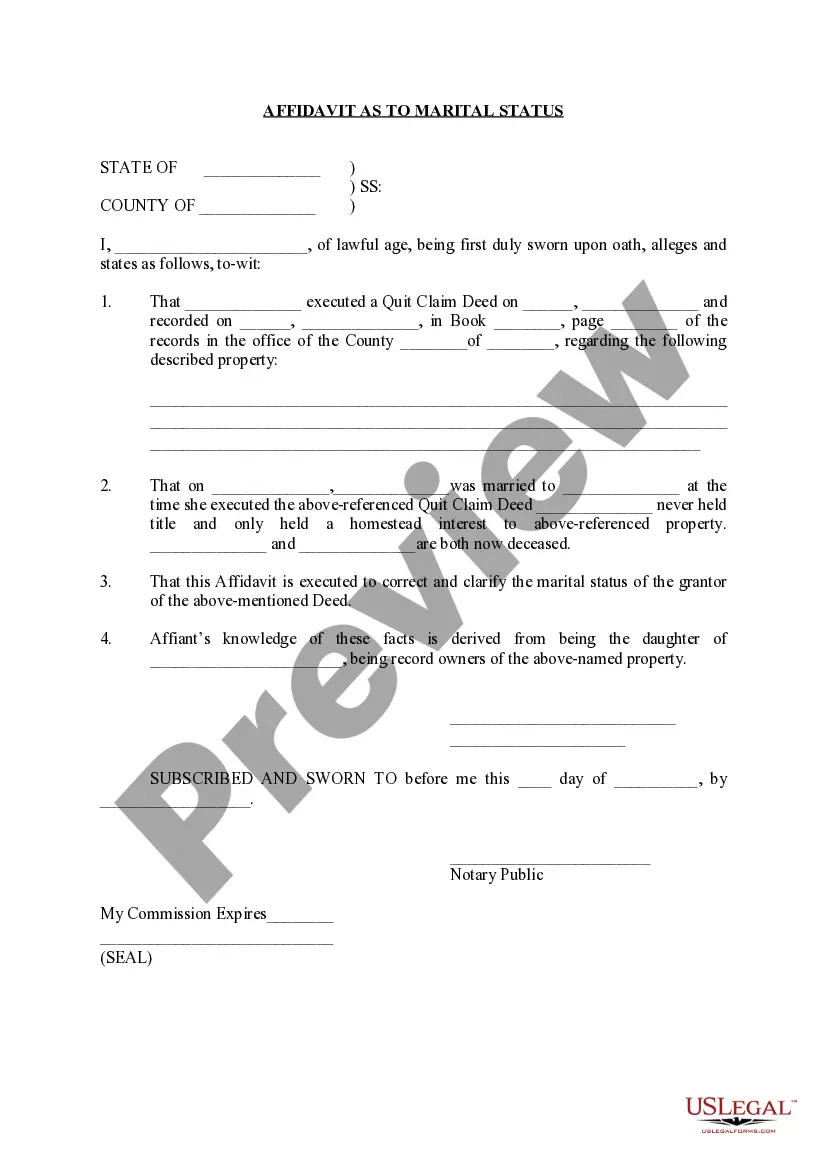

Oklahoma City Oklahoma Affidavit as to Marital Status

Description

status of a married person. Reference is made to the recorded

deed involved.

