Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse

Description

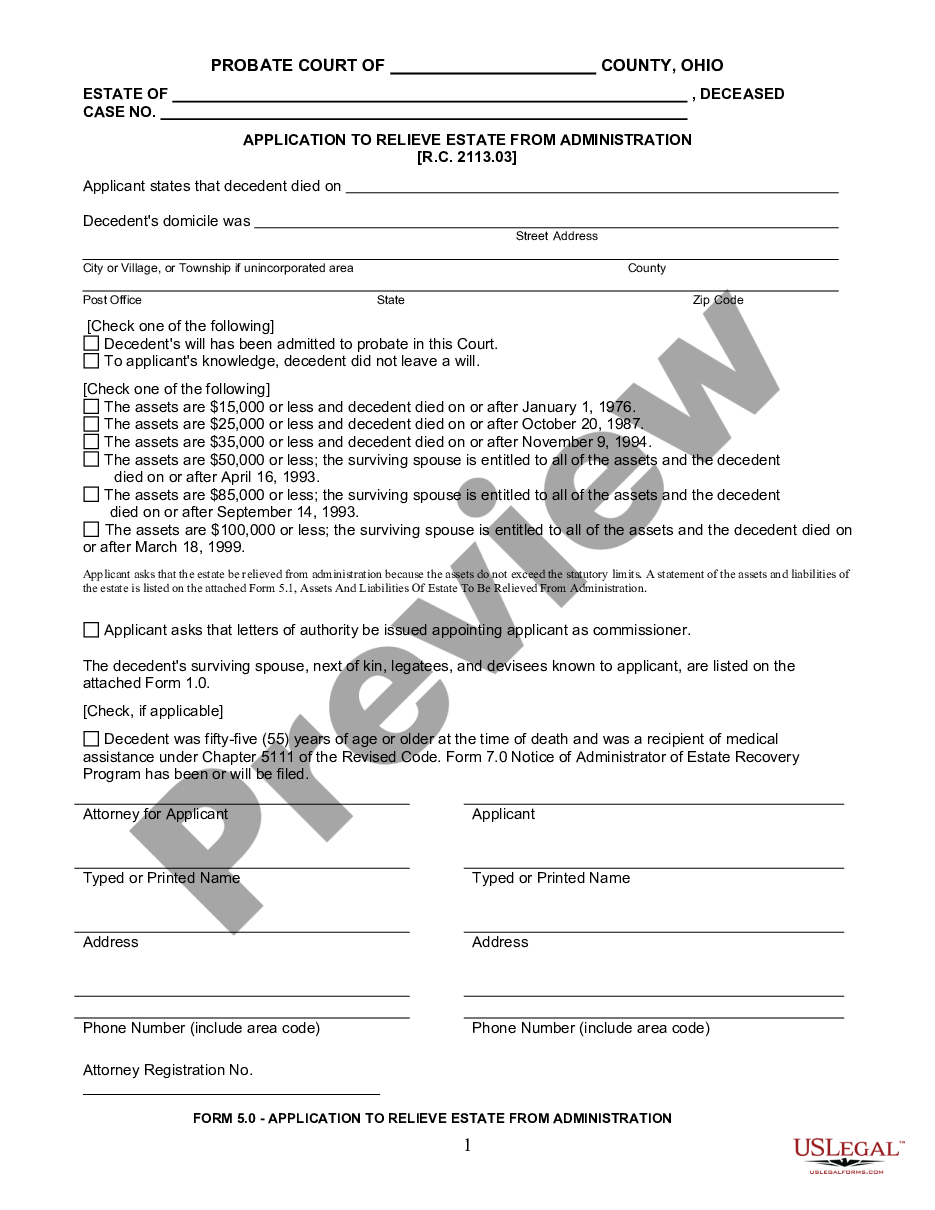

How to fill out Ohio Small Estate Affidavit For Estates Not More Than $35,00, Or $100,000 And Inherited Fully By Spouse?

