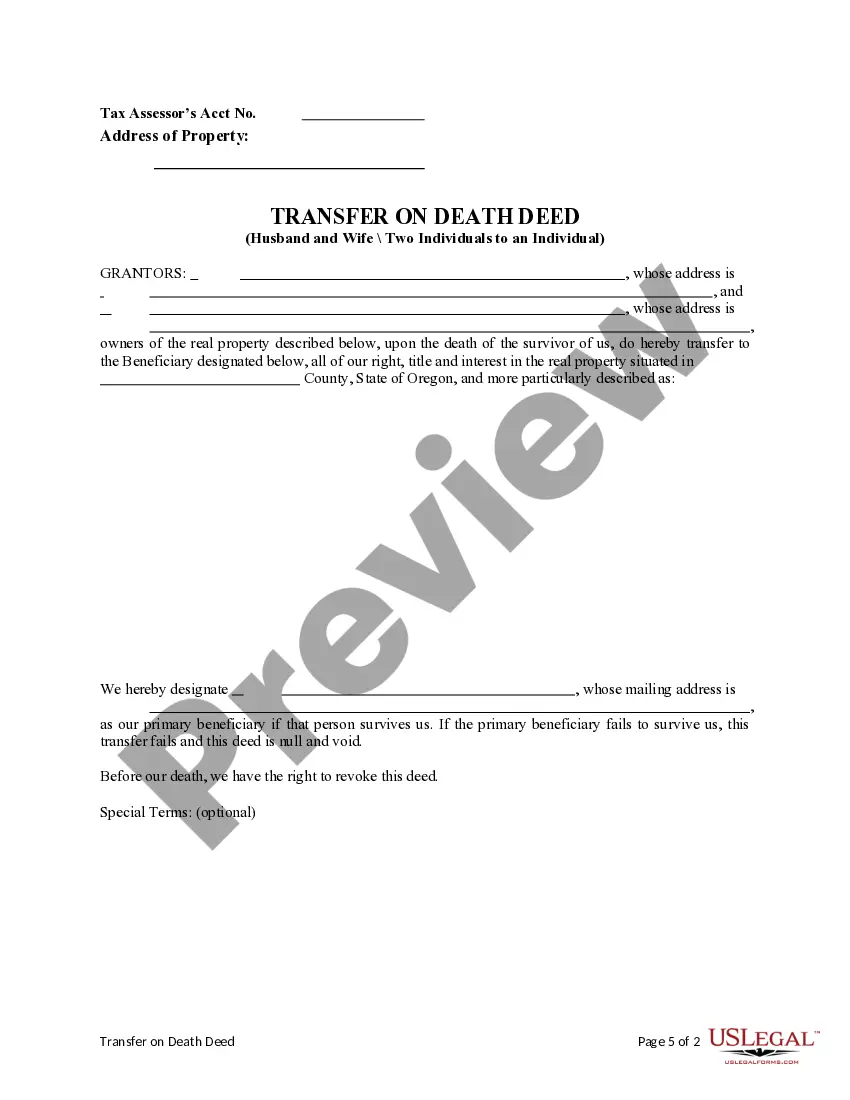

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. There is no provision for an alternate beneficiary. If the primary beneficiary does not qualify, the deed is null and void. This deed complies with all state statutory laws.

Portland Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary.

Description

How to fill out Oregon Transfer On Death Deed From Two (2) Individuals Or Husband And Wife To An Individual WITHOUT Provision For Appointment Of Alternate Beneficiary.?

Utilize the US Legal Forms and gain prompt access to any document you need.

Our practical platform with a vast collection of document templates enables you to discover and acquire nearly any sample you desire.

You can download, fill out, and validate the Portland Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary in just a few minutes instead of spending hours on the Internet searching for the correct template.

Using our library is an excellent method to enhance the security of your record submissions. Our expert legal professionals regularly assess all the documents to ensure that the forms are applicable for a specific region and comply with current regulations and laws.

Initiate the saving process. Click Buy Now and select the pricing option you prefer. Then, register for an account and pay for your order using a credit card or PayPal.

Download the document. Specify the format to obtain the Portland Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary and edit and complete, or sign it according to your needs.

