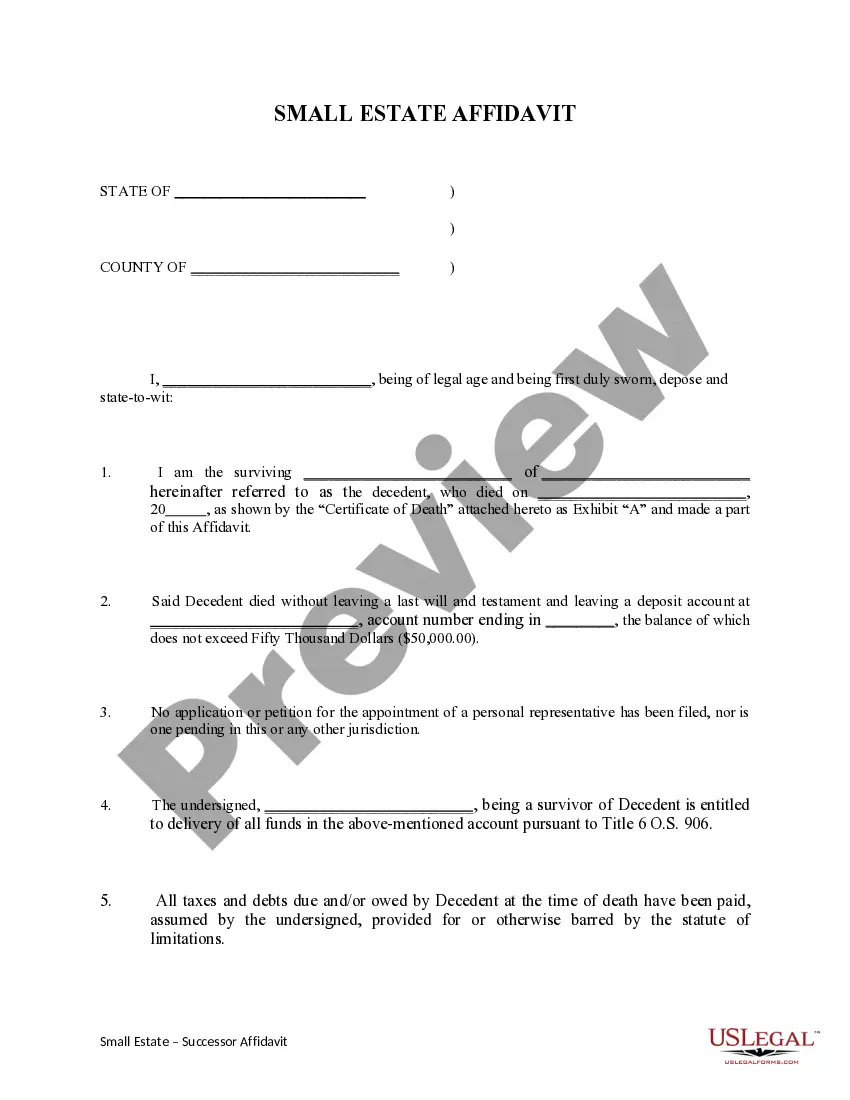

Oklahoma City Oklahoma Small Estate Successor Affidavit - Not to Exceed $50,000

Description

How to fill out Oklahoma Small Estate Successor Affidavit - Not To Exceed $50,000?

