The Oregon Limited Liability Company Act provides in part as follows:

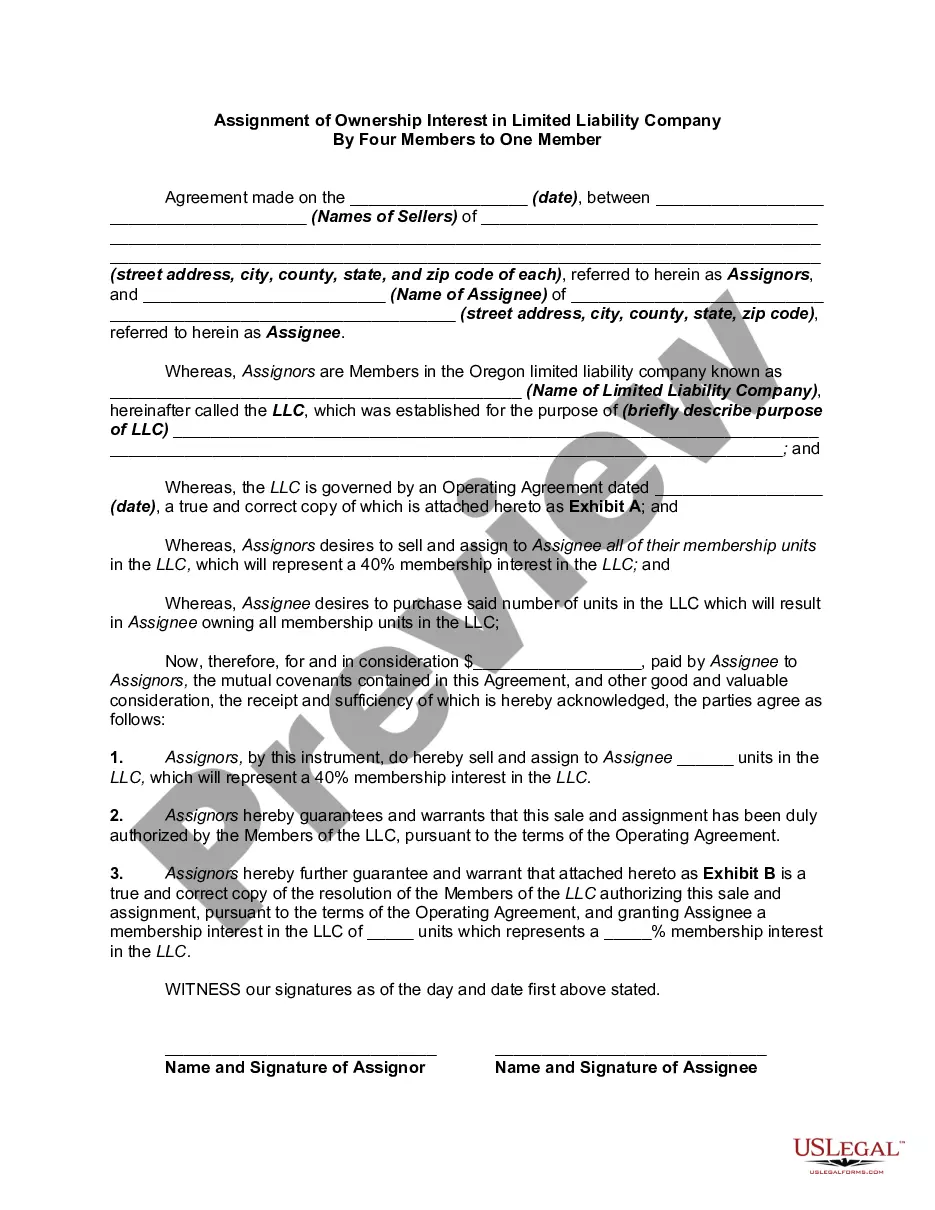

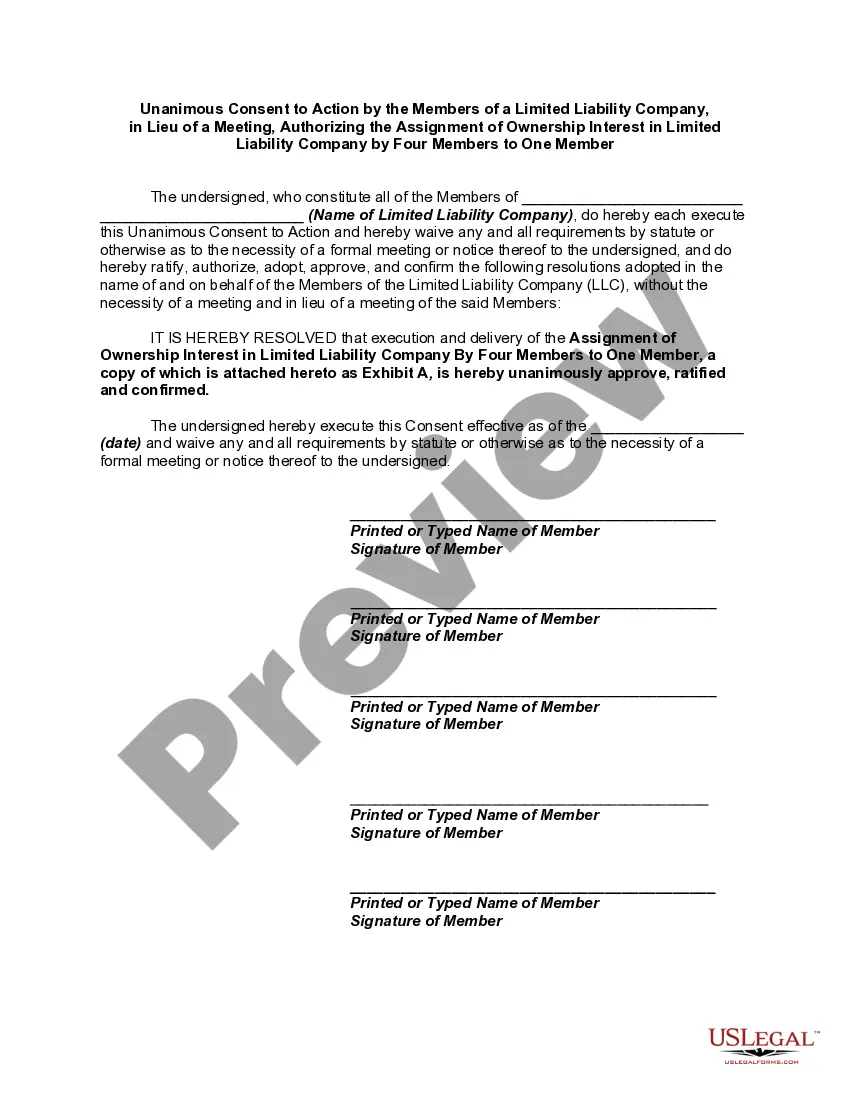

63.249 Assignment of membership interest; effect of assignment. Except as provided in the articles of organization or any operating agreement:

(1) A membership interest is assignable in whole or in part.

(5) The assignor of all or a portion of a membership interest ceases to be a member with respect to the interest assigned, but is not released from liability as a member accruing or arising prior to assignment solely as a result of the assignment, and is not relieved of any fiduciary duties the assignor otherwise may continue to owe the limited liability company or its remaining members.

(6) Any otherwise permissible assignment of a membership interest shall be effective as to and binding on the limited liability company only after reasonable notice of and proof of the assignment have been provided to the managers of the limited liability company.