Philadelphia Pennsylvania Heirship Affidavit - Descent

Description

How to fill out Pennsylvania Heirship Affidavit - Descent?

We consistently aim to mitigate or avert legal complications when handling intricate legal or financial matters.

To accomplish this, we engage attorney services that, as a general rule, tend to be quite expensive.

However, not every legal challenge is equally complicated; many can be addressed by ourselves.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and power of attorneys to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it from the My documents section. The process remains just as simple if you’re new to the platform! You can set up your account in just a few minutes. Be sure to verify whether the Philadelphia Pennsylvania Heirship Affidavit - Descent conforms to the laws and regulations of your state and locality. Additionally, it’s essential to review the form’s details (if available), and if you notice any inconsistencies with what you were initially seeking, search for an alternative template. Once you’ve confirmed that the Philadelphia Pennsylvania Heirship Affidavit - Descent meets your requirements, you can select a subscription plan and process your payment. Then you can download the document in any available format. With over 24 years in the business, we have assisted millions by offering customizable and current legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Our library empowers you to manage your matters independently without needing to consult legal experts.

- We provide access to legal form templates that aren't universally accessible.

- Our templates are specific to certain states and regions, significantly easing the search process.

- Utilize US Legal Forms whenever you need to locate and download the Philadelphia Pennsylvania Heirship Affidavit - Descent or any other form securely and effortlessly.

