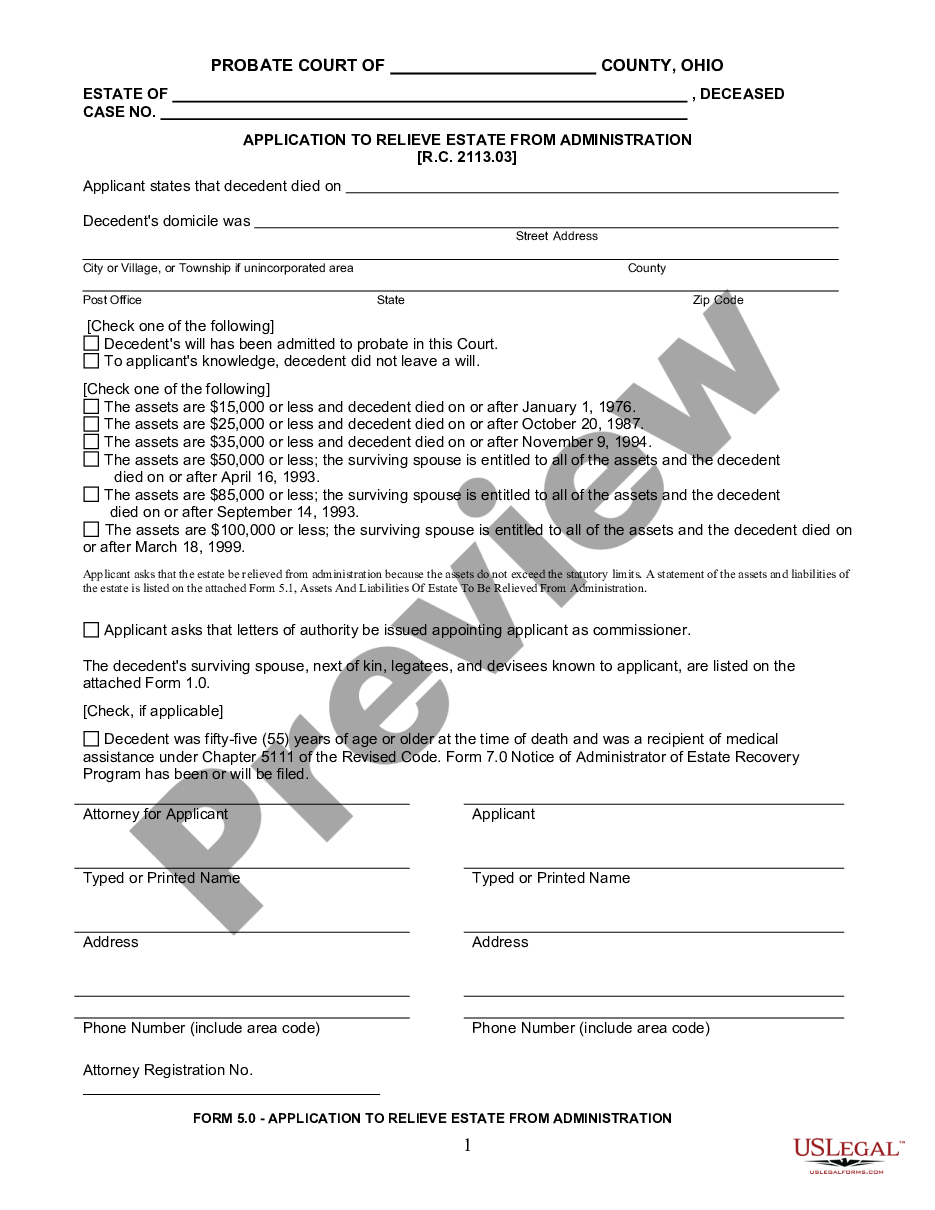

Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

1.Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2.Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Ohio Summary:

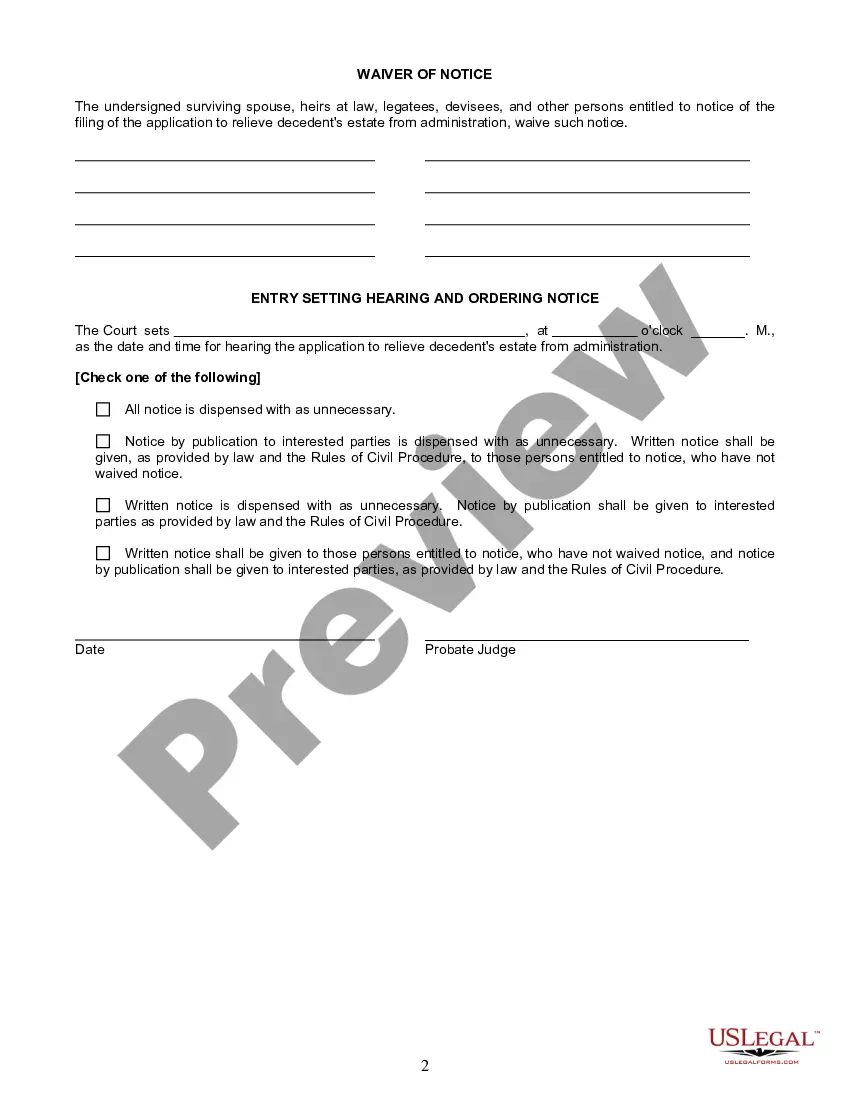

Under Ohio statute, where as estate is valued at less than $100,000, an authorized party, (please see below for details on who can administer an estate under this statute), may file a request with the court that the estate be resolved without the regular process of administration. If the court finds the request valid under the below statute, the court may enter an order relieving the estate from administration and directing delivery of personal property and transfer of real estate to the persons entitled to the personal property or real estate.

Ohio Requirements:

Ohio requirements are set forth in the statutes below.

§ 2113.031 Summary Release from administration.

(A) As used in this section:

(1) "Financial institution" has the same meaning as in section 5725.01 of the Revised Code. "Financial institution" also includes a credit union and a fiduciary that is not a trust company but that does trust business.

(2) "Funeral and burial expenses" means whichever of the following applies:

(a) The funeral and burial expenses of the decedent that are included in the bill of a funeral director;

(b) The funeral expenses of the decedent that are not included in the bill of a funeral director and that have been approved by the probate court;

(c) The funeral and burial expenses of the decedent that are described in divisions (A)(2)(a) and (b) of this section.

(3) "Surviving spouse" means either of the following:

(a) The surviving spouse of a decedent who died leaving the surviving spouse and no minor children;

(b) The surviving spouse of a decedent who died leaving the surviving spouse and minor children, all of whom are children of the decedent and the surviving spouse.

(B)

(1) If the value of the assets of the decedent's estate does not exceed the lesser of five thousand dollars or the amount of the decedent's funeral and burial expenses, any person who is not a surviving spouse and who has paid or is obligated in writing to pay the decedent's funeral and burial expenses, including a person described in section 2108.89 of the Revised Code, may apply to the probate court for an order granting a summary release from administration in accordance with this section.

(2) If either of the following applies, the decedent's surviving spouse may apply to the probate court for an order granting a summary release from administration in accordance with this section:

(a) The decedent's funeral and burial expenses have been prepaid, and the value of the assets of the decedent's estate does not exceed the total of the following items:

(i) The allowance for support that is made under division (A) of section 2106.13 of the Revised Code to the surviving spouse and, if applicable, to the decedent's minor children and that is distributable in accordance with division (B)(1) or (2) of that section;

(ii) An amount, not exceeding five thousand dollars, for the decedent's funeral and burial expenses referred to in division (A)(2)(c) of this section.

