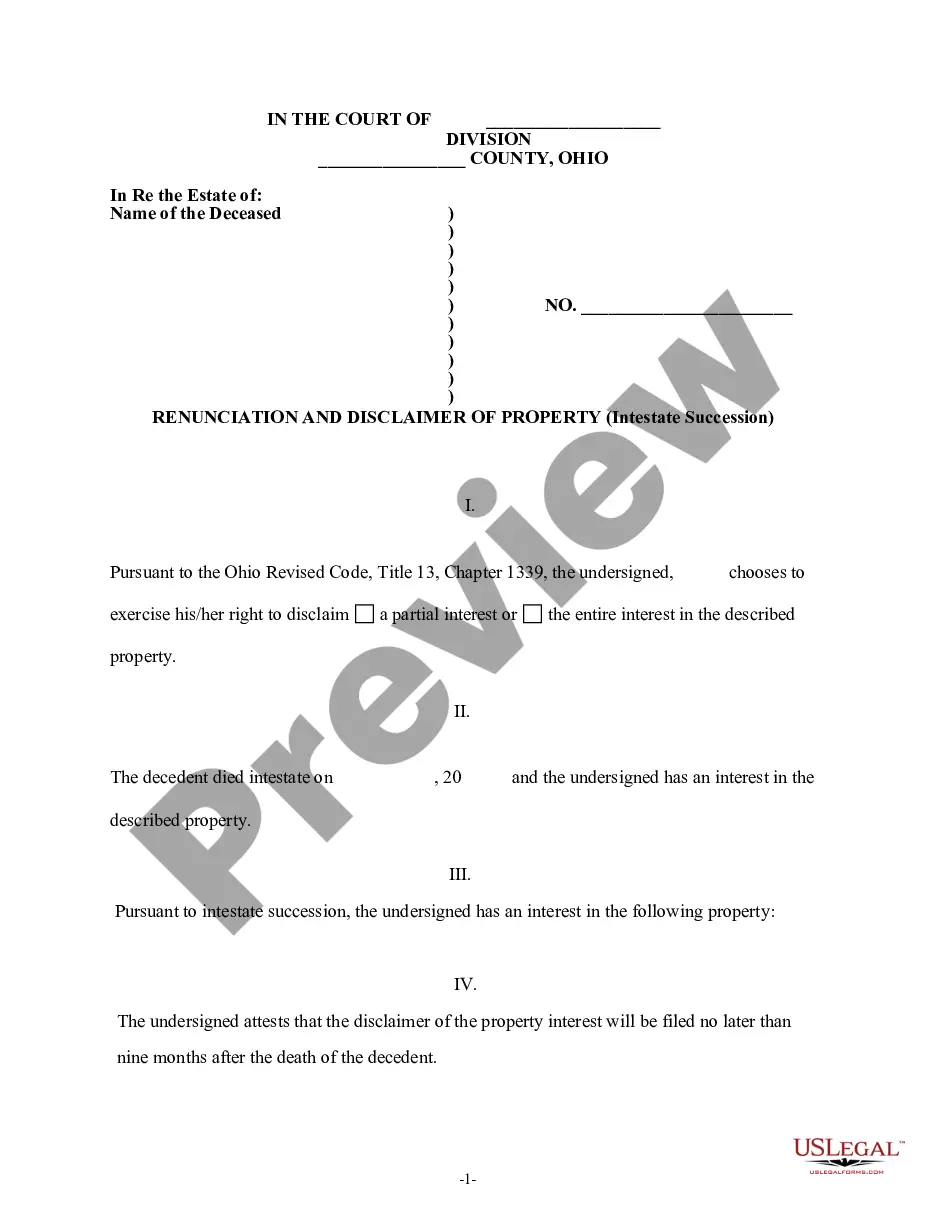

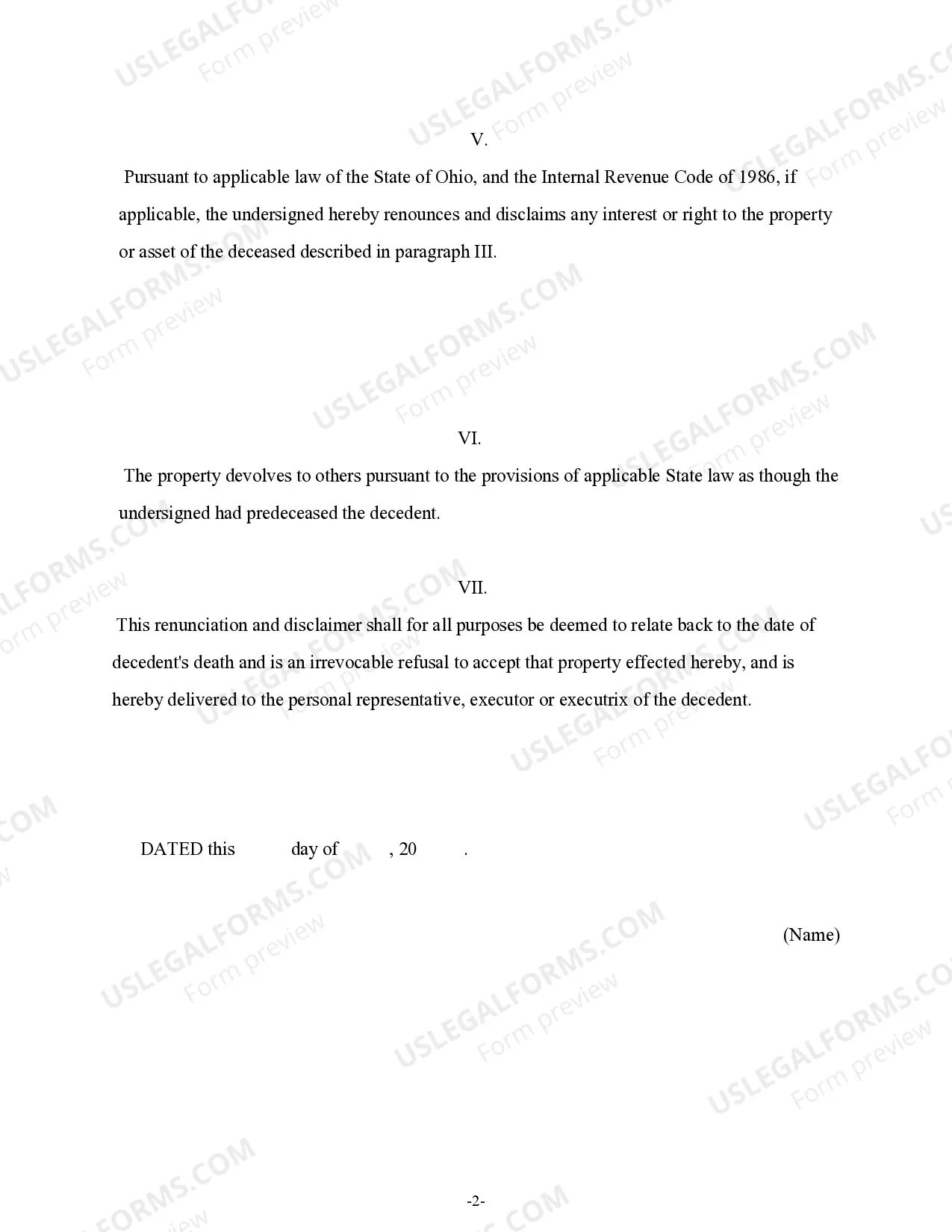

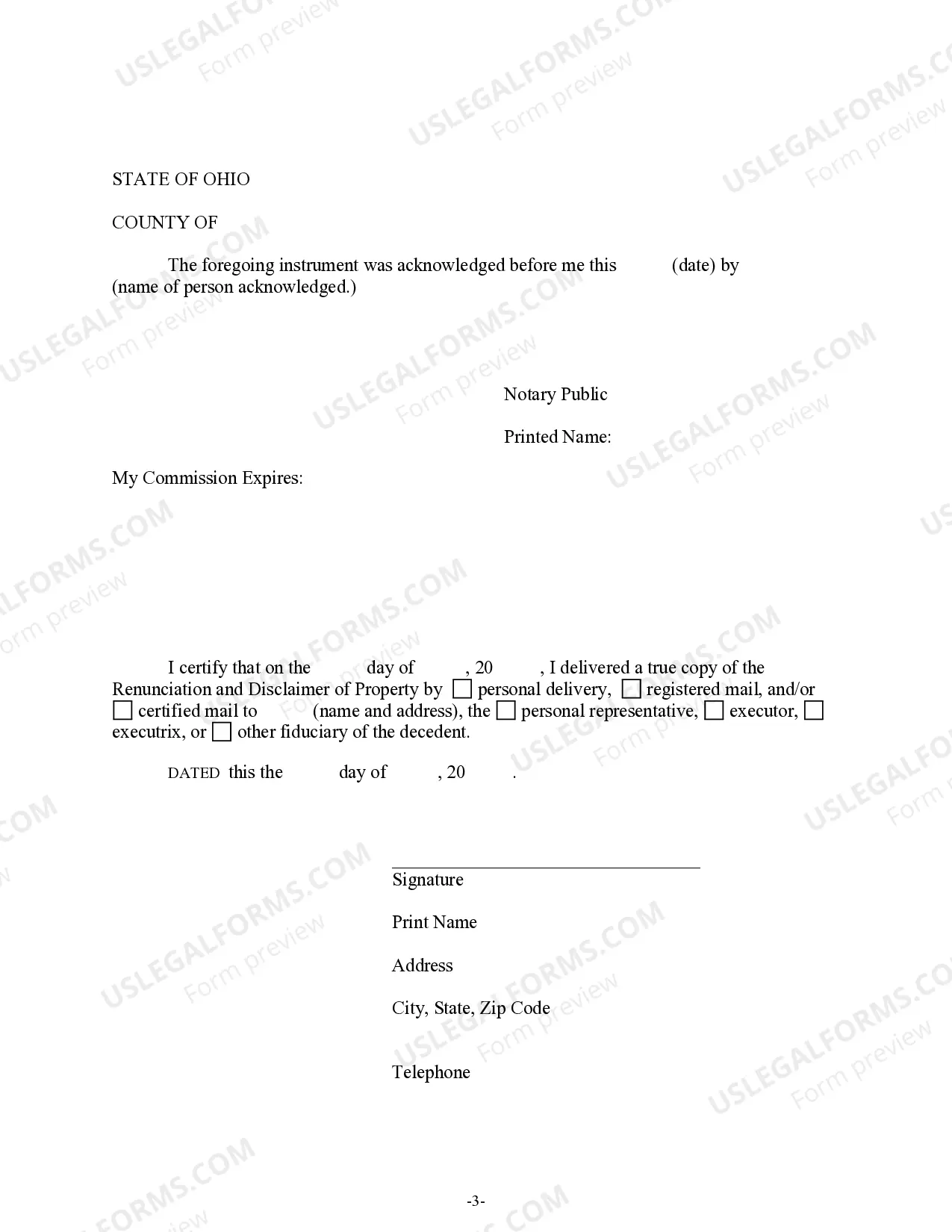

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate (without a will) and the beneficiary gained an interest in the property, but, pursuant to the Ohio Revised Code, Title 13, Chapter 1339, has decided to disclaim a portion of or the entire interest in the property. The property will now devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify document delivery.

Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Ohio Renunciation And Disclaimer Of Property Received By Intestate Succession?

We consistently aim to minimize or evade legal complications when handling intricate legal or financial issues.

To achieve this, we seek legal solutions that are typically quite costly.

Nonetheless, not every legal issue is equally intricate. Most can be addressed independently by ourselves.

US Legal Forms is an online repository of updated DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection enables you to manage your issues independently without the necessity of legal representation. We provide access to legal form templates that are not always publicly available. Our templates are specific to states and regions, significantly easing the search process.

Ensure to verify if the Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession complies with the laws and regulations of your state and region.

- Take advantage of US Legal Forms whenever you need to obtain and download the Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession or any other form swiftly and securely.

- Just Log In to your account and click the Get button next to it.

- If you happen to misplace the document, you can always re-download it from the My documents tab.

- The procedure is equally simple if you’re new to the platform!

Form popularity

FAQ

