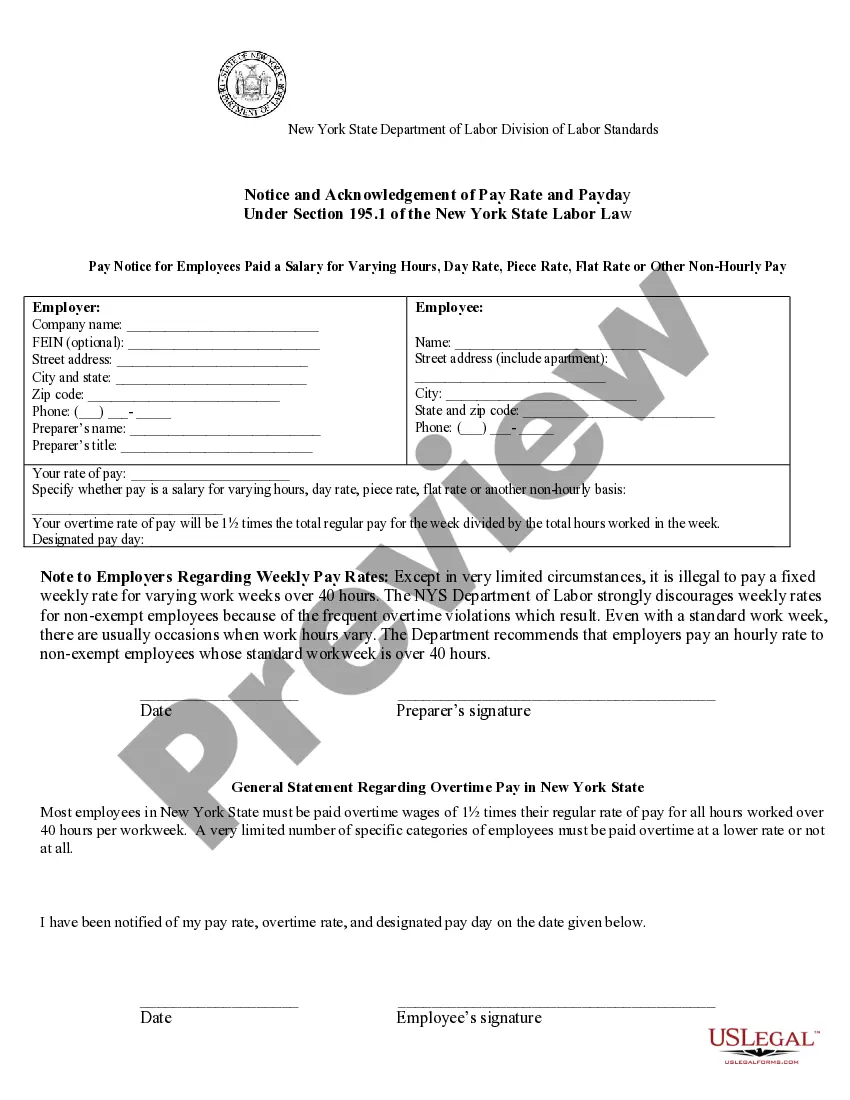

Syracuse New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Multiple Hourly Rates- Notice And Acknowledgement Of Pay Rate And Payday?

Regardless of social or professional rank, finalizing law-related paperwork is an unfortunate obligation in today's society.

It is frequently nearly impossible for someone without legal training to draft such documents from the ground up, primarily due to the complex language and legal nuances they entail.

This is where US Legal Forms proves to be invaluable.

However, if you are not familiar with our library, be sure to follow these steps before acquiring the Syracuse New York Pay Notice for Multiple Hourly Rates - Notice and Acknowledgment of Pay Rate and Payday.

Ensure the template you have selected is appropriate for your locality, as the laws governing one state or county do not apply to another.

Examine the document and read a brief summary (if available) of the scenarios where the document can be utilized.

If the one you chose does not meet your requirements, you can restart and search for the necessary form.

Click Buy now and choose the subscription plan that best fits your needs.

- Our service provides an extensive collection of over 85,000 ready-to-use state-specific documents that cater to nearly any legal situation.

- US Legal Forms also acts as a significant resource for associates or legal advisors who wish to enhance their efficiency and make better use of our DIY papers.

- Regardless of whether you need the Syracuse New York Pay Notice for Multiple Hourly Rates - Notice and Acknowledgment of Pay Rate and Payday or any other document suitable for your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how you can swiftly obtain the Syracuse New York Pay Notice for Multiple Hourly Rates - Notice and Acknowledgment of Pay Rate and Payday using our trustworthy platform.

- If you are already a subscriber, go ahead and Log In to your account to download the appropriate template.

Access your account using your credentials or create a new one from scratch.

Select the payment method and proceed to download the Syracuse New York Pay Notice for Multiple Hourly Rates - Notice and Acknowledgment of Pay Rate and Payday once the payment is processed.

You’re all set! Now you can either print the document or complete it online.

If you encounter any issues locating your purchased documents, you can easily find them in the My documents tab.

No matter what case you’re trying to resolve, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

The State of New York requires that employers tell their employees what their compensation will be in plain terms. The compensation could be paid out hourly, daily, weekly, or monthly. If the salary is paid weekly, then the employer should clearly explain to the employee the number of hours covered by the weekly rate.

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

There is no general legal limit on how long the employer can require adults to work, but you are entitled to overtime pay for all hours worked after 40 in a work week.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

General Minimum Wage Rate Schedule Location12/31/1612/31/19NYC - Big Employers (of 11 or more)$11.00NYC - Small Employers (10 or less)$10.50$15.00Long Island & Westchester$10.00$13.00Remainder of New York State Workers$9.70$11.80

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

Work any number of hours in a day: New York employers are not restricted in the number of hours they require employees to work each day. This means that an employer may legally ask an individual to work shifts of 8, 10, 12 or more hours each day.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.