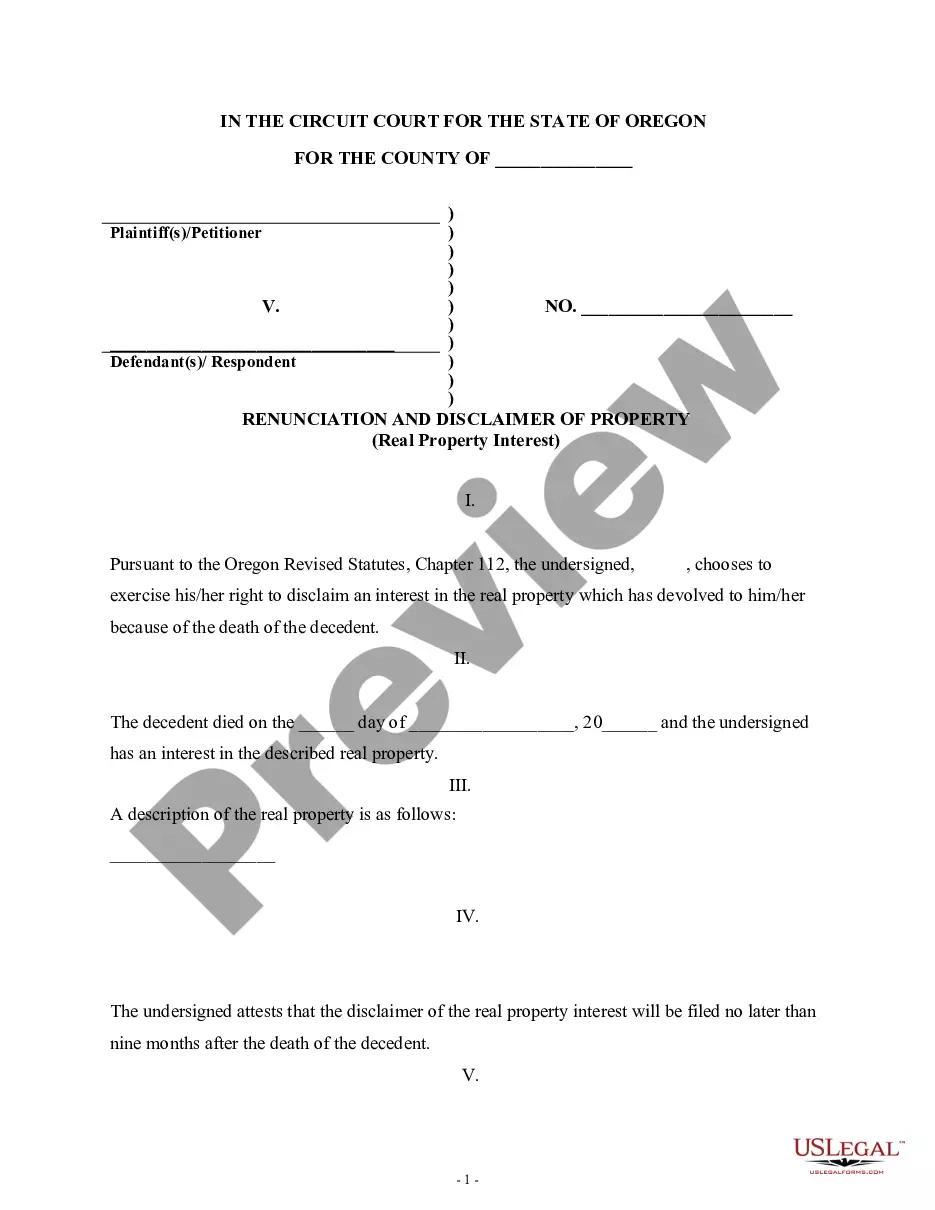

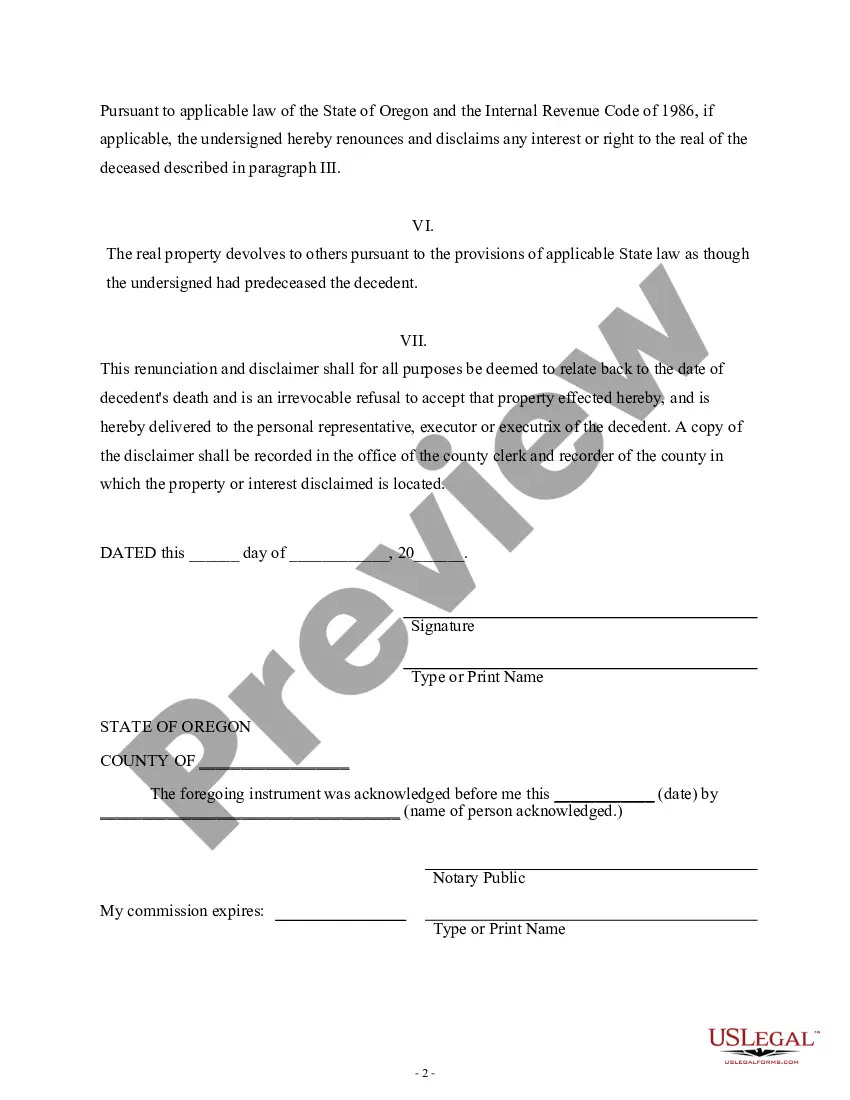

This form is a Renunciation and Disclaimer of a Real Property Interest where the beneficiary gained the interest upon the death of the decedent, but, pursuant to the Oregon Revised Statutes, Chapter 112, the beneficiary has chosen to disclaim his/her interest in the real property. Therefore, the property will pass to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify the delivery of the document.

Portland Oregon Renunciation And Disclaimer of Real Property Interest

Description

How to fill out Oregon Renunciation And Disclaimer Of Real Property Interest?

Take advantage of the US Legal Forms and gain instant access to any sample document you require.

Our helpful website with numerous records simplifies the process of locating and acquiring nearly any document sample you might need.

You can download, complete, and sign the Portland Oregon Renunciation And Disclaimer of Real Property Interest within minutes instead of spending hours online searching for a suitable template.

Utilizing our catalog is an excellent method to enhance the security of your document submissions.

Additionally, you can locate all previously saved documents under the My documents menu.

If you don’t possess an account yet, follow the instructions provided below.

- Our expert legal professionals frequently review all the documents to ensure that the forms are applicable to a specific state and adhere to current laws and regulations.

- How can you access the Portland Oregon Renunciation And Disclaimer of Real Property Interest.

- If you already have a subscription, simply Log In to your account. The Download button will be activated for all the samples you view.

Form popularity

FAQ

Key Takeaways. Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