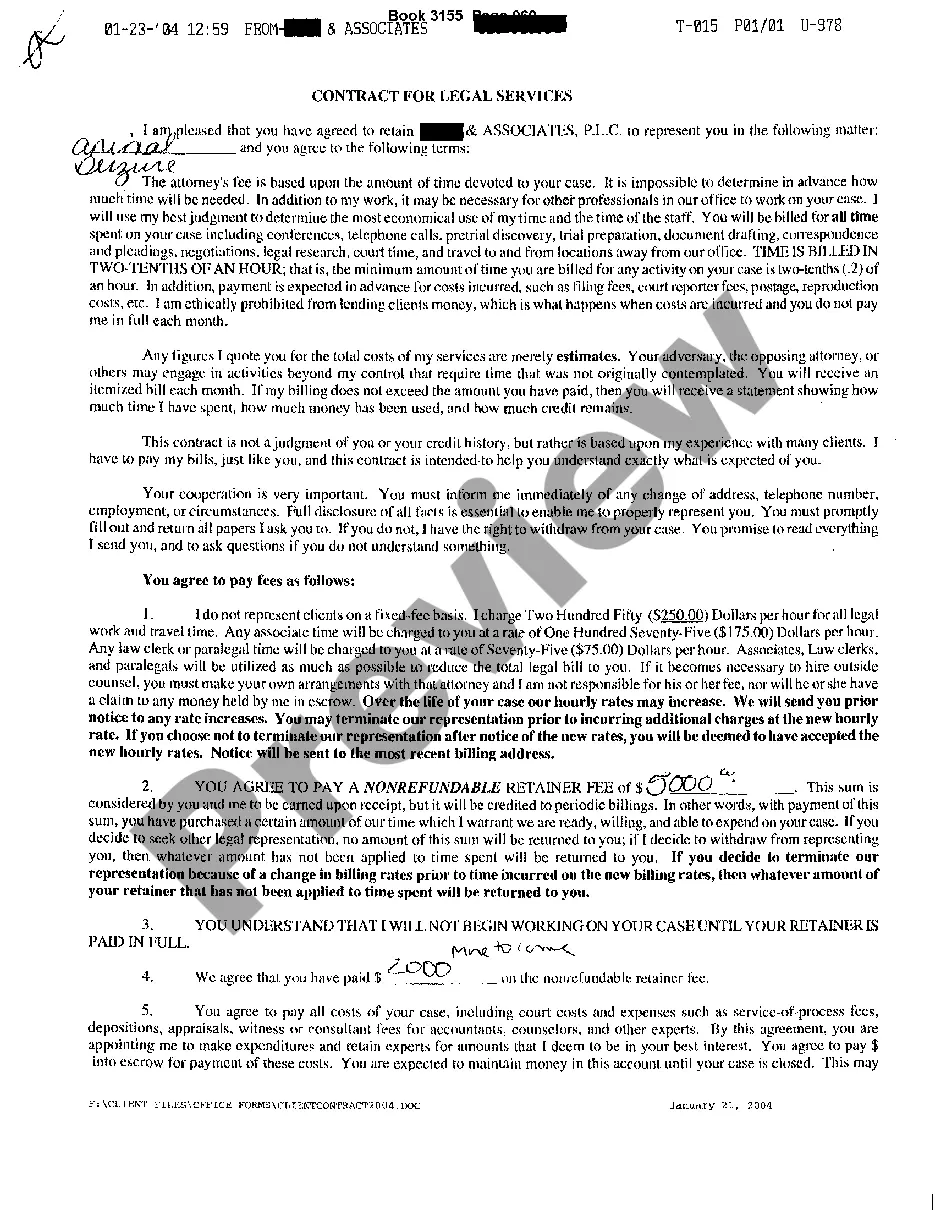

We consistently aim to lessen or evade legal repercussions while navigating intricate legal or financial matters.

To achieve this, we enlist attorney services that are typically very expensive.

However, not all legal challenges are equally complicated.

Many can be resolved independently.

Take advantage of US Legal Forms whenever you need to locate and download the Oklahoma City Oklahoma Small Estate Successor Affidavit - Not to Exceed $50,000 or any other form swiftly and securely.

- US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our collection empowers you to manage your affairs independently without the necessity of consulting an attorney.

- We offer access to legal form templates that are not always readily accessible to the public.

- Our templates are designed to be specific to your state and locality, making the search process significantly easier.

Form popularity

FAQ

If the cumulative value of a deceased person's probate personal property (not including real estate) that would otherwise go through probate court is less than $50,000, that probate property can be obtained by the deceased person's successors by the use of a Small Estates Affidavit and thus avoid probate.

Small Estate Affidavit. This form is to be used to transfer the ownership of a vehicle subject to the disposition by will, when the total value of the estate is no more than $50,000.00. State of Oklahoma.

