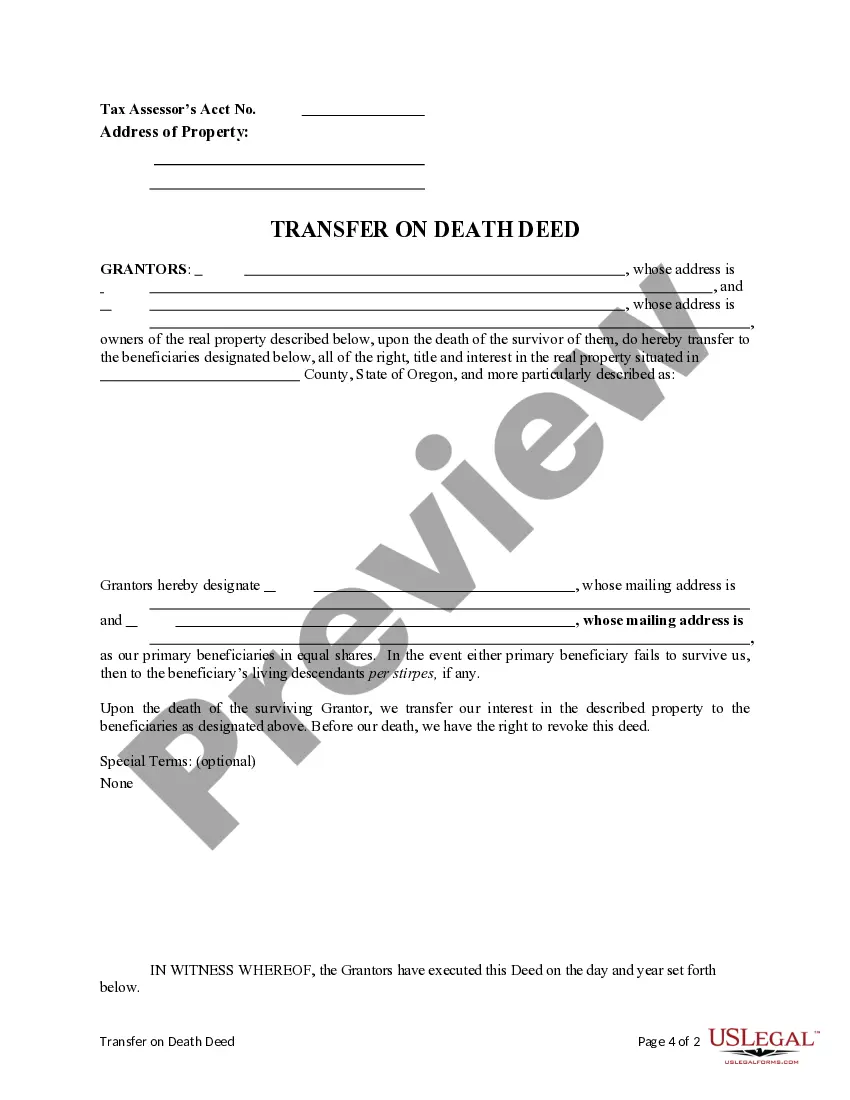

This form is a Transfer on Death Deed where the Grantors are husband and wife, or two individuals, and the Grantee Beneficiaries are two individuals, or Husband and Wife. This transfer is revocable until the last Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary Grantees takes the property in equal shares if the primary beneficiaries survive the Grantors. If a primary beneficiary fails to survive Grantors, their interest in the property would go to their descendants per stirpes, if any.

Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries.

Description

How to fill out Oregon Transfer On Death Deed From Two Individuals Or Husband And Wife To Two Individuals With Provision For Successor Beneficiaries.?

We consistently aim to reduce or avert legal repercussions when handling intricate legal or financial issues.

To achieve this, we seek attorney services that are often quite expensive. However, not every legal situation is equally complicated. Many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and power of attorney to articles of incorporation and petitions for dissolution. Our platform empowers you to manage your affairs independently without relying on an attorney.

We give you access to legal form templates that are not always readily available to the public. Our templates are tailored to specific states and regions, which significantly simplifies the search process.

