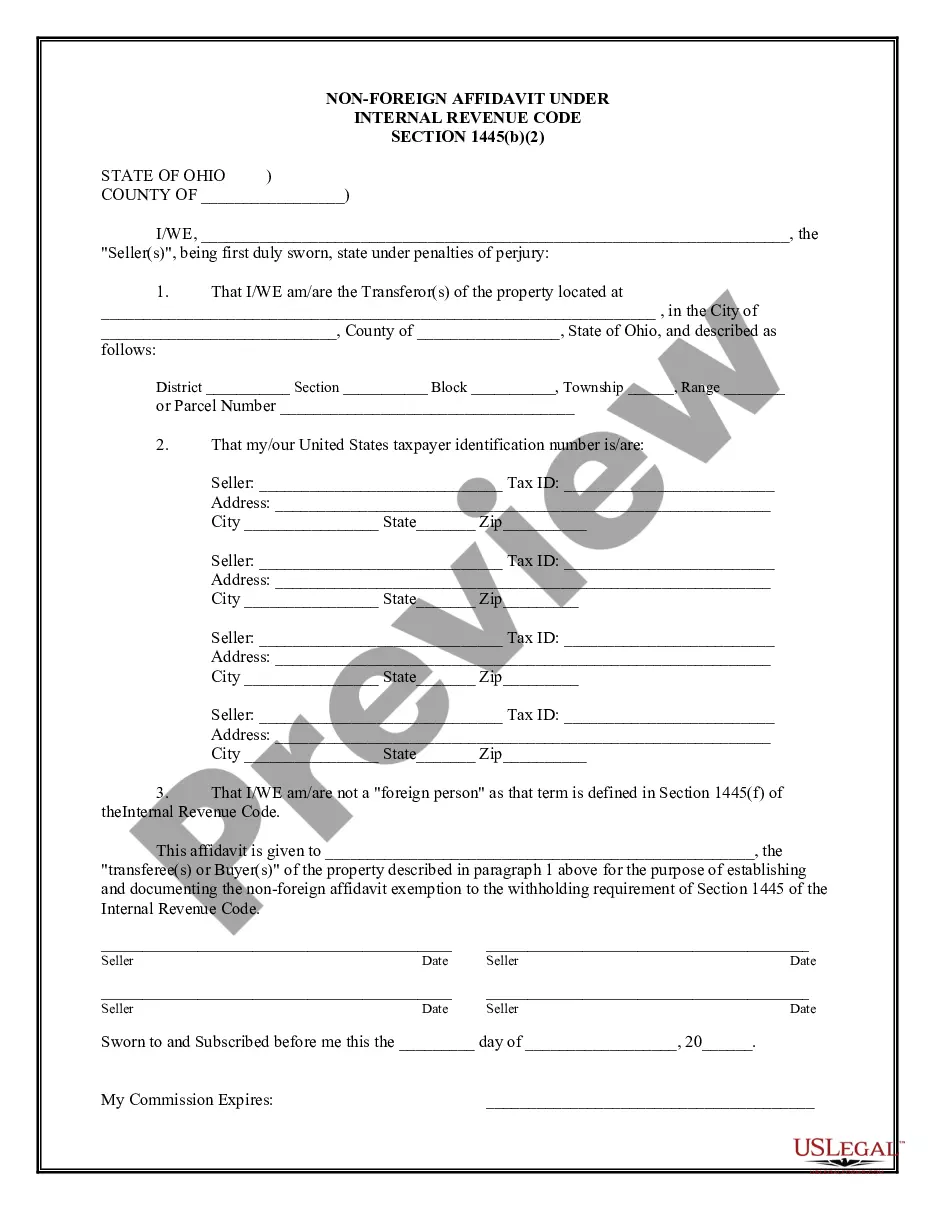

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Dayton Ohio Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Ohio Non-Foreign Affidavit Under IRC 1445?

Locating authenticated templates tailored to your regional legislation can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both individual and professional requirements and various real-world circumstances.

All the papers are correctly categorized by area of application and jurisdiction categories, making it simple and swift to search for the Dayton Ohio Non-Foreign Affidavit Under IRC 1445.

