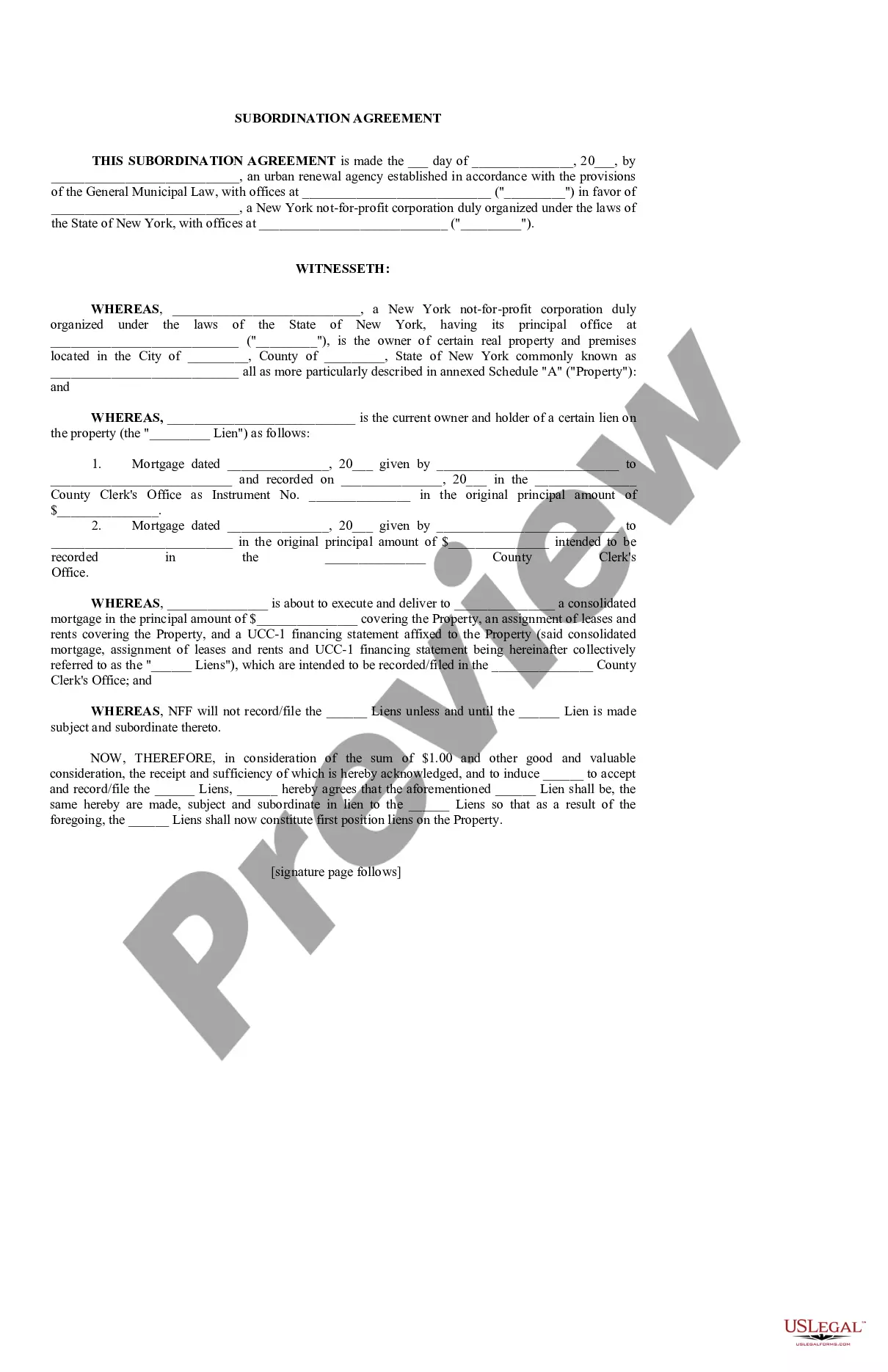

Suffolk New York Subordination Agreement

Description

How to fill out New York Subordination Agreement?

