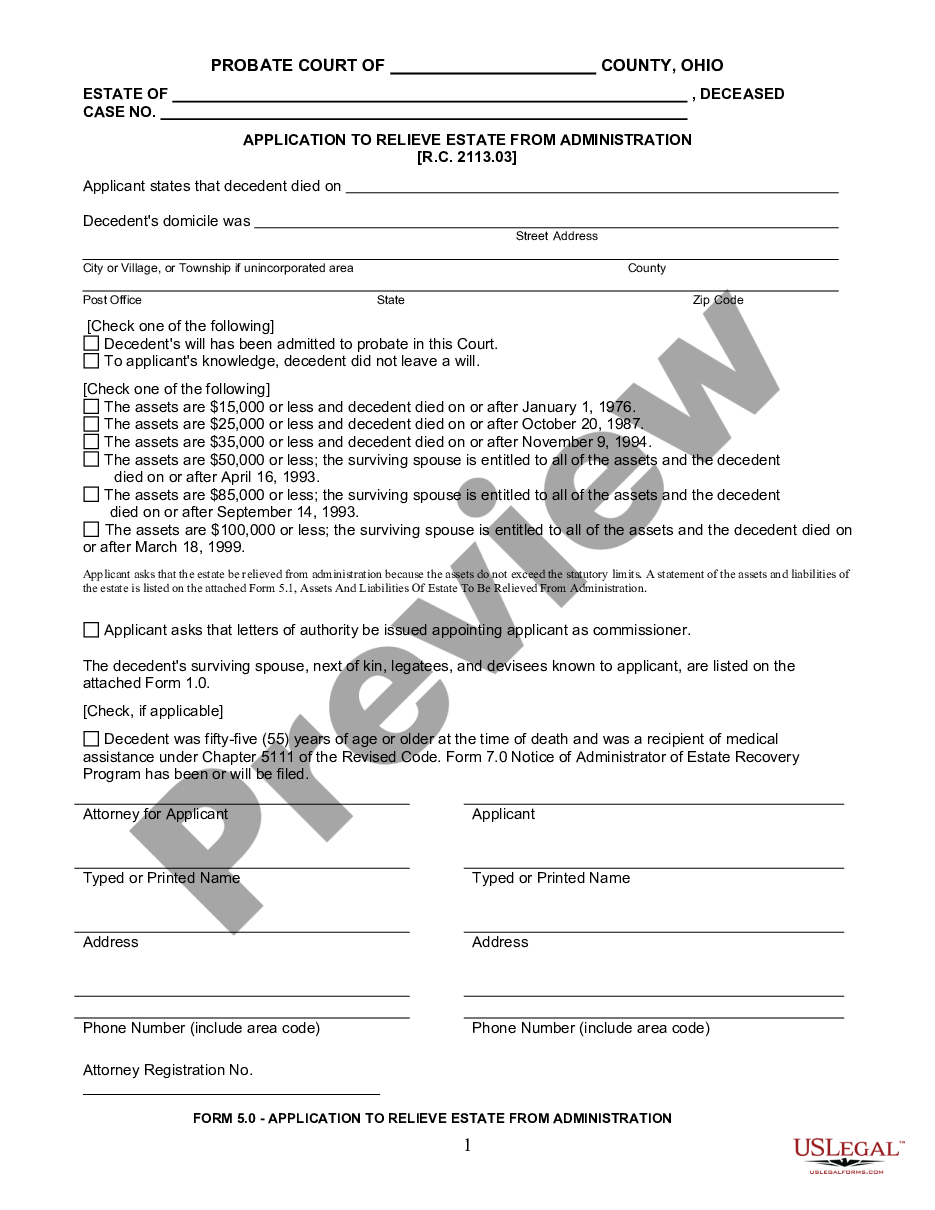

Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse

Description

How to fill out Ohio Small Estate Affidavit For Estates Not More Than $35,00, Or $100,000 And Inherited Fully By Spouse?

If you are in search of a pertinent form, it's unattainable to discover a superior platform than the US Legal Forms site – one of the most comprehensive online collections.

Here you can acquire a vast array of document examples for business and personal use categorized by types and regions, or specific keywords.

With our sophisticated search feature, locating the latest Cuyahoga Ohio Small Estate Affidavit for Estates Not Exceeding $35,000, or $100,000 and Fully Inherited by Spouse is as simple as 1-2-3.

Receive the template. Specify the format and download it onto your device.

Make alterations. Fill out, modify, print, and sign the received Cuyahoga Ohio Small Estate Affidavit for Estates Not Exceeding $35,000, or $100,000 and Fully Inherited by Spouse.

- If you are already familiar with our system and possess an account, simply Log In to your profile and select the Download option to obtain the Cuyahoga Ohio Small Estate Affidavit for Estates Not Exceeding $35,000, or $100,000 and Fully Inherited by Spouse.

- If you are utilizing US Legal Forms for the first time, just adhere to the instructions below.

- Ensure you have located the sample you need. Review its description and employ the Preview function to assess its content. If it does not satisfy your needs, use the Search feature at the top of the page to find the necessary document.