In Ohio, when a person dies without a will, intestate succession laws dictate how their property is distributed. Generally, the estate is divided among the surviving spouse and children, but if there are no descendants, the parents may inherit next. It’s essential to understand the Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession process to ensure that your interests are protected. Utilizing platforms like US Legal Forms can help simplify this procedure and ensure compliance with local regulations.

Typically, all heirs do not need to agree for an executor to sell property. The authority depends on the stipulations in the will or applicable state laws. Still, ensuring that all parties are informed can alleviate tensions. If you are uncertain about this process in relation to Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession, seek assistance from platforms like US Legal Forms.

In Ohio, not all heirs must agree to sell property if the will or estate plan grants the executor the authority to sell. The executor must, however, act in the estate's best interests and follow legal protocols. Open communication helps in reducing potential conflicts. For detailed processes regarding Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession, consult resources like US Legal Forms.

An executor may sell property without unanimous approval from all beneficiaries, provided the will allows such action. Ohio law entrusts executors with specific powers to manage the estate effectively. However, they must still prioritize the estate's interests and maintain open lines of communication. Reviewing the detailed guidelines on Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession can help navigate these complexities.

Generally, an executor can sell property without consent from all beneficiaries if the will grants them that authority. However, transparency and communication are crucial. If any beneficiaries object, it may lead to disputes. Understanding the role of an executor in respect to Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession can simplify this process.

To disclaim inherited property, you must submit a written disclaimer that clearly states your intention to renounce the property. This document should be filed with the probate court handling the estate in Ohio. It’s important to ensure that the disclaimer meets all legal requirements. For guidance on Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession, resources from US Legal Forms can provide clarity.

