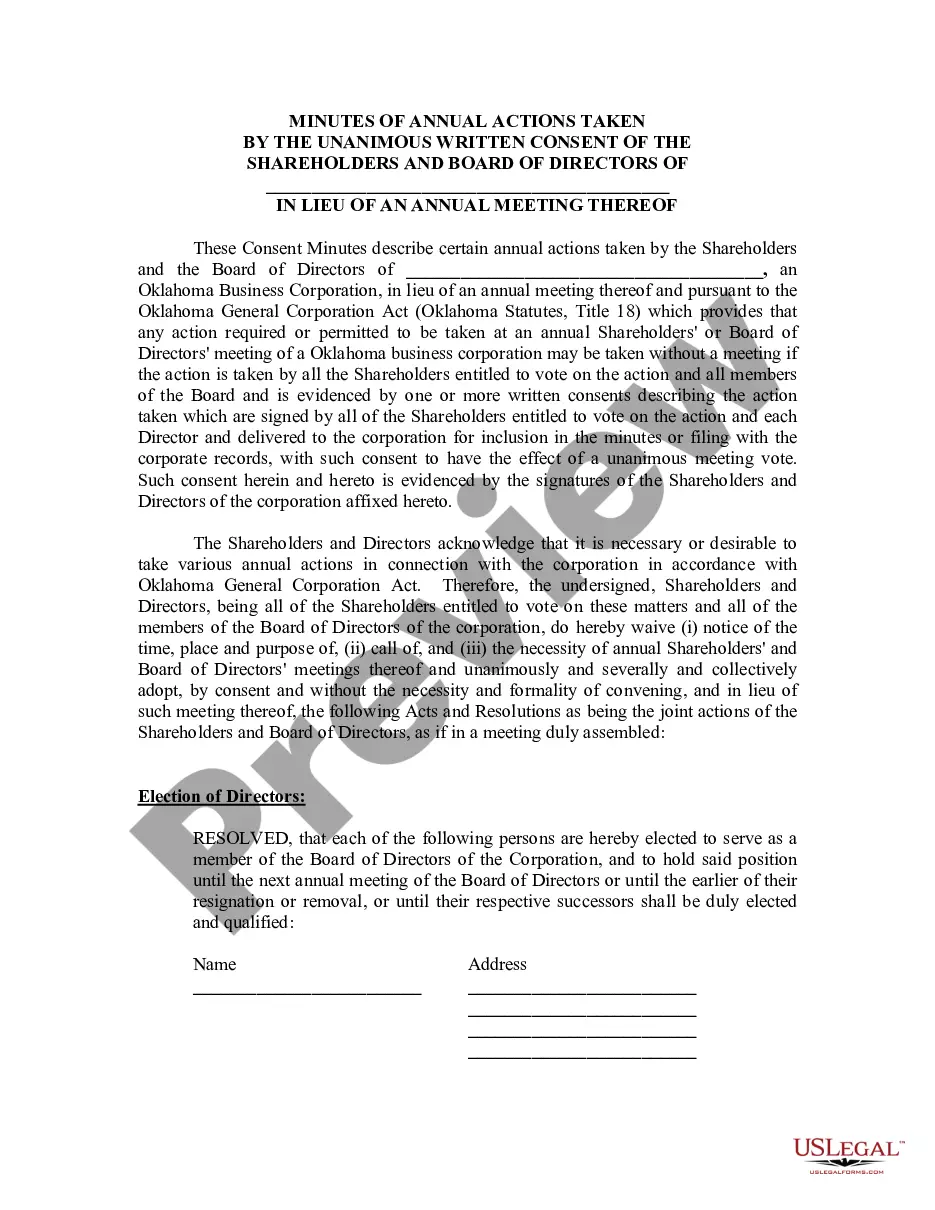

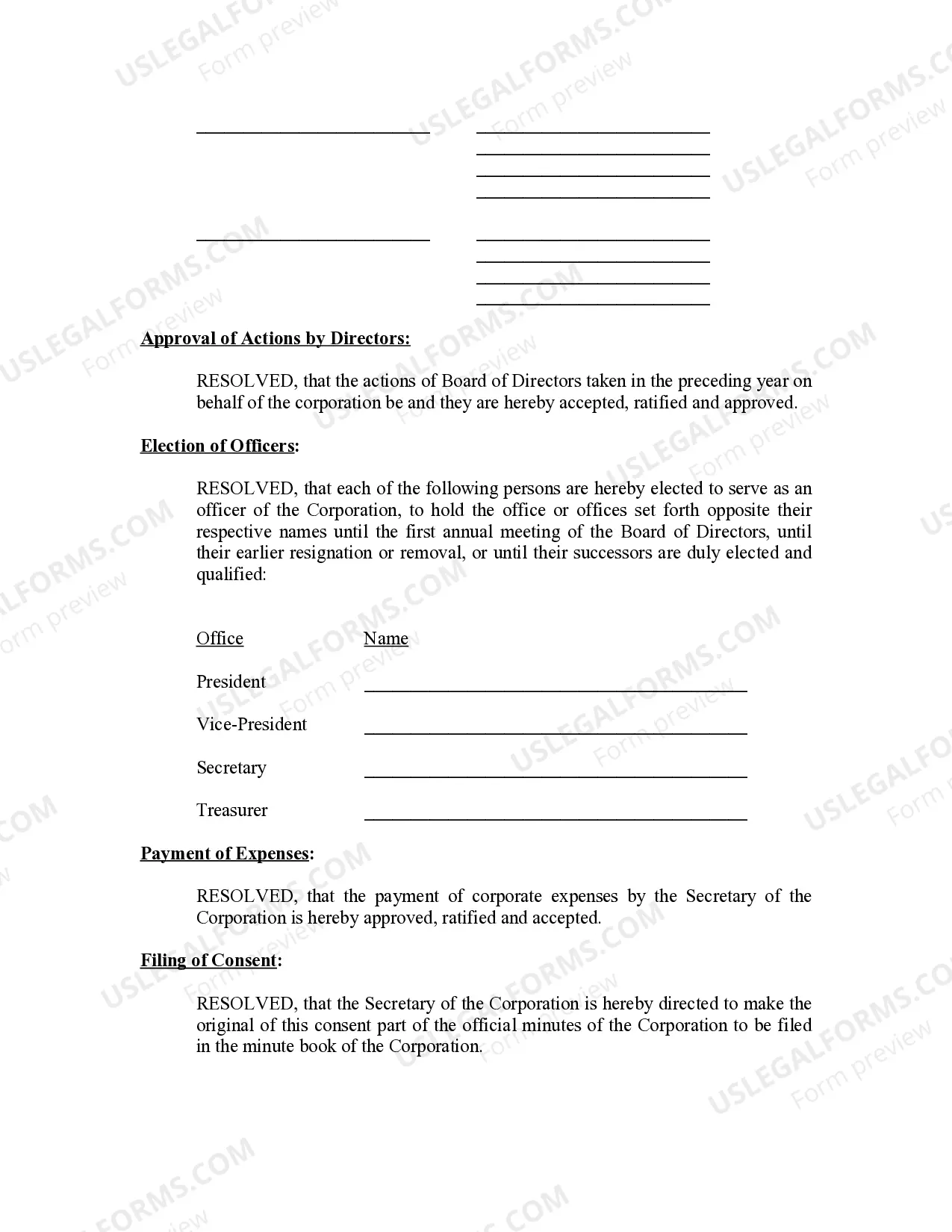

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Oklahoma City Oklahoma Annual Minutes

Description

How to fill out Oklahoma Annual Minutes?

Irrespective of societal or occupational rank, finalizing legal-related documents is a regrettable requirement in the contemporary professional setting.

Frequently, it’s nearly impossible for individuals lacking any legal experience to create such documents from scratch, mainly due to the intricate language and legal nuances they entail.

This is where US Legal Forms steps in to assist.

Verify that the template you’ve located is appropriate for your area, as the regulations of one state or region may not apply to another.

Review the document and check a brief description (if available) of the scenarios for which the paper can be utilized.

- Our platform provides an extensive assortment with over 85,000 ready-to-utilize state-specific forms that cater to nearly any legal situation.

- US Legal Forms also acts as an outstanding resource for associates or legal advisors who wish to conserve time utilizing our DIY templates.

- Regardless of whether you seek the Oklahoma City Annual Minutes - Oklahoma or any other documentation that will be recognized in your state or locality, with US Legal Forms, everything is readily accessible.

- Here’s how you can swiftly obtain the Oklahoma City Annual Minutes - Oklahoma via our reliable platform.

- If you already possess a subscription, you can proceed to Log In to your account to retrieve the appropriate form.

- However, if you are new to our library, make sure to follow these instructions before acquiring the Oklahoma City Annual Minutes - Oklahoma.

Form popularity

FAQ

An Oklahoma annual report is typically filed through the Secretary of State's online business filings portal. To do this, you'll need to login by entering your name and email address. You need to have your entity's filing number handy. You can also file by mail, but this does take longer to process.