- Verify your selection. Choose the Buy now option. Afterward, choose the preferred payment plan and provide details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the sign-up process.

Form popularity

FAQ

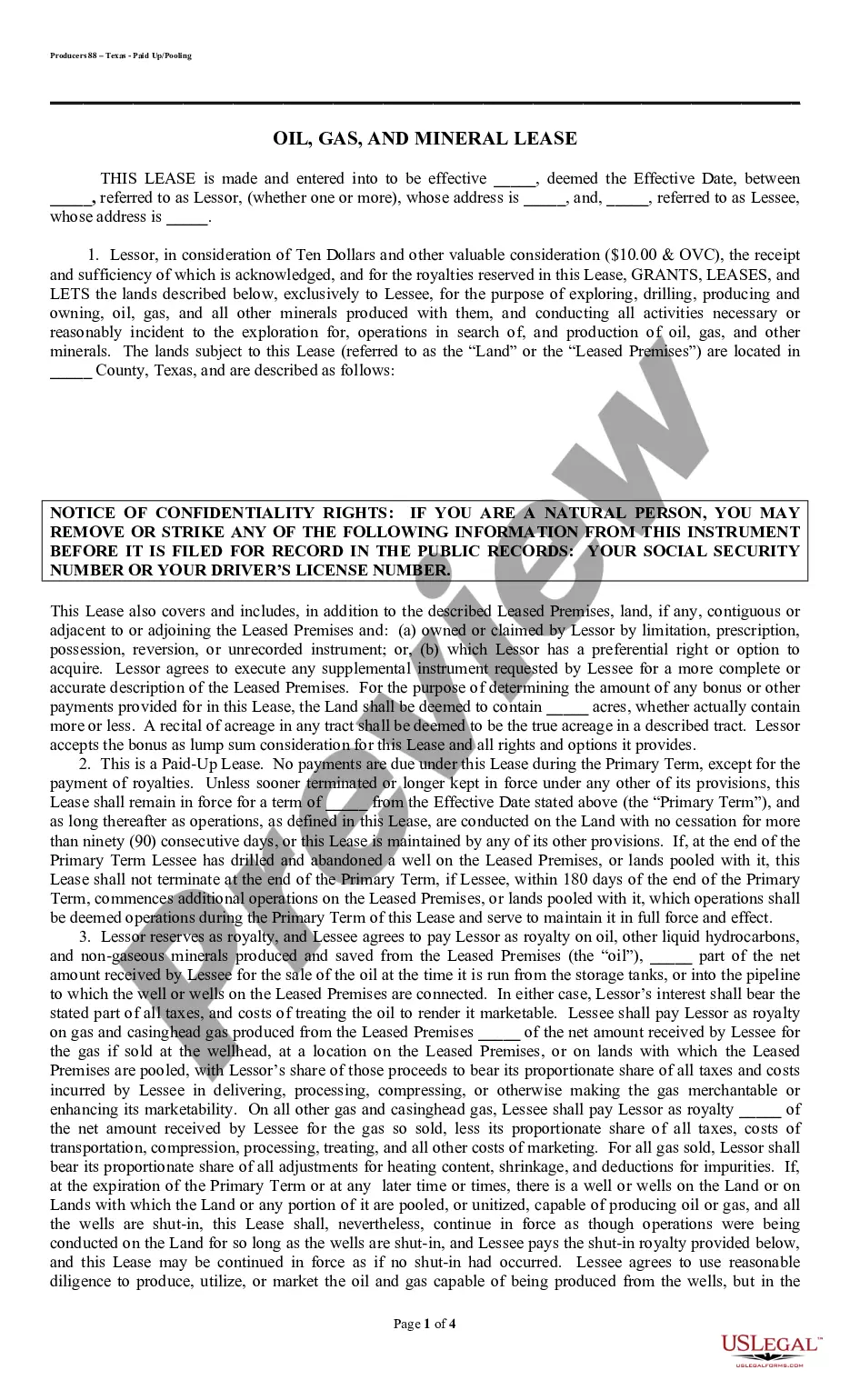

Filling out an affidavit of inheritance involves detailing the relationship between the deceased and the heirs. You will need to include relevant personal information, such as dates of birth and social security numbers. This form is critical when dealing with assets under the scope of the Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, so utilizing tools from platforms like USLegalForms can enhance accuracy and compliance.

To fill out an affidavit of heirs, start by gathering all necessary information regarding the decedent and potential heirs. Clearly list names, relationships, and addresses to establish rightful claims. With a Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, accuracy is vital to ensure proper distribution. USLegalForms provides templates to simplify this process.

In Ohio, the surviving spouse is entitled to a specific allowance from the estate, which can help cover living expenses after the spouse's passing. This allowance protects the financial stability of the surviving partner, especially in cases involving a Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. Utilize reliable platforms to clarify entitlements and navigate the process smoothly.

In Washington state, real property typically must go through probate, but there are exceptions, especially for small estates. If the estate qualifies under a similar framework to the Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, limited property may bypass formal probate. Always consult legal resources to confirm the specifics of your situation.

