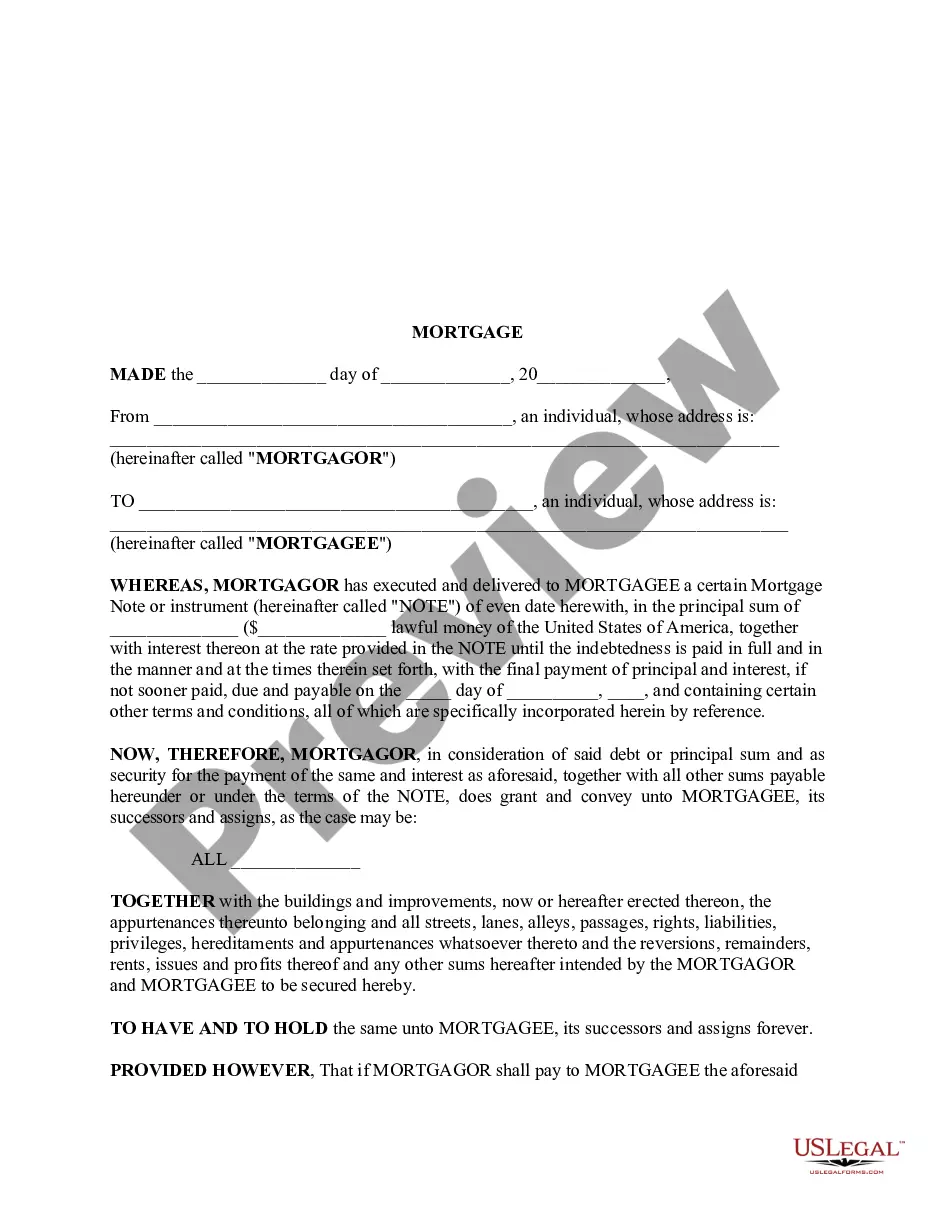

Philadelphia Pennsylvania Mortgage - Short

Description

How to fill out Pennsylvania Mortgage - Short?

If you’ve previously utilized our service, Log In to your account and store the Philadelphia Pennsylvania Mortgage - Short on your device by clicking the Download button. Ensure your subscription is active. If not, renew it in accordance with your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your file.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to quickly find and store any template for your personal or professional requirements!

