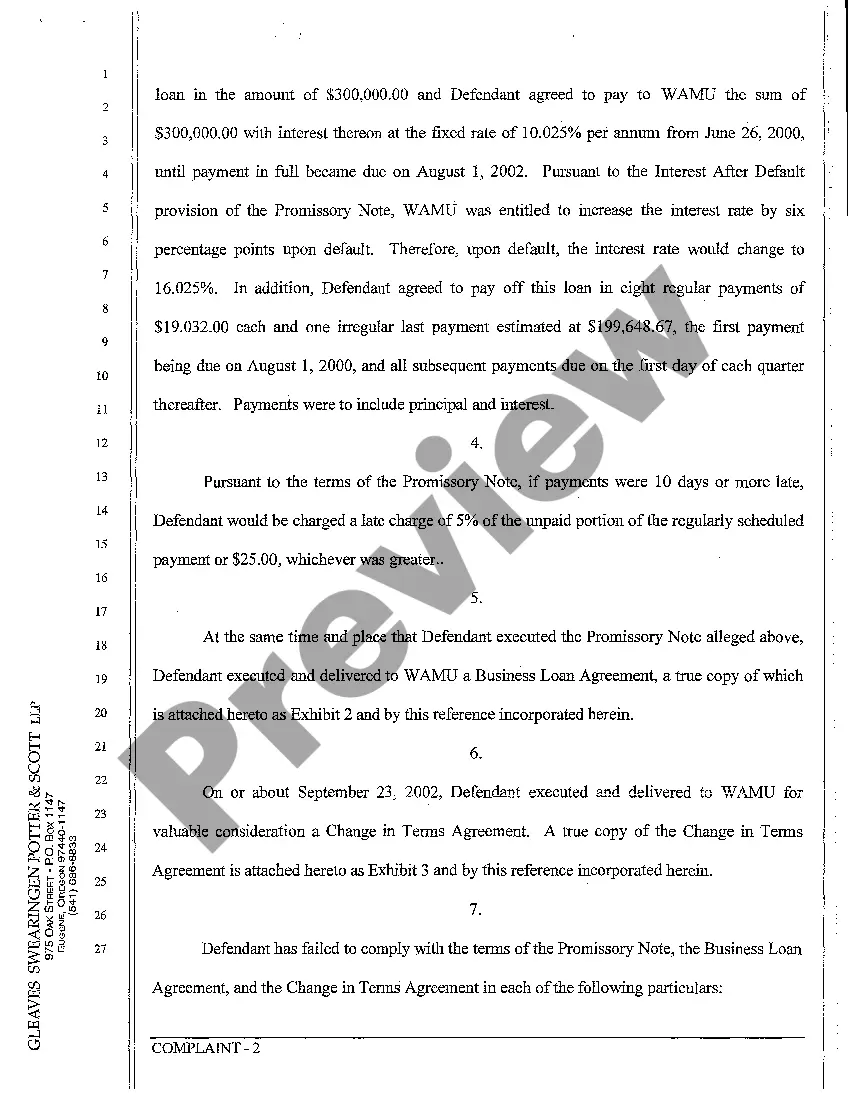

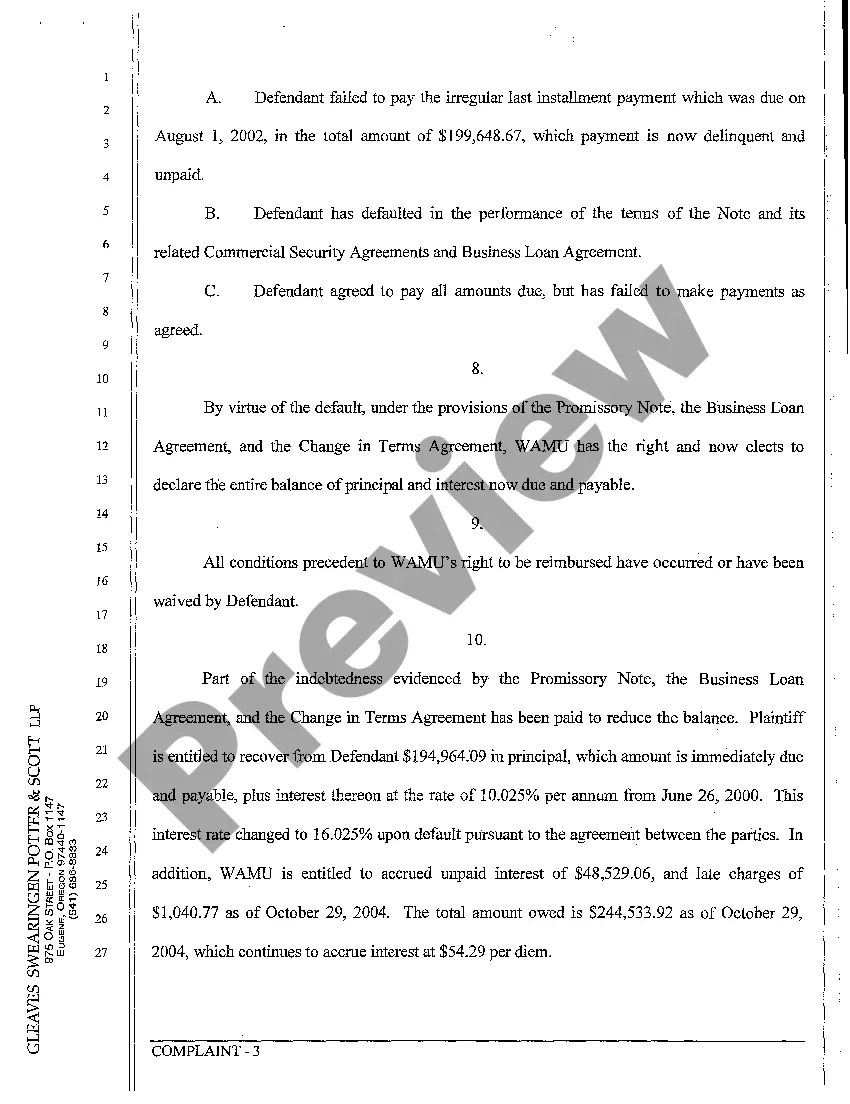

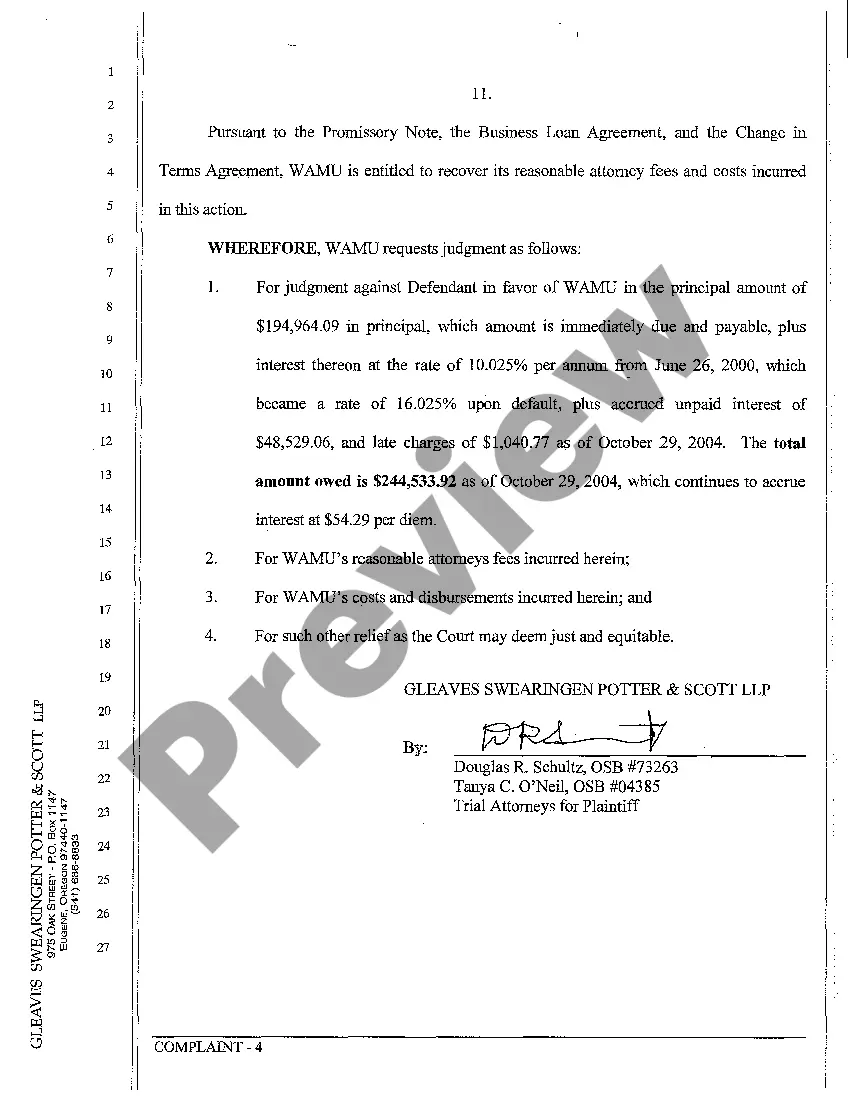

Gresham Oregon Complaint — Action on Promissory Note is a legal process in Gresham, Oregon, initiated by a party to seek legal action against a debtor who has failed to fulfill their obligations stated in a promissory note. A promissory note is a legal document that outlines the terms and conditions of a loan or debt, including the repayment schedule, interest rate, and penalties for non-payment. The purpose of the Gresham Oregon Complaint — Action on Promissory Note is to enable the creditor to recover the outstanding indebtedness owed to them by the debtor. This legal action is taken to enforce the terms of the promissory note and compel the debtor to fulfill their financial obligations. There can be various types of Gresham Oregon Complaint — Action on Promissory Note, each pertaining to a specific situation or circumstance. Some common types include: 1. Gresham Oregon Complaint — Action on Promissory Note for Non-payment: This type of complaint is filed when the debtor fails to make the required payments according to the agreed-upon schedule in the promissory note. The creditor seeks legal action to recover the outstanding balance. 2. Gresham Oregon Complaint — Action on Promissory Note for Default: This complaint is filed when the debtor violates any other terms and conditions mentioned in the promissory note, such as providing collateral, breaching confidentiality clauses, or engaging in prohibited actions. The creditor seeks legal remedies due to the debtor's default. 3. Gresham Oregon Complaint — Action on Promissory Note for Fraud: If the creditor believes that the debtor obtained the loan or debt through deceit or fraudulent means, they can file a complaint seeking legal action for fraud. The complaint will detail the fraudulent actions committed by the debtor. 