§ 19?1502. (3) ?Disclaimer? means the refusal to accept an interest in or power over property. (4) ?Fiduciary? means a personal representative, trustee, agent acting under a power of attorney, or other person authorized to act as a fiduciary with respect to the property of another person.

If you are asked to sign a Disclaimer Deed proceed with caution. If you are told ?it's not a big deal? -think again! If you're the one signing a Disclaimer Deed to real property here's the deal: You affirmatively state that you have NO interest in the real property and NEVER had an interest in the real property.

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).

Owner understands that the Property is owned by Owner and not by Builder and, in connection therewith, further understands and acknowledges that Builder did not perform any due diligence or other inspections in connection with the Property.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

Legal Definition of disclaimer 1 : a refusal or disavowal of something that one has a right to claim specifically : a relinquishment or formal refusal to accept an interest or estate ? see also qualified disclaimer. 2 : a denial of responsibility for a thing or act: as.

A disclaimer trust is an estate planning technique in which a married couple incorporates an irrevocable trust in their planning, which is funded only if the surviving spouse chooses to ?disclaim,? or refuse to accept, the outright distribution of certain assets following the deceased spouse's death.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

In the context of a contract, a renunciation occurs when one party, by words or conduct, evinces an intention not to perform, or expressly declares that they will be unable to perform their obligations under the contract in some essential respect. The renunciation may occur before or at the time of performance.