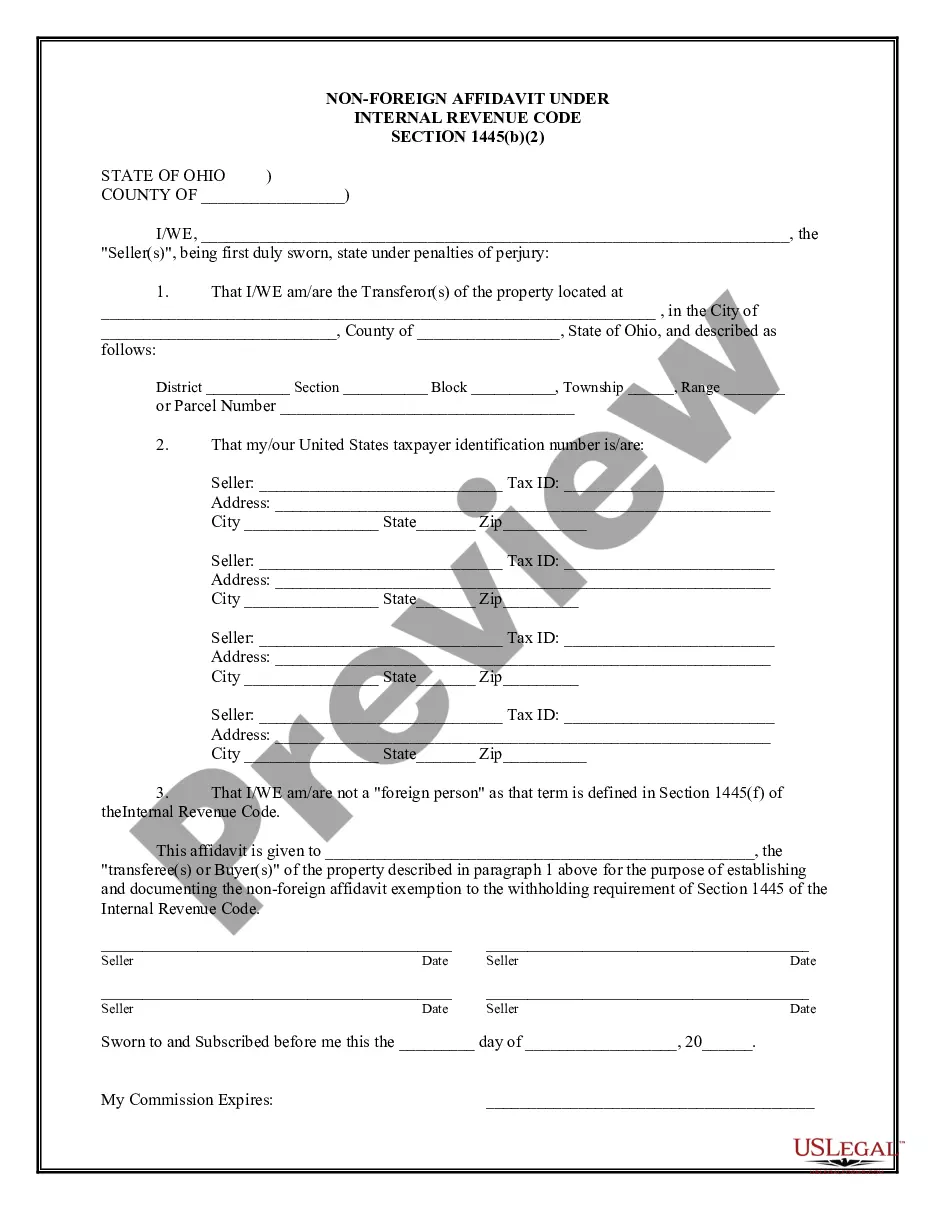

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Columbus Ohio Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Ohio Non-Foreign Affidavit Under IRC 1445?

Securing verified templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents for both personal and professional requirements and various real-world situations.

All files are categorically arranged by field of use and jurisdiction areas, making it as swift and simple as A-B-C to find the Columbus Ohio Non-Foreign Affidavit Under IRC 1445.

Maintaining organized paperwork that adheres to legal standards is critically important. Take advantage of the US Legal Forms library to always have necessary document templates for any requirements right at your fingertips!

- Inspect the Preview mode and document description.

- Ensure you’ve picked the appropriate one that fulfills your needs and aligns fully with your local jurisdiction criteria.

- Look for an alternative template, if necessary.

- Upon discovering any discrepancy, utilize the Search tab above to locate the correct one.

- If it meets your requirements, proceed to the subsequent step.

Form popularity

FAQ

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an authorized officer of Borrower, stating (a) that Borrower is not a ?foreign corporation,? ?foreign partnership,? ?foreign trust,? or ?foreign estate,? as those terms are defined in the Code and the regulations promulgated

One of these is IRS Notice 1445, which is a notice explaining how anyone can receive tax assistance in other languages. This is particularly useful for any taxpayer for whom English is a second language, which can make it easier for you to navigate the tax process and avoid complications or penalties.

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

If you're buying property, you should make sure the seller signs a FIRPTA Affidavit to protect yourself. You shouldn't take the seller's word for it ? or you could face serious penalties for not abiding by FIRPTA rules if they apply. A buyer can be penalized for not determining or disclosing a foreign seller.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

A citizen or resident of the United States, ? A domestic partnership, or ? A domestic corporation, or ? An estate or trust (other than a foreign estate of foreign trust as those terms are defined in Section 7701 (a) (31) of the Code.

FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests. A disposition means ?disposition? for any purpose of the Internal Revenue Code. This includes but is not limited to a sale or exchange, liquidation, redemption, gift, transfers, etc.