- How do you acquire the Portland Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary.

- If you have an account, simply Log In to your profile. The Download button will show up on all the documents you review.

- Additionally, you can access all the previously saved files in the My documents menu.

- If you haven’t created an account yet, follow the steps below.

- Locate the form you need. Verify that it is the document you intended to find: review its title and description, and take advantage of the Preview feature if available. Otherwise, utilize the Search box to find the correct one.

Form popularity

FAQ

The primary advantage of a transfer on death deed is to avoid the probate process. If a property owner has executed a transfer on death deed, then as soon as the property owner dies, that property passes to the person named. The beneficiary does not have to go to court.

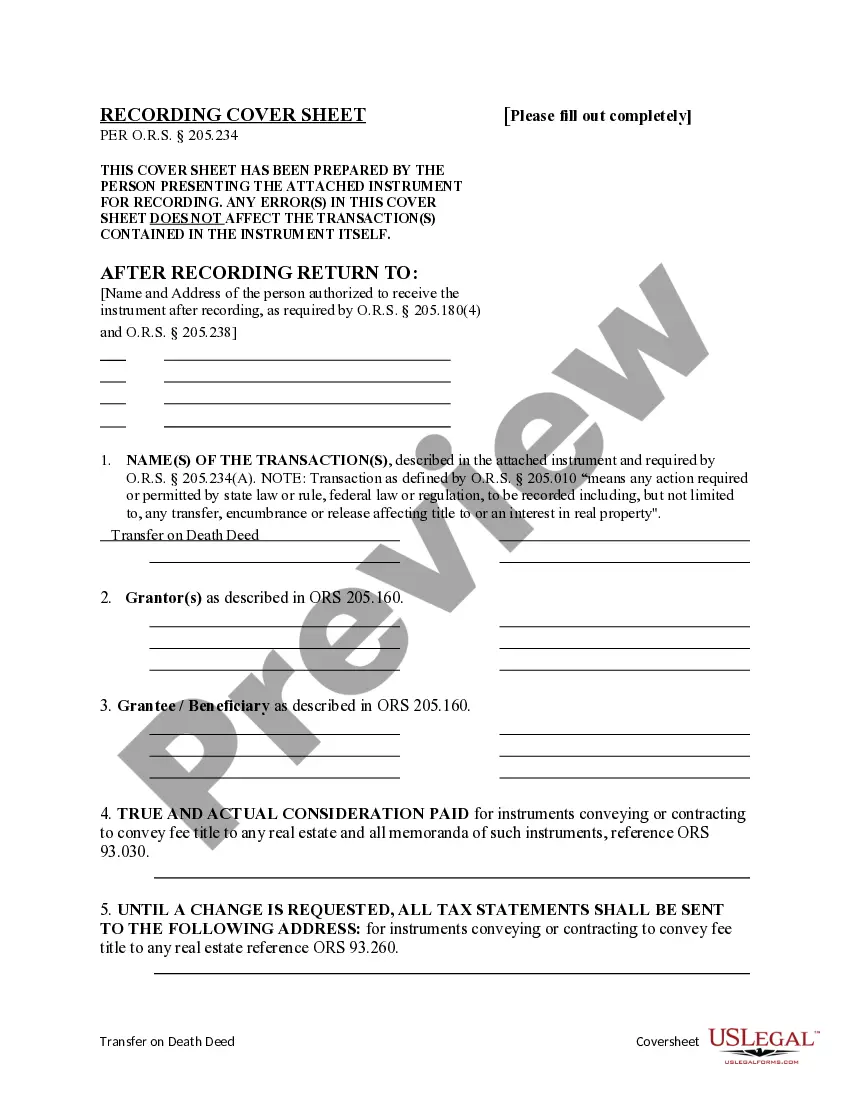

An original certified death certificate will need to be recorded in our office. This removes the name of the decedent from the County's ownership records. Fees are involved with this process.

