Portland Oregon Self-Insurer Report of Losses - Experience Rating Period

Description

How to fill out Oregon Self-Insurer Report Of Losses - Experience Rating Period?

If you are searching for a pertinent form, it’s challenging to discover a more suitable platform than the US Legal Forms website – likely the most extensive collections on the internet.

With this collection, you can locate a vast array of templates for commercial and personal uses by categories and states, or keywords.

With the enhanced search function, locating the latest Portland Oregon Self-Insurer Report of Losses - Experience Rating Period is as straightforward as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

Retrieve the template. Select the file format and save it to your device.

- Moreover, the relevance of each document is verified by a team of skilled attorneys who consistently review the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Portland Oregon Self-Insurer Report of Losses - Experience Rating Period is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the guidelines below.

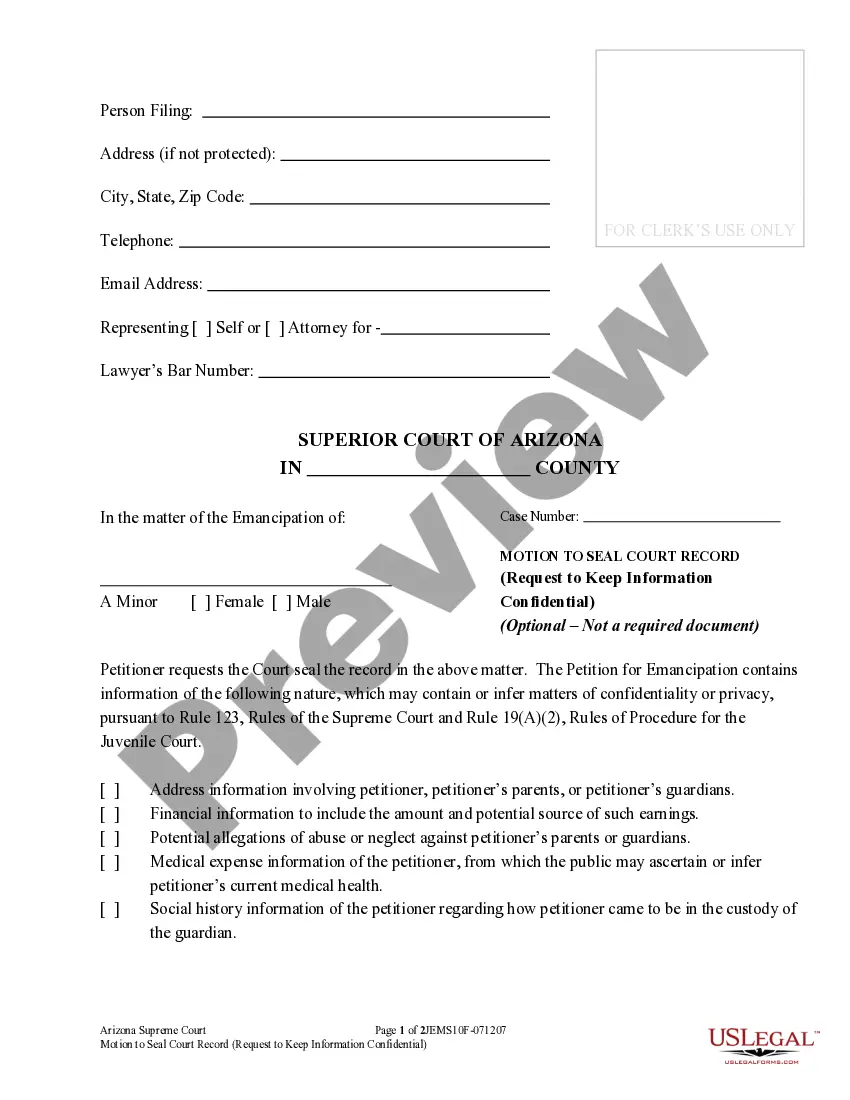

- Ensure you have located the form you need. Verify its details and use the Preview option (if available) to inspect its contents. If it doesn’t meet your requirements, utilize the Search feature at the top of the page to find the suitable record.

- Validate your choice. Choose the Buy now option. Afterwards, select your desired pricing plan and provide credentials to create an account.

Form popularity

FAQ

Premiums based on a community rating allocate risks evenly across a defined community. This means that everyone pays the same, regardless of age, gender or health status. With experience-rated underwriting guidelines, premiums are adjusted based on the age, gender and health history of those covered.

The experience rating calculation generally consists of an experience period of three policy years (36 months) of class code, payroll and claim data. The most recent policy year of data used is the policy year that expired one year prior to the rating effective date.

What is the benefit of experience rating? It allows employers with low claims experience to get lower premiums; Group health insurance is usually subject to experience rating where the premiums are determined by the experience of this particular group as a whole.

How is EMR Calculated? The EMR is calculated by dividing a company's payroll by classification by 100 and then by a ?class rate? determined by the National Council on Compensation Insurance (NCCI) reflecting the classification's potential risk factor.

Experience rating assigns an unemployment insurance tax rate (experience rate) to employers who have paid covered wages for a sufficient period to rate their experience with unemployment insurance. The less unemployment that an employer's workers have experienced, the lower the unemployment insurance tax rate will be.

The goal is to encourage those with high injury costs to improve safety, and to encourage those with low injury costs to continue to provide safe workplaces.

The easy answer is that any experience modification factor below 1.00 is a good rating. Since 1.00 is average, or neutral, any Emod below 1.00 means that business is performing better than average for other businesses in the same industry and state.

An experience rating is the amount of loss that an insured party experiences compared to the amount of loss that similar insured parties have. Experience rating is most commonly associated with workers' compensation insurance. It is used to calculate the experience modification factor.