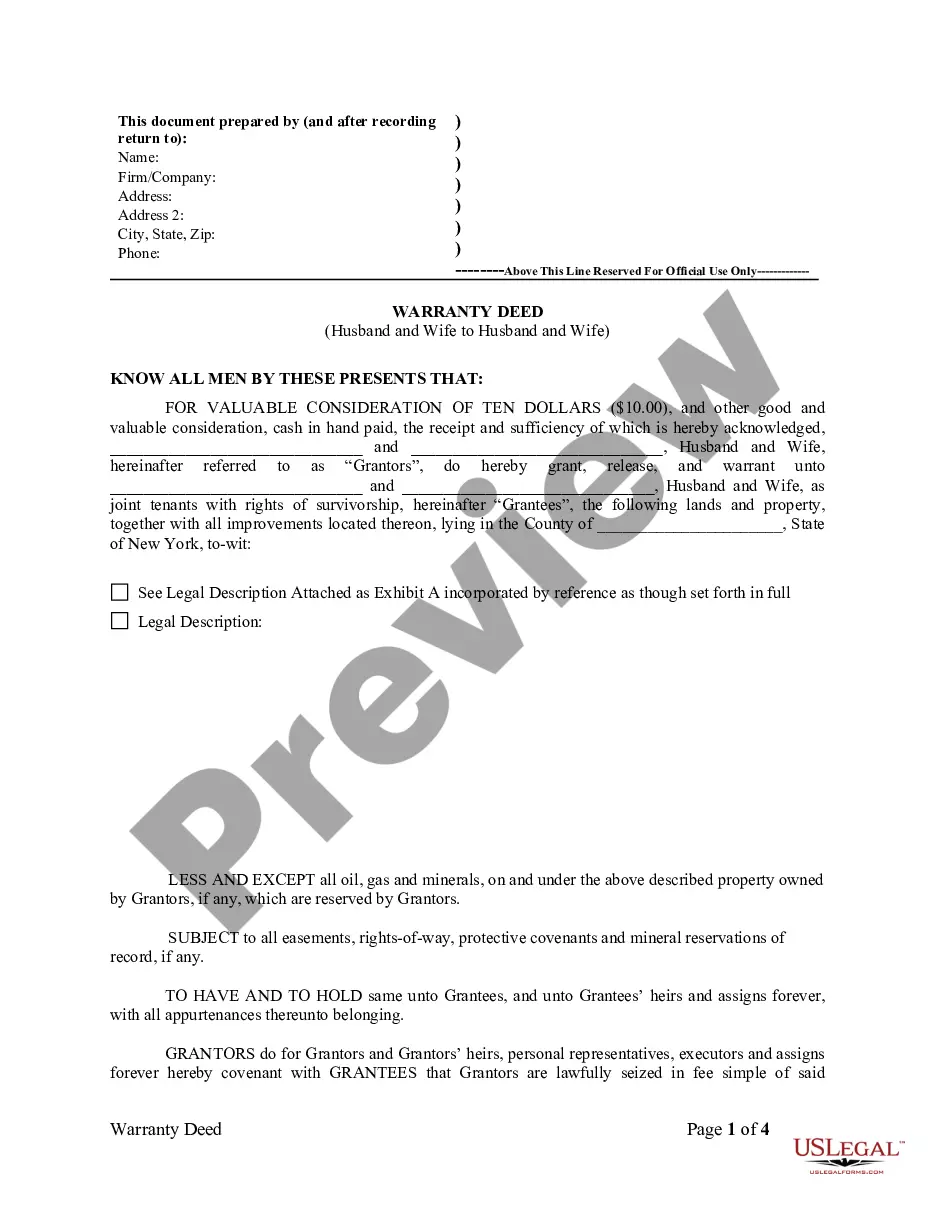

The statute allowing for an affidavit of tangible personal property to transfer an estate's personal assets also allows for an affidavit of death and heirship to transfer severed mineral interests to an heir. The affidavit must be filed with the county clerk in the county where the property is located.

If a person owned a small estate, then, after the owner of the small estate dies, it will be easier for the owner's heirs will be able to transfer property owned by the estate, or collect debts owed to the estate. The heirs will need only to fill out an affidavit; the heirs will not have to go through probate.

2. This form may be signed by a member of the family, as long as they are not an heir to the deceased, but the Corroborating Affidavit MUST be signed by a person not a member of the family.

Located in this state ? if all of the property that the decedent owns, located in this state, is of a total value less than $50,000, it's a small estate.

Oklahoma law defines a small estate as an estate in which the value of the estate property in Oklahoma, owned by the decedent and subject to disposition by will or intestate succession, minus liens and encumbrances, is less than $50,000. You are the successor in interest to the decedent's estate.

An Oklahoma small estate affidavit is a document that is used by a person to claim a right to the property of a deceased person, known as a decedent. The filer, known as the ?affiant?, has to file this affidavit with the individual or entity that has control over the property itself.

Yes, you still need the probate in Oklahoma even if you have a will. One purpose of probate is to determine if the will is valid. Another purpose is to begin the Oklahoma probate creditor statute of limitations. However, depending on the circumstances, you may qualify for another type of probate.