If you are in search of a pertinent form template, it’s incredibly challenging to find a superior place than the US Legal Forms website – one of the most comprehensive libraries on the internet.

Here you can acquire a vast number of document samples for business and personal needs by categories and areas, or keywords.

With the advanced search capability, locating the latest Toledo Ohio Small Estate Affidavit for Estates Not Exceeding $35,000, or $100,000 and Fully Inherited by Spouse is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the account creation.

Download the document. Choose the file format and store it on your device.

- Moreover, the significance of each record is validated by a team of experienced lawyers who routinely examine the templates on our site and update them according to the most recent state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Toledo Ohio Small Estate Affidavit for Estates Not Exceeding $35,000, or $100,000 and Fully Inherited by Spouse is to Log In to your account and click the Download button.

- If you use US Legal Forms for the first time, just follow the guidelines listed below.

- Ensure you have located the sample you require. Review its details and make use of the Preview function (if available) to view its content. If it doesn’t satisfy your needs, use the Search bar at the top of the page to find the suitable document.

- Validate your choice. Click the Buy now button. Subsequently, select your desired subscription plan and provide your details to create an account.

Form popularity

FAQ

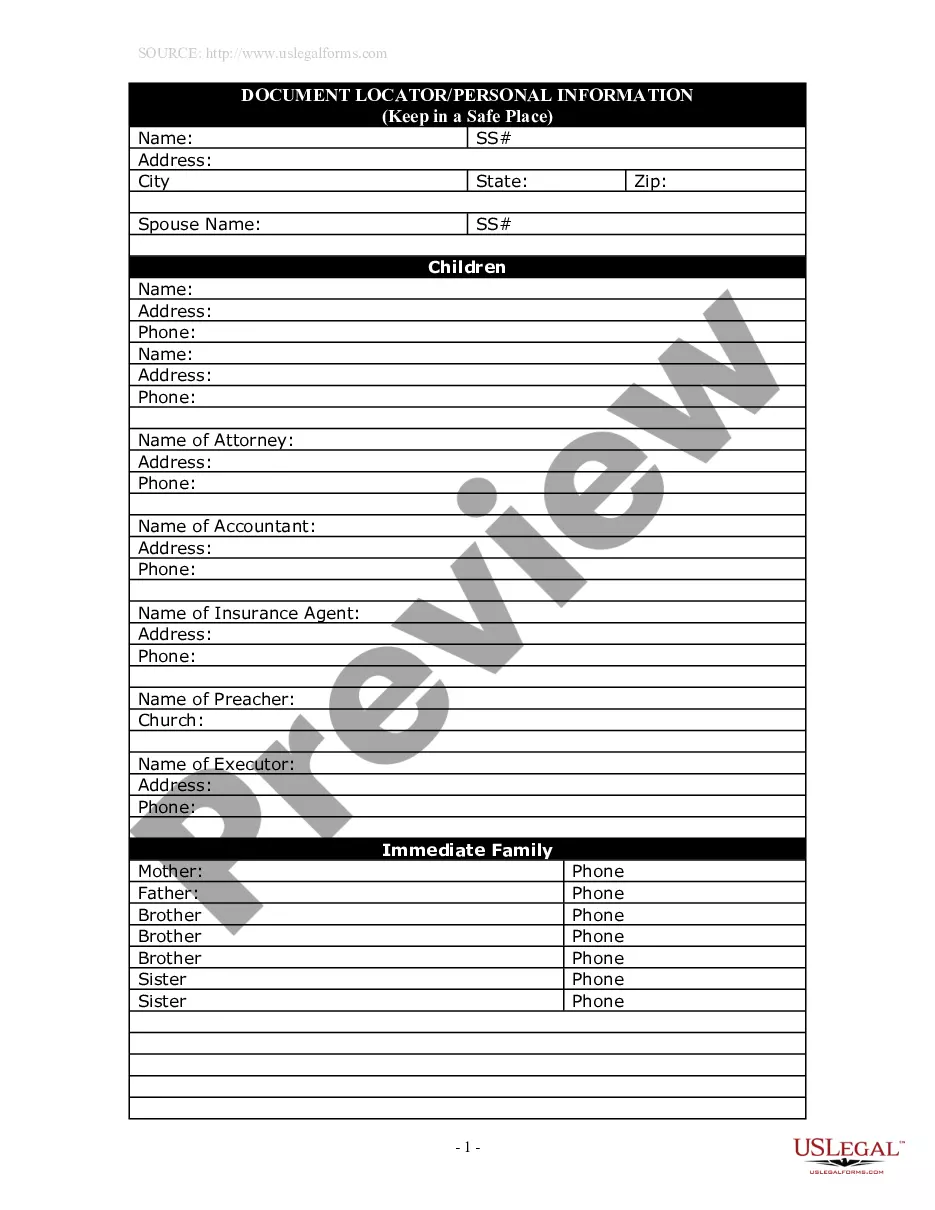

A general affidavit of heirship is a document that declares the rightful heirs of a deceased person's estate, especially relevant for a Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. It outlines the identities and relationships of heirs and helps transfer assets without the need for probate court. Using services like US Legal Forms can assist you in creating a legally sound affidavit that meets your state’s requirements efficiently.

Typically, any individual who has a claim to the estate can fill out an affidavit of heirship online, especially when dealing with a Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. This includes spouses, children, or other close relatives of the deceased. Platforms such as US Legal Forms make this process accessible for everyone, providing clear instructions to help you submit the required information easily.

To fill out an affidavit form for a Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, you will need to provide information such as the deceased’s details, names of heirs, and relationship to the deceased. You can access user-friendly templates on platforms like US Legal Forms, which guide you through the process step by step. Ensure that all information is accurate and complete to avoid any possible delays in the estate transfer.