4. Gresham Oregon Complaint — Action on Promissory Note for Disputed Terms: In certain situations, the debtor may dispute the validity or enforceability of certain terms in the promissory note. The creditor can file a complaint seeking a court's decision on the disputed terms and requesting to enforce the remaining valid terms. When filing a Gresham Oregon Complaint — Action on Promissory Note, it is important to gather all relevant documentation, such as the original promissory note, payment records, communication records, and any other evidence supporting the creditor's claim. A skilled attorney specializing in debt collection and contract law can assist in preparing and filing the complaint correctly and representing the creditor throughout the legal process. In conclusion, Gresham Oregon Complaint — Action on Promissory Note refers to the legal process employed by creditors in Gresham, Oregon, to seek enforcement of a promissory note and recover outstanding debts. Different types of complaints can be filed based on the specific circumstances, including non-payment, default, fraud, and disputed terms. Hiring an experienced attorney is advisable to navigate through the legal complexities efficiently.

Gresham Oregon Complaint - Action on Promissory Note

Description

How to fill out Gresham Oregon Complaint - Action On Promissory Note?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Gresham Oregon Complaint - Action on Promissory Note becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Gresham Oregon Complaint - Action on Promissory Note takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Gresham Oregon Complaint - Action on Promissory Note. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

? To start a case, fill out the Small Claim and Notice of Small Claim form located on our website at and pay the filing fee. o If you are asking for money damages, you must itemize and prove your actual loss.

If you use the Claim and Notice form in Supporting Documents below, you will need one complete original to file with the Court. Upon payment of the $37 filing fee, two copies will be made and certified for service. If you need additional copies, you can purchase them for .