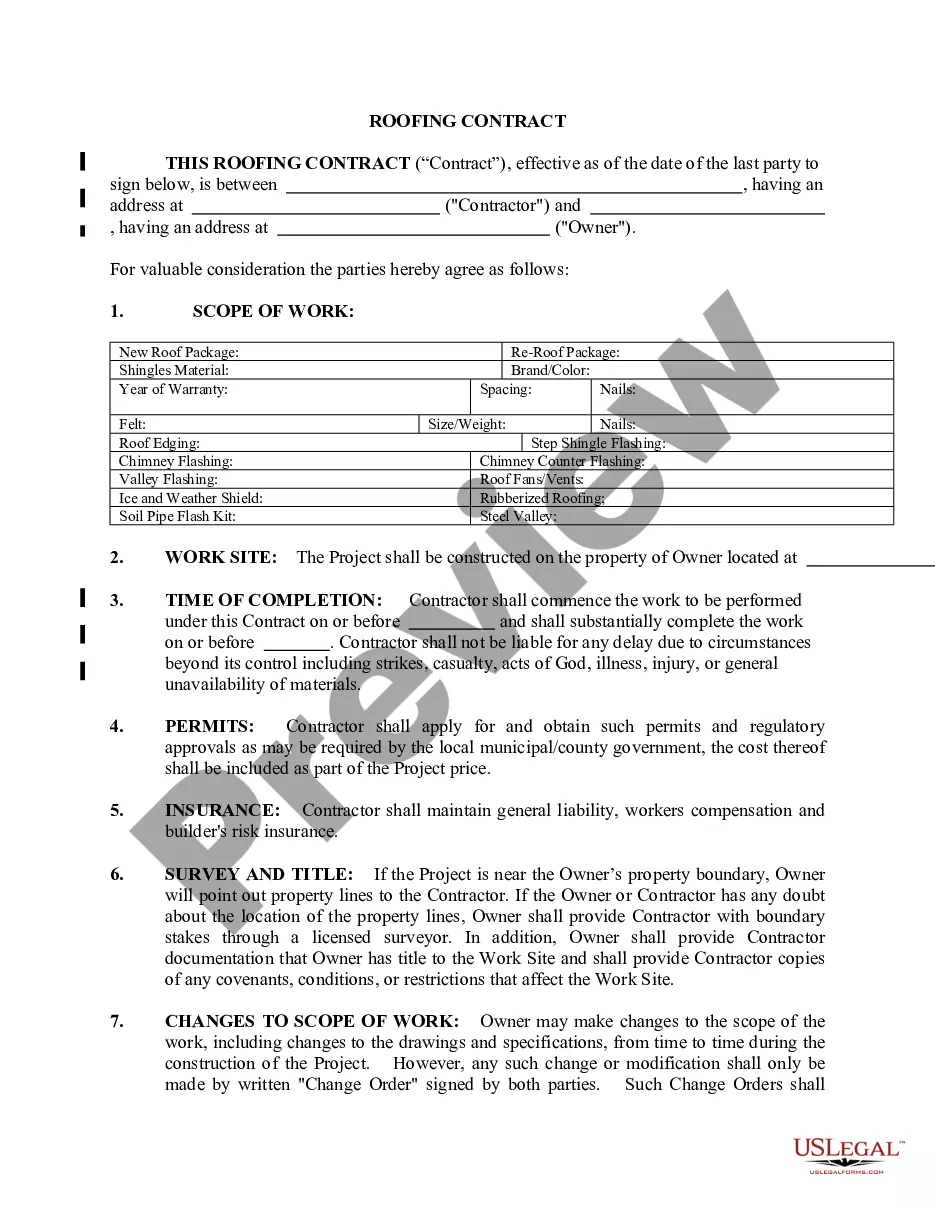

How to fill out Oklahoma Affidavit As To Marital Status?

Regardless of one’s societal or occupational position, completing legal documentation is a regrettable requirement in the contemporary world.

Frequently, it’s nearly unfeasible for an individual lacking legal expertise to produce such forms independently, primarily due to the intricate jargon and legal subtleties involved.

This is where US Legal Forms can be of assistance.

Verify that the form you have located is tailored for your location since the laws of one region do not apply to another.

Examine the document and review a brief summary (if available) of instances the form can be utilized for.

- Our platform offers an extensive repository containing over 85,000 ready-to-use, state-specific documents suitable for nearly any legal situation.

- US Legal Forms additionally functions as an invaluable resource for associates or legal advisors aiming to enhance their time efficiency using our DIY forms.

- Regardless of whether you require the Oklahoma City Oklahoma Affidavit concerning Marital Status or any other relevant documentation for your state or region, US Legal Forms makes everything readily accessible.

- Here’s how you can acquire the Oklahoma City Oklahoma Affidavit as to Marital Status in mere minutes using our reliable service.

- If you are an existing user, you can go ahead and Log In to your account to download the required form.

- However, if you are not familiar with our database, ensure you follow these steps before downloading the Oklahoma City Oklahoma Affidavit regarding Marital Status.

