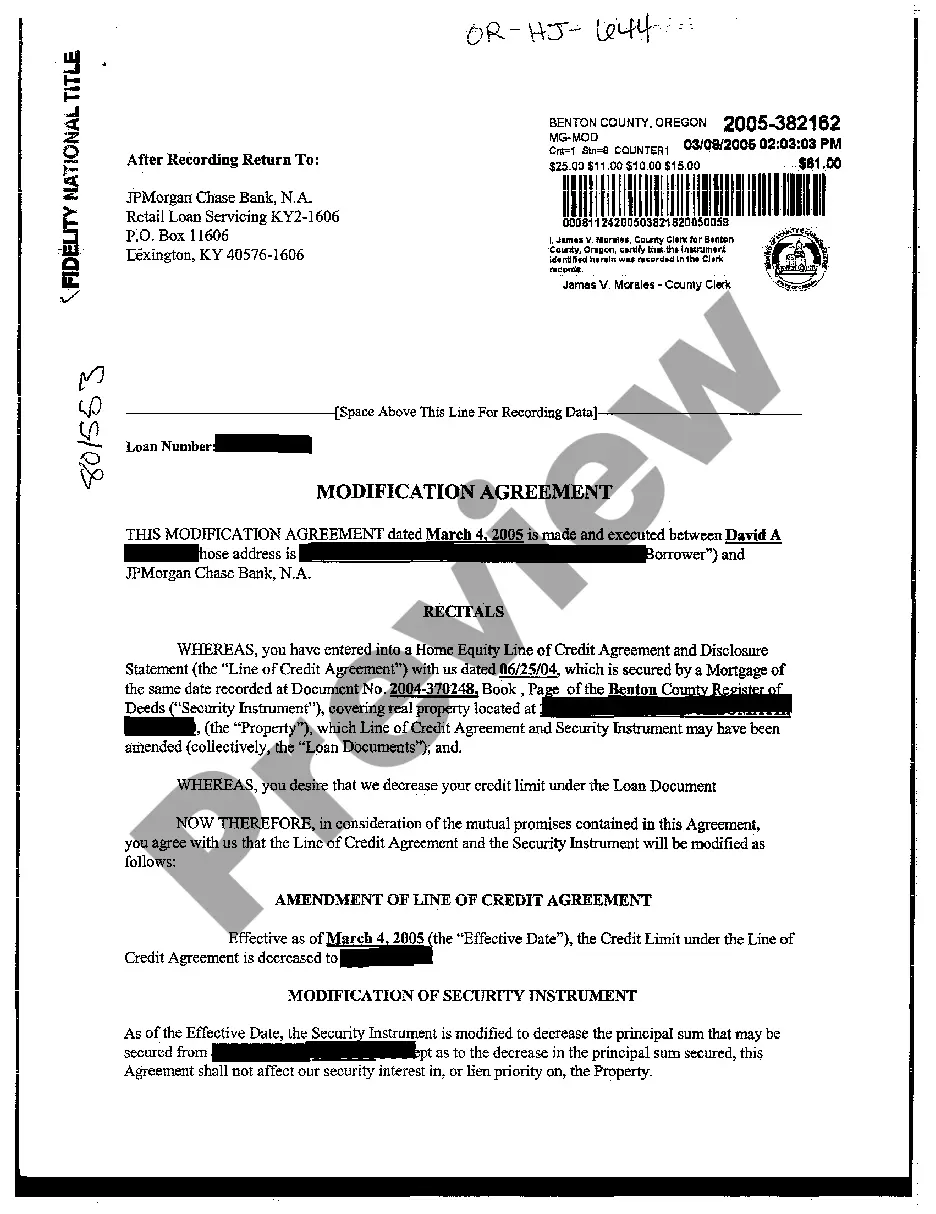

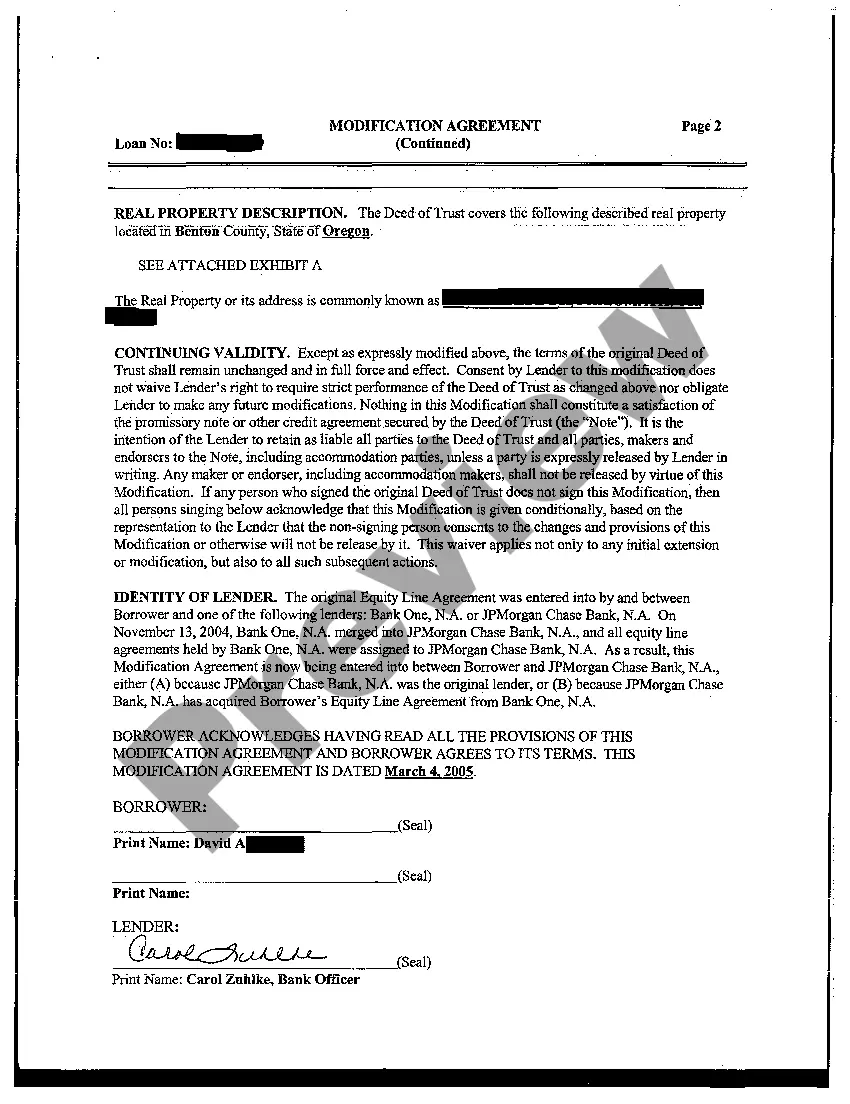

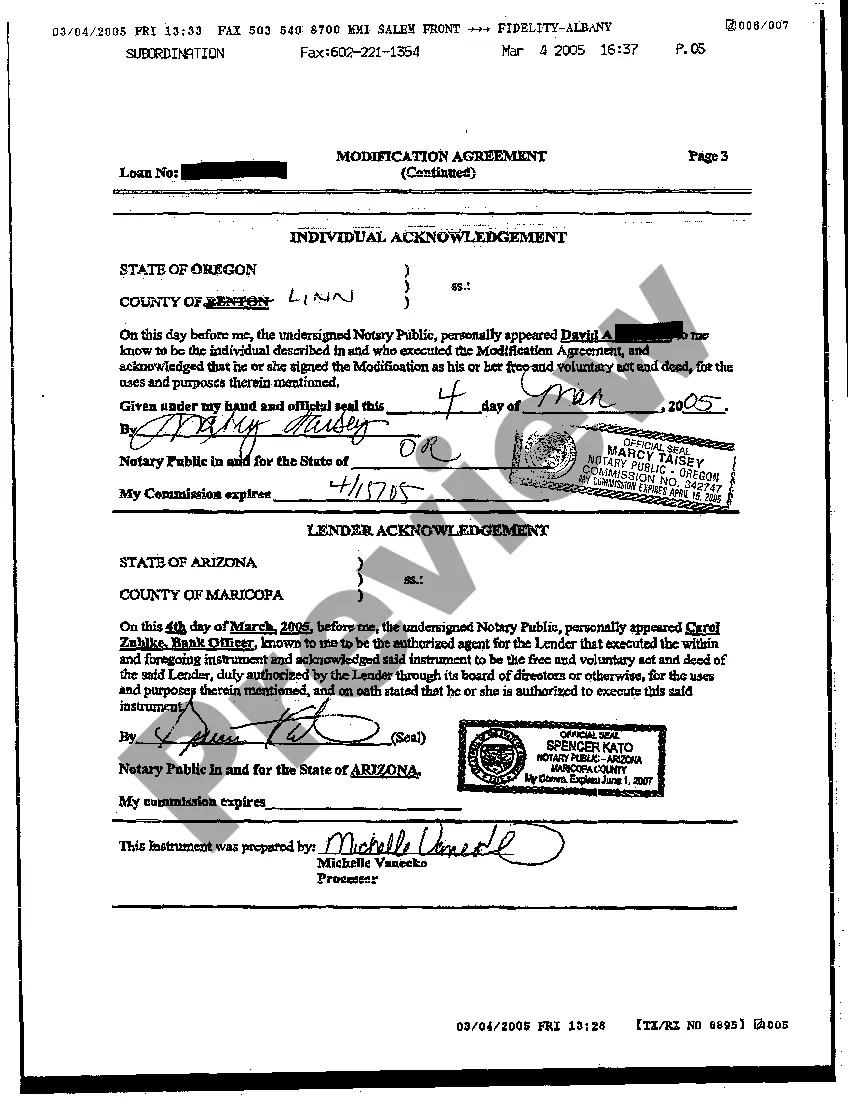

Gresham Oregon Modification Agreement Decreasing Line of Credit A Gresham Oregon Modification Agreement decreasing Line of Credit is a legal document that allows individuals or businesses to modify the terms of an existing line of credit, resulting in a reduction of the available credit limit. This agreement is usually undertaken when borrowers wish to lower their line of credit for various reasons, such as reducing debt, managing expenses, or adjusting to changing financial circumstances. By entering into a Gresham Oregon Modification Agreement to decrease the Line of Credit, borrowers can effectively limit their borrowing capacity, ensuring a more controlled and manageable credit profile. This agreement offers the flexibility required to reallocate financial resources and prevent excessive debt accumulation. Types of Gresham Oregon Modification Agreement Decreasing Line of Credit: 1. Personal Line of Credit Modification: This refers to a modification agreement that applies to individuals seeking to decrease the limit of their personal line of credit. It is commonly used for managing personal debts, consolidating loans, or adjusting credit availability based on personal financial goals. 2. Business Line of Credit Modification: This type of agreement applies to businesses and allows them to decrease the credit limit of their existing line of credit. Businesses often utilize this modification to regulate cash flow, streamline operations, or optimize credit utilization. 3. Home Equity Line of Credit (HELOT) Modification: HELOT borrowers can also opt for a Gresham Oregon Modification Agreement to decrease their line of credit. This type of modification primarily concerns homeowners who wish to reduce their HELOT borrowing capacity due to financial stability concerns, debt management, or changing housing circumstances. The Gresham Oregon Modification Agreement decreasing Line of Credit typically involves key elements such as: — Identification of parties involved: Clearly outlines the identification and contact information of both the borrower and the lender. — Original Line of Credit Details: Provides specifics about the initial line of credit, such as