Queens New York Last Will and Testament for other Persons

Description

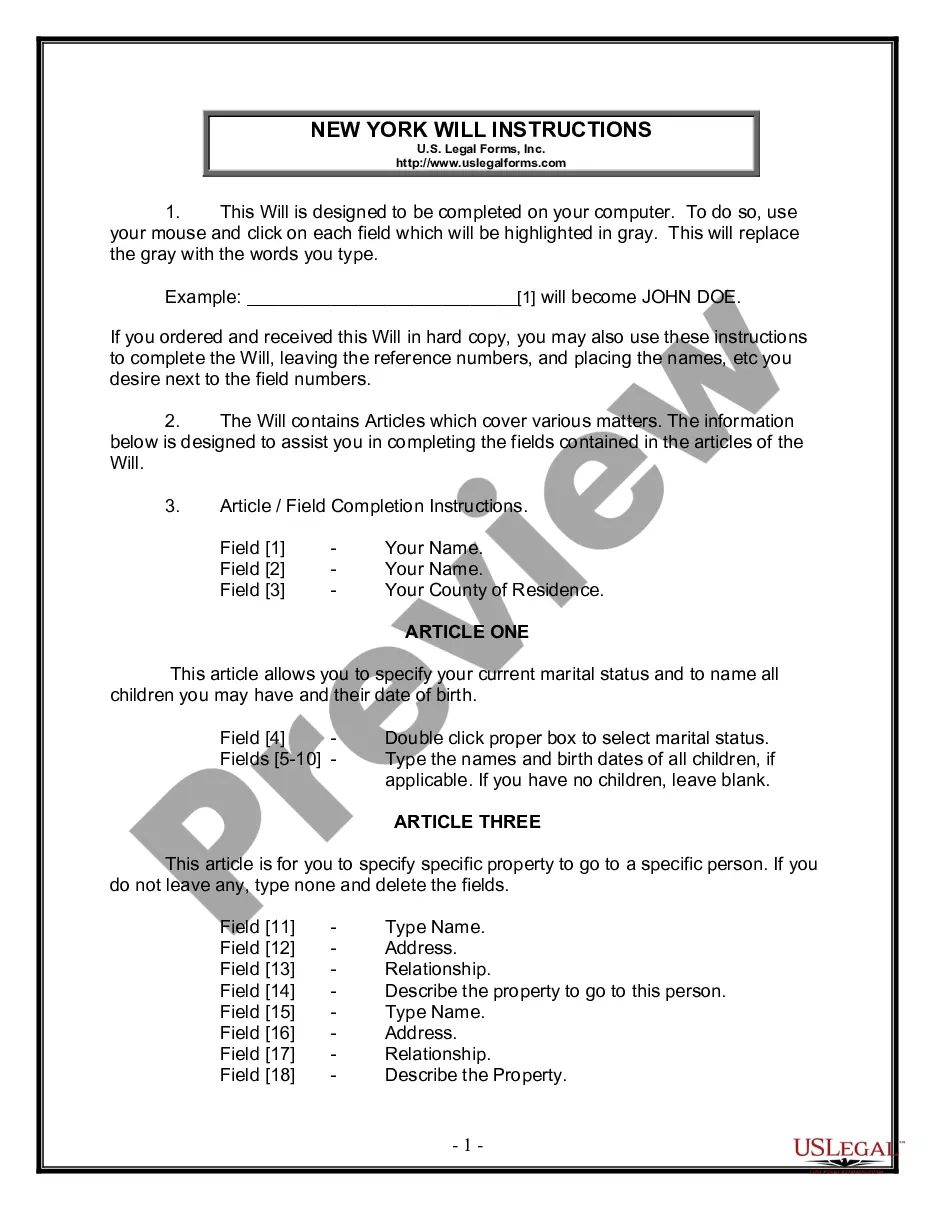

How to fill out New York Last Will And Testament For Other Persons?

Obtaining validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and professional purposes, covering various real-world scenarios.

All the paperwork is effectively categorized by field of use and jurisdiction, making it quick and simple to find the Queens New York Last Will and Testament for other Individuals.

Maintaining organized paperwork that complies with legal standards is extremely important. Leverage the US Legal Forms library to have essential document templates readily available for all your needs!

- Make sure to check the Preview mode and form description.

- Ensure you've chosen the correct document that fulfills your requirements and aligns with your local jurisdiction standards.

- If necessary, search for another template.

- In case you find any discrepancies, use the Search tab above to find the appropriate one.

- Proceed to the purchase of the document.

