This form is a Quitclaim Deed where a limited liability company as Grantor and the Grantee who is either a limited liability company or corporation. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation

Description

How to fill out Pennsylvania Quitclaim Deed From LLC To LLC Or Corporation?

Finding authenticated templates that are tailored to your regional laws can be difficult unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents for both personal and commercial purposes covering various real-world situations.

All the papers are accurately organized by field of application and jurisdiction categories, making it as simple as one-two-three to find the Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation.

Keeping documentation organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to have vital document templates readily available for any of your needs!

- For those already acquainted with our repository and have utilized it previously, obtaining the Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation requires only a few clicks.

- Simply Log In to your account, select the document, and click Download to save it to your device.

- This procedure will require just a few additional steps for newcomers.

- Follow the instructions below to commence using the largest online document repository.

- Review the Preview mode and document description. Ensure you’ve selected the right one that aligns with your requirements and fully adheres to your local jurisdiction standards.

Form popularity

FAQ

Transferring ownership of an LLC can be challenging due to specific regulations and potential tax implications that vary by state. Additionally, each LLC's operating agreement may dictate unique requirements for transferring ownership interests, complicating the process further. When dealing with property transfers, such as a Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation, understanding these nuances is critical. Consulting an expert can provide clarity and ensure a smoother transition.

