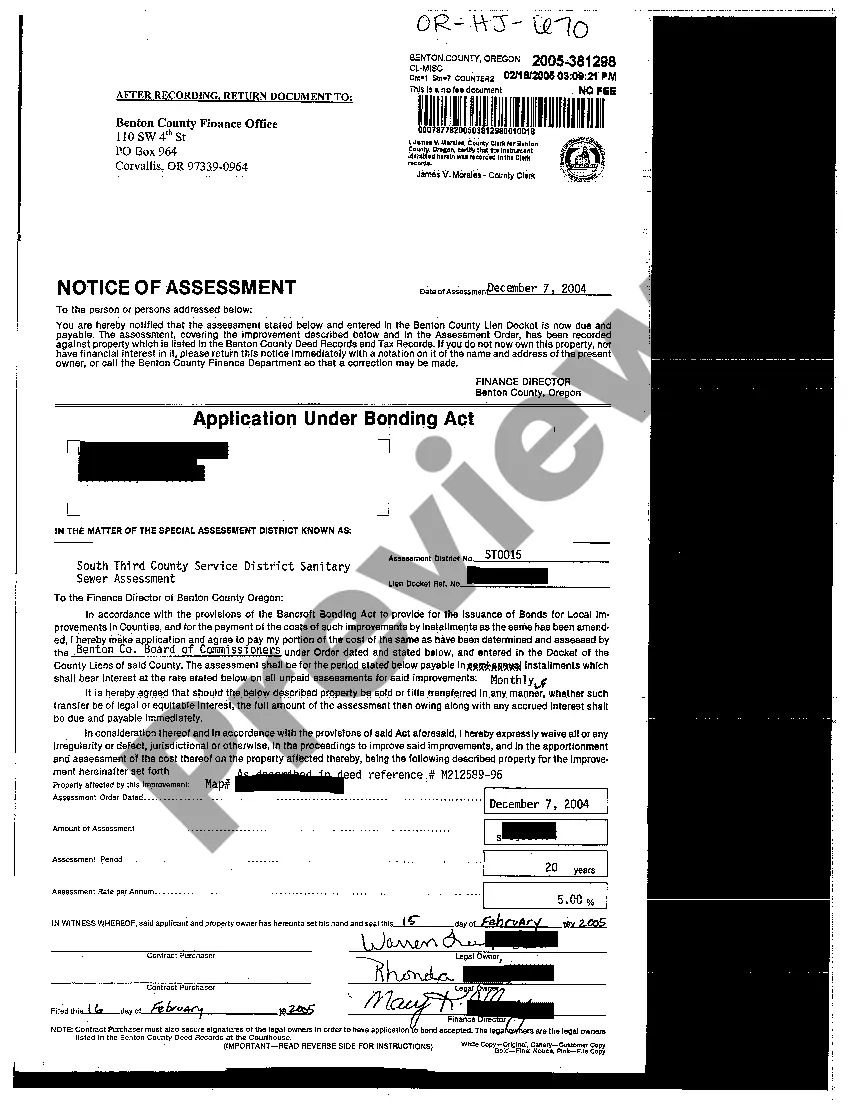

The Gresham Oregon Notice of Assessment for County Improvements is a document that informs property owners in Gresham about the assessed value of their property for the purpose of funding county improvements. This notice is issued by the Gresham County Assessor's Office and plays a crucial role in determining property taxes. One type of Gresham Oregon Notice of Assessment for County Improvements is the Annual Assessment Notice. This notice is sent out to property owners on an annual basis and provides information about the assessed value of their property for the upcoming tax year. It includes details such as the property's market value, assessed value, and any changes made in comparison to the previous year's assessment. Another type of Gresham Oregon Notice of Assessment for County Improvements is the Supplementary Assessment Notice. This notice is issued when there are significant changes to a property that affect its assessed value, such as new construction, renovations, or property additions. It informs property owners about the updated assessed value and the corresponding impact on their property taxes. The Gresham Oregon Notice of Assessment for County Improvements utilizes keywords such as Gresham, Oregon, Notice of Assessment, County Improvements, property owners, assessed value, property taxes, market value, Annual Assessment Notice, Supplementary Assessment Notice, and property changes. Property owners should carefully review the Gresham Oregon Notice of Assessment for County Improvements to ensure accuracy and determine the potential impact on their property taxes. It is important to understand the assessment process, including how market values are determined and how to appeal an assessment if necessary. These notices serve as valuable resources for property owners, enabling them to stay informed about their property's value and how it contributes to funding county improvements.