Irrespective of social or professional rank, completing law-related paperwork is a regrettable necessity in the modern world.

Often, it is nearly impossible for someone lacking legal training to produce such documents from scratch, primarily because of the intricate language and legal nuances involved.

This is where US Legal Forms comes to the rescue.

Ensure the template you have selected is specific to your area since the regulations of one state or region do not apply to another.

Review the document and read through a brief outline (if provided) of situations for which the paper can be utilized.

- Our platform provides an extensive collection with over 85,000 ready-to-use state-specific documents that cater to nearly any legal requirement.

- US Legal Forms is also a valuable resource for colleagues or legal advisors who wish to conserve time by using our DIY forms.

- Whether you need the Suffolk New York Subordination Agreement or any other document valid in your state or region, US Legal Forms has everything available.

- Here’s how to obtain the Suffolk New York Subordination Agreement within minutes using our reliable platform.

- If you are already a subscriber, feel free to Log In to your account to download the required document.

- If you are new to our library, make sure you follow these steps before downloading the Suffolk New York Subordination Agreement.

Form popularity

FAQ

Yes, a Suffolk New York Subordination Agreement typically requires notarization to enhance its credibility and legal enforceability. Having a notarized agreement provides additional protection, as it verifies the identities of the signers. This step helps to prevent disputes over the authenticity of the document in the future.

A subordination agreement is usually prepared by a real estate attorney or a qualified professional familiar with Suffolk New York Subordination Agreements. They will ensure that the document complies with local laws and accurately reflects the intentions of the parties. Enlisting expert assistance helps prevent misunderstandings and legal complications down the road.

In Suffolk New York, a subordination agreement is typically recorded after the new mortgage is executed. Recording the subordination agreement ensures that the new lender's position is legally recognized. By doing so, it clarifies the priority of the debts and protects the rights of all parties involved.

To create a Suffolk New York Subordination Agreement, you need to identify the current mortgage, the new mortgage, and the parties involved. It requires written consent from all mortgage holders. Moreover, the agreement must clearly outline the priority of the loans to ensure that the new lender's interests are protected.

You can still file your taxes even if you have an outstanding warrant. However, it's important to address any existing warrants as they may affect your financial dealings. A Suffolk New York Subordination Agreement might assist in resolving your current tax issues, allowing you to file your taxes without additional complications. It is advisable to stay informed about your rights and options to manage your financial health effectively.

A tax lien is simply called a tax lien, which represents a legal claim against a property due to unpaid taxes. This lien gives the government the right to take action if the taxes remain unpaid. If you find yourself facing a tax lien, a Suffolk New York Subordination Agreement might provide a solution by allowing you to negotiate terms with your creditors. Understanding tax terminology can empower you to take control of your financial situation.

When a tax warrant is filed against you, it signifies that the government can take legal action to collect unpaid taxes. This may lead to property liens, garnished wages, or other financial consequences. If you're dealing with a tax warrant, a Suffolk New York Subordination Agreement could offer you a structured way to address and resolve your tax liabilities. Keeping informed about your options can help you regain financial stability.

Yes, a tax warrant can appear on a background check, as it is a publicly recorded document. This may potentially impact your credit and ability to secure loans or housing. To improve your financial standing, consider drafting a Suffolk New York Subordination Agreement to address your tax obligations and facilitate a more favorable outcome. It's essential to be proactive about your financial health.

No, a tax warrant and a tax lien are not the same. A tax warrant is a court order allowing the government to collect unpaid taxes, while a tax lien is the claim placed against your property. If you are dealing with either situation, a Suffolk New York Subordination Agreement may assist you in resolving these issues and maintaining ownership of your property. Understanding the differences can help you better manage your financial obligations.

To file a quit claim deed in New York, begin by filling out the appropriate form, which can typically be obtained from your local county clerk's office. After completing the form, you must sign it in the presence of a notary public. Finally, submit the deed to the county clerk for recording. A Suffolk New York Subordination Agreement can complement this process by establishing new terms if you owe existing debts on the property.