the original credit limit, terms, interest rate, and any other relevant provisions. — Proposed Modification: Clearly states the desired revised credit limit, ensuring all parties are in agreement regarding the new terms and conditions. — Effective Date: Specifies the date on which the modification becomes effective and the newly revised credit limit comes into force. — Signatures: Requires authorized signatures of all parties involved, confirming their agreement and signaling their consent to the modification. In conclusion, a Gresham Oregon Modification Agreement decreasing Line of Credit allows borrowers in Gresham, Oregon, to modify the terms of their existing line of credit to reduce the available credit limit. This agreement provides individuals and businesses with the flexibility to manage debts, control cash flow, and align financial resources as per their specific needs and goals.

Gresham Oregon Modification Agreement decreasing Line of Credit

Description

How to fill out Gresham Oregon Modification Agreement Decreasing Line Of Credit?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Gresham Oregon Modification Agreement decreasing Line of Credit gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Gresham Oregon Modification Agreement decreasing Line of Credit takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Gresham Oregon Modification Agreement decreasing Line of Credit. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

Judges in Oregon look for the child's best interests when deciding custody cases. They assess each parent's capability to provide for the child's emotional and physical needs. By securing a Gresham Oregon Modification Agreement decreasing Line of Credit, you can demonstrate your financial preparedness and stability, which can positively influence a judge's decision.

Oregon courts consider several factors when determining custody arrangements. These include the child's emotional attachment to each parent, the stability of each parent's living situation, and the ability of each parent to meet the child's needs. A Gresham Oregon Modification Agreement decreasing Line of Credit can play a role in presenting your case by illustrating financial stability.

