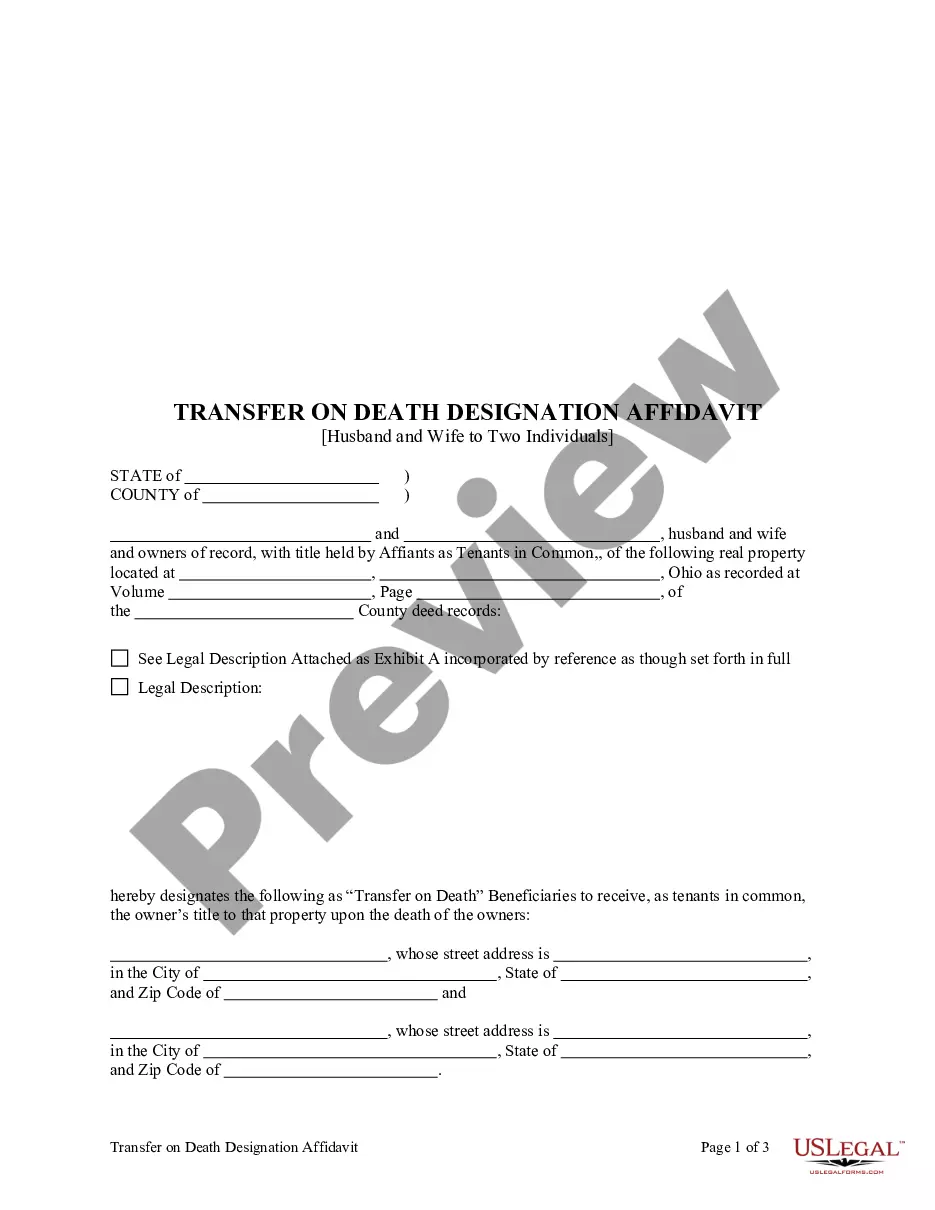

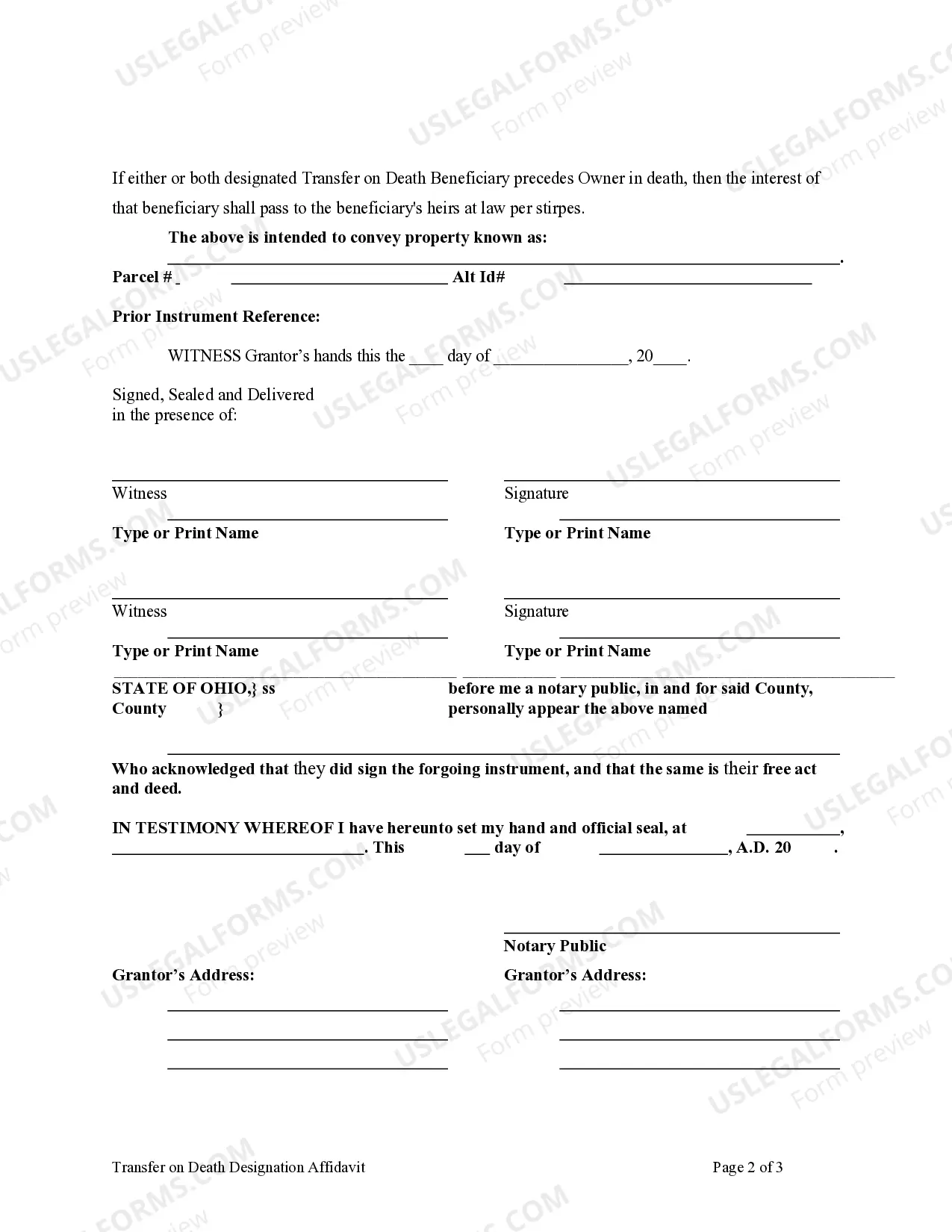

This form is a Transfer on Death Designation Affidavit where the affiants are husband and wife and the beneficiaries are two individuals. This affidavit of designation is revocable by affiants/grantors until afiant's death and effective only upon the death of the affiants. The beneficiaries take the property as tenants in common. Is a beneficiary fails to survive the grantors, their interest goes to their heirs per stirpes. This deed complies with all state statutory laws.

Columbus Ohio Transfer on Death Designation Affidavit - TOD - Husband and Wfie to Two Individuals Beneficiaries

