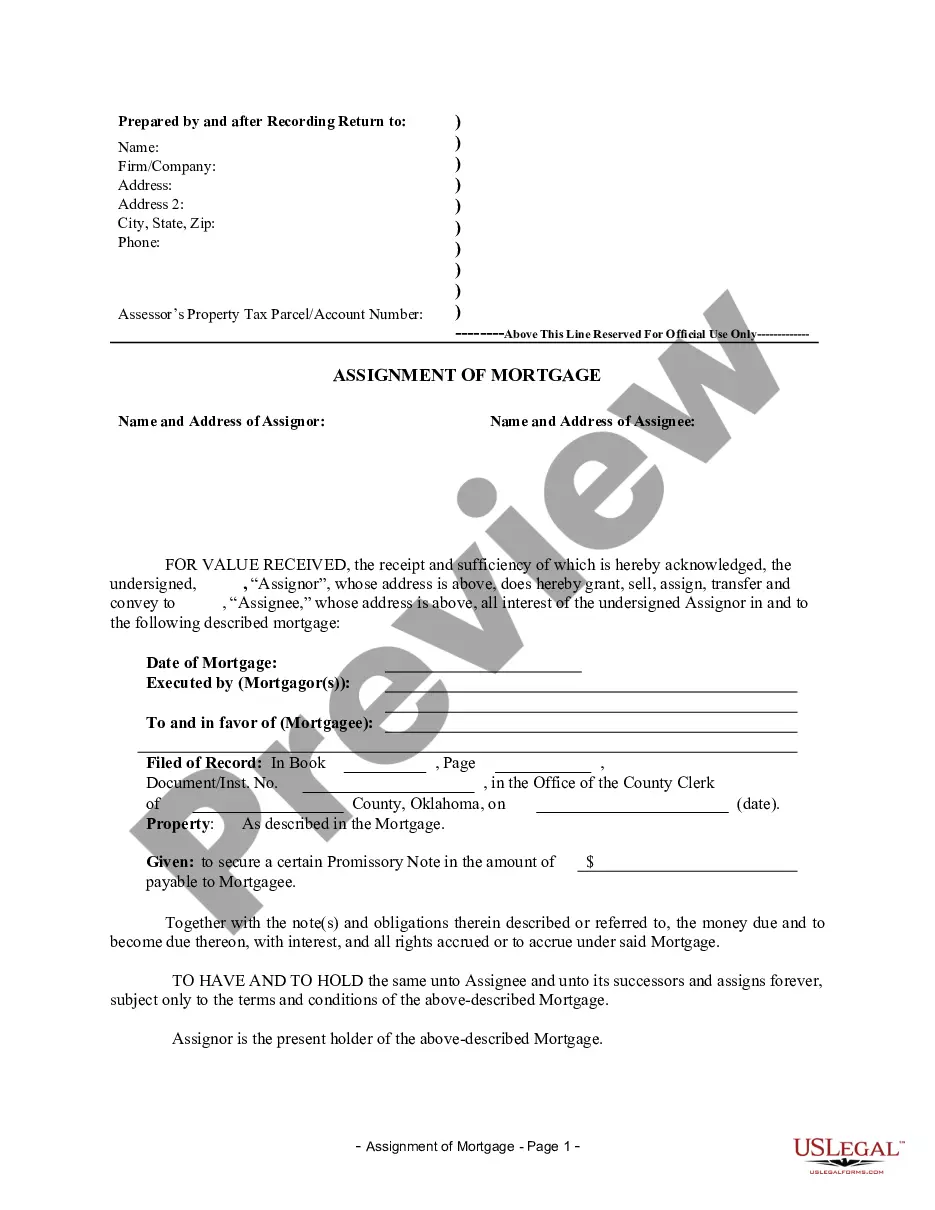

Oklahoma City Oklahoma Assignment of Mortgage by Individual Mortgage Holder

Description