An executor does not have complete freedom in decision-making. In Ohio, the executor must act in the best interest of the estate and its beneficiaries. Their authority is often guided by the will and state law. If you need clarity on the powers of an executor concerning the Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession, consider consulting legal resources or platforms like US Legal Forms.

In Ohio, you generally have nine months from the date of the decedent's death to file a disclaimer of inheritance. This timeframe is critical, especially in cases involving the Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession, as late disclaimers may not be honored. It is important to act promptly and seek legal advice to ensure compliance with state laws. Utilizing platforms like USLegalForms can simplify the process by providing necessary documentation and guidance.

To disclaim an inheritance with the IRS, you need to formally renounce your interest in the property. You must file a disclaimer that meets IRS requirements, which includes stating your intent not to accept the assets. Ensure that you do this within the applicable timeframe, and consult regulations pertaining to the Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession. This process allows you to avoid potential tax consequences while distributing the assets according to your wishes.

To obtain a letter of authority in Ohio, you must first file a probate application with the local probate court. The court reviews your petition along with the necessary documents, which may include a death certificate and a will if available. Once your application is approved, the court issues a letter of authority, allowing you to act as the estate administrator. This process is essential for managing the estate, particularly when it involves the Franklin Ohio Renunciation And Disclaimer of Property received by Intestate Succession.