Nassau Report and Account to Settle Small Estate in New York

Description

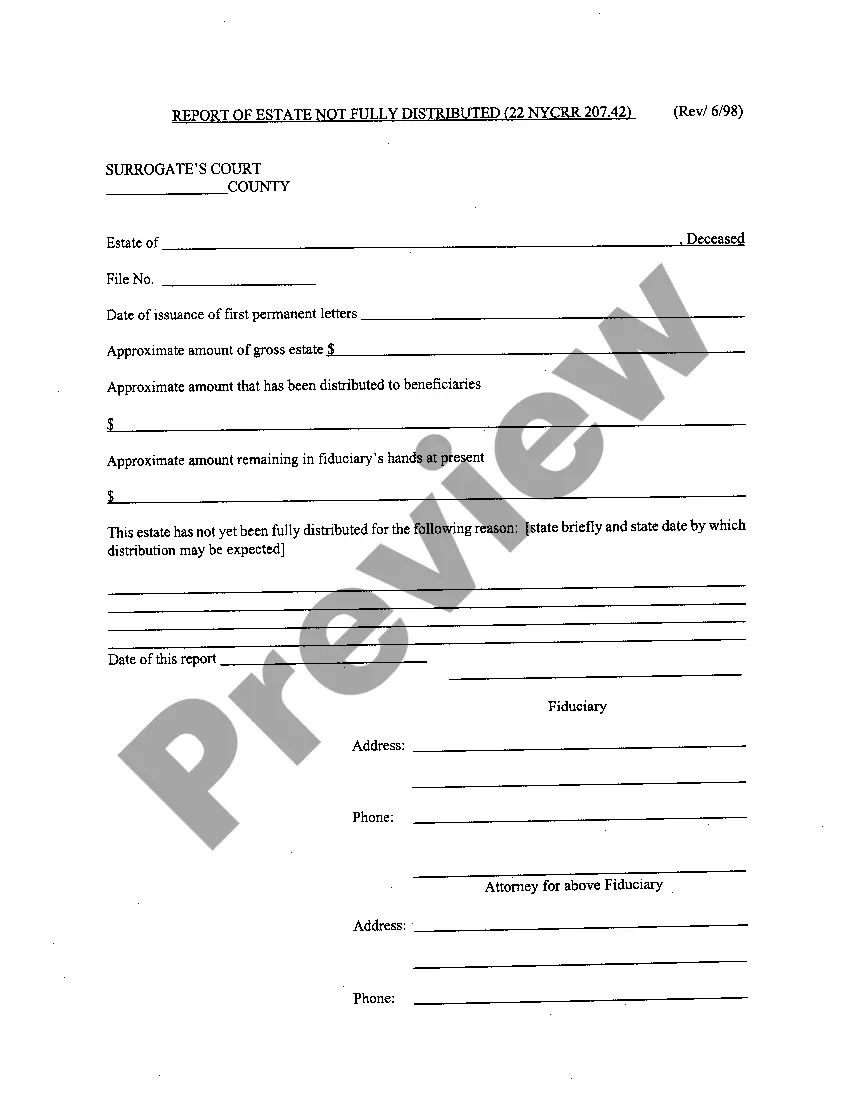

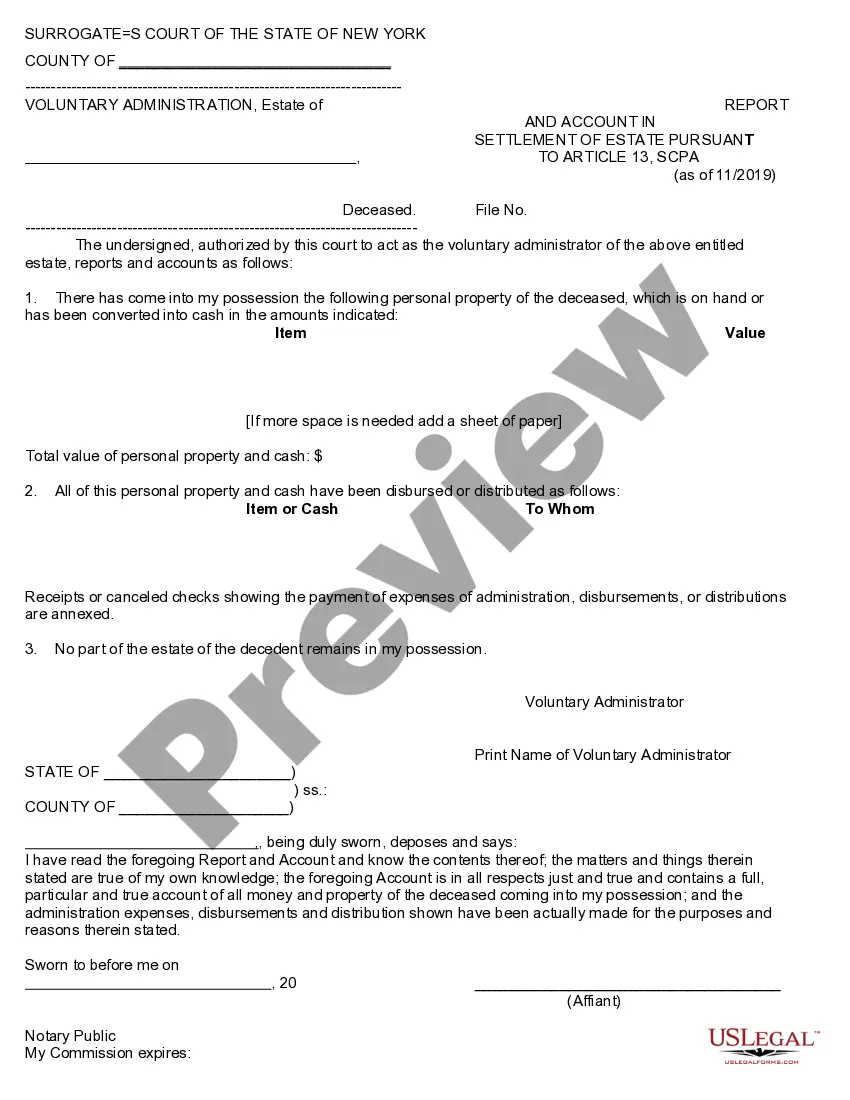

How to fill out Report And Account To Settle Small Estate In New York?

If you’ve already used our service previously, Log In to your account and retrieve the Nassau Report and Account to Settle Small Estate in New York onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifetime access to all documents you have purchased: you can locate it in your profile within the My documents menu whenever you wish to reuse it. Leverage the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Ensure you’ve identified the correct document. Browse the description and utilize the Preview option, if available, to verify if it satisfies your requirements. If it doesn’t meet your needs, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Receive your Nassau Report and Account to Settle Small Estate in New York. Choose the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

While hiring a lawyer is not mandatory for settling an estate in New York, it can be beneficial. Legal experts can help navigate the Nassau Report and Account to Settle Small Estate in New York process, ensuring compliance with all legal requirements. If your estate has complexities, a lawyer may provide valuable assistance. However, many individuals successfully settle small estates without legal representation.

To obtain a small estate affidavit in New York, you need to gather essential documents that prove your relationship to the deceased. After compiling the required paperwork, you can complete the Nassau Report and Account to Settle Small Estate in New York. Submitting the affidavit to the appropriate court is the next step. For guidance, you may consider using services like US Legal Forms for user-friendly templates.

The approval time for a small estate affidavit typically varies based on the specific circumstances of the case and the court's workload. Generally, you can expect the Nassau Report and Account to Settle Small Estate in New York process to take a few weeks to a couple of months. Timely filing and ensuring all required documentation is complete can help speed up the process. Staying organized and following up with the court can also minimize delays.

