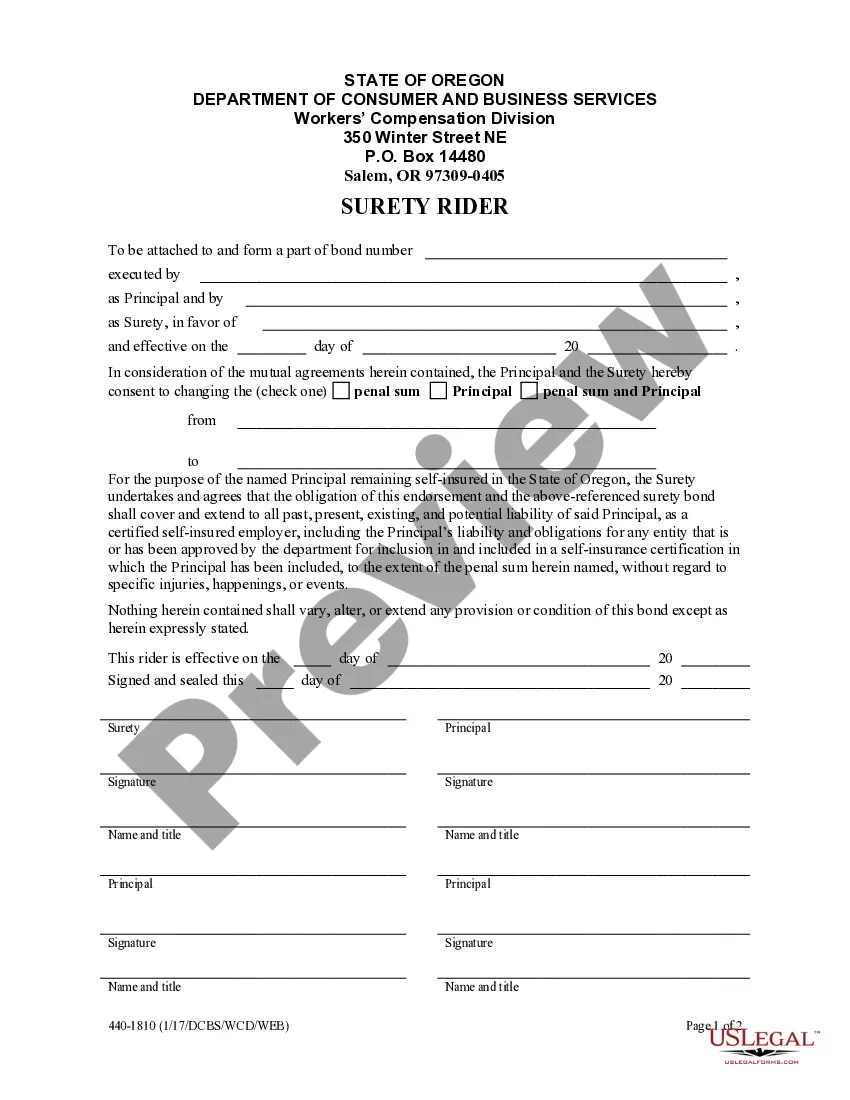

Portland Oregon Workers Compensation Surety Bond

Description

How to fill out Oregon Workers Compensation Surety Bond?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life situations.

All the files are appropriately organized by usage area and jurisdiction, making it as simple as ABC to find the Portland Oregon Workers Compensation Surety Bond.

Maintaining documentation orderly and compliant with legal requirements is crucial. Leverage the US Legal Forms library to have necessary document templates readily available for any requirements!

- Review the Preview mode and document description.

- Ensure you've selected the right one that fulfills your needs and completely aligns with your local jurisdiction criteria.

- Look for another template, if necessary.

- If you identify any discrepancies, utilize the Search tab above to find the right document.

- If it meets your needs, proceed to the next stage.

Form popularity

FAQ

For applicants with good credit, the surety bond premium is often between 1% and 3% of the total value of the surety bond. This means that for a surety bond of $10,000, it is normal for an applicant with strong credit history to pay the surety company between $100 and $300.

On average, the cost for a surety bond falls somewhere between 1% and 15% of the bond amount. That means you may be charged between $100 and $1,500 to buy a $10,000 bond policy. Most premium amounts are based on your application and credit health, but there are some bond policies that are written freely.

?A surety bond is a promise by a bonding company to pay all or a portion of a CCB final order if a contractor fails to pay the order in order to protect consumers. A property owner can file a CCB complaint against a contractor for breach of contract or improper work.

The bond must meet the following requirements: Filed with TxDMV before a permit is issued. Issued and signed by a resident Texas agent or issued by a non-resident agent with a valid Texas insurance license on behalf of an authorized insurance company. Issued on Form 439 for $10,000.

You can get a surety bond through your local insurance agency or a surety bond company. Many people choose a surety bond company because surety companies specialize in surety. Most companies let you apply for your surety bond online. Browse available Oregon surety bonds.

You pay the face value. For example, a $50 EE bond costs $50. EE bonds come in any amount to the penny for $25 or more. For example, you could buy a $50.23 bond.

The bond must be written by a surety company licensed through the California Department of Insurance. The bond must be in the amount of $15,000. The business name and license number on the bond must correspond exactly with the business name and license number on the CSLB's records.

Oregon Contractor License Bonds The bond amount varies: $10,000 ? $20,000 for residential contractors and $20,000 ? $75,000 for commercial contractors.

The Oregon Contractor License surety bond can cost anywhere between $100 to $200 per year. Insurance companies determine the rate based on a number of factors including your customer's credit score and experience.