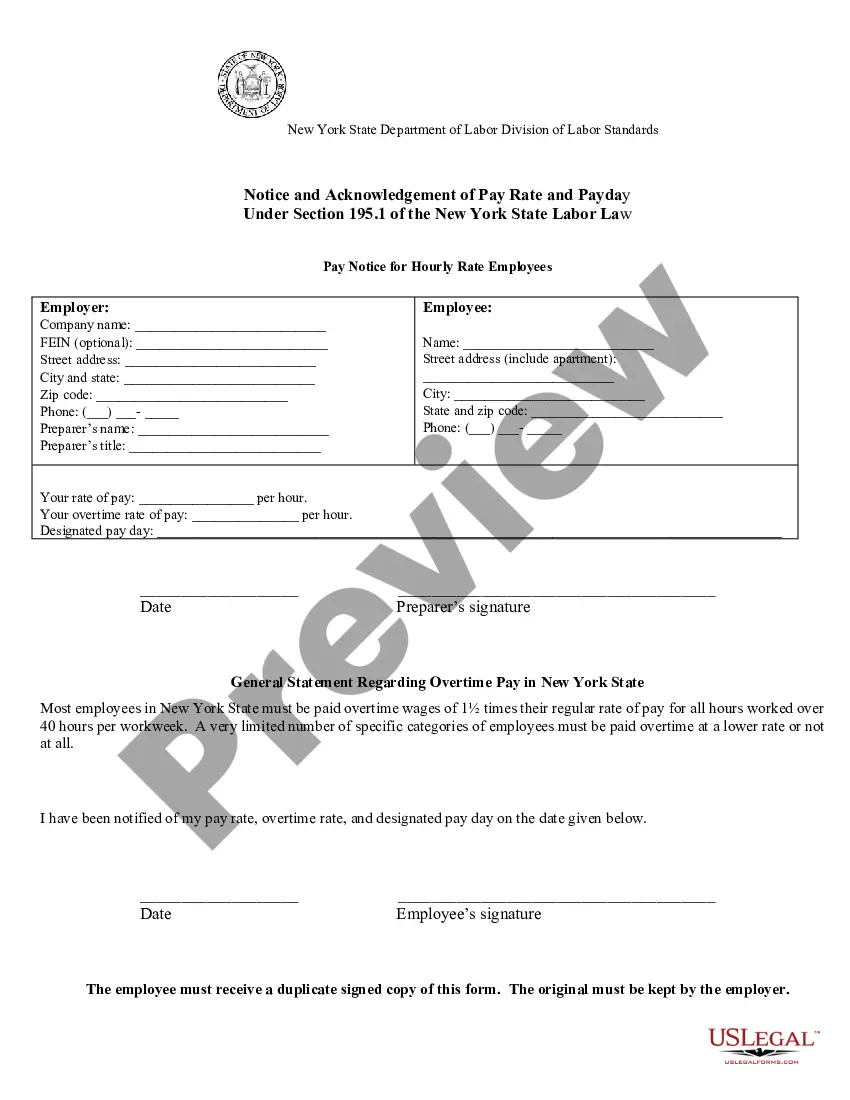

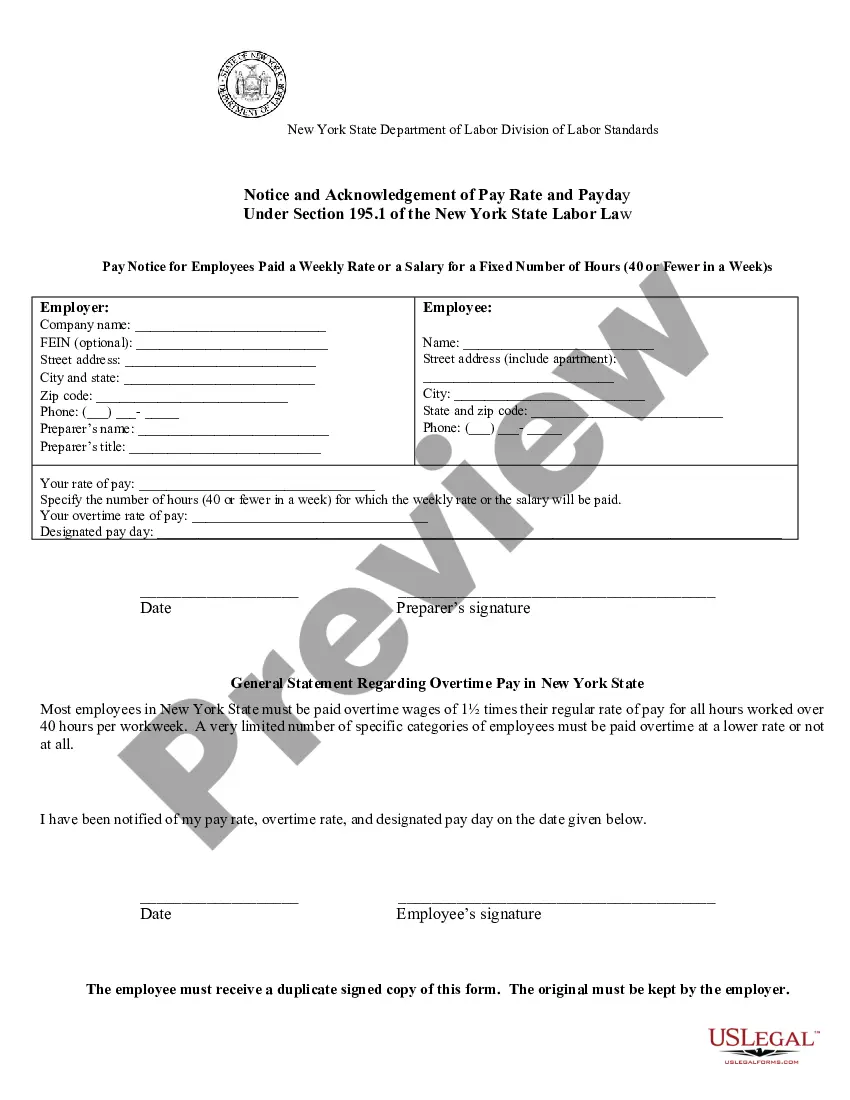

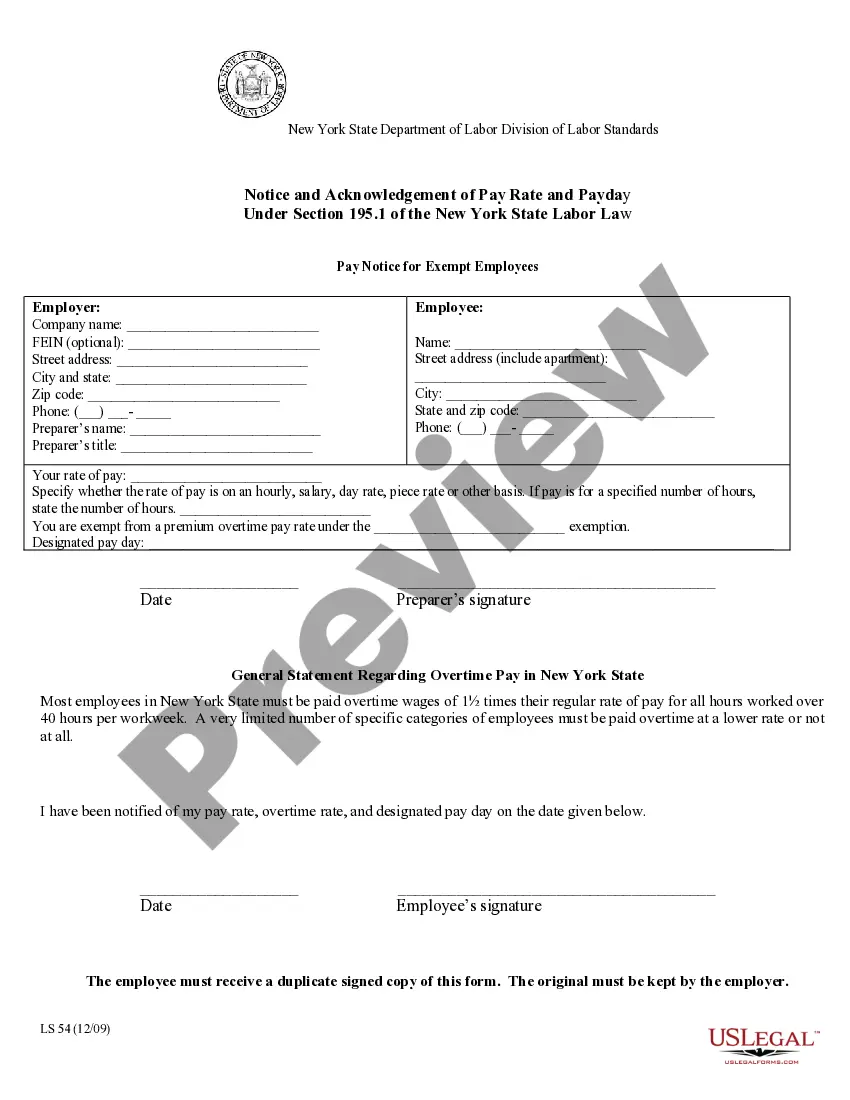

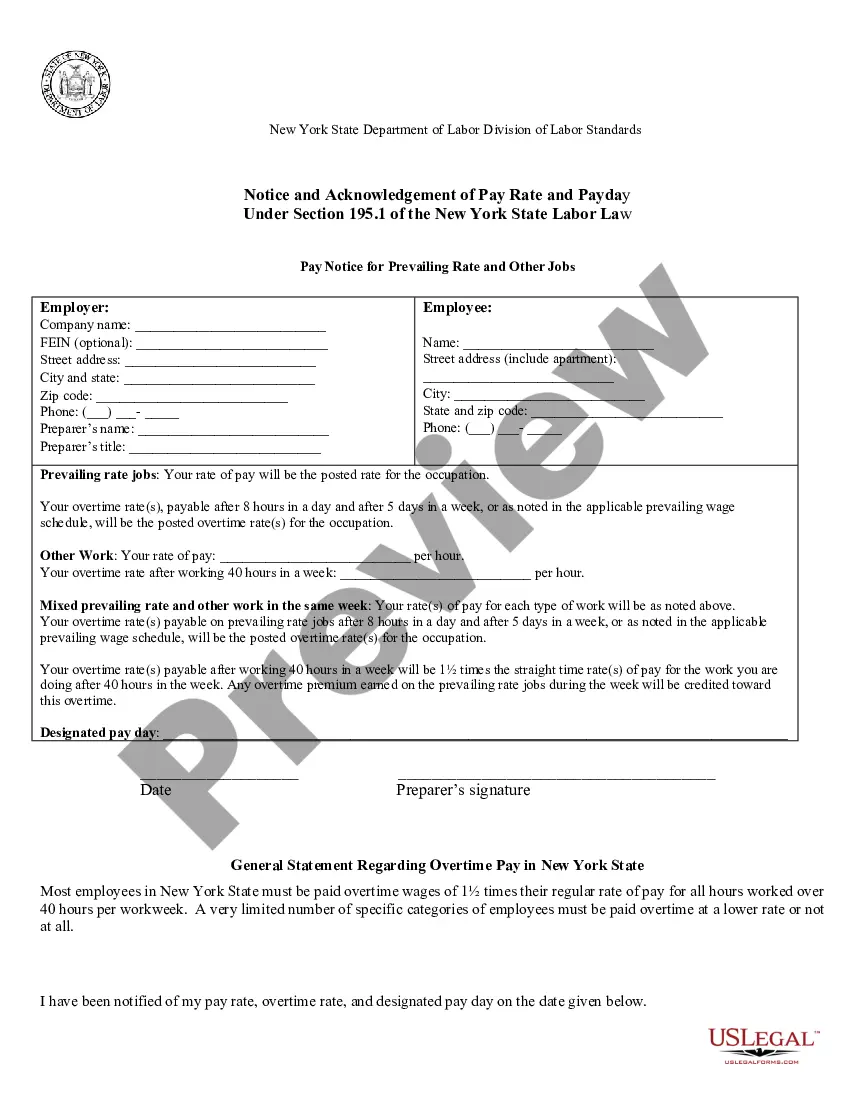

Syracuse New York Guidelines for Written Notice of Rates of Pay and Regular Payday

Description

How to fill out New York Guidelines For Written Notice Of Rates Of Pay And Regular Payday?

If you have previously utilized our service, Log In to your account and retrieve the Syracuse New York Guidelines for Written Notice of Rates of Pay and Regular Payday on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You will have continuous access to all documents you have acquired: you can find them in your profile under the My documents menu whenever you wish to reuse them. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!

- Make sure you have located a suitable document. Review the description and use the Preview option, if accessible, to ascertain if it fulfills your needs. If it is not satisfactory, use the Search tab above to find the correct one.

- Obtain the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or utilize the PayPal option to finalize the transaction.

- Receive your Syracuse New York Guidelines for Written Notice of Rates of Pay and Regular Payday. Choose the file format for your document and store it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Section 192 of the New York State Labor law governs the payment of wages to employees by outlining acceptable payment methods. It clarifies the types of deductions that can be made from wages, ensuring that employees are compensated fairly and according to law. Familiarity with these guidelines can help both employees and employers navigate wage payment issues effectively.

If you need additional assistance to file your complaint, please call: 1-888-4-NYSDOL (1-888-469-7365).

Who gets a payslip. Employers must give all their employees and workers payslips, by law (Employment Rights Act 1996). Workers can include people on zero-hours contracts and agency workers. Agency workers get their payslips from their agency.

If you no longer have your paycheck stubs, contact your payroll department or human resources department to request copies. If you're getting paid by direct deposit, your paystubs are most likely emailed to you, so there's a good chance they're in your email inbox already.