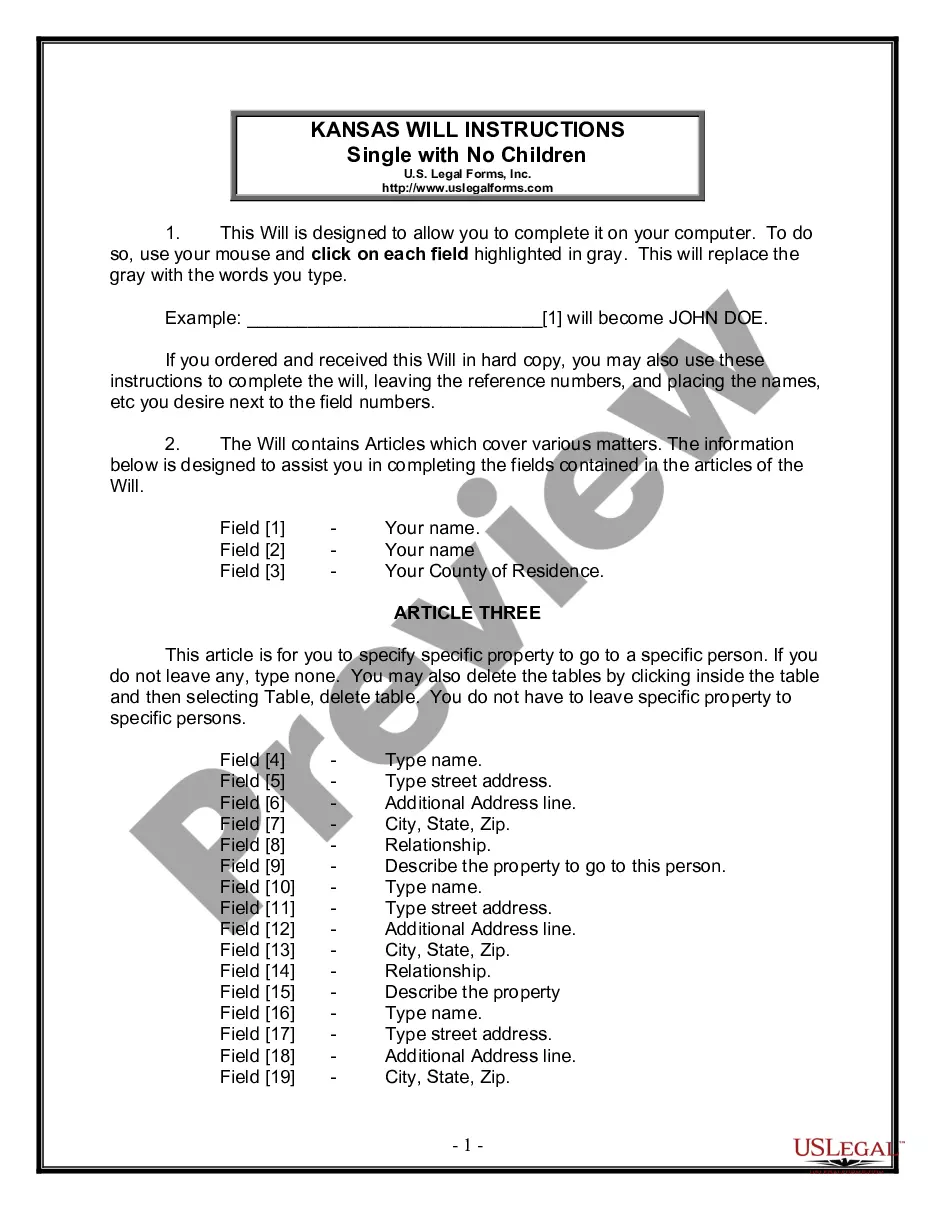

How to fill out Oklahoma Assignment Of Mortgage By Individual Mortgage Holder?