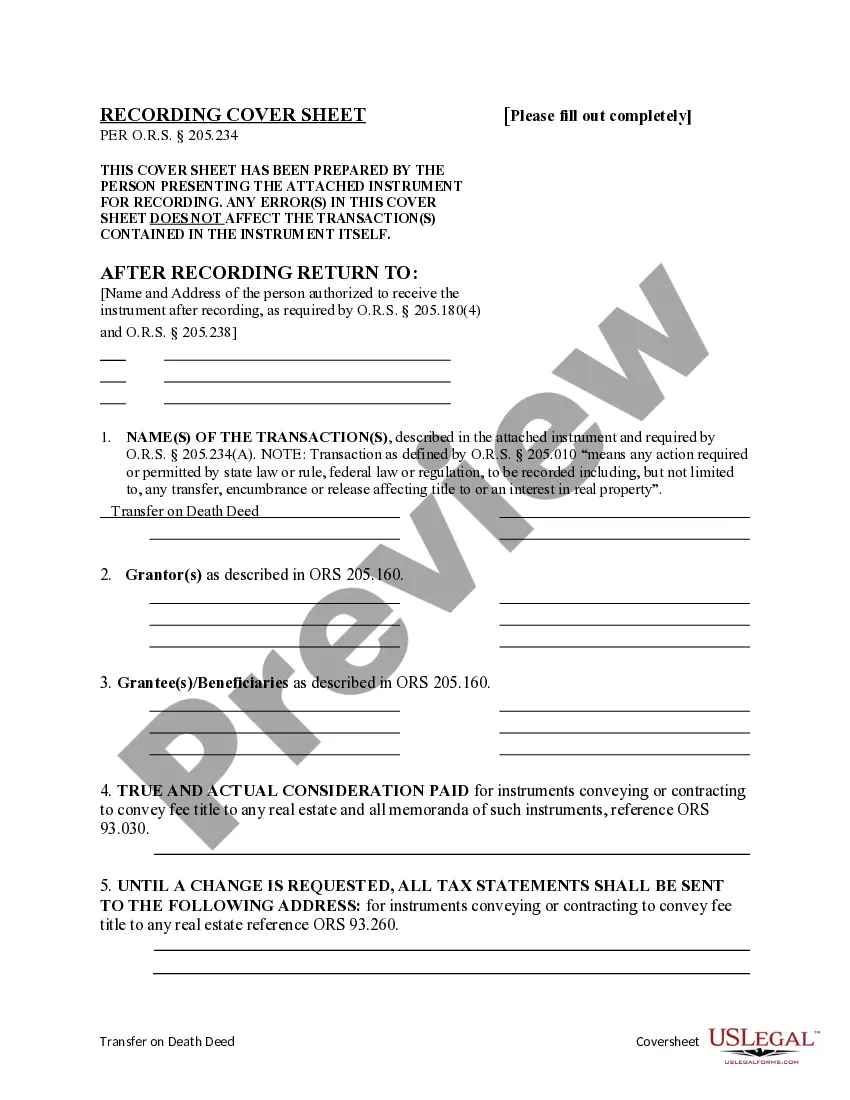

The procedure is just as easy if you’re not familiar with the site! You can create your account in a matter of minutes. Ensure to verify if the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provisions for Successor Beneficiaries adheres to the regulations and statutes of your state and locality. Furthermore, it’s important to review the description of the form (if available), and if you notice any inconsistencies with your initial requirements, look for a different form. Once you've confirmed that the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provisions for Successor Beneficiaries is suitable for your situation, you can choose a subscription plan and proceed to payment. You can then download the document in any preferred file format. Over the past 24 years, we’ve assisted millions by providing customizable and current legal forms. Take full advantage of US Legal Forms today to conserve time and resources!

- Make use of US Legal Forms whenever you need to access and download the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provisions for Successor Beneficiaries.

- or any other form swiftly and securely.

- Just Log In to your account and click the Get button adjacent to it.

- If you happen to misplace the document, you can always redownload it from the My documents section.

Form popularity

FAQ

Yes, you can have two beneficiaries on a Transfer on Death (TOD) deed. In the context of the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries, designating two beneficiaries allows both parties to inherit the property upon the death of the original owners. This arrangement ensures that your property is transferred without going through probate, simplifying the process for your loved ones. Additionally, consider using the US Legal Forms platform, as it offers resources and guidance to help you create a TOD deed tailored to your needs.

Yes, a Transfer on Death deed in Oregon allows your property to bypass probate. This means that when you use the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries, your designated beneficiaries receive the property directly upon your death. This can lead to a faster and more efficient transfer of assets.

While a Transfer on Death deed offers many benefits, there are also some disadvantages to consider. For instance, the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries does not provide tax benefits during your lifetime. Additionally, any debts owed by you or your estate can still affect the property, making it essential to weigh your options carefully.

Transferring a property deed from a deceased relative in Oregon typically involves gathering necessary documents and filing a new deed. If your relative had a Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries, the transfer is straightforward. You simply need to present the deed to the relevant authorities to complete the transfer.

To transfer a property using a Transfer on Death deed to two beneficiaries, you must first prepare and file the deed with the appropriate county office. The Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries simplifies this process. Once filed, the property automatically transfers to the named beneficiaries without the need for probate.

Yes, you can name more than one person on a Transfer on Death deed. In fact, the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries allows you to designate multiple beneficiaries. This feature provides flexibility, ensuring that your property transfers smoothly upon your passing.

You may not need an attorney for a Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries, but having legal guidance can be beneficial. An attorney can help navigate the complexities and ensure all documentation is correctly filled out. While the process might seem straightforward, legal missteps can lead to complications later. Therefore, consider consulting a professional to safeguard your interests.

While a transfer on death deed offers many benefits, there are some drawbacks to consider. One concern with the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries is that it cannot account for changes in your situation after its creation. Additionally, if beneficiaries become unavailable or unable to inherit, the property may face complications. It’s wise to evaluate your entire estate plan before proceeding.

A Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries generally does not affect inheritance taxes. While the deed can streamline the transfer process, tax implications depend on various factors including the value of the estate and the tax laws of the state. Consulting with a tax professional can provide clarity on how such transfers may impact inheritance taxes.

Currently, many states, including Oregon, recognize transfers on death deeds. The Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries is a valid option for smooth property transfer in these states. It’s essential to ensure that local laws are consulted, as the acceptance of this deed varies by state.