Eugene Oregon Assignment to Living Trust

Description

How to fill out Oregon Assignment To Living Trust?

If you have previously employed our service, sign in to your account and download the Eugene Oregon Assignment to Living Trust onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial use of our service, follow these straightforward steps to obtain your document.

You have ongoing access to all documents you have purchased: you can locate them in your profile under the My documents menu whenever you wish to reuse them. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business needs!

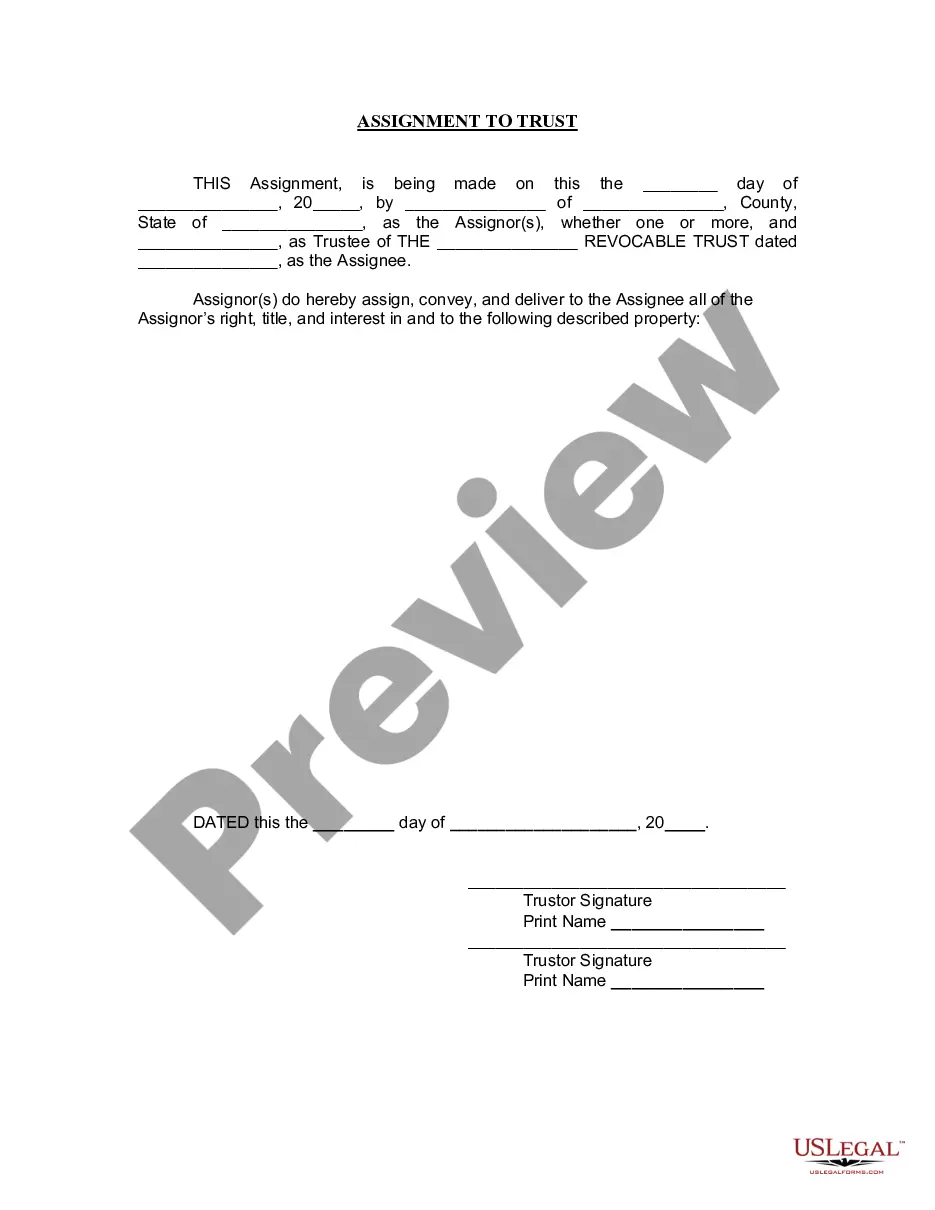

- Confirm you’ve found the correct document. Review the description and utilize the Preview option, if available, to see if it fits your requirements. If it doesn’t work for you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and process a payment. Enter your credit card information or use the PayPal option to finish the transaction.

- Obtain your Eugene Oregon Assignment to Living Trust. Choose the file format for your document and store it on your device.

- Complete your sample. Either print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A common mistake parents make when creating a trust fund, like the Eugene Oregon Assignment to Living Trust, is not clearly defining the criteria for distributions to their children. This can lead to misunderstandings and frustration later on. Parents often overlook the importance of revisiting and updating the trust as family dynamics change, which can be crucial for effective asset management.

Family trusts can sometimes create a sense of entitlement among beneficiaries, which may discourage them from being financially responsible. Another disadvantage of a family trust, including the Eugene Oregon Assignment to Living Trust, is the potential for family conflicts, especially if all members do not agree on the management of the trust. Open communication and clear trust terms can help reduce such issues.

One notable pitfall of establishing a trust, such as the Eugene Oregon Assignment to Living Trust, is failing to fund it properly. Many individuals create trusts but don’t transfer assets into them, rendering the trust ineffective. Furthermore, lack of clear instructions for the trustee can lead to disputes among beneficiaries, underscoring the importance of thorough and thoughtful planning.

