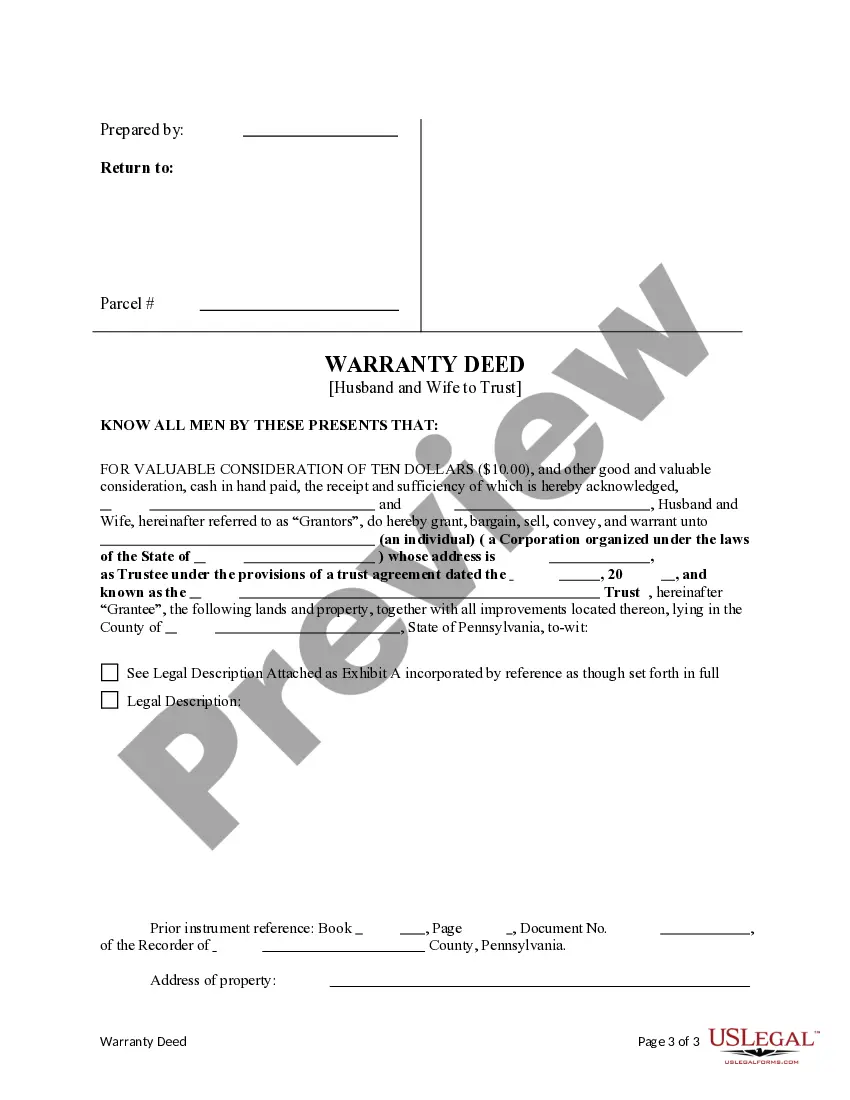

This form is a Warranty Deed where the Grantors are Husband and Wife and the Grantee is a Trust. Grantors convey and warrant the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Philadelphia Pennsylvania Husband and Wife to a Trust

Description

How to fill out Pennsylvania Husband And Wife To A Trust?

If you have previously made use of our service, sign in to your account and retrieve the Philadelphia Pennsylvania Husband and Wife to a Trust onto your device by selecting the Download button. Ensure your subscription is active. If it is not, renew it based on your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to obtain your document.

You have lifelong access to every document you have acquired: you can find it in your profile under the My documents section whenever you wish to access it again. Utilize the US Legal Forms service to effortlessly find and store any template for your personal or professional requirements!

- Verify you’ve chosen a suitable document. Review the description and employ the Preview option, if available, to see if it fulfills your requirements. If it doesn’t match your needs, use the Search tab above to find the correct one.

- Acquire the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or utilize the PayPal method to finalize the transaction.

- Receive your Philadelphia Pennsylvania Husband and Wife to a Trust. Choose the file format for your document and download it to your device.

- Finalize your form. Print it or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

The choice between a will and a trust often depends on your unique needs and goals. While a will outlines how your assets will be distributed, a trust provides more comprehensive management of your estate, especially for a husband and wife in Philadelphia, Pennsylvania. Trusts can help avoid probate and provide privacy in asset distribution, which a will cannot offer. Evaluating your circumstances with a platform like US Legal Forms can guide you in making the best decision.