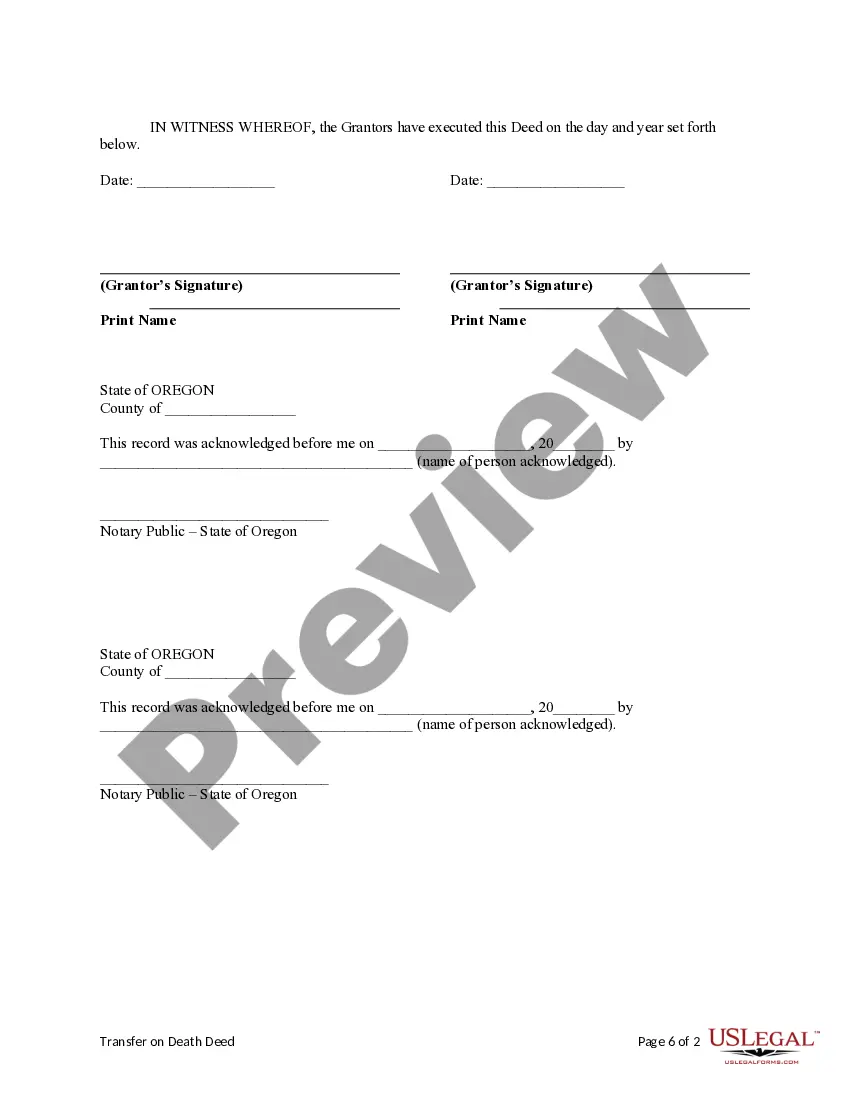

An Oregon deed must be signed by the current owner transferring real estate?the grantor?or a lawful agent or attorney signing for the grantor. Notarization. The current owner's signature must be acknowledged before a notary or other authorized officer.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

Effective January 1, 2012, Oregon law provides for a new form of deed known as a transfer on death (TOD) deed. These deeds allow an owner of real property to designate a beneficiary who will obtain title to that real property when the owner dies, without having to go through probate (subject to some exceptions).

Because TOD accounts are still part of the decedent's estate (although not the probate estate that the Last Will establishes), they may be subject to income, estate and/or inheritance tax. TOD accounts are also not out of reach for the decedent's creditors or other relatives.

What are the Requirements for an Oregon TOD Deed? State that the transfer to the beneficiary is to occur upon the property owner's death; Identify the beneficiary by name; and. Be recorded in the land records of the county clerk's office for the county where the property is located.41.

Be sure that you have completed all the tasks in the affidavit before filing. An affidavit can be filed if the fair market value of the estate is $275,000 or less. Of that amount, no more than $200,000 can be attributable to real property and no more than $75,000 can be attributable to personal property.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Transfer-on-death (TOD) refers to named beneficiaries that receive assets at the death of the property owner without the need for probate, facilitating the executor's disposition of the property owner's assets after their death.