Form popularity

FAQ

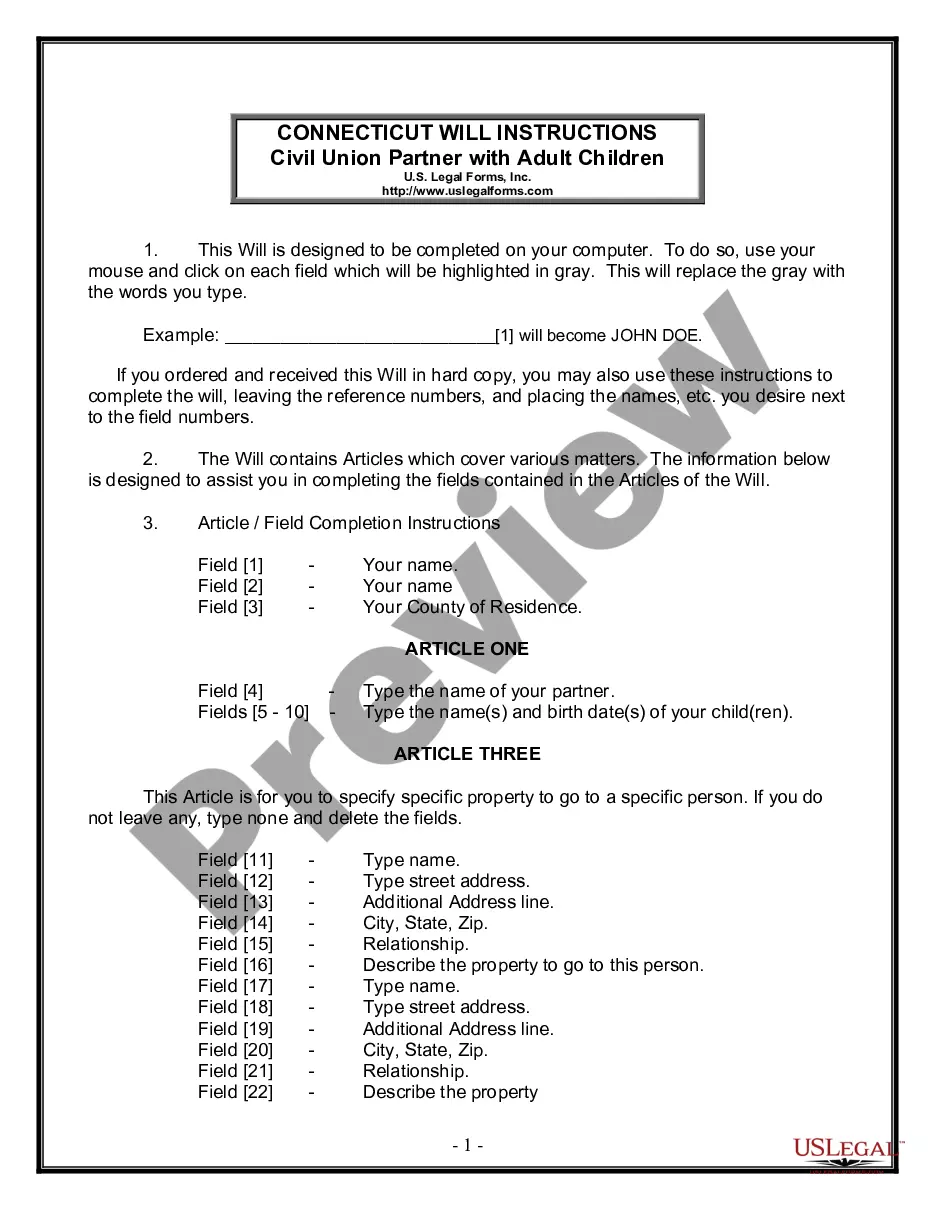

Oklahoma law defines a small estate as an estate in which the value of the estate property in Oklahoma, owned by the decedent and subject to disposition by will or intestate succession, minus liens and encumbrances, is less than $50,000. You are the successor in interest to the decedent's estate.