Yes, you can place your house in a trust in Pennsylvania, offering both flexibility and protection for your home. When a husband and wife establish a trust, they can designate how the property will be managed and distributed after their passing. This process can help avoid probate, ensuring a more efficient transfer of ownership. Additionally, setting up a trust for your property can create peace of mind for both partners regarding asset management.

A trust serves as a legal framework that allows a husband and wife to manage and protect their assets together. In Philadelphia, Pennsylvania, Husband and Wife to a Trust can ensure that both partners retain control over their estate during their lifetimes. This arrangement can simplify the transfer of assets upon death, allowing for a smoother transition to heirs. Moreover, a trust can provide tax benefits and help avoid probate, making it a valuable tool for couples.

Writing a trust document starts with identifying the type of trust you want to create and outlining its terms clearly. Include details such as the trustee's powers, the beneficiaries, and how assets should be managed and distributed. For couples considering a Philadelphia Pennsylvania Husband and Wife to a Trust, an online platform like USLegalForms can provide templates that ensure all necessary components are included.

Filling out trust paperwork typically requires gathering necessary information about the assets, beneficiaries, and trustees before you begin. Clear instructions on the forms will guide you through each section. If you're creating a Philadelphia Pennsylvania Husband and Wife to a Trust, utilizing resources like USLegalForms can simplify this process and ensure all details are accurately captured.

The best trust for a married couple is often a revocable living trust, as it allows flexibility and control over assets during their lifetime. This option also simplifies the transfer of assets upon death, avoiding probate. For a Philadelphia Pennsylvania Husband and Wife to a Trust, this type of trust facilitates both partners working together effectively to manage family wealth.

One significant mistake parents make is failing to fund the trust adequately after its creation. A trust only functions as intended when it contains assets. For those setting up a Philadelphia Pennsylvania Husband and Wife to a Trust, it’s essential to transfer assets into the trust to ensure its purpose is met for your children's benefit.

