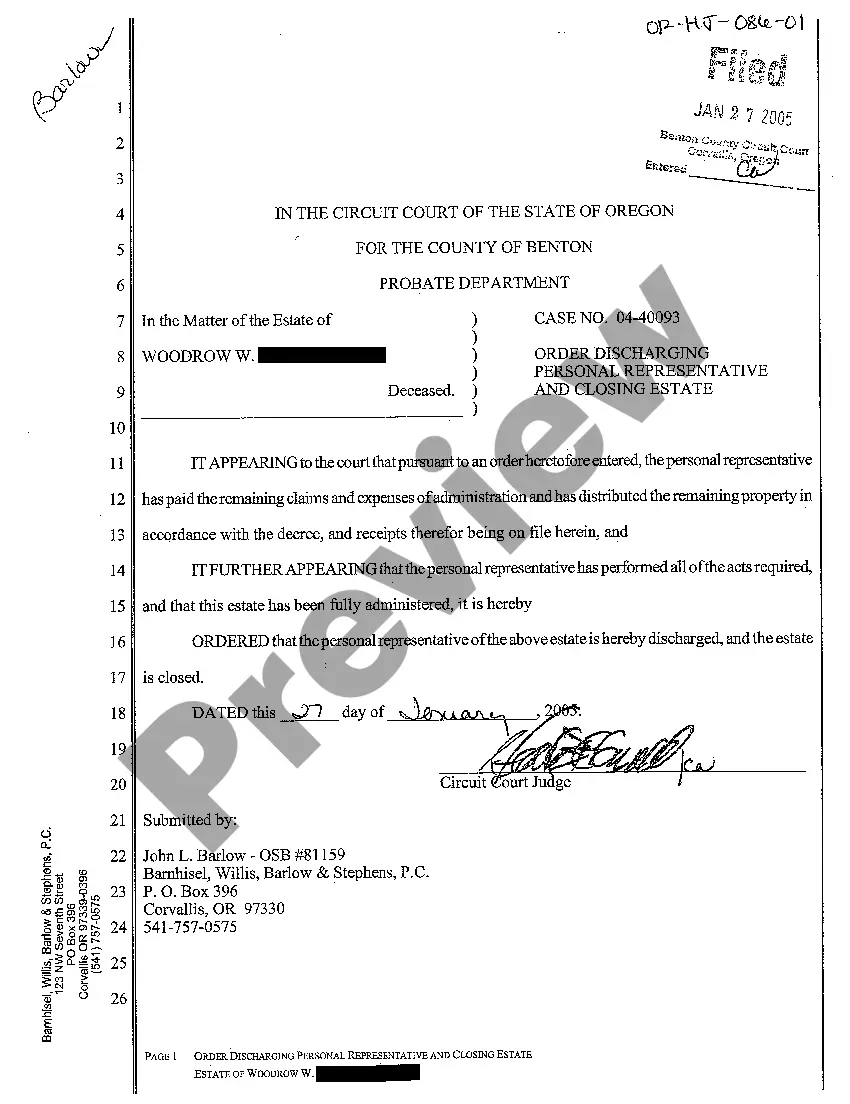

Eugene Oregon Order Discharging Personal Representative and Closing Estate

Description

How to fill out Oregon Order Discharging Personal Representative And Closing Estate?

If you’ve already made use of our service previously, Log In to your account and download the Eugene Oregon Order Discharging Personal Representative and Closing Estate to your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have continuous access to every document you’ve purchased: you can find it in your profile under the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business requirements!

- Confirm you’ve located the correct document. Review the description and utilize the Preview option, if accessible, to verify if it fulfills your needs. If not, use the Search tab above to discover the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Eugene Oregon Order Discharging Personal Representative and Closing Estate. Select the file format for your document and store it on your device.

- Fill out your sample. Print it or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

The correct order of payment from an estate typically follows a specific hierarchy. First, settle funeral expenses and any outstanding debts, including taxes, followed by payments to creditors and then distributions to beneficiaries. Understanding this order is crucial for effectively completing the Eugene Oregon Order Discharging Personal Representative and Closing Estate. Utilizing resources like USLegalForms can guide you through these steps with ease.

Structuring an estate involves organizing assets in a way that facilitates their management and distribution after death. This includes assessing properties, investments, and debts, and deciding how these will be shared among heirs. For those looking to ensure proper execution of the Eugene Oregon Order Discharging Personal Representative and Closing Estate, consulting a legal expert or using online resources like USLegalForms is beneficial. These resources help you create a clear plan for your estate.

A letter to the executor of an estate serves as formal communication regarding the administration of the estate. This letter can provide instructions or request information, thereby ensuring a smooth process for settling the estate. When navigating the Eugene Oregon Order Discharging Personal Representative and Closing Estate, such correspondence helps keep all parties informed. It is vital for maintaining transparency and trust among beneficiaries.

Filling out an estate document requires careful attention to detail. Start by gathering all necessary information about the estate, including asset values and beneficiary details. You can use platforms like USLegalForms to access templates specifically designed for Eugene Oregon Order Discharging Personal Representative and Closing Estate. These templates simplify the process, ensuring compliance with state regulations.

The final estate distribution letter is a document that outlines how the deceased's assets will be divided among beneficiaries. This letter is crucial for completing the Eugene Oregon Order Discharging Personal Representative and Closing Estate process. It ensures that everyone involved understands their share and helps prevent future disputes. Commonly, this document is prepared after all debts and taxes have been settled.

A personal representative has broad authority to manage the estate, including selling assets, paying creditors, and addressing tax responsibilities. They also represent the estate in court and have the power to settle claims made against it. Ultimately, they aim to achieve an order discharging them and closing the estate, which signifies their duties are complete. For smooth estate handling, utilizing resources like USLegalForms can provide helpful templates and guidance.

In Oregon, the timeline to settle an estate can vary, but generally, you should aim to close the estate within a year of starting the process. However, complexities such as disputes or tax obligations can extend this timeline. Achieving an order discharging the personal representative and closing the estate is the goal, and taking timely actions can help in adhering to this timeframe. Staying organized and informed will assist you during this period.

While the terms 'executor' and 'personal representative' often overlap, there can be context-specific differences. An executor is specifically named in a will to administer the estate, while a personal representative may be appointed by a court if no will exists. Both roles culminate in the establishment of an order discharging the personal representative and closing the estate, indicating they have fulfilled their duties. Therefore, it’s vital to understand these roles when developing an estate plan.

A power of attorney is a legal document that gives one person authority to act on behalf of another while they are alive. In contrast, a personal representative takes over after someone has passed away, managing the estate's final affairs. The personal representative receives an order discharging them upon completing their responsibilities, which includes closing the estate. Understanding the distinction is essential when planning for estate management.

The personal representative manages the estate, which includes gathering assets, paying debts, and distributing property to beneficiaries. They must also file necessary documents with the court, handle tax obligations, and ensure compliance with state laws. In Eugene, Oregon, the order discharging the personal representative and closing the estate formalizes their completion of these duties. Overall, their role is critical to ensuring the estate is settled efficiently and fairly.