Oklahoma Annual Report Service & Filing Instructions. The state of Oklahoma requires all corporations, nonprofits, LLCs, and LPs to file an Annual Franchise Tax Return, Annual Certificate, and/or pay a Registered Agent Fee ? depending on what type of business you own.

Instead, an LLC annual report provides basic information and facts about your company, such as the names and addresses of your registered agent and directors and managers. It's a comprehensive report on the company's activities throughout the preceding year.

How much does it cost to form an LLC in Oklahoma? The Oklahoma Secretary of State charges a $100 fee to file the Articles of Organization. You can reserve your business name by filing an LLC name reservation for $10. Oklahoma LLCs are also required to file an Annual Certificate each year, the fee for which is $25.

Visit us at tax.ok.gov to file your Franchise Tax Return, Officer Listings, Balance Sheets and Franchise Election Form 200-F. Line 1 (through 3) Cash, notes, accounts receivable, and inventories are to be reported at book value. Line 4 United States, municipal, commercial and other bonds owned by the corporation.

The state of Oklahoma requires all corporations, nonprofits, LLCs, and LPs to file an Annual Franchise Tax Return, Annual Certificate, and/or pay a Registered Agent Fee ? depending on what type of business you own.

In Oklahoma, an annual certificate (also known as an annual report) is a regular filing that your LLC must complete every year to update your business information, including: Principal street address. Primary contact email address.

An Oklahoma annual report is typically filed through the Secretary of State's online business filings portal. To do this, you'll need to login by entering your name and email address. You need to have your entity's filing number handy. You can also file by mail, but this does take longer to process.

Even if a company has all necessary business licenses, it still needs to file its annual reports. Annual report filing requirements continue even after forming your company. Just like tax returns and business licenses, formation and incorporation filings are different from annual report filings.

Oklahoma Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state.