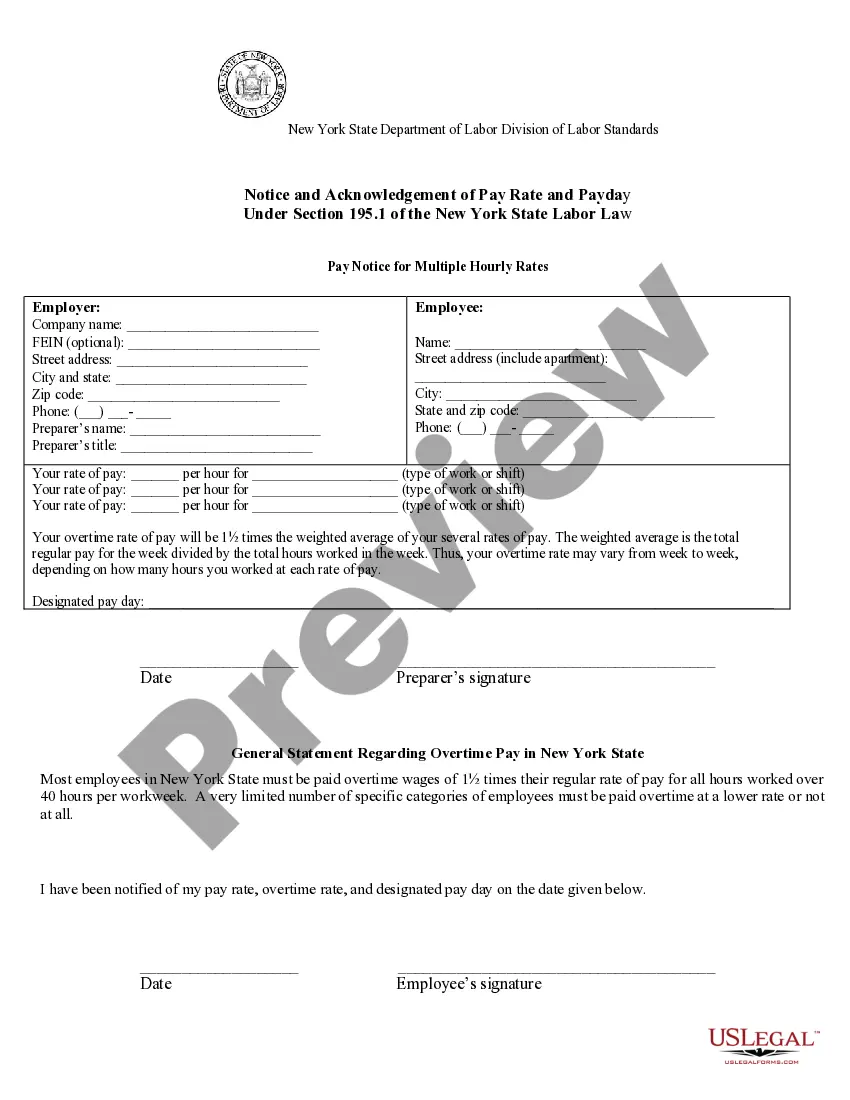

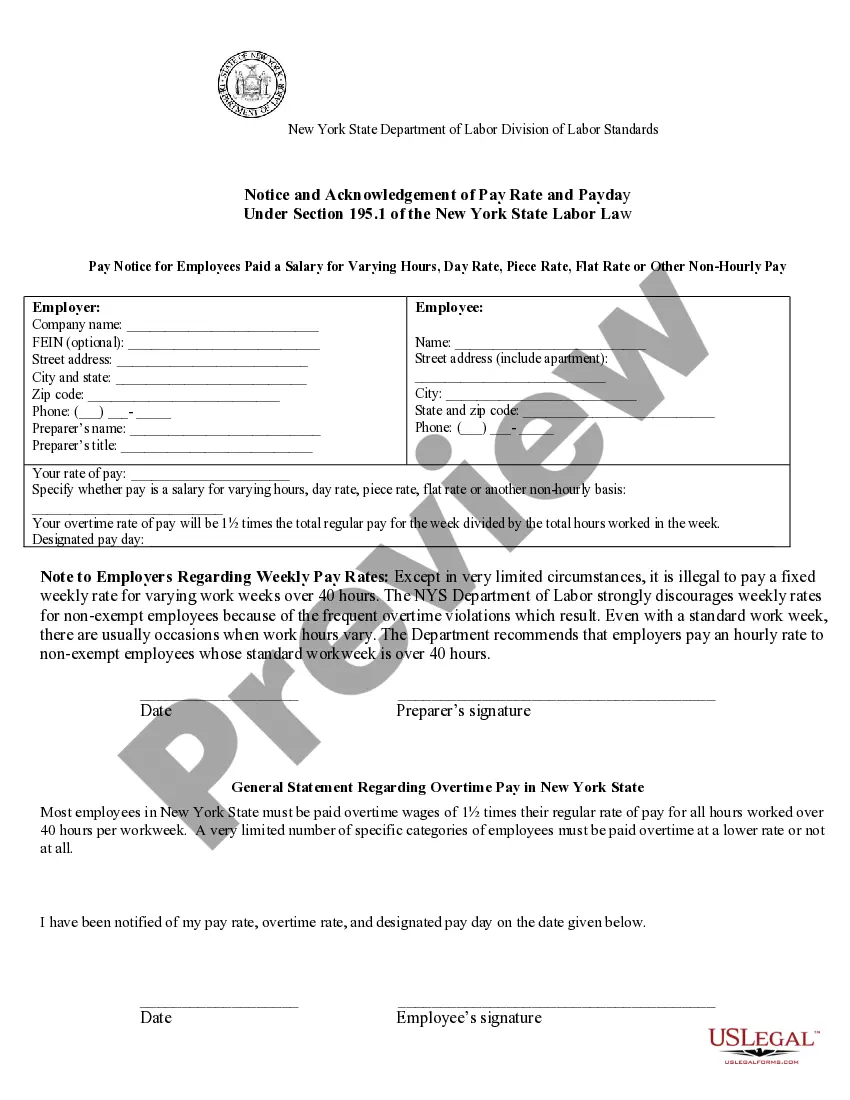

Rochester New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Prevailing Rate And Other Jobs - Notice And Acknowledgement Of Pay Rate And Payday?

If you are looking for a legitimate form, it’s exceedingly difficult to select a more suitable service than the US Legal Forms site – likely the most comprehensive libraries online.

With this collection, you can discover thousands of document templates for business and personal needs by types and locations, or keywords.

Utilizing our top-notch search function, obtaining the most recent Rochester New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the form. Choose the file format and save it on your device.

- Furthermore, the relevance of each document is confirmed by a team of expert attorneys that periodically review the templates on our platform and revise them according to the latest state and county regulations.

- If you are already familiar with our service and have an account, all you need to obtain the Rochester New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the very first time, simply adhere to the instructions outlined below.