A trust, including the Eugene Oregon Assignment to Living Trust, can involve higher initial setup costs, which might deter some people. Additionally, while a trust provides privacy for asset distribution, it also requires ongoing management and may involve complex tax implications. That said, these downsides can be mitigated with proper planning and guidance.

Filling out a living trust can be straightforward when you follow a clear process. First, gather all necessary documents, including property titles and financial accounts. Next, create a detailed inventory of your assets and decide who will benefit from the Eugene Oregon Assignment to Living Trust. Using a reliable platform like US Legal Forms can simplify this task, offering customizable templates and guidance to ensure that your living trust meets legal requirements.

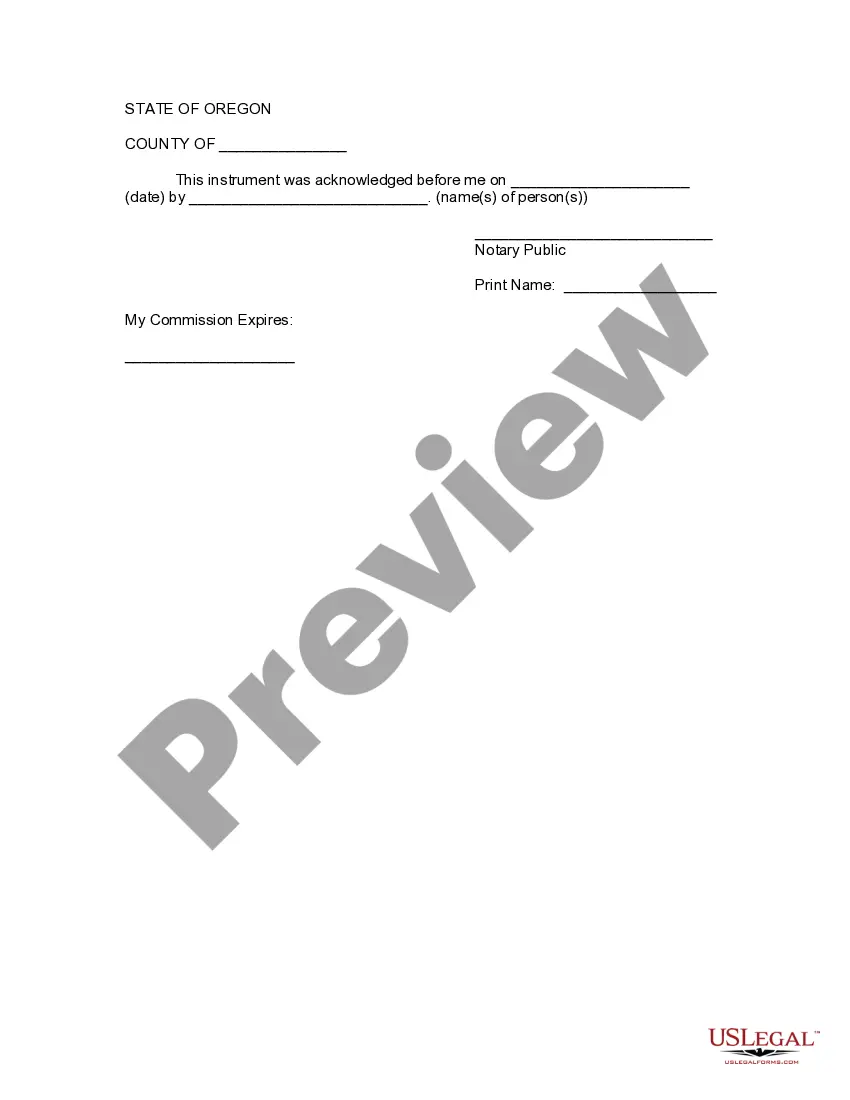

Assigning assets to a trust is a crucial step in establishing your Eugene Oregon Assignment to Living Trust. This process typically involves transferring ownership of your assets, such as real estate or bank accounts, to the trust. You will need to prepare documents, including a deed for real property and change account titles direct to the trust. Utilizing platforms like US Legal Forms can simplify this process, providing the necessary documentation and guidance for a seamless transition.

Using a trust does not automatically avoid estate tax in Oregon; however, it can provide strategies to reduce your overall tax burden. By transferring assets into a trust, you may be able to take advantage of certain exclusions and deductions available under state law. Understanding the intricacies of tax implications with the Eugene Oregon Assignment to Living Trust can be complex, so consulting with a tax professional or estate planning attorney is recommended. Resources from uslegalforms can also guide you through trust formation and its tax benefits.

To put your property in a trust in Oregon, you will need to execute a formal transfer process. Start by establishing your trust, and then formally transfer your assets into it through a trustee deed or a similar document depending on the type of property. Following this process helps ensure that your estate plan aligns with your intentions for the Eugene Oregon Assignment to Living Trust. Using tools from uslegalforms can streamline this process and save you time.

Transferring property to a trust in Oregon involves several key steps. First, you need to create your trust document, outlining the terms and beneficiaries. Next, you must execute the property transfer by preparing and filing the relevant documents, such as a deed if real estate is involved. The Eugene Oregon Assignment to Living Trust simplifies this process, and you can rely on platforms like uslegalforms to ensure you handle everything correctly and efficiently.

One of the biggest mistakes parents often make when setting up a trust fund is not clearly defining their intentions. Without clear goals, the trust can create confusion among heirs and lead to disputes. Additionally, failing to properly fund the trust can result in assets remaining outside of it, which goes against the primary purpose of the Eugene Oregon Assignment to Living Trust. Working with an experienced professional can help you avoid these pitfalls and establish a trust that meets your family's needs.