Form popularity

FAQ

Yes, wills in New York become public record once they are filed with the Surrogate's Court after the testator's death. This means anyone can request to view or obtain a copy of a will. To maintain control over your wishes documented in your Queens New York Last Will and Testament for other Persons, consider how and when you want to disclose your will.

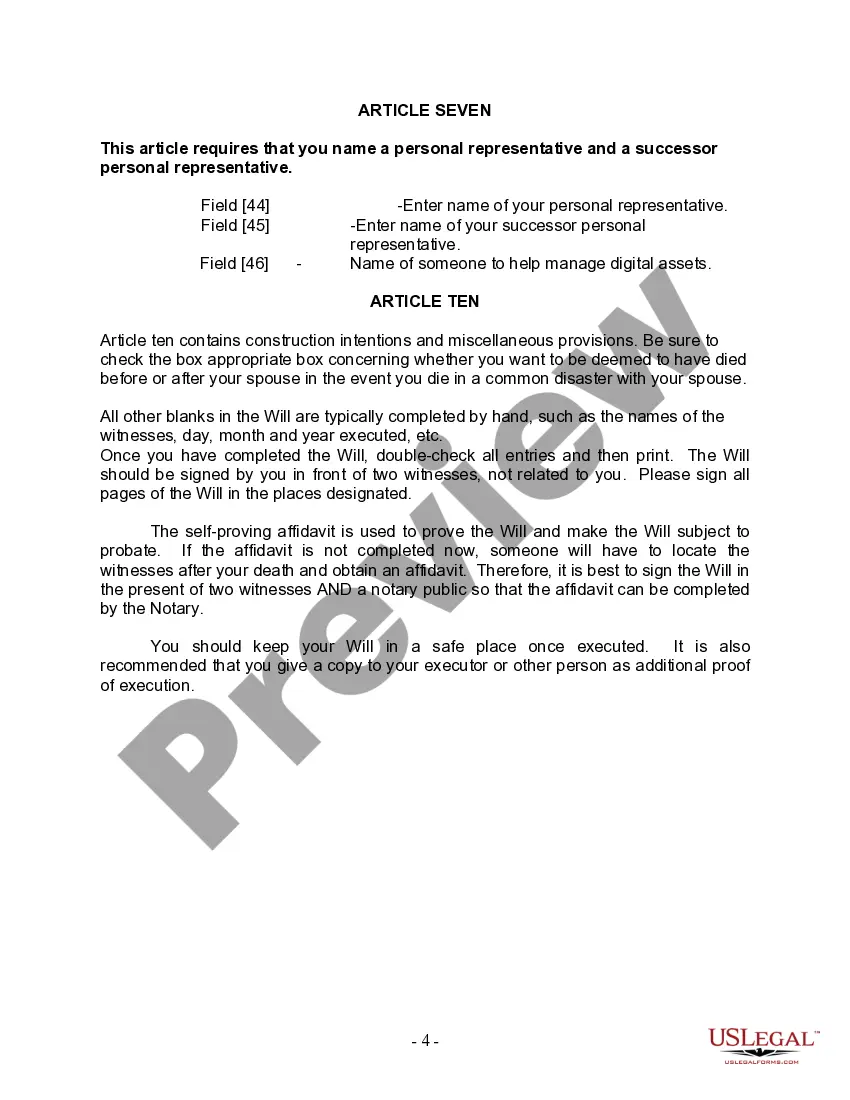

To make a will without a lawyer in New York, you can use simple templates and guidelines found online. It is essential to follow the state's legal requirements, such as signing and witnessing. With uslegalforms, you can easily draft your Queens New York Last Will and Testament for other Persons that reflects your wishes without the need for expensive legal fees.

Yes, you can write your own will in New York, and having it notarized can help validate your intentions. However, keep in mind that simply notarizing a will does not replace the requirement for two witnesses. If you choose to create your own Queens New York Last Will and Testament for other Persons, using forms from uslegalforms can streamline the process.

