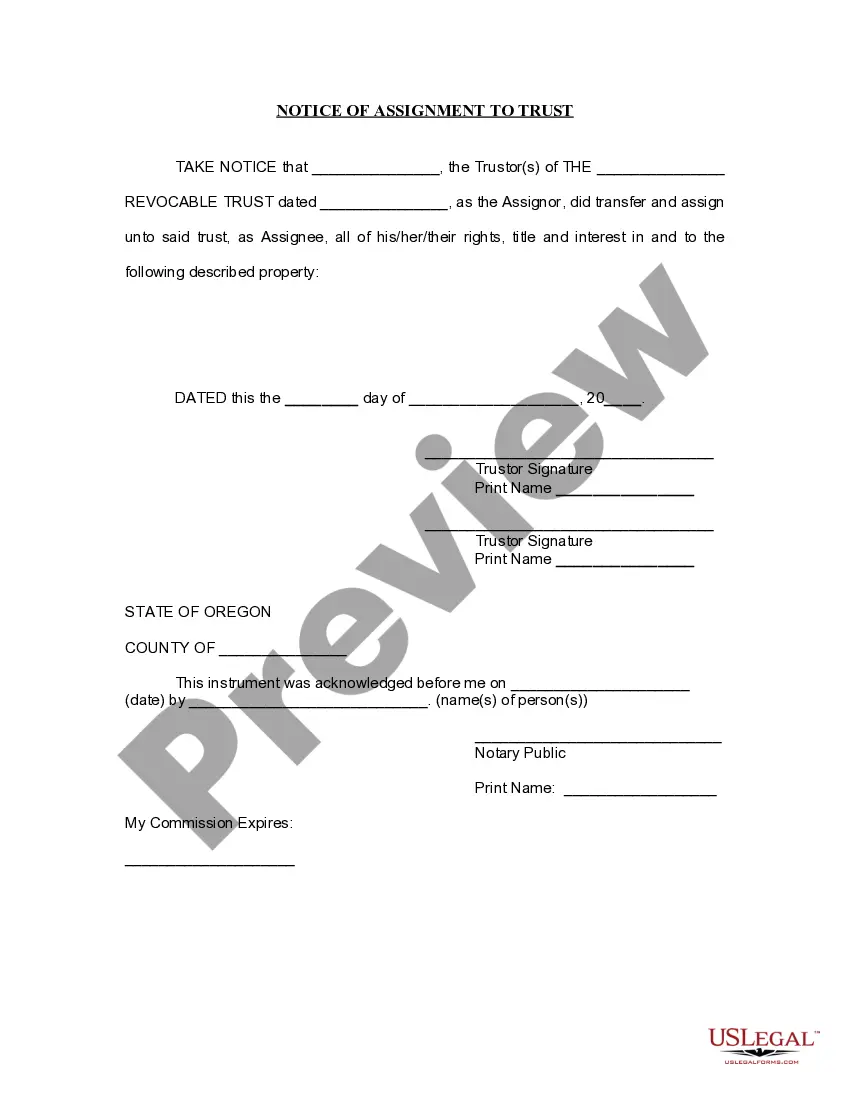

Portland Oregon Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Oregon Notice Of Assignment To Living Trust?

We consistently seek to minimize or evade legal repercussions when engaging in intricate legal or financial matters.

To achieve this, we enlist legal services that are generally very expensive.

Nevertheless, not all legal concerns are equally complicated.

Most of them can be managed independently.

Utilize US Legal Forms whenever you wish to obtain and download the Portland Oregon Notice of Assignment to Living Trust or any other document quickly and securely. Just Log In to your account and click the Get button beside it. If you happen to misplace the form, you can always re-download it in the My documents tab.