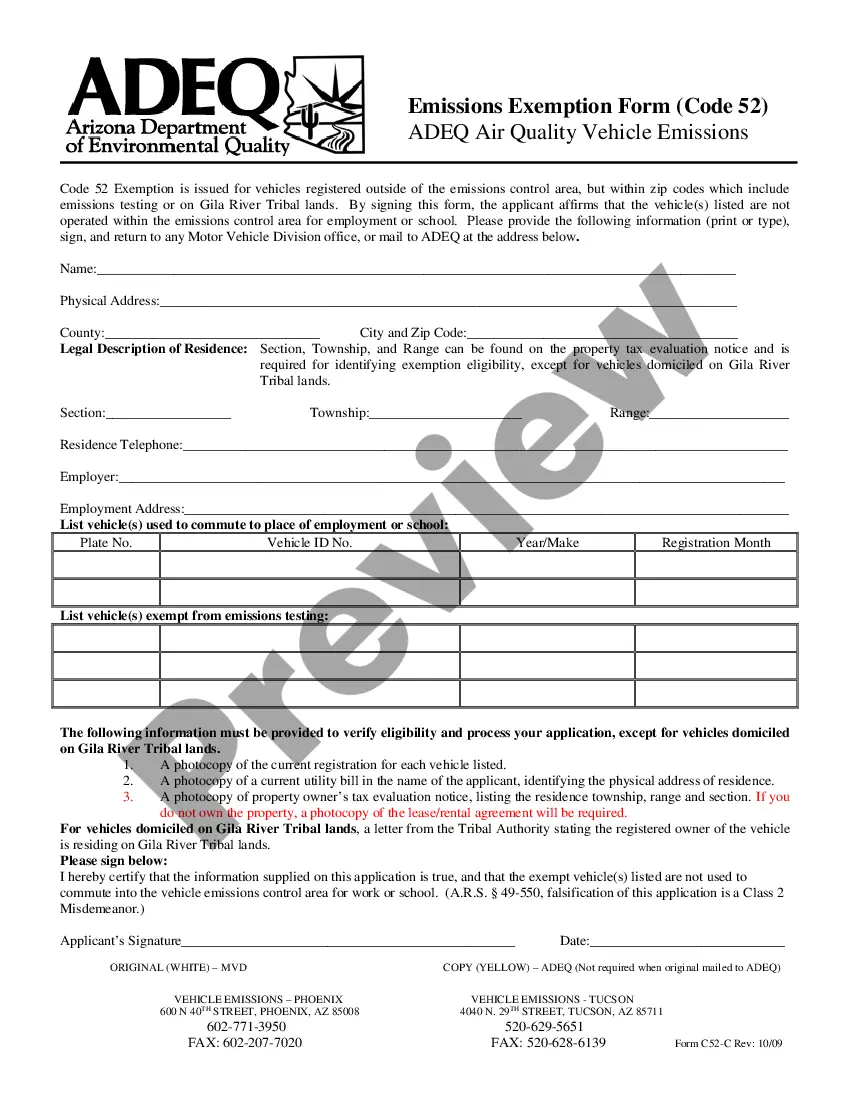

- Ensure you’ve located the correct document. Review the description and utilize the Preview option, if available, to verify if it aligns with your needs. If it falls short, use the Search tab above to find the appropriate one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and finalize a payment. Enter your credit card information or the PayPal option to conclude the purchase.

- Retrieve your Philadelphia Pennsylvania Mortgage - Short. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or leverage professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