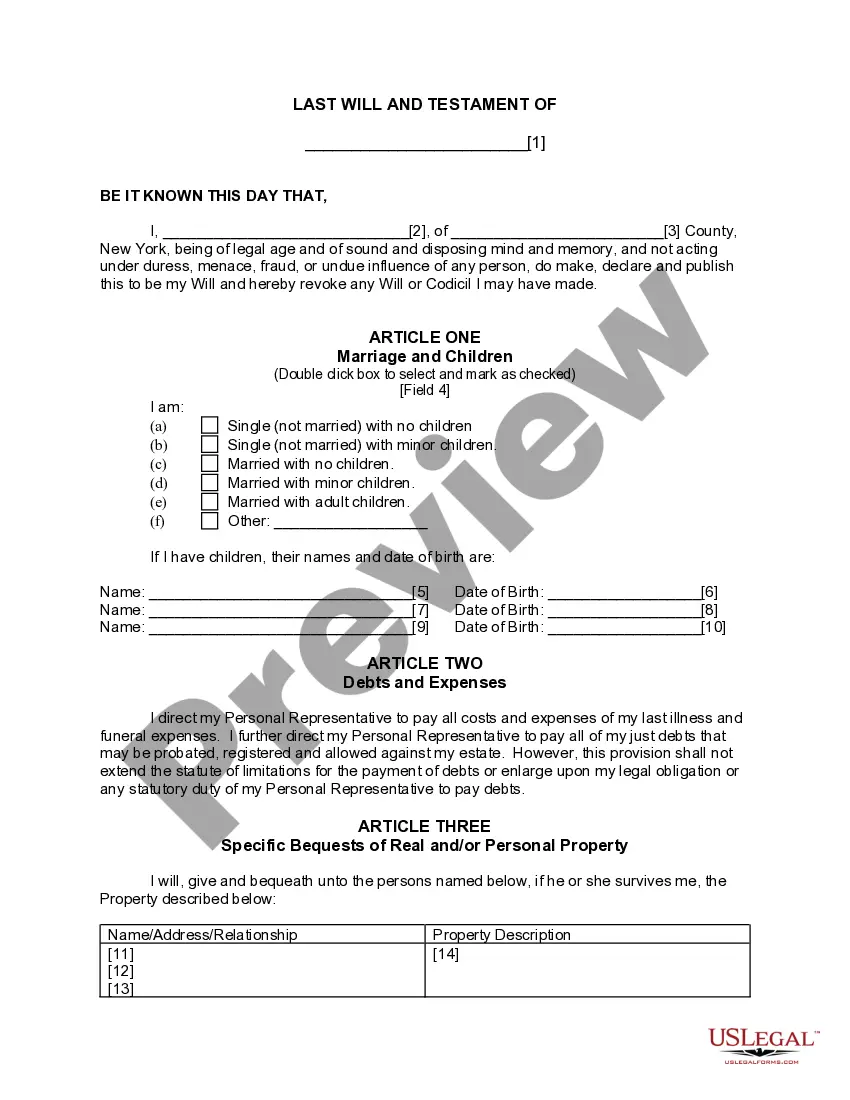

In New York, for a will to be valid, it must be in writing and signed by the testator, the person making the will. Additionally, it should be witnessed by at least two people who are present at the same time. If you want to ensure your Queens New York Last Will and Testament for other Persons meets all legal standards, consider using a reliable resource like uslegalforms to guide you.

Yes, you can create a will without a lawyer in New York. Formulating a Queens New York Last Will and Testament for other Persons on your own is possible; however, many find that using a legal document service, like uslegalforms, provides clarity and peace of mind. These services can guide you through the process, ensuring that your will meets all legal requirements.

Inheritance laws in New York dictate how an estate is distributed if there is no will or with a valid will in place, like the Queens New York Last Will and Testament for other Persons. Key aspects include the rights of spouses and children, along with rules that determine who inherits based on the deceased's relationships. It is beneficial to understand these laws to ensure that your estate plan reflects your wishes.

Heirs generally have a period of seven months to claim their inheritance after the executor initiates the probate process in New York. If you do not claim your inheritance within this timeframe, you may risk losing it based on the stipulations set forth in the Queens New York Last Will and Testament for other Persons. Therefore, make sure to stay informed and act swiftly.

Yes, there is a time limit to claim an inheritance in New York. Typically, beneficiaries have a limited time to claim their inheritance once the estate goes through probate, often within seven months from the date of initial filing. It is important to act promptly to avoid losing your rightful claim to assets outlined in the Queens New York Last Will and Testament for other Persons.

In New York, you can keep an estate open for an extended period, generally up to seven years, especially if you are dealing with complexities in settling the estate. However, you should aim to resolve the estate as promptly as possible to minimize costs and ensure that beneficiaries receive their inheritance from the Queens New York Last Will and Testament for other Persons. Always consult an attorney for specific guidance related to your situation.

If a beneficiary does not claim their inheritance, the distribution will depend on the terms outlined in the Queens New York Last Will and Testament for other Persons. Typically, the unclaimed inheritance may revert to the estate and be distributed according to intestacy laws if the will does not specify otherwise. This means that instead of going to the intended beneficiary, the assets could pass to other heirs.