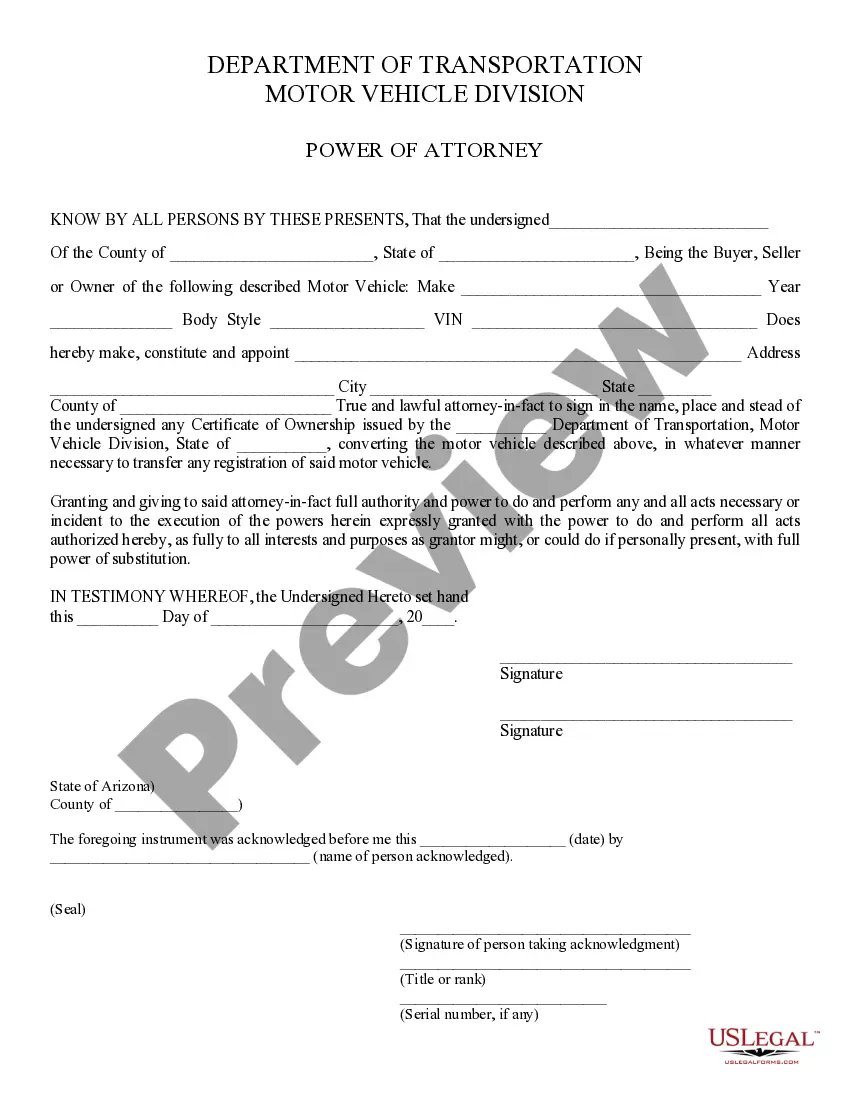

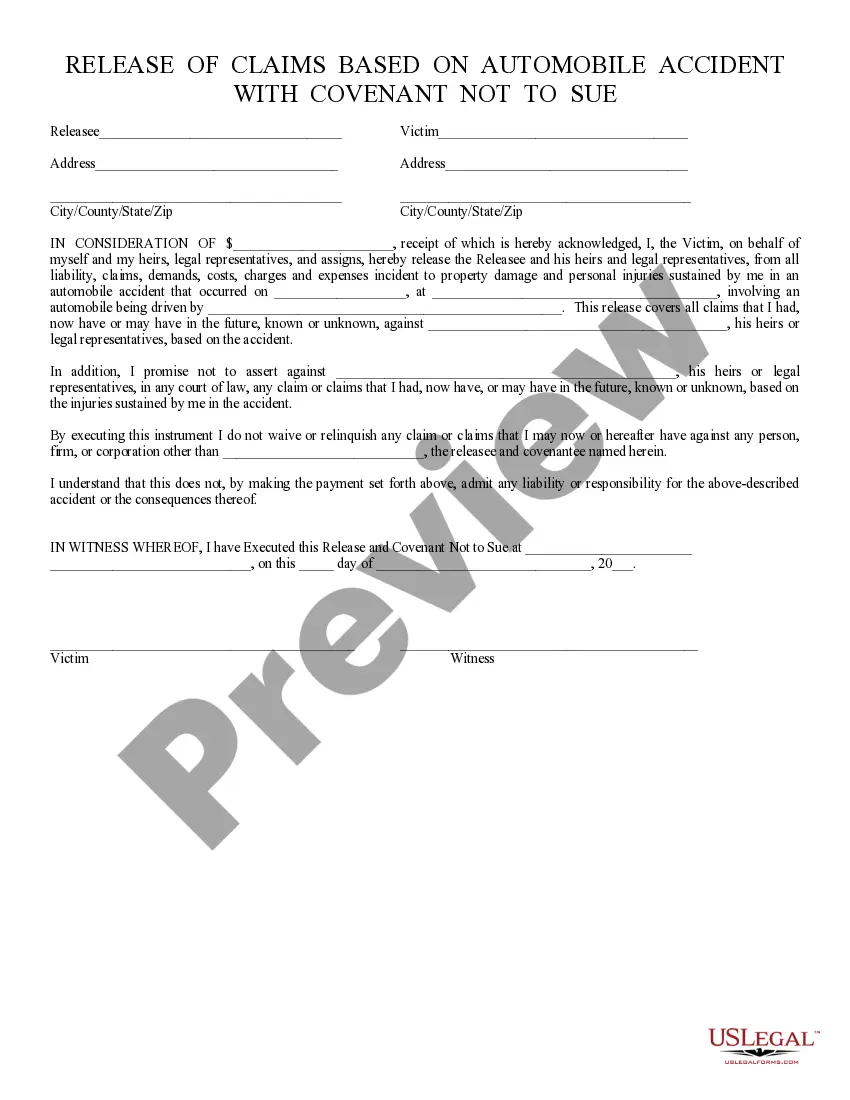

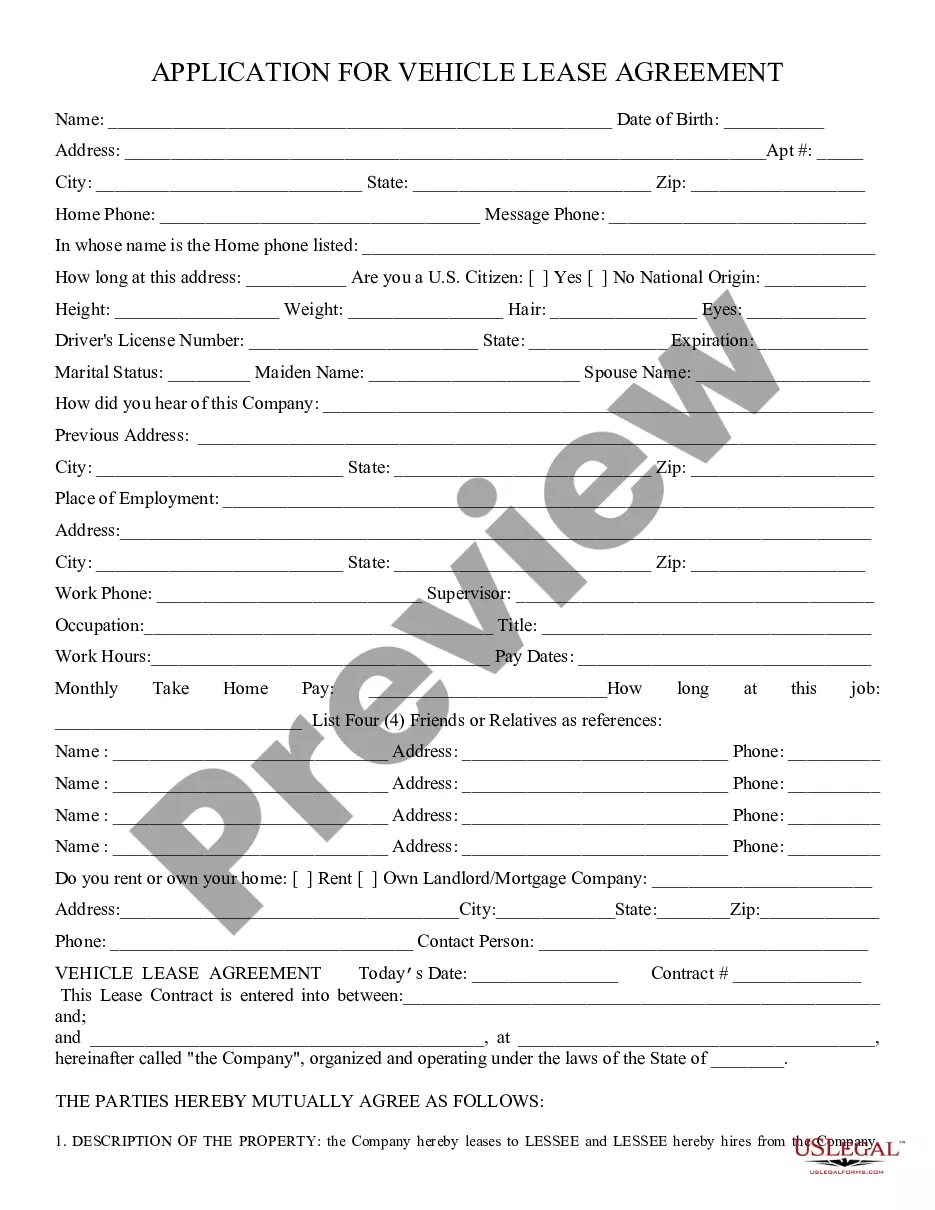

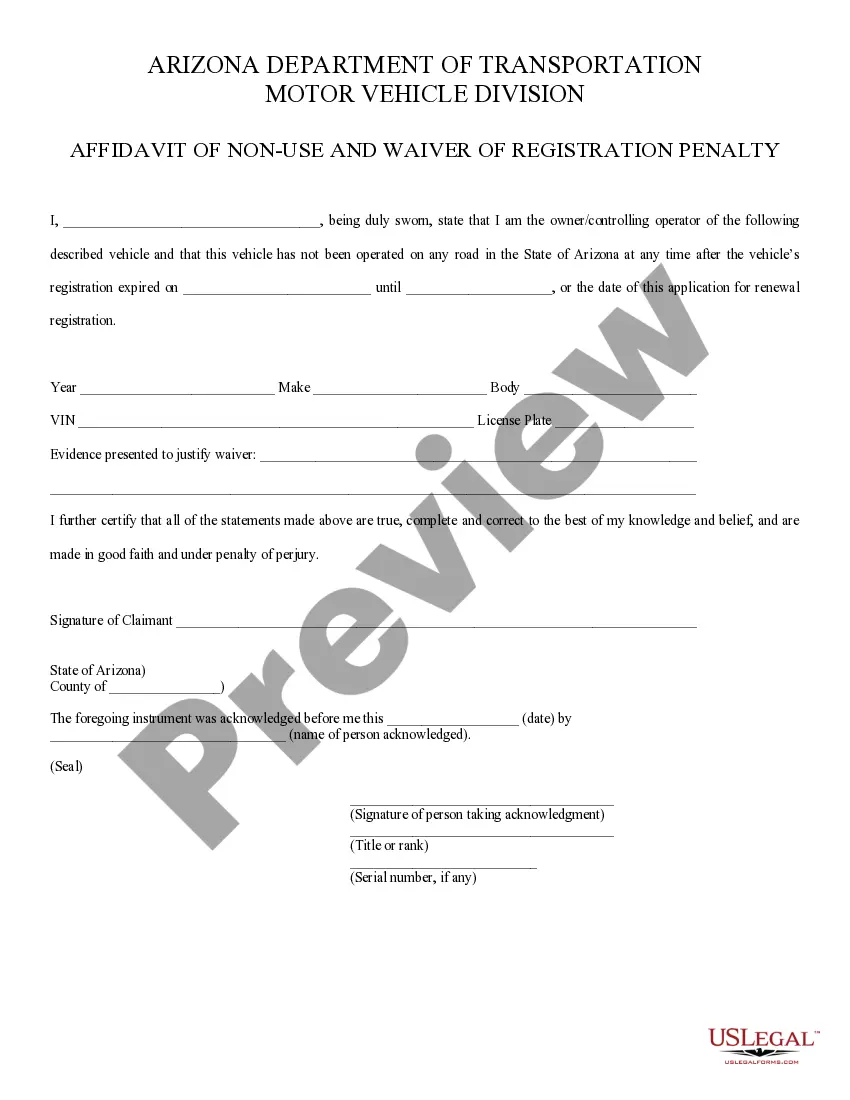

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and power of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to manage your matters without the assistance of a lawyer.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to state and region, which greatly eases the search process.

Form popularity

FAQ

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

To make a living trust in Oregon, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Generally the terms of your living trust are confidential, with only your named beneficiaries and trustee having access to that information.

For example: Within 60 days after taking the responsibility of the Trust, the Trustee shall give notice to the qualified beneficiaries of the acceptance and their full name and address of the Trustee.

Oregon law requires that trustee's make certain information available to trust beneficiaries. Generally speaking, a trustee must keep the beneficiaries of the trust reasonably informed about the administration of the trust and of the material facts necessary for those beneficiaries to protect their interests.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Creating a living trust Oregon requires you to prepare a trust agreement. This document is then signed by you in front of a notary. The trust is not complete or functional until you transfer ownership of your assets into the trust.

Pricing for and Individual Trust Plan and for a Joint Trust Plan. Pricing depends on the size of the Estate. $3,200 for Estates under $2 million. $4,200 for Estates between $2 million and $5 million, and Estates over $5 million are subject to a special fee agreement based on the complexity of the Estate.

Register with the Oregon DOJ. Generally, nonprofit public benefit corporations or associations or trusts with a charitable purpose must register with the Charitable Activities Section of the Oregon DOJ.