To modify child support in Oregon, you must demonstrate a significant change in circumstances, such as changes in income or costs of care. You can file a petition with the court, outlining the reasons for your request. Utilizing resources like USLegalForms can simplify the process of obtaining a Gresham Oregon Modification Agreement decreasing Line of Credit, ensuring you meet all legal requirements.

In child custody cases, the best evidence typically includes documentation of parental involvement and the child's well-being. This may involve school records, medical reports, and testimonies from teachers or counselors. When pursuing a Gresham Oregon Modification Agreement decreasing Line of Credit, it's important to gather evidence that demonstrates your ability to provide a stable environment for your child.

Modifying Child Support in Nebraska A parent can request to modify (or change) the order after experiencing a material change in financial circumstances for at least three months. Also, this parent must expect this changed circumstance to continue for an additional six months.

If you are current in paying your support, the amount that can be withheld from your wages is the monthly support amount, but only up to a maximum of 50% of your take-home pay (up to 60% in some cases, if a court agrees after a hearing).

A variety of factors determine the amount of child support payments in Oregon. The court considers the needs of the children, as well as each parent's income and ability to pay. Things like debt, regular payments like union dues or spousal support, and other financial elements play a part.

The parent who wants the change would need to start a legal action with the Child Support Program or the Court to request a modification. The change would involve something significant about either parent's income or an unexpected increase or decrease in the child's needs.

7. Modification of judgment. ? A judgment of conviction may, upon motion of the accused, be modified or set aside before it becomes final or before appeal is perfected.

All child support review requests must be made in writing at the county child support office handling your case. The request must also include an Income and Expense Affidavit, supporting documents and list the reason for the change. Following the review, the child support order may go up, down or stay the same.