An affidavit of legal heirs is a legal document that identifies individuals entitled to inherit property from a deceased person. In the context of a Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, this affidavit establishes the heirs’ rights to the estate without going through lengthy probate proceedings. It serves as proof to transfer assets in accordance with the law, simplifying the process for families during difficult times.

To obtain an affidavit of inheritance, you typically need to gather relevant documents, including a death certificate and proof of the relationship to the deceased. After preparing these documents, you can file a Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse with your local court. Using the uslegalforms platform can help you navigate this process smoothly and ensure you have the necessary forms ready for submission.

A letter of proof of inheritance is an official document that verifies the rightful heirs of a deceased person's estate. This letter often accompanies a Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, to solidify claims to the inheritance. It serves as an important piece of documentation for both heirs and financial institutions involved in the estate.

In Toledo, Ohio, anyone can draft an affidavit of heirship, but it is often beneficial to seek assistance from a legal professional to ensure accuracy. It’s crucial to include all information regarding the deceased and the heirs involved. By utilizing a Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, you can simplify the process of identifying heirs effectively.

Generally, a small estate affidavit does not require an Employer Identification Number (EIN) for the estate itself. However, if the estate has income-generating assets, obtaining an EIN may be necessary for tax purposes. When dealing with a Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, consult a tax professional if you're unsure about your specific circumstances. Uslegalforms offers templates that clarify requirements, making your filing process smoother.

To fill out an affidavit of inheritance, start by gathering all necessary information regarding the deceased and the inheritors. You will need to include details such as the value of assets, names, and relationships of heirs. For those using the Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, remember to follow the state-specific guidelines to ensure accuracy. Utilizing resources from uslegalforms can simplify the process.

The small estate limit in New York is set at $50,000 for estates that do not require probate. However, you should consider that the rules and limitations vary widely by state. If you're dealing with a Toledo Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, prioritize understanding the specific regulations in Ohio. This knowledge can help simplify your estate management process.