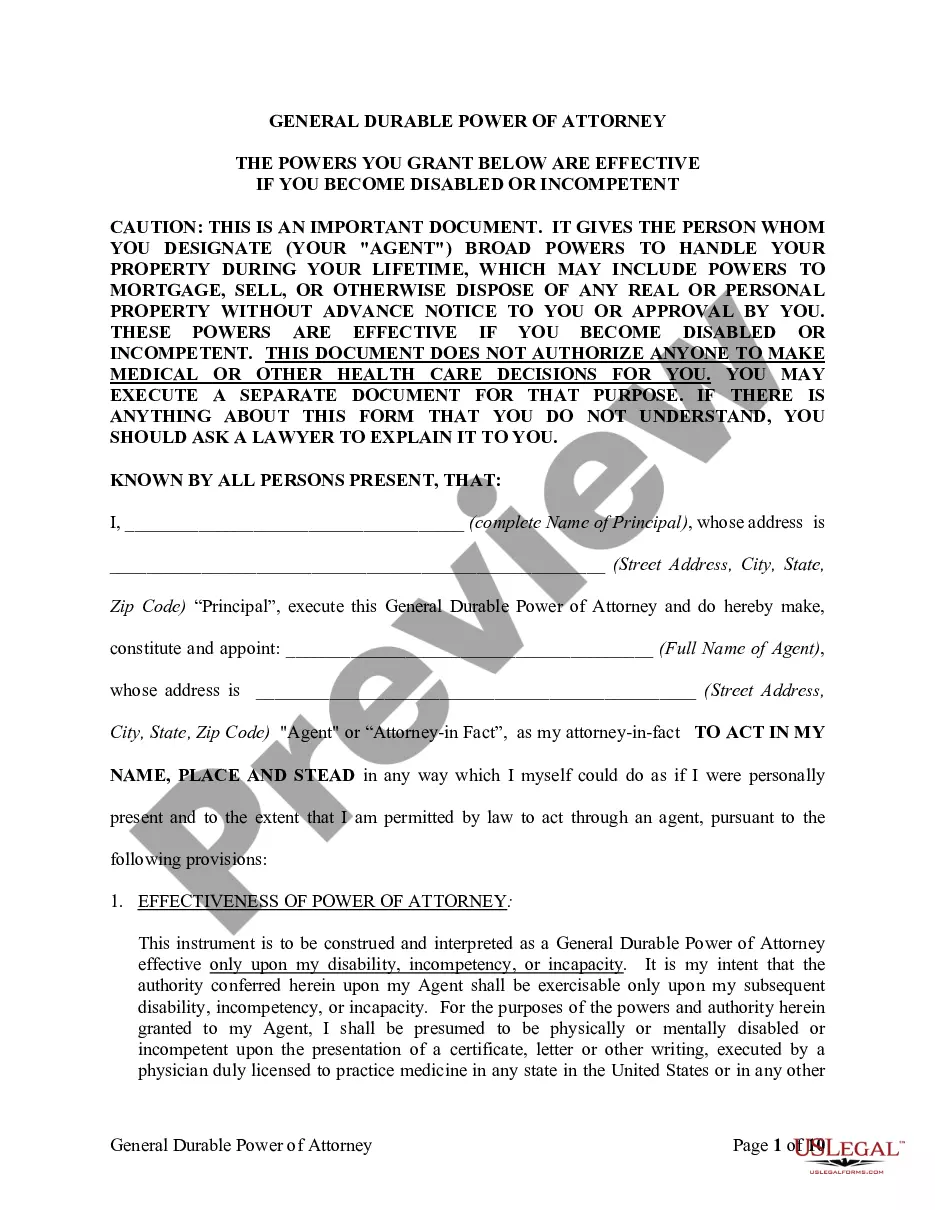

2. This form may be signed by a member of the family, as long as they are not an heir to the deceased, but the Corroborating Affidavit MUST be signed by a person not a member of the family.

The statute allowing for an affidavit of tangible personal property to transfer an estate's personal assets also allows for an affidavit of death and heirship to transfer severed mineral interests to an heir. The affidavit must be filed with the county clerk in the county where the property is located.