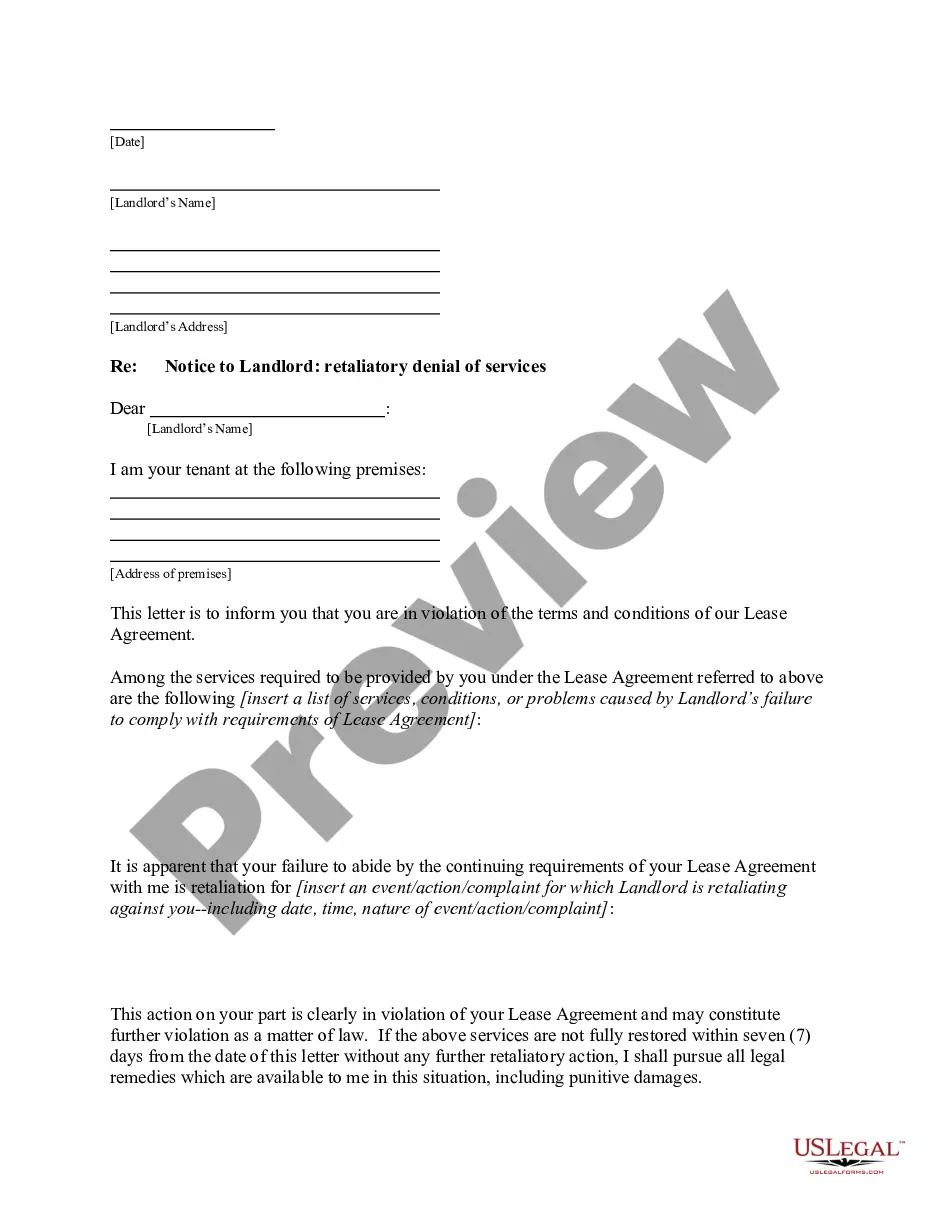

In Pennsylvania, a short sale occurs when a homeowner sells their property for less than the amount owed on their mortgage. To initiate this process, the homeowner must first get approval from their lender, who agrees to accept the reduced payment. This approach can help prevent foreclosure, allowing homeowners to settle their debts while reducing financial stress. If you’re navigating a Philadelphia Pennsylvania Mortgage - Short, working with a knowledgeable platform like UsLegalForms can guide you through the paperwork and negotiations with lenders.

The welcome home grant in Pennsylvania is available to first-time home buyers and individuals who have not owned a home within the last three years. Eligibility may depend on factors such as income level, credit score, and the specific location of the property. Finding out if you qualify can enhance your Philadelphia Pennsylvania mortgage experience and ease your transition into homeownership.

Similar to the state program, Philadelphia offers a $10,000 grant specifically for local first-time home buyers. This grant aims to reduce the financial strain of purchasing a home within the city. With the assistance of this grant, you can make your Philadelphia Pennsylvania mortgage more manageable and get into your new home sooner.

The Pennsylvania down payment assistance program offers financial support to help home buyers with their initial home investment. Based on eligibility, this program can provide significant aid for down payments, ultimately easing the burden of home buying. If you're exploring a Philadelphia Pennsylvania mortgage, consider utilizing this valuable program.

The foreclosure prevention program in Philadelphia aims to help homeowners avoid losing their properties. This program provides resources and support, including counseling and legal assistance. For those interested in Philadelphia Pennsylvania mortgages, understanding these resources ensures you have the necessary backup to safeguard your investment.

The $10,000 grant for first-time home buyers in Pennsylvania assists individuals in overcoming the financial barriers of purchasing a home. This program aims to help buyers with down payments and closing costs, making homeownership more attainable. If you are considering a Philadelphia Pennsylvania mortgage, this grant can substantially ease your journey.