Form popularity

FAQ

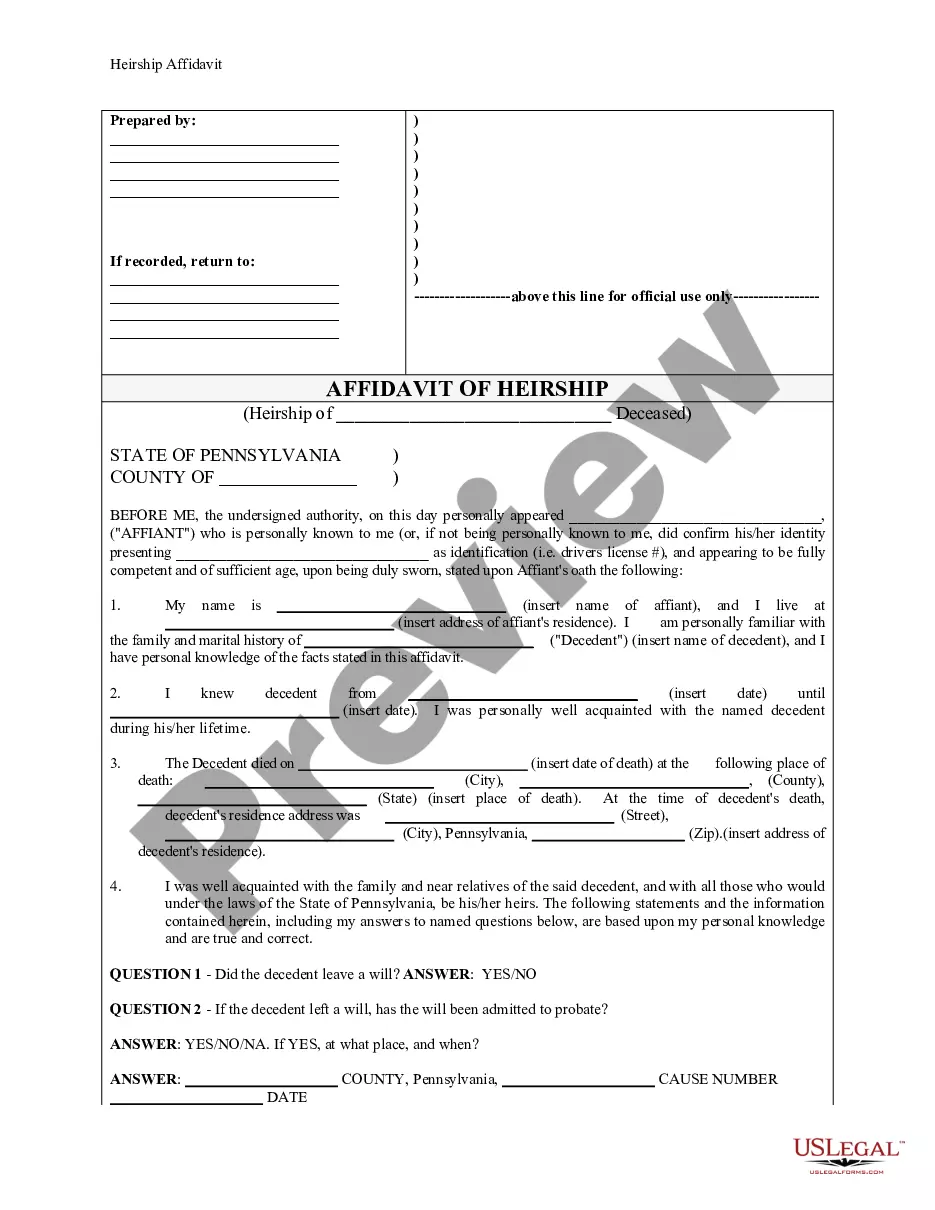

To fill out a proof of heirship affidavit, begin by gathering essential information, including the deceased's full name, date of death, and a list of heirs. Clearly identify each heir’s relationship to the deceased, ensuring the affidavit outlines the correct degree of kinship. Utilizing the Philadelphia Pennsylvania Heirship Affidavit - Descent from US Legal Forms can simplify the process, providing templates and guidance for accurate completion. Be sure to sign the document in front of a notary to validate it.

An affidavit of heirship in Pennsylvania serves as a legal document that establishes the heirs of a deceased person. This document is often required to prove who inherits property when someone passes away without a will. The Philadelphia Pennsylvania Heirship Affidavit - Descent verifies relationships among heirs and ensures a smooth transfer of assets. This is crucial for property owners to maintain clear ownership and avoid disputes.

To obtain a short certificate in Philadelphia, you must first complete the Philadelphia Pennsylvania Heirship Affidavit - Descent. This document identifies the rightful heirs to a deceased person's estate. After preparing the affidavit, you must file it with the Register of Wills, along with any required supporting documentation. Utilizing platforms like USLegalForms can simplify the process, providing you with the necessary forms and guidance to ensure everything meets legal requirements.

Filling out a renunciation form typically involves specifying your name, the decedent's name, and your reasons for renouncing your role. It is crucial to sign and date the document before submitting it to the appropriate court. Utilizing platforms like UsLegalForms can simplify this process, providing clear templates that adhere to the guidelines related to the Philadelphia Pennsylvania Heirship Affidavit - Descent.

If there is no will in Pennsylvania, the state's intestacy laws dictate who inherits the deceased's estate. Generally, spouses, children, and parents hold priority in inheritance hierarchies. The Philadelphia Pennsylvania Heirship Affidavit - Descent provides valuable guidance in identifying rightful heirs under these circumstances.

A renunciation form in Pennsylvania is a legal document used by individuals to formally decline their appointment as executor or administrator of an estate. By submitting this form, a person legally steps aside, allowing other appointed individuals to take over estate management. This is particularly relevant when dealing with the Philadelphia Pennsylvania Heirship Affidavit - Descent, as it may streamline the process of estate distribution.

In Pennsylvania, the limit for a small estate affidavit is currently set at $50,000. This legal document allows heirs to claim assets of the deceased without undergoing formal probate. The Philadelphia Pennsylvania Heirship Affidavit - Descent can be beneficial in navigating these small estate procedures effectively.

The purpose of a letter of renunciation is to formally announce that an individual declines to serve as the executor or administrator of an estate. This document helps provide clarity and allows for the appointment of another person to manage the estate. In the context of the Philadelphia Pennsylvania Heirship Affidavit - Descent, this letter can expedite the process of estate administration.

To renounce an executor in Pennsylvania, you must complete a written document known as a letter of renunciation, which is often supplied by the probate court. This document should express your decision to step back from your role as executor of the estate. After signing, file this letter with the court, ensuring clarity in your decision while referencing the Philadelphia Pennsylvania Heirship Affidavit - Descent if applicable.

To fill out a renunciation form in Pennsylvania, start by obtaining the correct form from your local probate court or the UsLegalForms platform. Enter your personal details, including your name and address, as well as the decedent's information. Clearly state your intent to renounce your rights as an executor or administrator on behalf of the Philadelphia Pennsylvania Heirship Affidavit - Descent.