Gresham Oregon Notice of Assessment for County Improvements

Description

How to fill out Gresham Oregon Notice Of Assessment For County Improvements?

Make use of the US Legal Forms and obtain instant access to any form sample you want. Our useful website with thousands of document templates makes it simple to find and obtain almost any document sample you need. You are able to export, fill, and sign the Gresham Oregon Notice of Assessment for County Improvements in a matter of minutes instead of surfing the Net for hours seeking an appropriate template.

Utilizing our catalog is a superb way to improve the safety of your document filing. Our experienced legal professionals regularly review all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and regulations.

How can you obtain the Gresham Oregon Notice of Assessment for County Improvements? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Moreover, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the tips listed below:

- Open the page with the template you require. Make sure that it is the template you were seeking: examine its title and description, and utilize the Preview option when it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Indicate the format to get the Gresham Oregon Notice of Assessment for County Improvements and modify and fill, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable form libraries on the internet. We are always happy to help you in virtually any legal process, even if it is just downloading the Gresham Oregon Notice of Assessment for County Improvements.

Feel free to benefit from our service and make your document experience as convenient as possible!

Form popularity

FAQ

In Oregon, the assessed value is typically determined by the county assessor based on the property’s market value and the specific county improvements. This process involves analyzing recent sales data and the physical condition of the property. When you receive your Gresham Oregon Notice of Assessment for County Improvements, it reflects this determined value, ensuring that property taxes are calculated accurately. Understanding how assessed value works can help you navigate property taxes and make informed decisions.

Oregon law caps property tax increases at 3% per year, as outlined in Measure 50. This cap limits how much your property taxes can rise annually, providing balance for property owners. However, if there are improvements made to your property, like those outlined in the Gresham Oregon Notice of Assessment for County Improvements, this can sometimes lead to a higher assessed value, affecting your overall tax bill. It's beneficial to review any assessments carefully to understand how they impact your financial responsibilities.

In Oregon, properties are typically reassessed every year, but the assessed value can only increase by 3% annually due to Measure 50 limitations. This means that while your property may appreciate in value, the amount assessed for taxes stays relatively stable, protecting you from significant tax hikes. Understanding the reassessment process helps homeowners in Gresham, Oregon, anticipate how changes might affect their Notice of Assessment for County Improvements. Keeping this in mind can aid in effective budgeting and planning.

Your property assessed value is determined by the county assessor and reflects the value of your property for tax purposes. This value can significantly influence the amount you owe in taxes, particularly in relation to the Gresham Oregon Notice of Assessment for County Improvements. To find your assessed value, you can review your property tax statement or contact the county assessor's office. Familiarizing yourself with this value can assist you in making informed financial decisions regarding your property.

Property tax compression in Oregon occurs when a property's taxes are limited by Measure 50, which was established in the 1990s. This cap means that the total amount of property taxes cannot exceed certain levels, affecting how much revenue local governments can collect. For residents in Gresham, Oregon, understanding this can clarify the impact of the Notice of Assessment for County Improvements on their taxes. The system aims to provide a fair approach to property taxation while ensuring that property owners are not overburdened.

The property tax rate in Gresham, Oregon, usually varies slightly from the surrounding areas but generally aligns with the regional average, around 1.1%. This rate influences the amount you owe and can be examined in detail through the Gresham Oregon Notice of Assessment for County Improvements, which breaks down your specific tax responsibility and any applicable exemptions.

In Oregon, property tax increases are capped at 3% per year due to state law, with specific exceptions for new construction or improvements. This cap helps property owners predict and plan their tax obligations without steep annual surprises. For accurate updates on your property's assessment, the Gresham Oregon Notice of Assessment for County Improvements serves as an essential resource.

The assessed value in Oregon is determined by various factors, including the property's market value and unique characteristics in the local area. Local assessors conduct evaluations and adjustments to arrive at this figure, which directly impacts your property taxes. You can find these details in your Gresham Oregon Notice of Assessment for County Improvements, which comprehensively outlines how your property's value affects your tax responsibility.

In Oregon, seniors aged 62 or older may apply for property tax deferral programs, which allow them to postpone tax payments under certain conditions. However, this does not typically eliminate property taxes altogether. It is crucial to check the Gresham Oregon Notice of Assessment for County Improvements, as this document can provide detailed insights into tax liabilities and available exemptions for seniors.

Property taxes in Portland, Oregon, are levied on real estate owners to fund local services, such as schools and public infrastructure. These taxes are calculated based on the assessed value of your property, which may be detailed in the Gresham Oregon Notice of Assessment for County Improvements. Understanding your property tax obligations will help you budget better and enhance your financial planning.