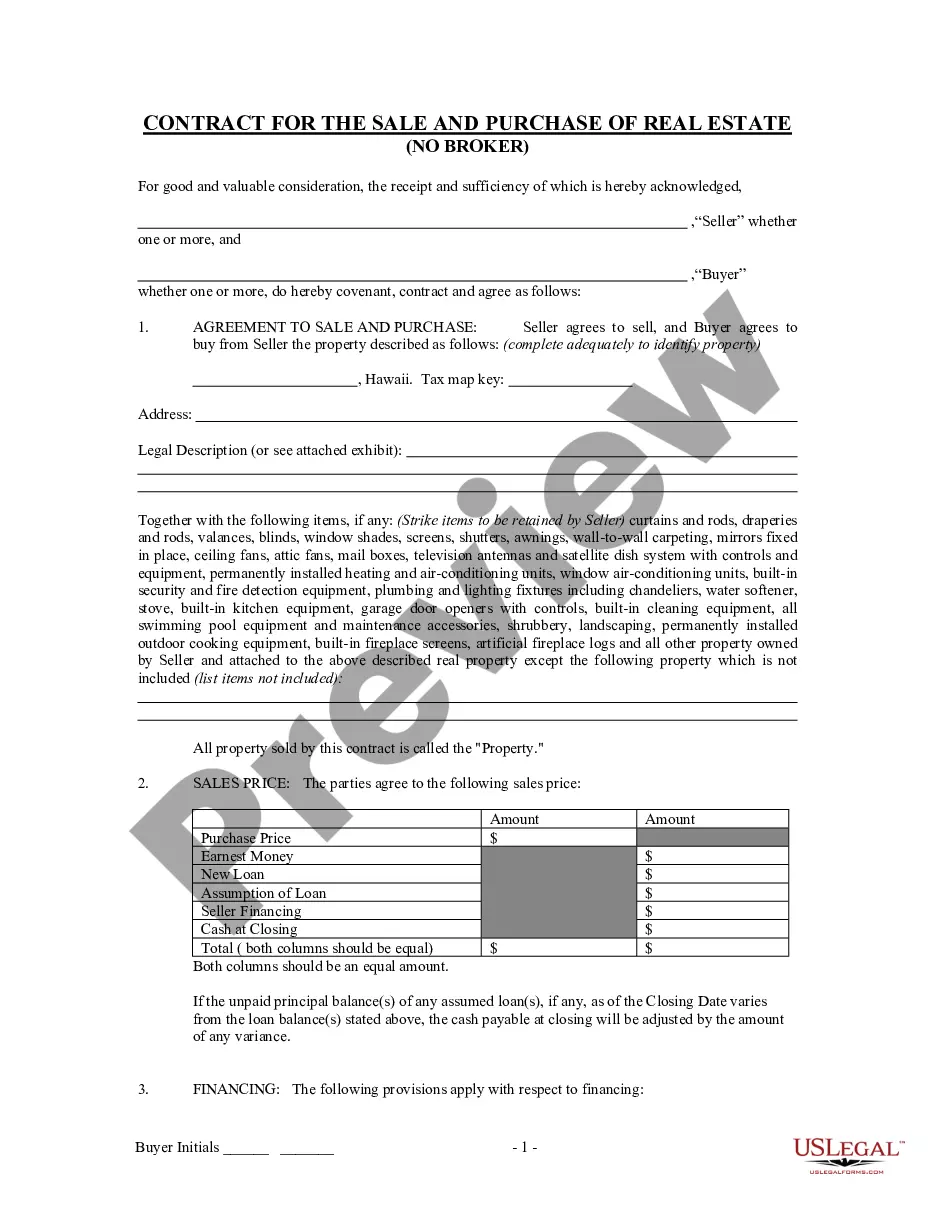

If the wife's name is not on the deed, it doesn't matter. It's still marital property because it was bought during the marriage. This makes it marital property and is still split between both parties. The wife is entitled to receive either equal share or equitable share of the house.

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

If the cumulative value of a deceased person's probate personal property (not including real estate) that would otherwise go through probate court is less than $50,000, that probate property can be obtained by the deceased person's successors by the use of a Small Estates Affidavit and thus avoid probate.

An Oklahoma small estate affidavit is a document that is used by a person to claim a right to the property of a deceased person, known as a decedent.... Step 1 ? Wait Ten (10) Days.Step 2 ? No Personal Representative.Step 3 ? Complete the Affidavit.Step 4 ? Present the Affidavit.

If a person owned a small estate, then, after the owner of the small estate dies, it will be easier for the owner's heirs will be able to transfer property owned by the estate, or collect debts owed to the estate. The heirs will need only to fill out an affidavit; the heirs will not have to go through probate.

Both spouses must sign a deed if the owner is married and the real estate qualifies as a homestead?unless the non-owner spouse resides outside Oklahoma.