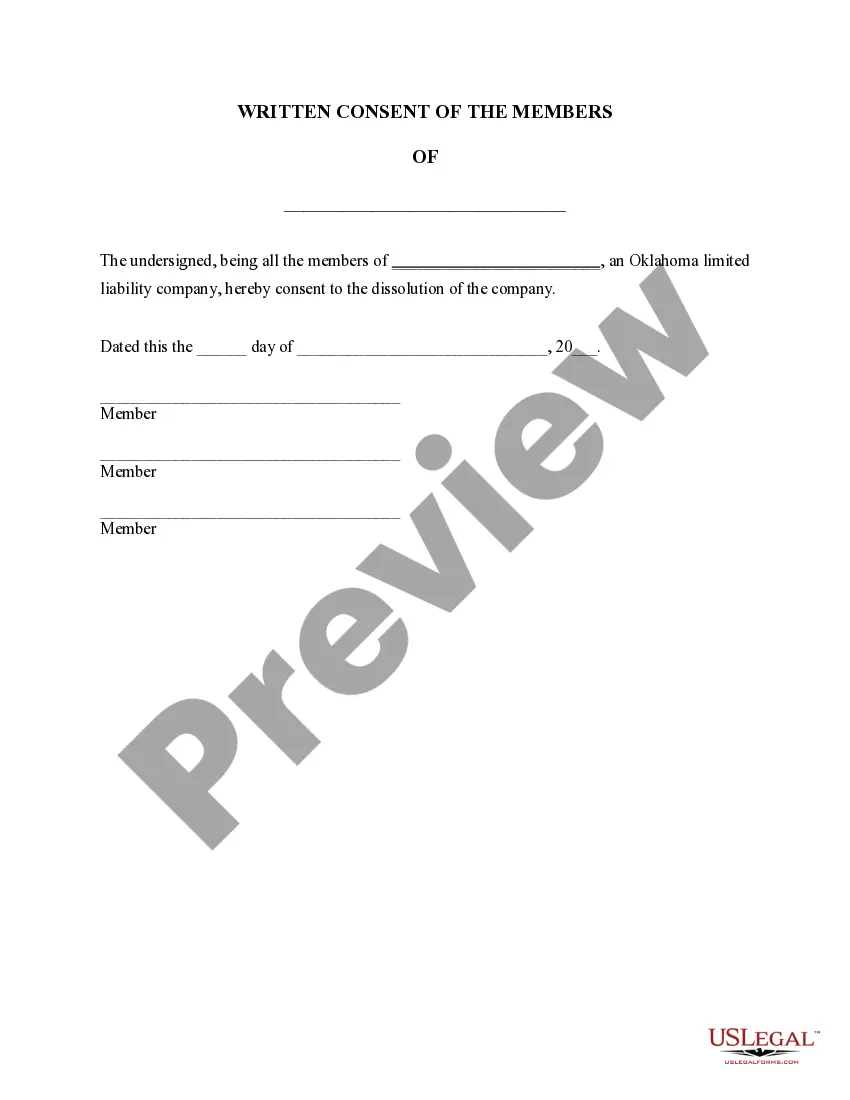

Oklahoma City Oklahoma Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Oklahoma Dissolution Package To Dissolve Limited Liability Company LLC?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our user-friendly website with a wide array of documents streamlines the process of locating and acquiring virtually any document sample you need.

You can download, complete, and validate the Oklahoma City Oklahoma Dissolution Package to terminate Limited Liability Company LLC in mere minutes instead of spending hours online searching for an appropriate template.

Leveraging our library is an excellent approach to enhance the security of your record submissions. Our experienced attorneys frequently review all documents to ensure that the templates are applicable to a specific state and adhere to new regulations and policies.

If you don’t have an account yet, follow the steps below.

Visit the page with the form you need. Ensure that it is the form you're looking for: review its title and description, and take advantage of the Preview option when available. If not, use the Search field to discover the suitable one.

- How can you obtain the Oklahoma City Oklahoma Dissolution Package to dissolve Limited Liability Company LLC.

- If you have an account, simply Log In to your account. The Download button will be visible on all the documents you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

