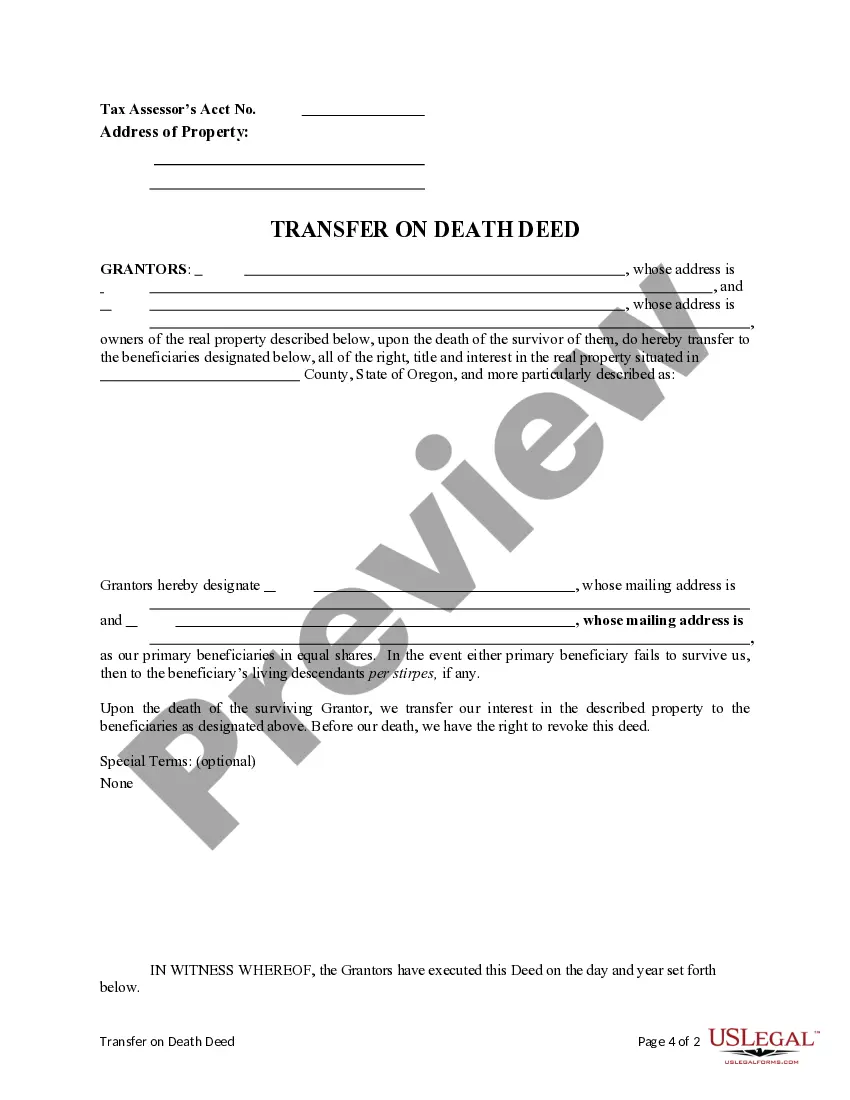

This form is a Transfer on Death Deed where the Grantors are husband and wife, or two individuals, and the Grantee Beneficiaries are two individuals, or Husband and Wife. This transfer is revocable until the last Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary Grantees takes the property in equal shares if the primary beneficiaries survive the Grantors. If a primary beneficiary fails to survive Grantors, their interest in the property would go to their descendants per stirpes, if any.

Portland Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries.

