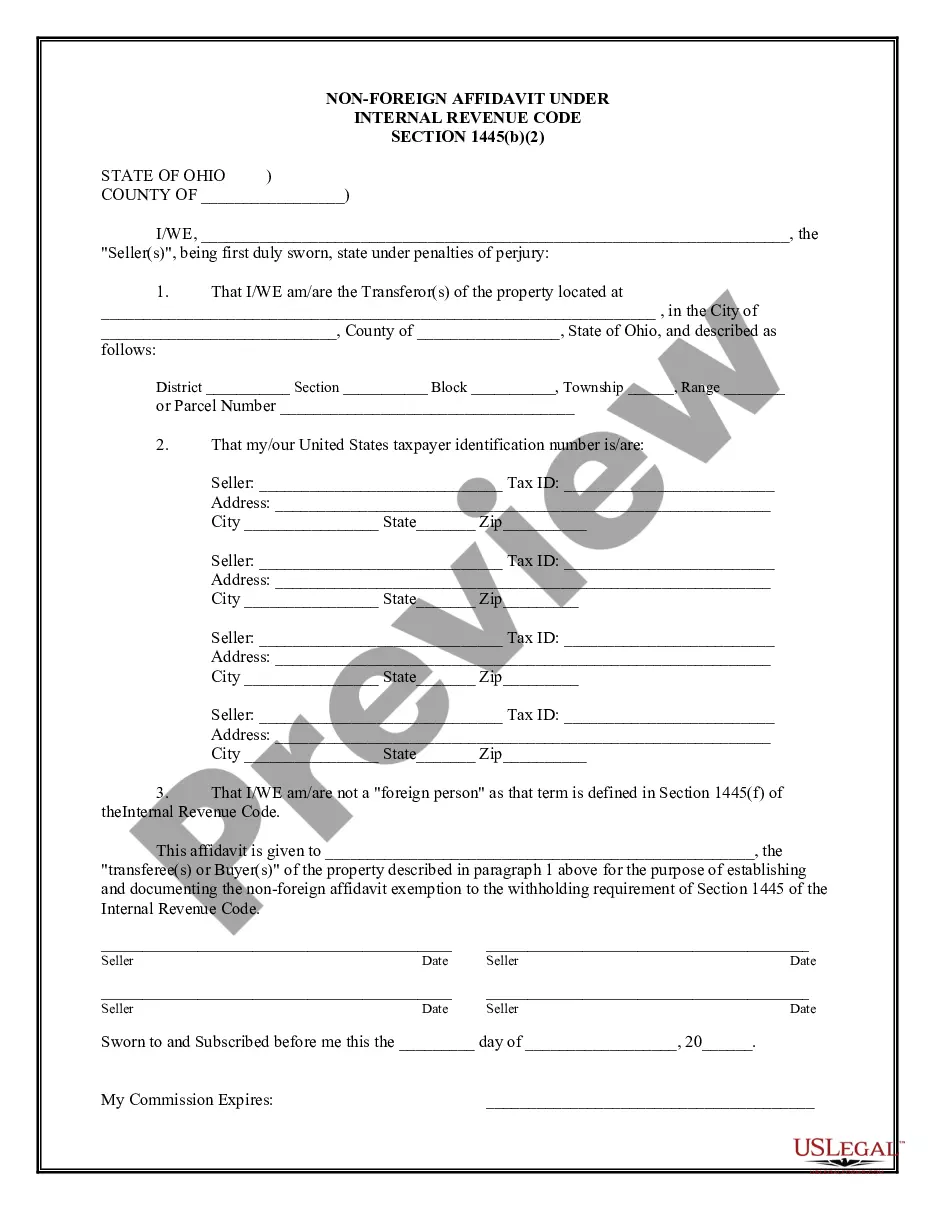

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Ohio Non-Foreign Affidavit Under IRC 1445?

If you’ve previously availed yourself of our service, Log In to your account and download the Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445 onto your device by clicking the Download button. Ensure your subscription is current. If it's not, renew it according to your billing plan.

If this marks your initial interaction with our service, follow these straightforward steps to obtain your document.

You have continuous access to all documents you have purchased: you can find them in your profile under the My documents section whenever you wish to use them again. Make the most of the US Legal Forms service to swiftly locate and save any template for your personal or business needs!

- Verify that you’ve located the correct document. Review the description and utilize the Preview feature, if available, to see if it aligns with your needs. If it doesn’t, use the Search tab above to find the appropriate one.

- Acquire the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and complete a payment. Provide your credit card information or use the PayPal option to finalize the purchase.

- Access your Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Yes, a FIRPTA affidavit typically must be notarized to enhance its validity and legal standing. Notarization acts as a safeguard, providing an additional level of assurance that the information contained within the document is accurate. If you are dealing with the Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445, it's essential to ensure that your affidavit is properly notarized. This step can prevent potential disputes and facilitate a smoother transaction.

foreign person affidavit is a legal statement confirming that an individual or entity is not a foreign person as defined by IRC 1445. This document plays a vital role in real estate transactions, providing assurance to buyers about tax implications. In Cincinnati, Ohio, completing the nonforeign affidavit can streamline the sale process, minimize the risk of FIRPTA withholding, and enhance confidence in the transaction for all parties involved.

A certificate that indicates a seller is not a foreign person is a crucial document in real estate transactions. This certificate verifies that the seller meets the requirements under the Foreign Investment in Real Property Tax Act (FIRPTA) and is not subject to withholding tax. In the context of the Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445, this certificate helps ensure compliance for both buyers and sellers, simplifying the process and avoiding complications during the sale.

Yes, a FIRPTA Affidavit typically requires notarization to validate the authenticity of the signatures involved. In situations involving a Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445, notarization strengthens the document's legitimacy. This added layer of verification may help prevent disputes and support compliance with tax regulations.

A FIRPTA statement formally documents the seller's status concerning foreign ownership. In the context of a Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445, this statement assures the buyer that the seller is not subject to FIRPTA withholding. It acts as a safeguard for all parties involved, ensuring compliance with U.S. tax laws during real estate transactions.

When creating a FIRPTA Affidavit, you must include the seller's full name, tax identification number, and a declaration of their non-foreign status. This is essential in transactions involving a Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445. Always ensure the document is accurately filled out as it plays a vital role in determining the obligations of both the buyer and the seller.

foreign status affidavit certifies that the seller is not a foreign person for U.S. tax purposes. This affidavit is critical in transactions involving a Cincinnati Ohio NonForeign Affidavit Under IRC 1445 to avoid FIRPTA withholding. By providing this affidavit, sellers confirm their status, aiding in smooth transactions and protecting both parties involved.

To file a FIRPTA certificate, you need to complete IRS Form 8288-B, which allows you to apply for a withholding certificate. This is particularly relevant when dealing with a Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445 for non-foreign sellers. Once completed, submit the form to the IRS along with any required documentation, and keep copies for your records to confirm compliance.

A FIRPTA statement typically includes details such as the seller's name, the transaction date, and the property being sold. For Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445, it should affirm the seller's non-foreign status, often supported by a completed affidavit. This statement ensures compliance with U.S. tax laws, making it essential for all parties involved in the transaction.

When dealing with Cincinnati Ohio Non-Foreign Affidavit Under IRC 1445, you should report FIRPTA withholding on Form 8288. This form serves to report and remit the withheld amounts to the IRS. Additionally, you will need to provide information about the transaction and the seller's status to ensure proper handling. Always consult a tax professional to ensure you're following the correct procedures.