Do you require a dependable and affordable provider of legal forms to obtain the Oklahoma City Oklahoma Assignment of Mortgage by Individual Mortgage Holder? US Legal Forms is your preferred option.

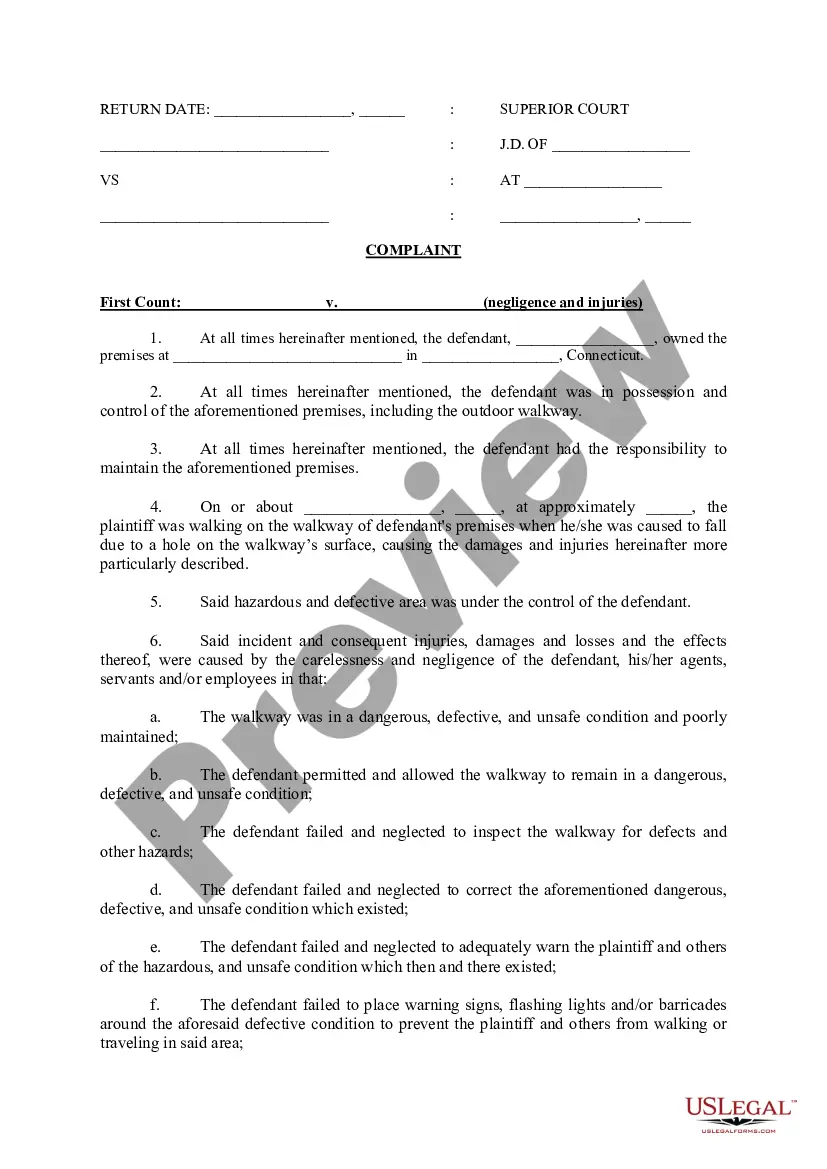

Whether you need a simple contract to establish rules for living together with your partner or a collection of documents to facilitate your divorce through the court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are tailored and structured based on the needs of specific states and regions.

To acquire the document, you must Log In to your account, find the required form, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents section.

Are you a newcomer to our platform? No problem. You can create an account in just a few minutes, but first, ensure to do the following.

Now you can register your account. Then choose the subscription plan and move forward to payment. Once the payment process is complete, download the Oklahoma City Oklahoma Assignment of Mortgage by Individual Mortgage Holder in any available format. You can return to the website at any moment and redownload the document at no extra cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time researching legal papers online once and for all.