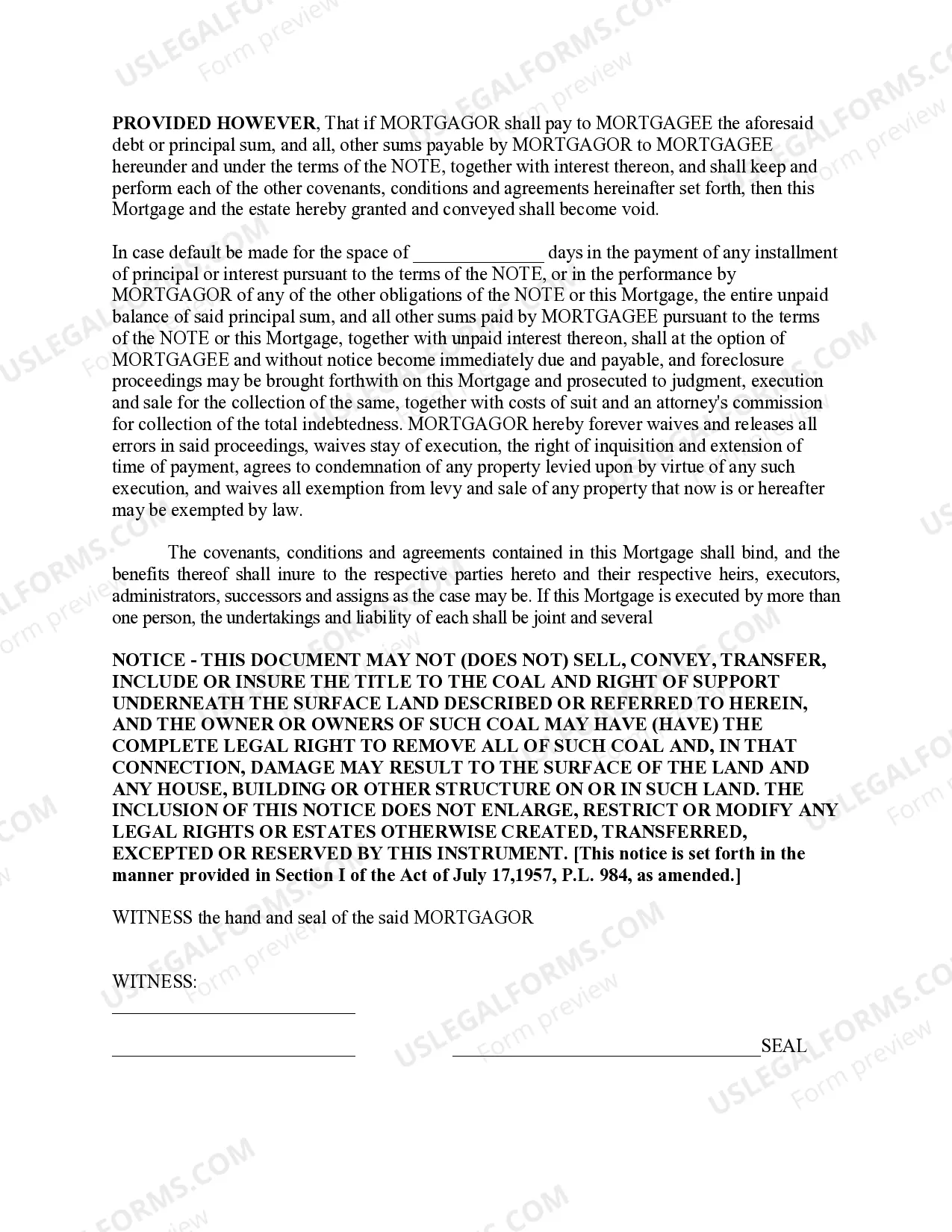

Filing a quitclaim deed in Pennsylvania involves several steps. First, complete the deed form accurately with all necessary details, including the property's full legal description. After having it notarized, you will need to submit the deed to the local county recorder of deeds for recording. This is especially important for those dealing with a Philadelphia, Pennsylvania mortgage - short, as proper documentation protects your investment.

A quitclaim deed does not guarantee clear title; it only transfers whatever interest the grantor has. This means that if there are any liens or disputes, you could face challenges down the road. Moreover, using a quitclaim deed may not offer the protection you need when managing your Philadelphia, Pennsylvania mortgage - short. It is wise to weigh these risks carefully against the benefits.

Yes, you can prepare a quitclaim deed yourself in Pennsylvania. It is important to ensure that you use the correct forms and follow the guidelines set by your county. While it may seem straightforward, even minor mistakes can lead to complications later on, especially when it pertains to your Philadelphia, Pennsylvania mortgage - short. Consider using legal document platforms like US Legal Forms for accurate templates and guidance.

To file a quitclaim deed in Pennsylvania, start by obtaining the correct form, which you can find online or at your local courthouse. After filling it out with accurate information, you must sign it in the presence of a notary public. Lastly, file the completed deed with the county recorder's office where the property is located. This process can be crucial when managing your Philadelphia, Pennsylvania mortgage - short.