Without an affidavit of heirship, heirs may face significant delays in accessing the estate. The absence of this document can complicate the transfer of assets and potentially lead to disputes among family members. For estates eligible for the Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, having an affidavit increases clarity and expedites the distribution process.

Filling out an affidavit form requires careful attention to detail. Begin by providing accurate personal information, such as your name and the names of the decedent and heirs. Ensure that you include specific details about the estate, as it directly relates to your Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. For ease, consider using platforms like USLegalForms, which offer guidance and templates.

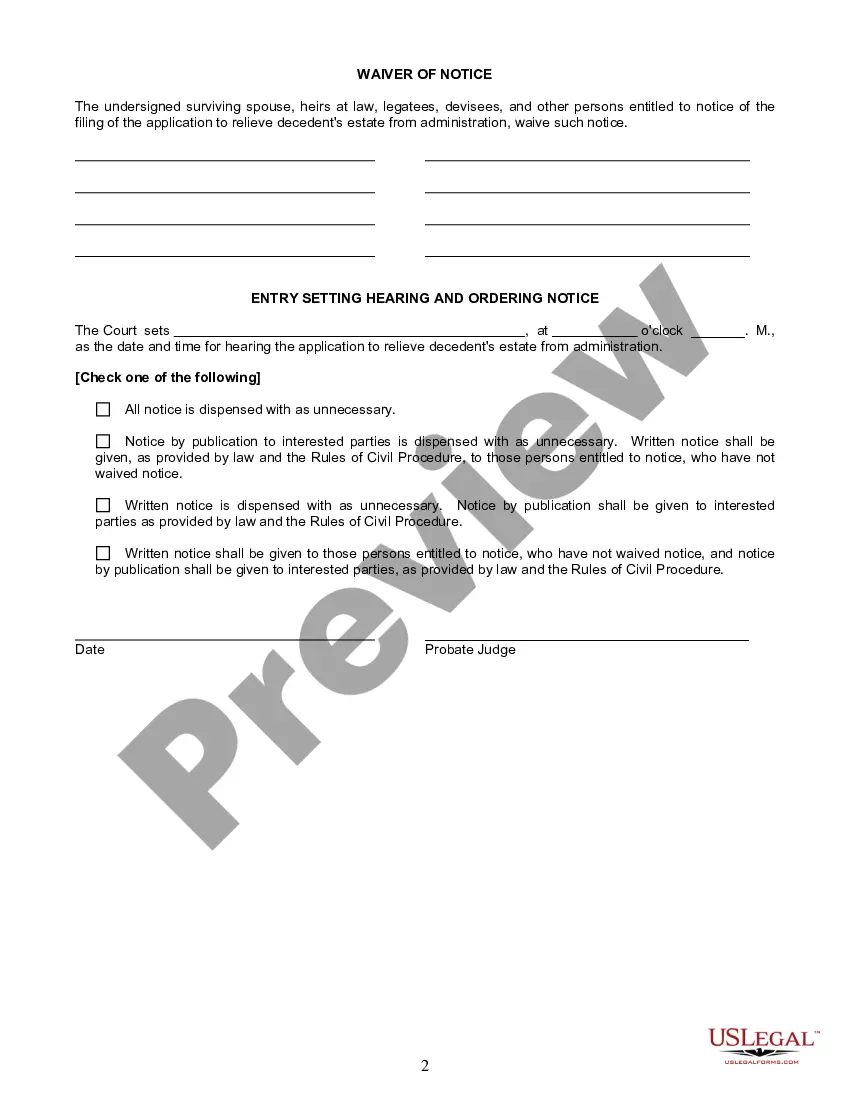

Probate limits in Ohio define when a small estate affidavit can be used instead of formal probate. For estates not exceeding $35,000, or $100,000 specifically for estates inherited fully by a spouse, you can opt for the Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. This streamlined process allows for swift distribution of assets without the complexities of traditional probate. Understanding these limits can help you make informed decisions regarding estate management.

In Ohio, if the estate's total value exceeds $35,000 for estates inherited fully by a spouse, probate is typically required. However, for smaller estates that do not meet this threshold, you can utilize the Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. This affidavit simplifies the transfer of assets without the need for probate proceedings. It’s an efficient option designed for those who want to handle small estates with minimal hassle.

Not all estates in Ohio are required to go through probate. Estates with a total value under $35,000 can typically use a small estate affidavit instead of facing the complexities of probate. This process offers a more straightforward way to handle the transfer of assets, especially in cases of estates inherited fully by a spouse under the Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000. Explore options like US Legal Forms for assistance with this process.

Yes, anyone who is a qualified beneficiary or heir of the estate can fill out a small estate affidavit in Ohio. However, it's important to ensure that you meet the specific criteria set for the Cuyahoga Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000, and Inherited Fully by Spouse. Following the right procedures ensures that the affidavit is valid and accepted. Consider using resources like US Legal Forms for guidance in completing the affidavit correctly.