(b) The decedent's funeral and burial expenses have not been prepaid, the decedent's surviving spouse has paid or is obligated in writing to pay the decedent's funeral and burial expenses, and the value of the assets of the decedent's estate does not exceed the total of the items referred to in divisions (B)(2)(a)(i) and (ii) of this section.

(C) A probate court shall order a summary release from administration in connection with a decedent's estate only if the court finds that all of the following are satisfied:

(1) A person described in division (B)(1) of this section is the applicant for a summary release from administration, and the value of the assets of the decedent's estate does not exceed the lesser of five thousand dollars or the amount of the decedent's funeral and burial expenses, or the applicant for a summary release from administration is the decedent's surviving spouse, and the circumstances described in division (B)(2)(a) or (b) of this section apply.

(2) The application for a summary release from administration does all of the following:

(a) Describes all assets of the decedent's estate that are known to the applicant;

(b) Is in the form that the supreme court prescribes pursuant to its powers of superintendence under Section 5 of Article IV, Ohio Constitution, and is consistent with the requirements of this division;

(c) Has been signed and acknowledged by the applicant in the presence of a notary public or a deputy clerk of the probate court;

(d) Sets forth the following information if the decedent's estate includes a described type of asset:

(i) If the decedent's estate includes a motor vehicle, the motor vehicle's year, make, model, body type, manufacturer's vehicle identification number, certificate of title number, and date of death value;

(ii) If the decedent's estate includes an account maintained by a financial institution, that institution's name and the account's complete identifying number and date of death balance;

(iii) If the decedent's estate includes one or more shares of stock or bonds, the total number of the shares and bonds and their total date of death value and, for each share or bond, its serial number, the name of its issuer, its date of death value, and, if any, the name and address of its transfer agent.

(3) The application for a summary release from administration is accompanied by all of the following that apply:

(a) A receipt, contract, written declaration as defined in section 2108.70 of the Revised Code, or other document that confirms the applicant's payment or obligation to pay the decedent's funeral and burial expenses or, if applicable in the case of the decedent's surviving spouse, the prepayment of the decedent's funeral and burial expenses;

(b) An application for a certificate of transfer as described in section 2113.61 of the Revised Code, if an interest in real property is included in the assets of the decedent’s estate;<br />

<br />

(c) The fee required by division (A)(59) of section 2101.16 of the Revised Code.<br />

<br />

(4) At the time of its determination on the application, there are no pending proceedings for the administration of the decedent’s estate and no pending proceedings for relief of the decedent’s estate from administration under section 2113.03 of the Revised Code.<br />

<br />

(5) At the time of its determination on the application, there are no known assets of the decedent’s estate other than the assets described in the application.<br />

<br />

(D) If the probate court determines that the requirements of division (C) of this section are satisfied, the probate court shall issue an order that grants a summary release from administration in connection with the decedent’s estate. The order has, and shall specify that it has, all of the following effects:<br />

<br />

(1) It relieves the decedent’s estate from administration.<br />

<br />

(2) It directs the delivery to the applicant of the decedent’s personal property together with the title to that property.<br />

<br />

(3) It directs the transfer to the applicant of the title to any interests in real property included in the decedent’s estate.<br />

<br />

(4) It eliminates the need for a financial institution, corporation, or other entity or person referred to in any provision of divisions (A) to (F) of section 5731.39 of the Revised Code to obtain, as otherwise would be required by any of those divisions, the written consent of the tax commissioner prior to the delivery, transfer, or payment to the applicant of an asset of the decedent’s estate.<br />

<br />

(E) A certified copy of an order that grants a summary release from administration together with a certified copy of the application for that order constitutes sufficient authority for a financial institution, corporation, or other entity or person referred to in divisions (A) to (F) of section 5731.39 of the Revised Code or for a clerk of a court of common pleas to transfer title to an asset of the decedent’s estate to the applicant for the summary release from administration.<br />

<br />

(F) This section does not affect the ability of qualified persons to file an application to relieve an estate from administration under section 2113.03 of the Revised Code or to file an application for the grant of letters testamentary or letters of administration in connection with the decedent’s estate.<br />

<br />

Effective Date: 12-13-2002; 10-12-2006