Filling out an affidavit of small estate involves several straightforward steps. First, gather the necessary information about the deceased, including their assets and the heirs, as this will form the foundation of your Nassau Report and Account to Settle Small Estate in New York. Next, ensure that you accurately complete the affidavit form, which typically requires specific details about the estate's value and the relationship to the deceased. Finally, once you have completed the affidavit, you must file it with the appropriate court to initiate the small estate process.

An executor in New York typically has up to seven years to settle an estate, although it is advisable to complete the process sooner. Delaying may incur interest and penalties on debts. The Nassau Report and Account to Settle Small Estate in New York can serve as a valuable resource to manage this timeline effectively and ensure compliance with all regulations.

In New York, a small estate qualifies if the total assets are valued at $50,000 or less at the time of death. This includes property, bank accounts, and other assets. Understanding this definition is crucial, and the Nassau Report and Account to Settle Small Estate in New York provides clear insight into what counts toward this limit.

Yes, there is a time limit to settle an estate in New York, generally set at seven years for most claims. However, you should aim to settle the estate as soon as possible to avoid complications. The Nassau Report and Account to Settle Small Estate in New York emphasizes the importance of timely actions, ensuring all obligations are met efficiently.

To write a small estate affidavit, start by gathering necessary information about the deceased and their assets. You will then need to declare that the estate qualifies as a small estate under New York law. Utilizing the Nassau Report and Account to Settle Small Estate in New York can guide you through this process to ensure you include all required details accurately.

In New York State, an estate typically needs to be valued at more than $50,000 for probate proceedings to begin. If the estate falls below this threshold, you can utilize the small estate process. The Nassau Report and Account to Settle Small Estate in New York helps clarify these distinctions, allowing you to handle the estate efficiently.

In New York, a small estate refers to an estate valued at $50,000 or less for individuals who died on or after January 1, 2022. To settle a small estate, you may use a simplified process that often avoids full probate. The Nassau Report and Account to Settle Small Estate in New York provides essential guidelines to navigate this process effectively, ensuring you meet legal requirements.