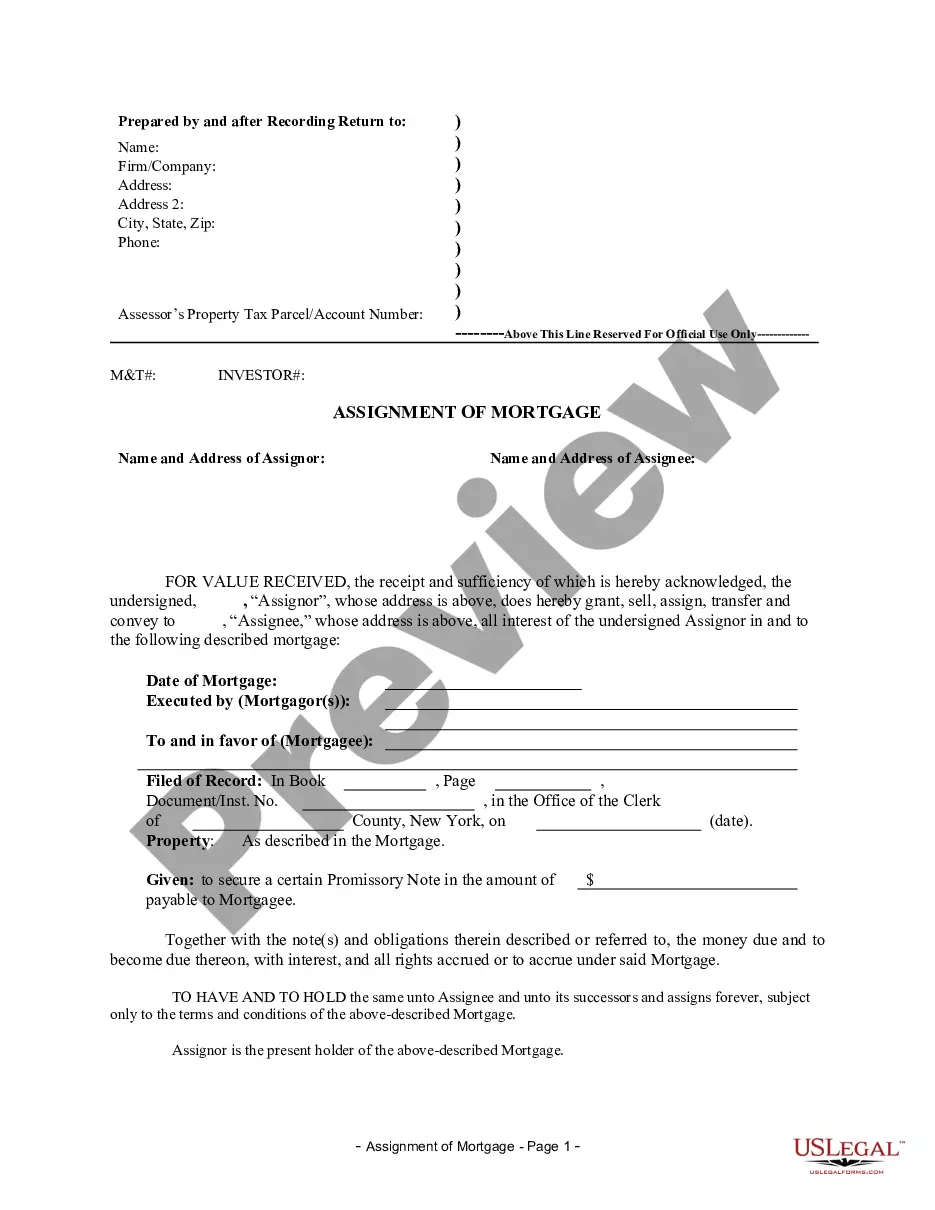

- Ensure you have found the form you need. Review its details and use the Preview feature to examine its content. If it doesn’t align with your requirements, utilize the Search option at the top of the page to locate the appropriate file.

- Validate your choice. Click on the Buy now button. After that, pick your desired pricing plan and submit details to create an account.

Form popularity

FAQ

The prevailing wage for construction laborers is in the range of $40 per hour, with overtime at $60 and double pay at $80 per hour for Sundays and holidays. With penalties, this can be as much as $240 per hour for unpaid overtime in prevailing wage jobs.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

Salespeople are entitled to all ?earned? commission pay, even after they quit or are terminated from their position. Regardless of which party ends the contract, salespeople must receive earned commission pay, which is legally considered wages under labor law and laws for commission pay.

The prevailing wage rate is the basic hourly rate paid on public works projects to a majority of workers engaged in a particular craft, classification or type of work within the locality and in the nearest labor market area (if a majority of such workers are paid at a single rate).

Connecticut has the highest mentioned prevailing wage threshold at $1,000,000 for its new construction landscape. This means that developers are often required to pay their workforce an average wage rather than a minimum one if they are on a federal contract.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

The State of New York requires that employers tell their employees what their compensation will be in plain terms. The compensation could be paid out hourly, daily, weekly, or monthly. If the salary is paid weekly, then the employer should clearly explain to the employee the number of hours covered by the weekly rate.

Home > Prevailing Wage Per hour:Electrician Wireman/ Technician07/01/2022Electrical/Technician Projectsunder $ 250,000.00$ 44.00+ 9.00113 more rows

The Minimum Wage Act (Article 19 of the New York State Labor Law) requires that all employees in New York State receive at least $14.20 an hour beginning December 31, 2022. Minimum wage rates differ based on industry and region.