Description

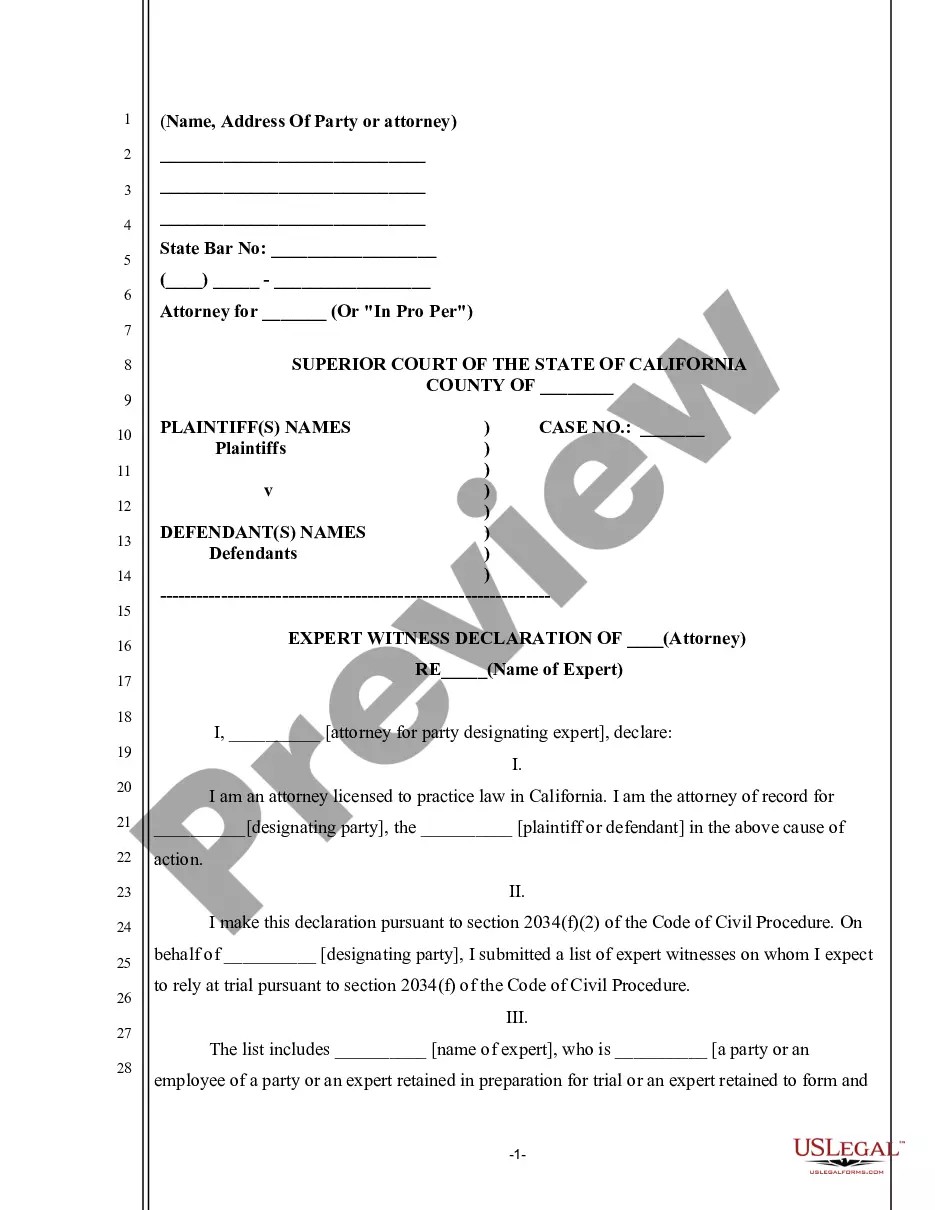

How to fill out Ohio Transfer On Death Designation Affidavit - TOD - Husband And Wfie To Two Individuals Beneficiaries?

We consistently seek to reduce or avert legal complications when handling intricate law-related or financial matters.

To achieve this, we request legal services that are typically quite costly.

Nevertheless, not every legal issue is equally intricate; most can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always download it again from the My documents section. The procedure is just as simple if you’re unfamiliar with the website! You can set up your account within minutes. Ensure to verify that the Columbus Ohio Transfer on Death Designation Affidavit - TOD - Husband and Wife to Two Individuals Beneficiaries adheres to the regulations of your state and region. Additionally, it’s vital that you review the form’s summary (if available), and should you find any inconsistencies with your initial requirements, look for an alternative form. Once you've confirmed that the Columbus Ohio Transfer on Death Designation Affidavit - TOD - Husband and Wife to Two Individuals Beneficiaries fits your needs, you can select your subscription plan and proceed with the payment. After that, you can download the form in any preferred file format. With over 24 years of experience, we’ve assisted millions of individuals by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Our library empowers you to manage your affairs without the need for a lawyer's services.

- We offer access to legal form templates that may not always be readily available.

- Our templates are tailored to state and local specifics, greatly easing the search process.

- Utilize US Legal Forms whenever you require and download the Columbus Ohio Transfer on Death Designation Affidavit - TOD - Husband and Wife to Two Individuals Beneficiaries or any other form swiftly and securely.

Form popularity

FAQ

The surviving spouse must execute a simple Affidavit of Survivorship to memorialize the transfer. The affidavit, along with the deceased spouse's death certificate, will then be recorded with the County Recorder's Office to officially document that the transfer took place.

More than 25 states, including Ohio, now allow the use of Transfer-On-Death deeds. You don't have to actually live in a state that allows TOD deeds to be able to use one, but the property must be located in such a state.

You can create a TOD Deed simply by moving real estate from your name only into your Beneficiary's name as a TOD. The property remains yours and you continue to control it until you pass away, at which point the deed automatically transfers to the name of your Beneficiary.

Ohio Eliminates Transfer on Death Deeds. Get answers to questions on the impact of Ohio's elimination of Transfer on Death deeds. Effective December 28, 2009, Ohio eliminated transfer on death deeds and replaced that deed with a TRANSFER ON DEATH DESIGNATION AFFIDAVIT.

Transfer on Death (TOD) Similarly, you can use a transfer on death affidavit to automatically transfer real estate or vehicles upon your death. Assets designated as TOD will not need to pass through probate court.

More than 25 states, including Ohio, now allow the use of Transfer-On-Death deeds. You don't have to actually live in a state that allows TOD deeds to be able to use one, but the property must be located in such a state.

How to create a Transfer on Death for your home Choose your recipients. You can choose one or more people to become owner of any home or land that you own.Find a copy of your deed.Complete the TOD for real estate form.Take the form to a notary .Submit the form at your County Recorder's Office.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (?TOD?) Designation Affidavit. What is a TOD Designation Affidavit?

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (?TOD?) Designation Affidavit.

The Transfer on Death Designation Affidavit (TOD), when properly recorded, permits the direct transfer of the described real property to the designated beneficiary or beneficiaries upon the death of the owner, thus avoiding Probate administration.