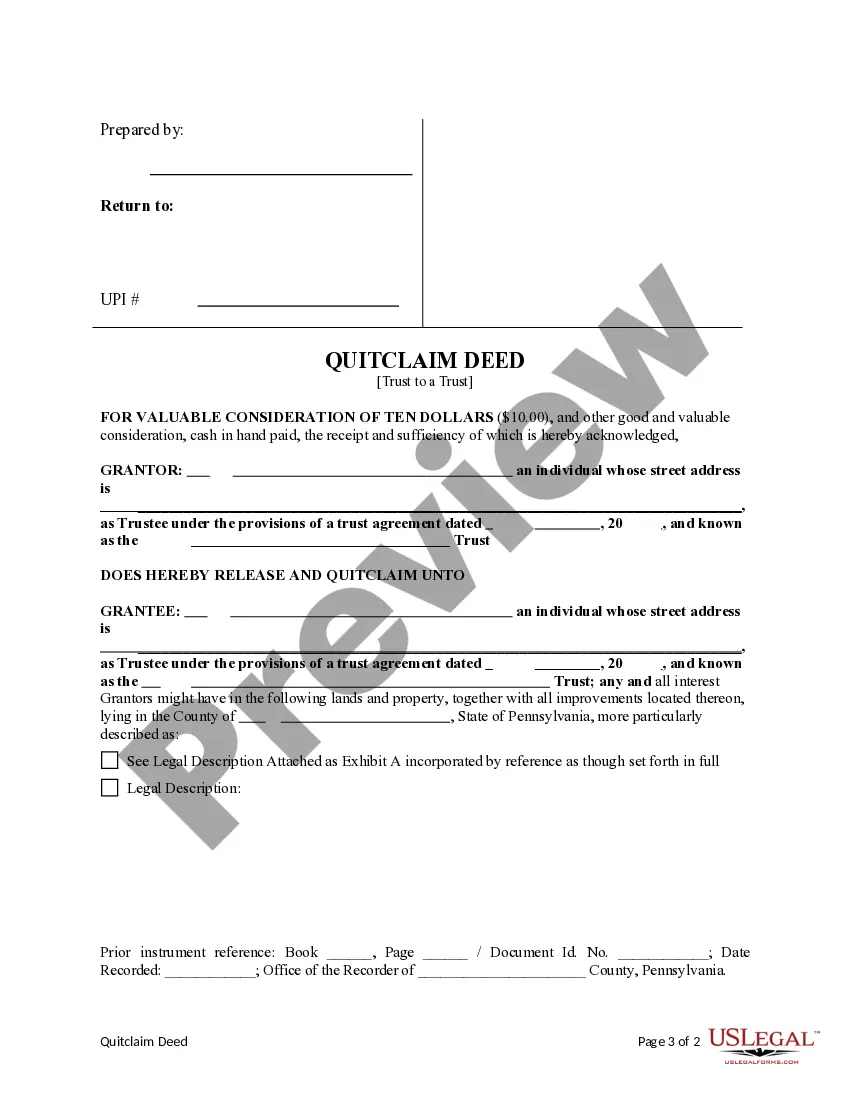

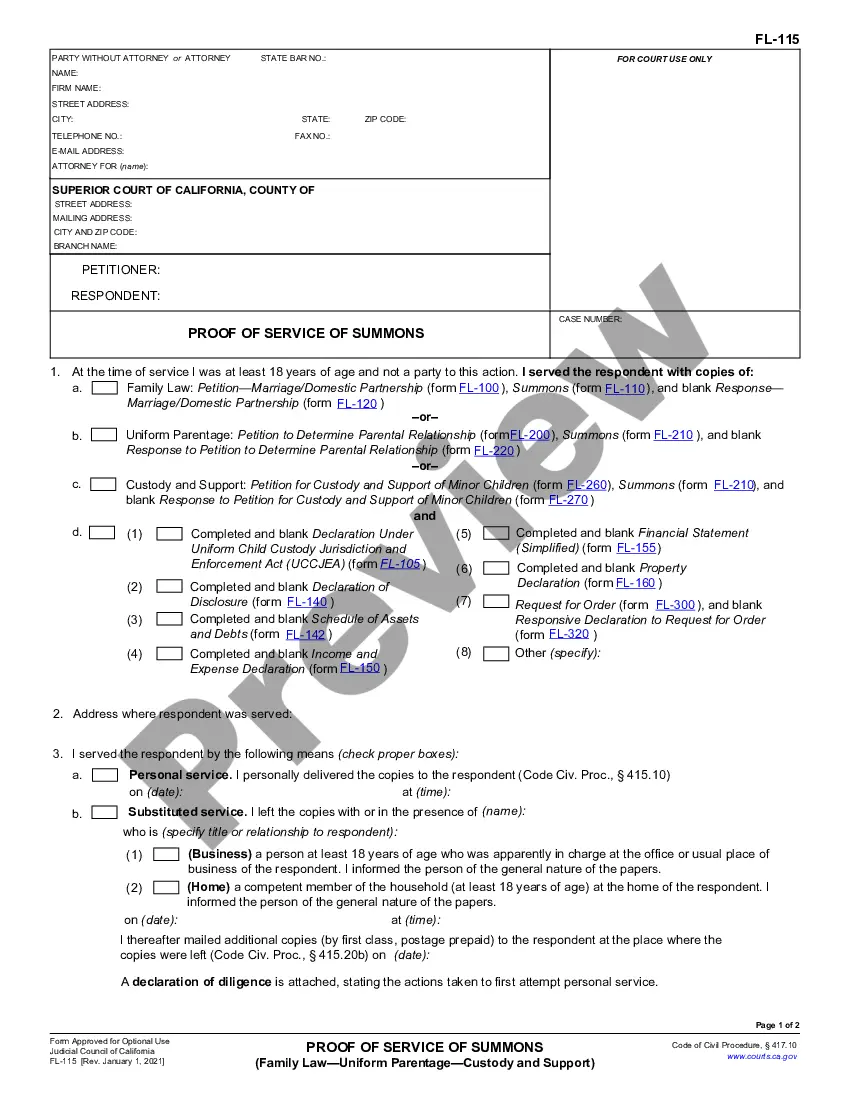

Transferring assets from a trust to a beneficiary can be straightforward if you follow the necessary steps. First, identify the specific assets that need to be transferred and review the terms outlined in the trust document. Then, execute the Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust for any real property involved. Finally, provide the beneficiary with all relevant documentation to complete the transfer, ensuring they understand how to manage the assets.