Employers in California are required to provide employees with an itemized wage statement, also known as a pay stub. Pay period regulations require employers to provide pay stubs semi-monthly or at the time of each payday.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

For example, some employers require workers to clock out and then perform additional unpaid work such as cleaning. Another example is when a worker takes an unpaid meal break (which they are entitled to under the law) but is then required to work through the break without being paid. These practices are wage theft.

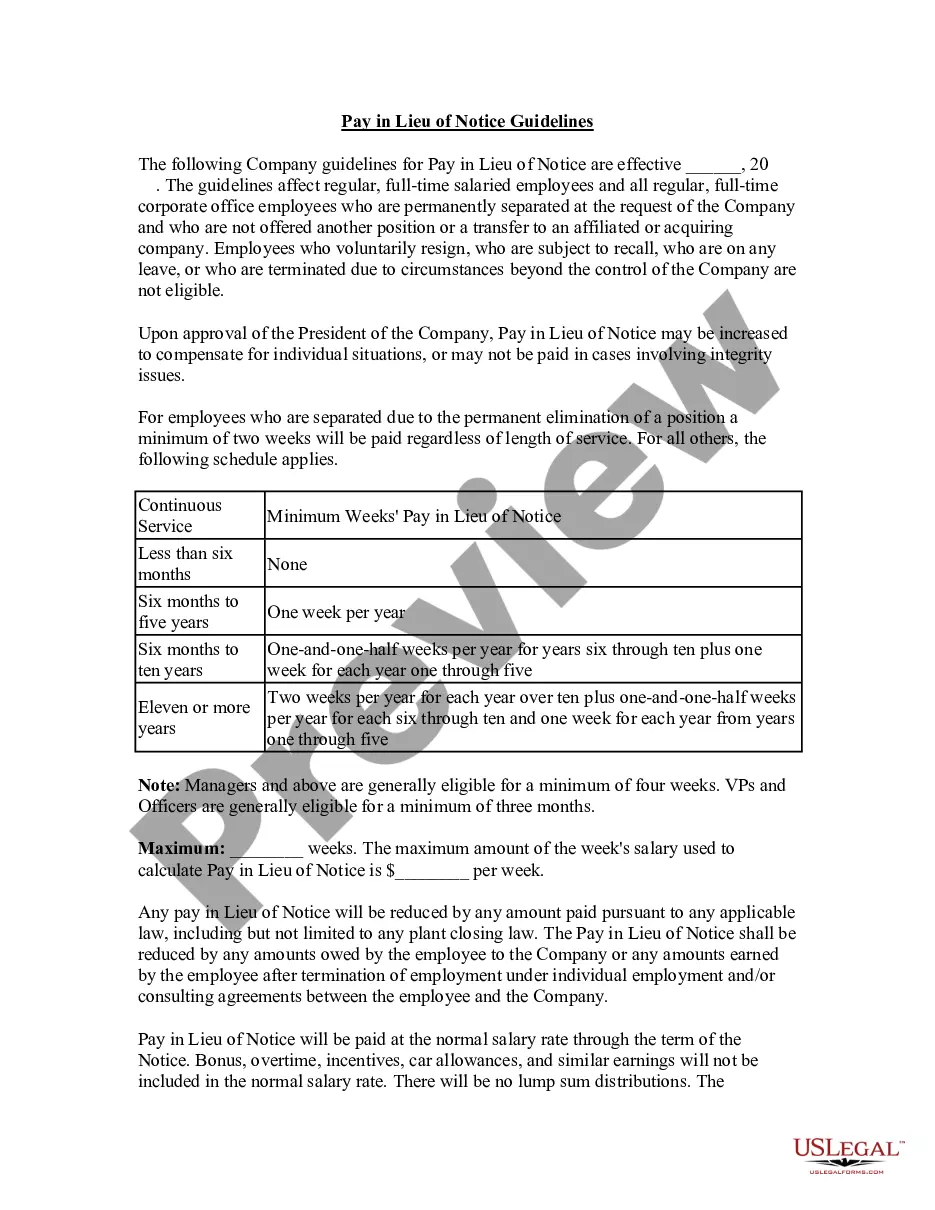

The Wage Theft Prevention Act (?WTPA?), passed in 2011, requires employers to provide employees with an annual notice regarding their compensation and other terms of employment. The notice must be provided to all employees between January 1 and February 1 of each year, regardless if they previously received a notice.

And Disclosure of Wages Section 194 of the Labor Law prohibits employers from restricting employees' ability to inquire about, discuss, or disclose wages with other employees.

Penalties for violating pay stub laws vary by state. In California, an employer who refuses to provide pay stubs can incur a penalty of up to $4,000 per employee.