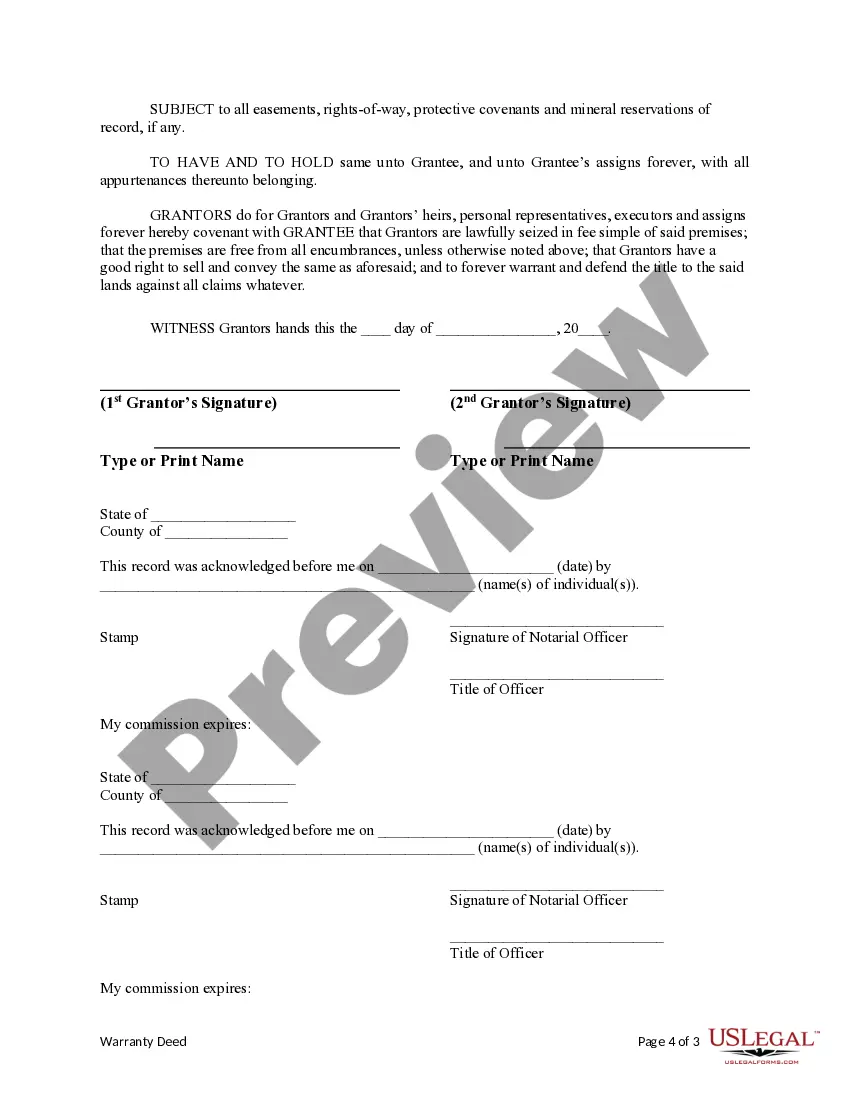

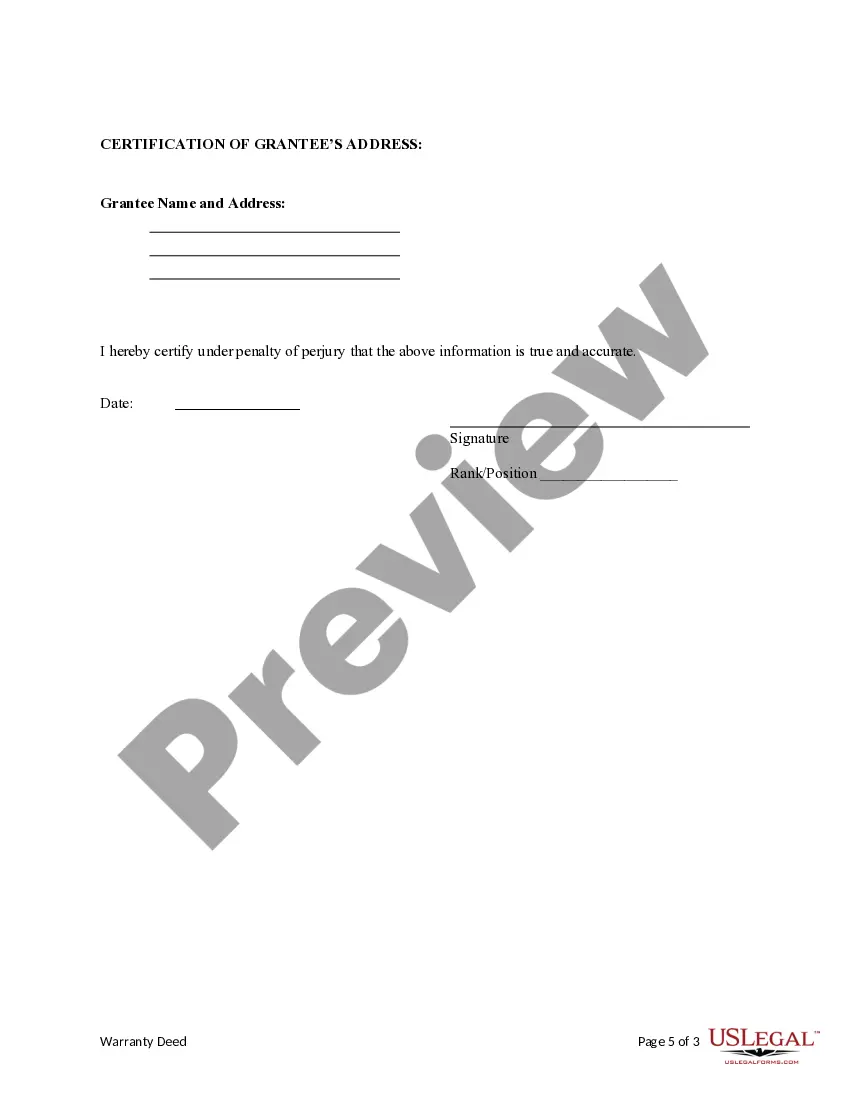

Filling out a certificate of trust involves providing essential details about the trust, including its name, date of creation, and the trustee's information. You should also outline the powers granted to the trustee within the document. If you're establishing a Philadelphia Pennsylvania Husband and Wife to a Trust, ensure that both spouses' names are clearly stated, reflecting their joint interests and responsibilities.

For a trust to be valid, you need a clear intention to create the trust, a designated trustee, identifiable trust property, and a definite beneficiary. In the context of a Philadelphia Pennsylvania Husband and Wife to a Trust, each spouse typically acts as trustee, ensuring mutual control and management of the trust. It is crucial to follow these requirements to avoid complications later.

The best type of trust for a married couple often includes a revocable living trust, especially for a Philadelphia Pennsylvania Husband and Wife to a Trust. This type of trust allows for changes as circumstances change and offers control over asset management. It helps avoid probate, ensuring a smooth transition of assets. Consulting with professionals can help tailor the trust to meet both spouses' specific needs.