Description

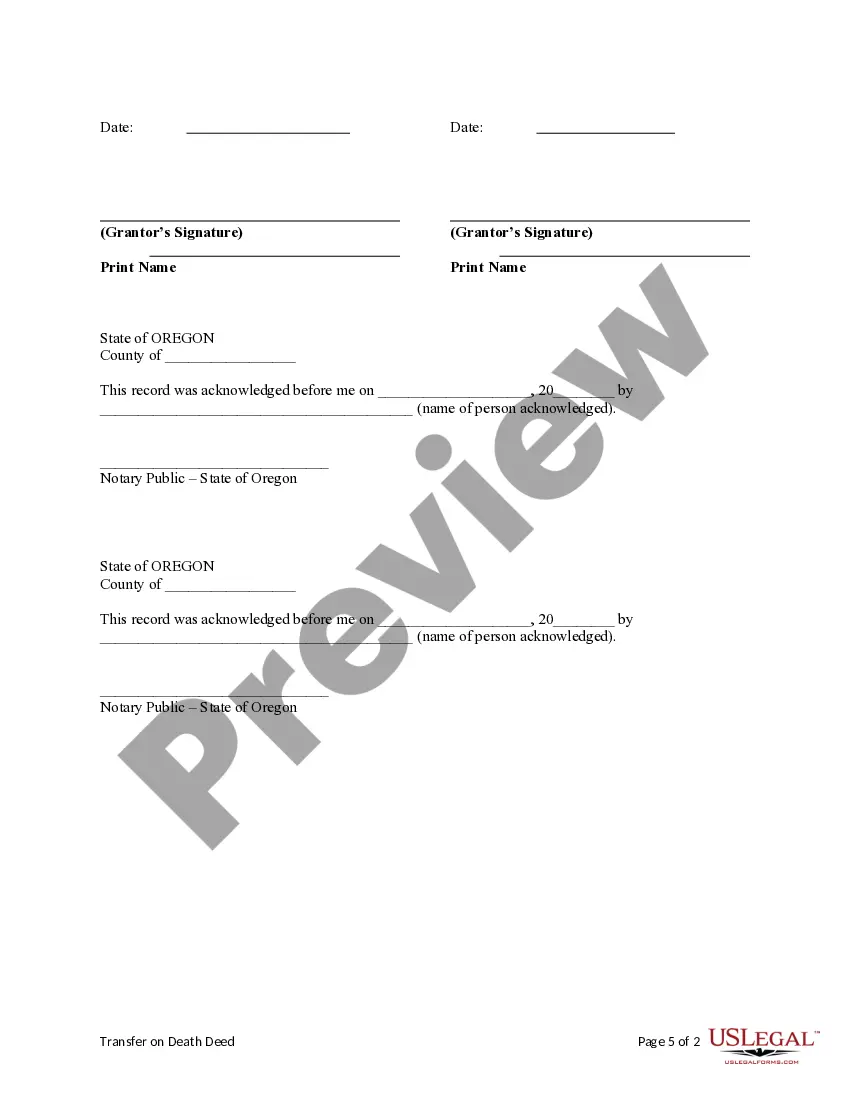

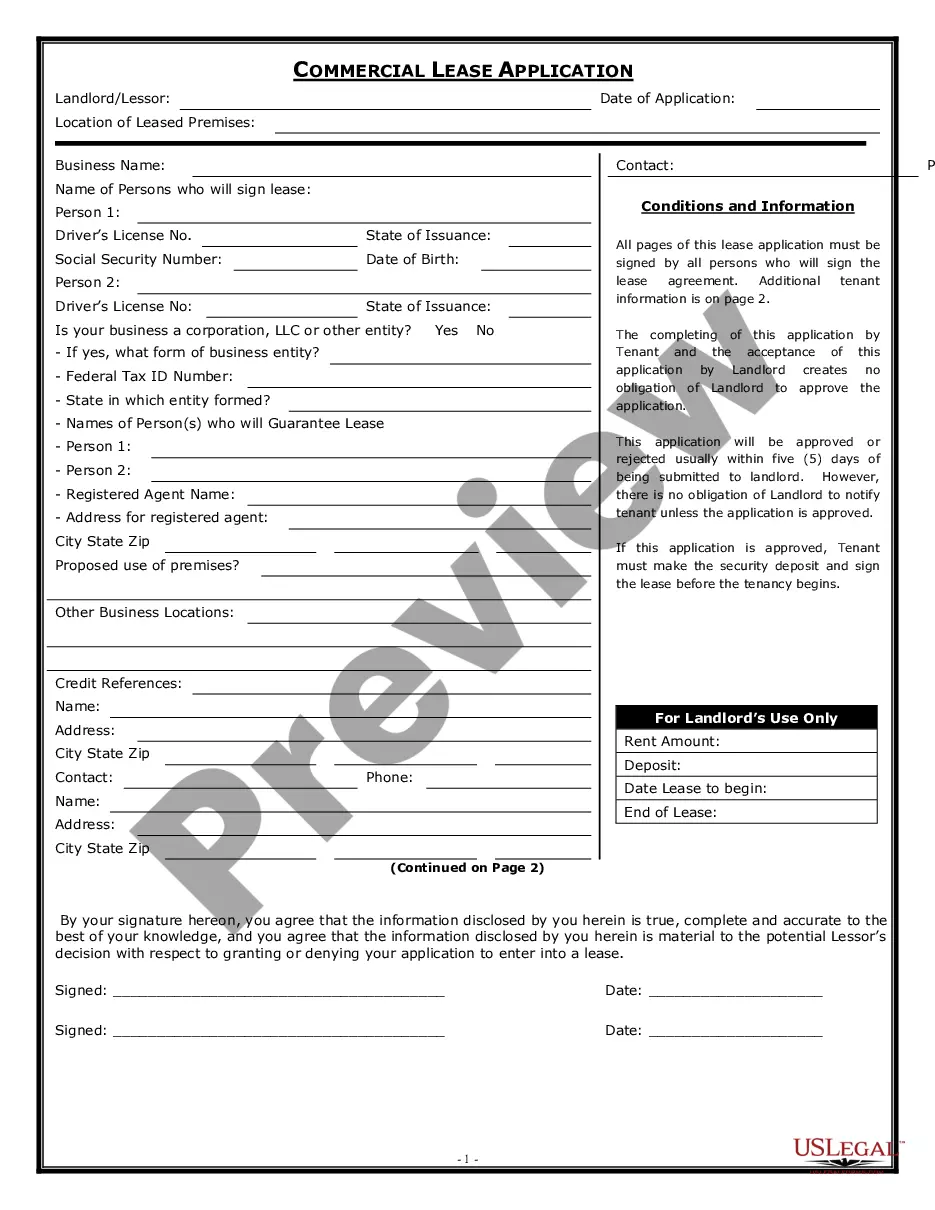

How to fill out Oregon Transfer On Death Deed From Two Individuals Or Husband And Wife To Two Individuals With Provision For Successor Beneficiaries.?

If you’ve previously employed our service, Log In to your account and retrieve the Portland Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provisions for Successor Beneficiaries onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to acquire your file.

You have indefinite access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Leverage the US Legal Forms service to efficiently find and secure any template for your personal or business requirements!

- Ensure you’ve identified the correct document. Review the description and utilize the Preview option, if available, to determine if it fulfills your needs. If it doesn’t fit, employ the Search tab above to locate the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Obtain your Portland Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provisions for Successor Beneficiaries. Choose the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Upon the property owner's death, title to real estate subject to an Oregon TOD deed automatically transfers to the named beneficiary?with no need for probate.

A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

An original certified death certificate will need to be recorded in our office. This removes the name of the decedent from the County's ownership records. Fees are involved with this process.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

Transfer-on-Death Deeds for Real Estate North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

A transfer on death deed, or a TOD Deed, allows for individuals to pass real property to a beneficiary upon their death.

Effective January 1, 2012, Oregon law provides for a new form of deed known as a transfer on death (TOD) deed. These deeds allow an owner of real property to designate a beneficiary who will obtain title to that real property when the owner dies, without having to go through probate (subject to some exceptions).

The order of the hierarchy starts with your spouse (if you are married), then your children, your grandchildren, your parents, your siblings, aunts and uncles, cousins, and so on. If you have absolutely no surviving relatives, the State of Oregon inherits from you.