This dissolution package contains forms, instructions, information and helpful links needed to dissolve a Limited Liabilty Company in Ohio.

Franklin Ohio Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Ohio Dissolution Package To Dissolve Limited Liability Company LLC?

Finding authenticated templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms library.

It’s a web-based collection of over 85,000 legal documents for both personal and business purposes and various real-life situations.

All the forms are appropriately sorted by category and jurisdiction, making the search for the Franklin Ohio Dissolution Package to dissolve Limited Liability Company LLC as swift and simple as ABC.

Providing your credit card information or using your PayPal account to complete the subscription payment is required.

- Inspect the Preview mode and document description.

- Ensure you've selected the right one that aligns with your specifications and fully meets your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Once you complete the process using the Franklin Ohio Dissolution Package to Dissolve Limited Liability Company LLC, your LLC officially ceases to exist. You'll need to settle any outstanding debts and obligations. It is also important to formally notify any stakeholders, such as clients or vendors, about the dissolution. Lastly, ensuring that you cancel your EIN and close any business accounts is essential for a seamless transition.

You can obtain a dissolution online in Ohio with the Franklin Ohio Dissolution Package to Dissolve Limited Liability Company LLC. This platform allows you to complete your filing conveniently from home, providing all essential forms and guidance. It streamlines the process and saves you time. By using this package, you ensure that you meet all requirements set by the state.

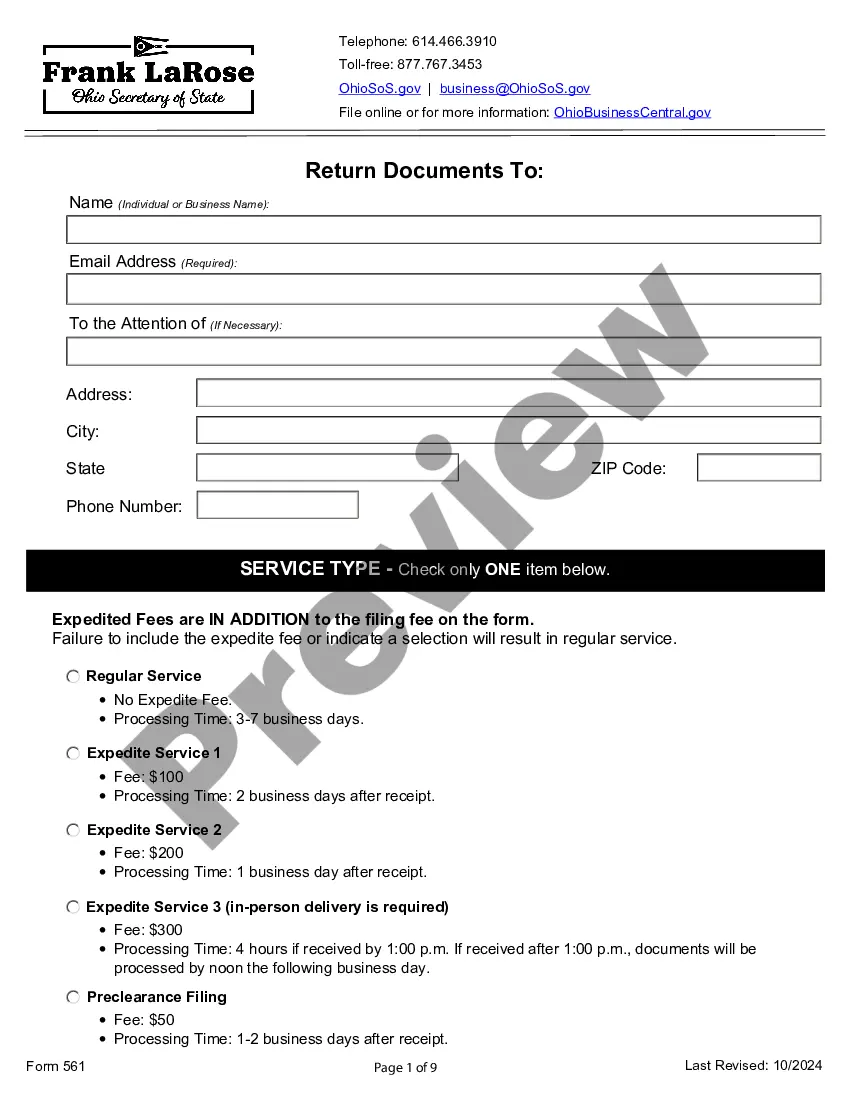

To dissolve your LLC in Ohio, you first need to file a document called the Articles of Dissolution with the Ohio Secretary of State. After filing, make sure to settle any business debts, notify creditors, and distribute remaining assets among members. You can streamline this process by using the Franklin Ohio Dissolution Package to Dissolve Limited Liability Company LLC, which provides all necessary forms and guidance. This package simplifies the process, ensuring you complete each step correctly and efficiently.

Yes, you can file for dissolution online in Ohio through the Secretary of State's website. When you choose the Franklin Ohio Dissolution Package to Dissolve Limited Liability Company LLC, you gain access to tools and resources that simplify the online filing process. This efficient method helps you manage your time and ensures that you meet all legal requirements seamlessly.

To shut down your LLC in Ohio, you must file Articles of Dissolution with the Secretary of State. Utilizing the Franklin Ohio Dissolution Package to Dissolve Limited Liability Company LLC makes this process straightforward, ensuring you complete all required steps. After filing, remember to notify your creditors and settle any outstanding debts to finalize your business closure properly.

Dissolving an LLC involves formally ending the business, while terminating refers to ceasing its operations without going through the legal dissolution process. When you use the Franklin Ohio Dissolution Package to Dissolve Limited Liability Company LLC, you ensure that the dissolution is completed correctly, protecting your interests. It's important to follow the official steps and notify the state to avoid future liabilities.

The dissolution process is more than just closing down your LLC. It also includes filling out paperwork to officially terminate the company's status in the eyes of the state. Once the LLC is dissolved, you'll be taxed as an individual and no more business reporting will be required.

Generally called articles of dissolution, it usually states the LLC's name, the date it was formed, the fact the LLC is dissolving, and the event triggering the dissolution. Upon the effective date of this document, the LLC is considered dissolved and must stop doing its regular business and start winding up.

To dissolve your LLC in Ohio, you must provide the completed Certificate of Dissolution of Limited Liability Company / Cancellation of Foreign LLC form to the Secretary of State by mail, in person, or online. Ohio's SOS does not require original signatures.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.