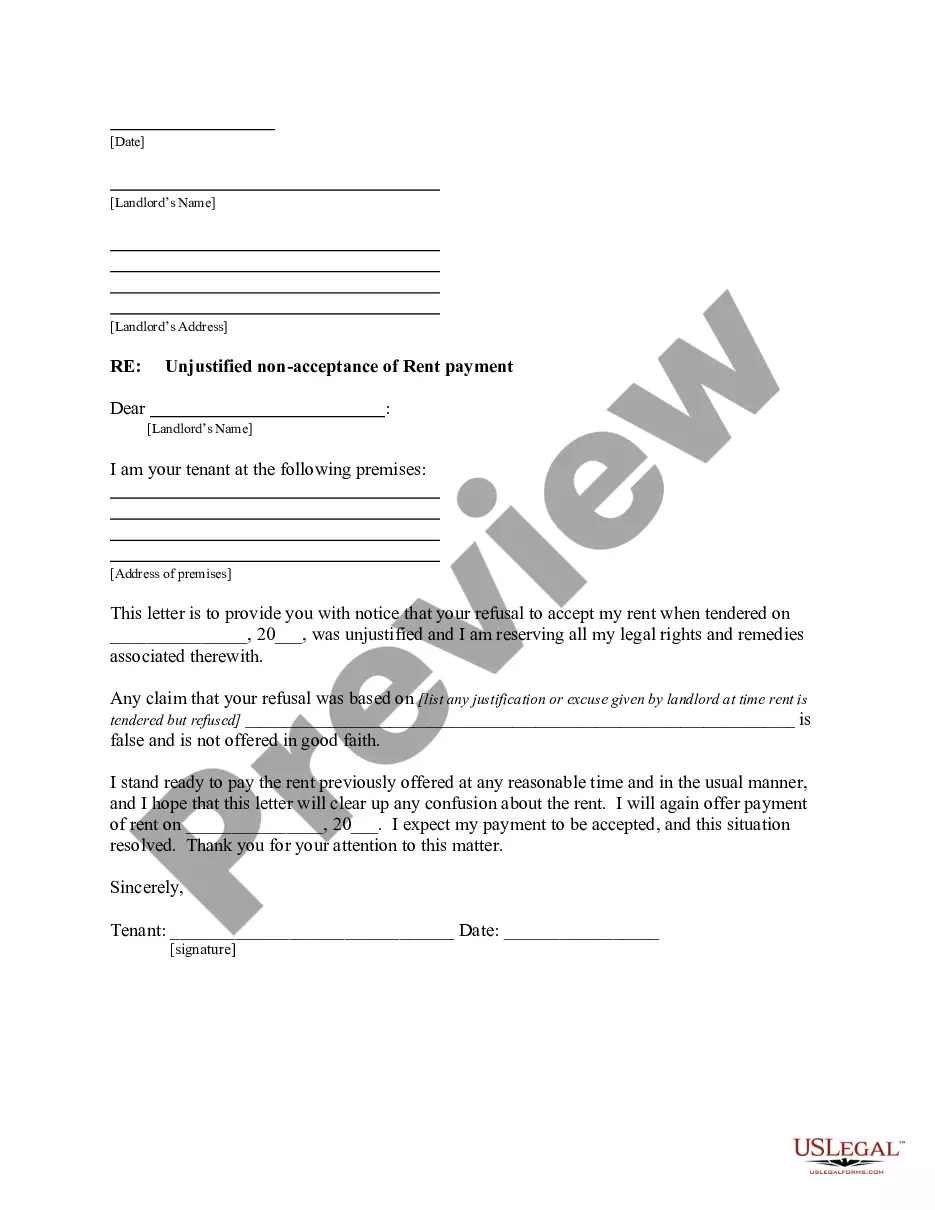

Filing a quitclaim deed in Pennsylvania requires you to complete a standard quitclaim deed form, including essential details such as the involved parties' names and property description. After signing the document in front of a notary, you must file it with the county recorder of deeds where the property is located. It's crucial to check any local regulations to ensure compliance, and services like uslegalforms can offer helpful support for this process.

To move a property from one LLC to another, you typically need to fill out a quitclaim deed stating the transfer between the two LLCs. Once you complete the form, both parties must sign it and have it notarized. Like any quitclaim deed in Philadelphia, the next step involves recording the deed with the relevant county office to ensure the transfer is official. Utilizing platforms like uslegalforms can help simplify this process with easy-to-use templates.

One disadvantage of placing a property in an LLC is the potential difficulty in securing financing, as some lenders may hesitate to lend to LLCs. Furthermore, transferring a Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation can lead to higher taxes and fees. Additionally, the LLC structure can complicate personal property rights and may require more extensive record-keeping. It’s important to weigh these factors carefully before making a decision.

Transferring a deed in Philadelphia involves completing a quitclaim deed form, which is a document that conveys property from one entity to another. After filling out the form, you must sign it in the presence of a notary public. Additionally, you need to record the quitclaim deed at the local county office to complete the transfer process. This process can be streamlined using services like uslegalforms, which provide templates and guidance.

Yes, you can transfer your property to your LLC using a quitclaim deed. The Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation allows you to manage your assets more efficiently. When you transfer property to your LLC, you may benefit from liability protection and potential tax advantages. Always consult with a legal expert to ensure the transfer aligns with your financial goals.

To file a quitclaim deed in Pennsylvania, you must obtain the official form from your local county office. Once you complete the Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation form, you should sign it in front of a notary. After notarization, you need to file the deed with the county clerk’s office where the property is located. This process ensures your transfer of ownership is legally recognized.

To quitclaim your property to an LLC, you need to complete a Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation. Start by filling out the deed form, accurately including the property details and the names of both the grantor and the LLC as the grantee. Once you have signed the deed in front of a notary, you should file it with the county's property records office. This process ensures a smooth transfer, allowing your LLC to hold the property effectively.

Yes, you can transfer property from one LLC to another LLC, and this is often accomplished through a quitclaim deed. Using the Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation simplifies this process while ensuring all legal requirements are met. It's important to file the deed correctly to maintain clear ownership records and protect your investment.

Selling your house to your own LLC might offer some tax advantages, but it does not guarantee avoidance of capital gains tax. The IRS recognizes such transactions, and taxes may still apply based on fair market value. Utilizing the Philadelphia Pennsylvania Quitclaim Deed from LLC to LLC or Corporation offers a straightforward way to transfer ownership, yet it is wise to consult with a tax professional before proceeding.