Maintaining paperwork organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to always have necessary document templates for any requirements readily available!

- Inspect the Preview mode and document description.

- Ensure you’ve selected the correct one that aligns with your needs and completely adheres to your local jurisdiction criteria.

- Search for another template, if necessary.

- If you detect any discrepancies, use the Search tab above to find the appropriate one. If it meets your approval, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Typically, either the seller or the buyer, along with their real estate agents or attorneys, prepares the FIRPTA documentation. They ensure that necessary forms are correctly filled out and submitted to the IRS. Utilizing USLegalForms can simplify this process for anyone needing a Dayton Ohio Non-Foreign Affidavit Under IRC 1445, providing clarity and convenience throughout the transaction.

foreign status affidavit declares that the seller is not a foreign person under the definitions outlined in the Internal Revenue Code. This affidavit is essential for buyers as it mitigates the withholding tax requirements typically associated with the sale of property. This document is particularly relevant when executing a Dayton Ohio NonForeign Affidavit Under IRC 1445, which streamlines transactions and assures compliance.

To obtain a FIRPTA certificate, you need to apply to the IRS by filing Form 8288-B. This form requests a withholding certificate and provides information about the sale and seller's tax status. If you are dealing with a property in Dayton and need a Dayton Ohio Non-Foreign Affidavit Under IRC 1445, you might want to consider using USLegalForms to navigate the process smoothly.

The IRC Code section 1445 relates to the Foreign Investment in Real Property Tax Act (FIRPTA), which requires buyers to withhold tax on sales of U.S. real property interests by foreign sellers. This section helps ensure tax compliance when properties are sold by non-resident aliens. Understanding the implications of the Dayton Ohio Non-Foreign Affidavit Under IRC 1445 is crucial for both buyers and sellers in the real estate market.

IRC Code 1445 is part of the Internal Revenue Code that details the requirements for withholding taxes during the sale of U.S. real property interests by foreign individuals. This code aims to ensure that taxes owed to the U.S. government are collected effectively in such transactions. Understanding IRC Code 1445 is crucial for anyone involved in real estate transactions, particularly when creating a Dayton Ohio Non-Foreign Affidavit Under IRC 1445. Consulting services like UsLegalForms can assist you in navigating these requirements smoothly.

IRS Notice 1445 is a document issued to buyers by the IRS, which outlines the requirements for withholding on real estate transactions involving foreign sellers. The notice highlights the importance of ensuring that the seller has properly filled out an affidavit to confirm their tax status. By following this notice correctly, you can eliminate any potential tax issues and ensure compliance with IRA regulations when handling a Dayton Ohio Non-Foreign Affidavit Under IRC 1445.

To successfully create a FIRPTA affidavit for real estate, you need to provide essential information, including the seller's status as a non-foreign person. This involves confirming their identity and providing necessary documentation that supports their non-foreign status. Producing a Dayton Ohio Non-Foreign Affidavit Under IRC 1445 can streamline this process and help ensure that all parties are protected. Utilizing platforms like UsLegalForms can simplify the documentation and compliance requirements.

Section 1445 of the IRS Code addresses the Foreign Investment in Real Property Tax Act (FIRPTA). This section mandates that buyers withhold tax on payments to foreign sellers during real property transactions. By ensuring compliance with Section 1445, you can avoid penalties and legal complications when dealing with foreign sellers. Thus, understanding this code is essential for a smooth transaction involving a Dayton Ohio Non-Foreign Affidavit Under IRC 1445.

The seller of the property is the primary signatory on a FIRPTA certificate, as they must declare their non-foreign status. Additionally, buyers may also need to sign to confirm their understanding of the FIRPTA implications. In the context of the Dayton Ohio Non-Foreign Affidavit Under IRC 1445, clarity on who signs is critical for a successful transaction. Consulting with legal or real estate professionals can ensure all forms are correctly completed.

Yes, in many cases, FIRPTA affidavits require notarization to be valid. Notarization serves as a verification of the identities of the signers, which adds a layer of protection for all parties involved. When dealing with the Dayton Ohio Non-Foreign Affidavit Under IRC 1445, ensuring proper notarization can help expedite the process and prevent legal complications. Always check local regulations to ensure compliance.