A civil action for collection of a sum of money may be commenced and tried where the plaintiff or any of the principal plaintiffs resides, or where the defendant or any of the principal defendants resides, or in the case of a non-resident defendant where he may be found, at the election of the plaintiff.

? To start a case, fill out the Small Claim and Notice of Small Claim form located on our website at and pay the filing fee. o If you are asking for money damages, you must itemize and prove your actual loss.

If you use the Claim and Notice form in Supporting Documents below, you will need one complete original to file with the Court. Upon payment of the $37 filing fee, two copies will be made and certified for service. If you need additional copies, you can purchase them for .

Contact Us Toll-Free: 1-877-877-9392, ? , Monday-Friday. Email: help@oregonconsumer.gov. Fill out the online Consumer Complaint Form »

Contact Us Toll-Free: 1-877-877-9392, ? , Monday-Friday. Email: help@oregonconsumer.gov. Fill out the online Consumer Complaint Form »

If you have been served with a Small Claim, you have 14 calendar days to file your response. If the response is not received by the court within that time, the plaintiff may request a default judgment against you for the amount claimed plus filing fees, service costs, and a prevailing party fee.

Basic rules keep your letter to the point. You need to give enough detail for your employer to be able to investigate your complaint properly.keep to the facts.never use abusive or offensive language.explain how you felt about the behaviour you are complaining about but don't use emotive language.

File a complaint with your local consumer protection office or the state agency that regulates the company. Notify the Better Business Bureau (BBB) in your area about your problem. The BBB tries to resolve your complaints against companies.