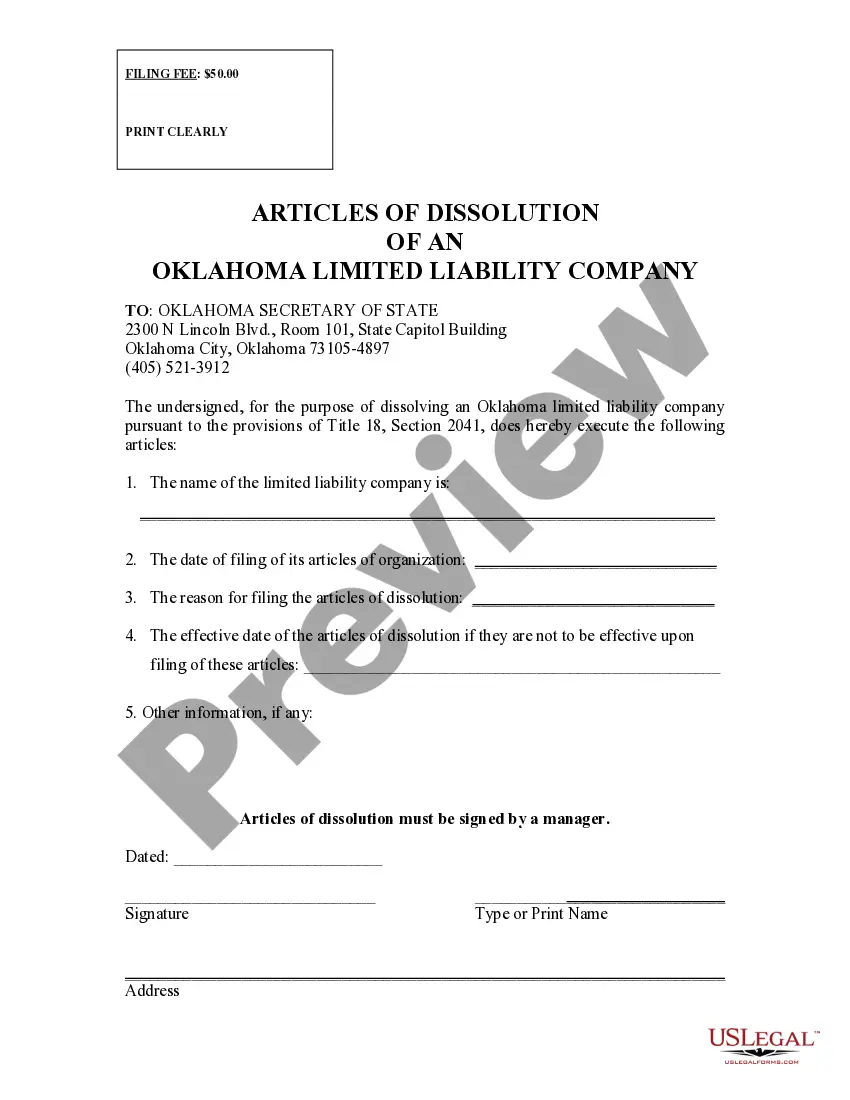

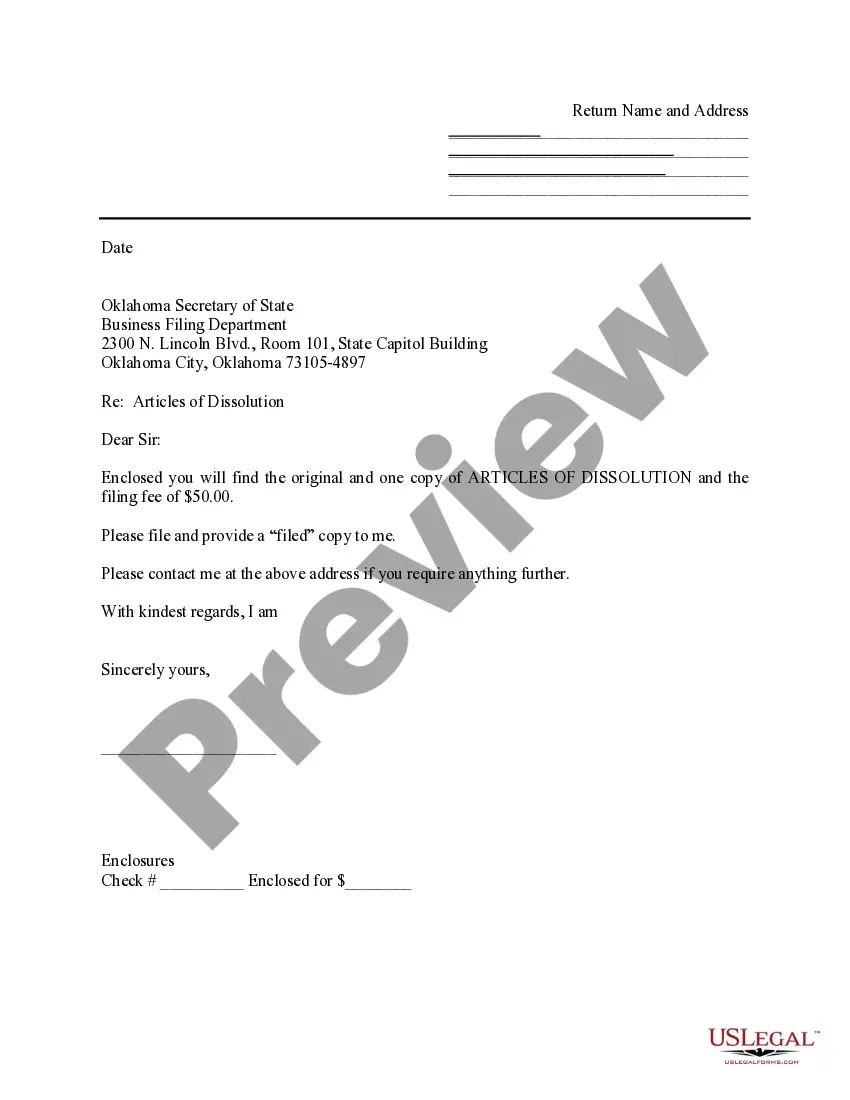

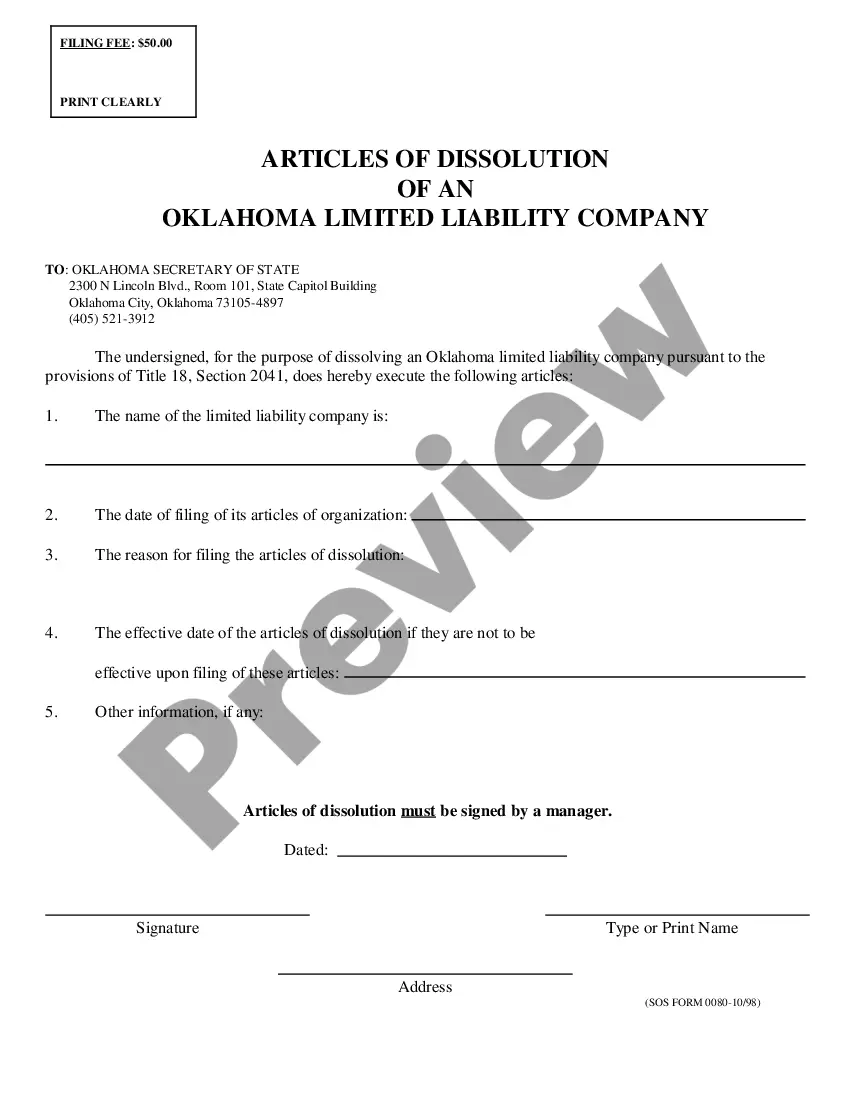

To dissolve your corporation in Oklahoma, you submit the completed Oklahoma Certificate of Dissolution form by mail, in person or by fax to the Secretary of State along with the filing fee.

In most cases, a simple majority vote is sufficient to pass the resolution for corporate dissolution. The Board needs to develop a plan of dissolution once the shareholders approve the dissolution.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

Termination: All that must be done has been done This document may be called articles of termination, articles of cancellation, or a similar name. In it, the LLC has to state that all debts and liabilities have been paid or provided for and any remaining assets distributed.

Dissolution: The beginning of the end, not the end itself. What it is and what it isn't. Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence.

The dissolution process is more than just closing down your LLC. It also includes filling out paperwork to officially terminate the company's status in the eyes of the state. Once the LLC is dissolved, you'll be taxed as an individual and no more business reporting will be required.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

The Certificate of Dissolution puts all on notice that the LLC has elected to wind up the business of the LLC and is in the process of paying liabilities and distributing assets. In order to terminate the LLC, the LLC also must file a Certificate of Cancellation (Form LLC-4/7).

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).