- Verify if the Oklahoma City Oklahoma Assignment of Mortgage by Individual Mortgage Holder is compliant with the laws of your state and locality.

- Review the form’s details (if provided) to understand who and what the document is intended for.

- Restart the search if the form isn't suitable for your particular situation.

Form popularity

FAQ

You can transfer a mortgage to someone else as long as the loan is assumable. The new borrowers will be treated as if they were initiating a new loan for themselves. If your mortgage is not assumable, you still have options even if your lender says no.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

An award-winning writer with more than two decades of experience in real estate. The bank or other mortgage lender that provides a borrower with the funds to purchase a home often later transfers or assigns its interest in the mortgage to another firm.

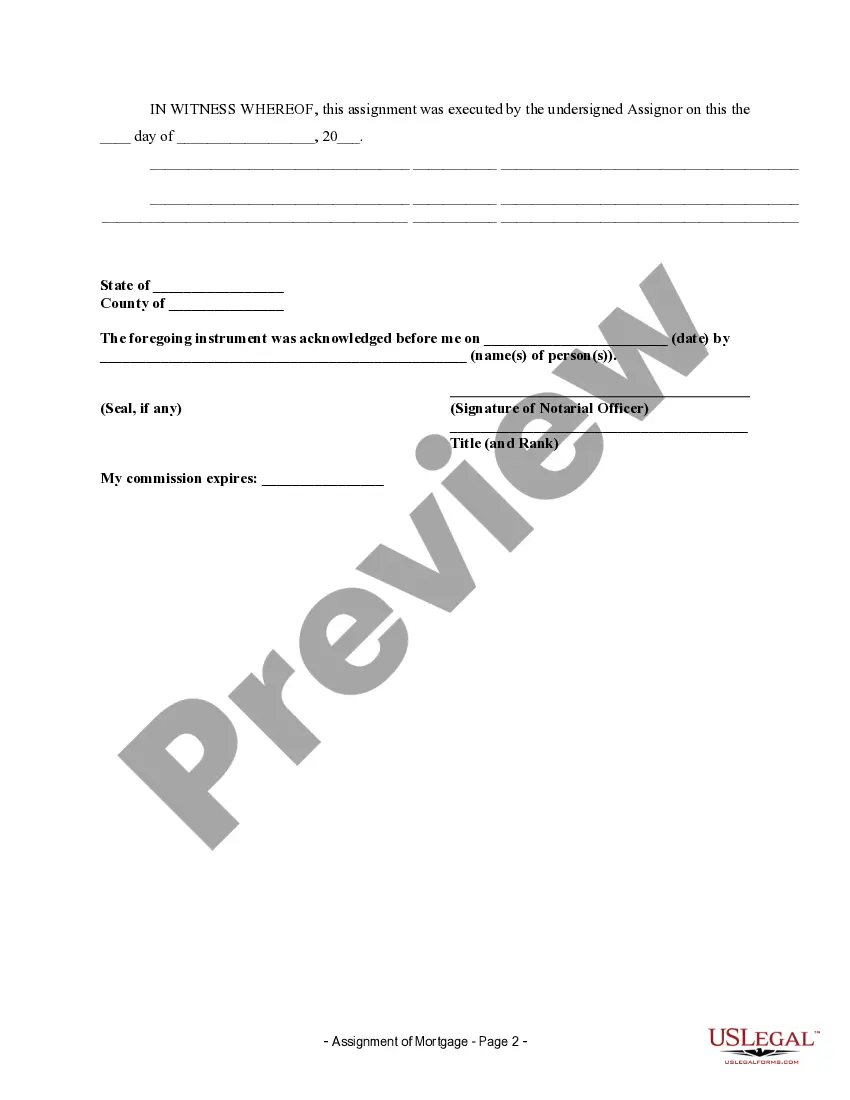

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt.

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.