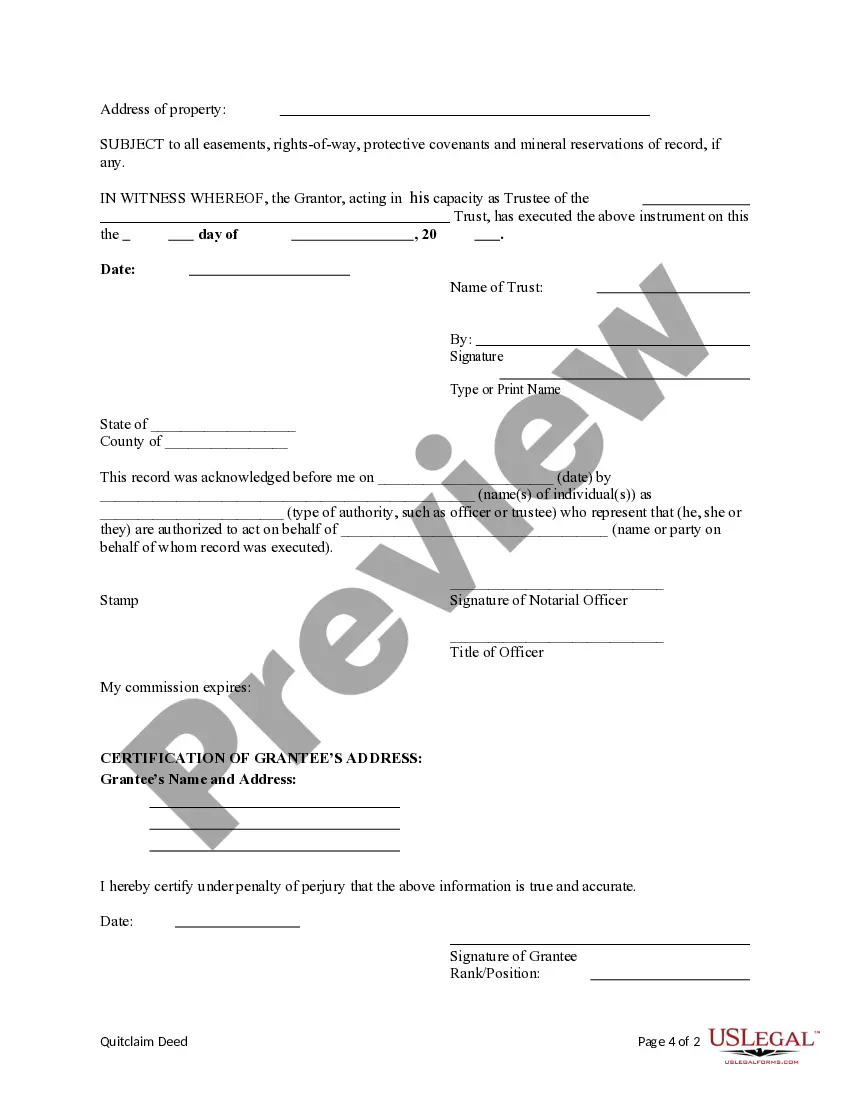

To file a Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust, begin by obtaining the correct form, available through various legal websites or local government offices. Next, complete the deed with accurate information about the trust and the property. After signing the deed before a notary, you will need to file it with the county’s Recorder of Deeds office. This process ensures that your transfer is officially recorded and legally binding.

There are specific situations where a Quitclaim Deed may not be appropriate. For instance, if the property has existing liens or debts, a Quitclaim Deed may not provide sufficient security to the new owner. Additionally, you cannot use it to transfer property that is jointly owned without consent from all parties involved. Always consult with professionals or use resources like USLegalForms for clarification in such situations.

Yes, a Quitclaim Deed can transfer property out of a trust. When using a Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust, the trustee can sign the deed to effectively remove the property from the trust's ownership. This transfer requires proper documentation and may need to be recorded with the county. Additionally, using services like USLegalForms can facilitate this process by offering templates and professional guidance.

Yes, you can transfer property from a trust to an individual. This process involves executing a Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust, which simplifies the transfer of ownership. The appointed trustee must sign the deed, ensuring that the transfer adheres to the trust's terms. If you need guidance, platforms like USLegalForms provide essential resources to assist in this process.

To obtain a Quitclaim Deed in Pennsylvania, you must complete the deed form and have it signed by the current property owner. You can download the appropriate form online from reliable sources like USLegalForms. After filling it out, you need to have the document notarized, then file it in the county courthouse where the property is located. This process helps formalize the Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust.

Yes, quitclaim deeds are legal in Pennsylvania and commonly used for property transfers. These deeds allow individuals to transfer interests without guaranteeing the title's validity. If you plan to use a Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust, ensure all parties understand its implications, as it may not protect against title defects.

The strongest form of deed is typically a warranty deed, which guarantees a clear title to the property. Unlike a quitclaim deed, which offers no such assurances, a warranty deed provides buyer protection against any claims. If you are looking to transfer property confidently, exploring a Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust can also serve specific needs effectively.

Choosing between a quitclaim deed and a trust depends on your specific needs. A quitclaim deed transfers property without warranties, while a trust provides a structured way to manage and distribute property. If you aim for simplicity in the transfer process, a Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust may be adequate. However, for long-term asset protection and management, consider creating a trust.

Yes, a quitclaim deed can be used to transfer property from a trust, facilitating a smooth transition to beneficiaries or another trust. This method does not require a title search, making it a quick option. However, ensure that the deed is drafted correctly; using US Legal Forms can simplify this process and help you create a Philadelphia Pennsylvania Quitclaim Deed from a Trust to a Trust efficiently.