Nassau New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday

Description

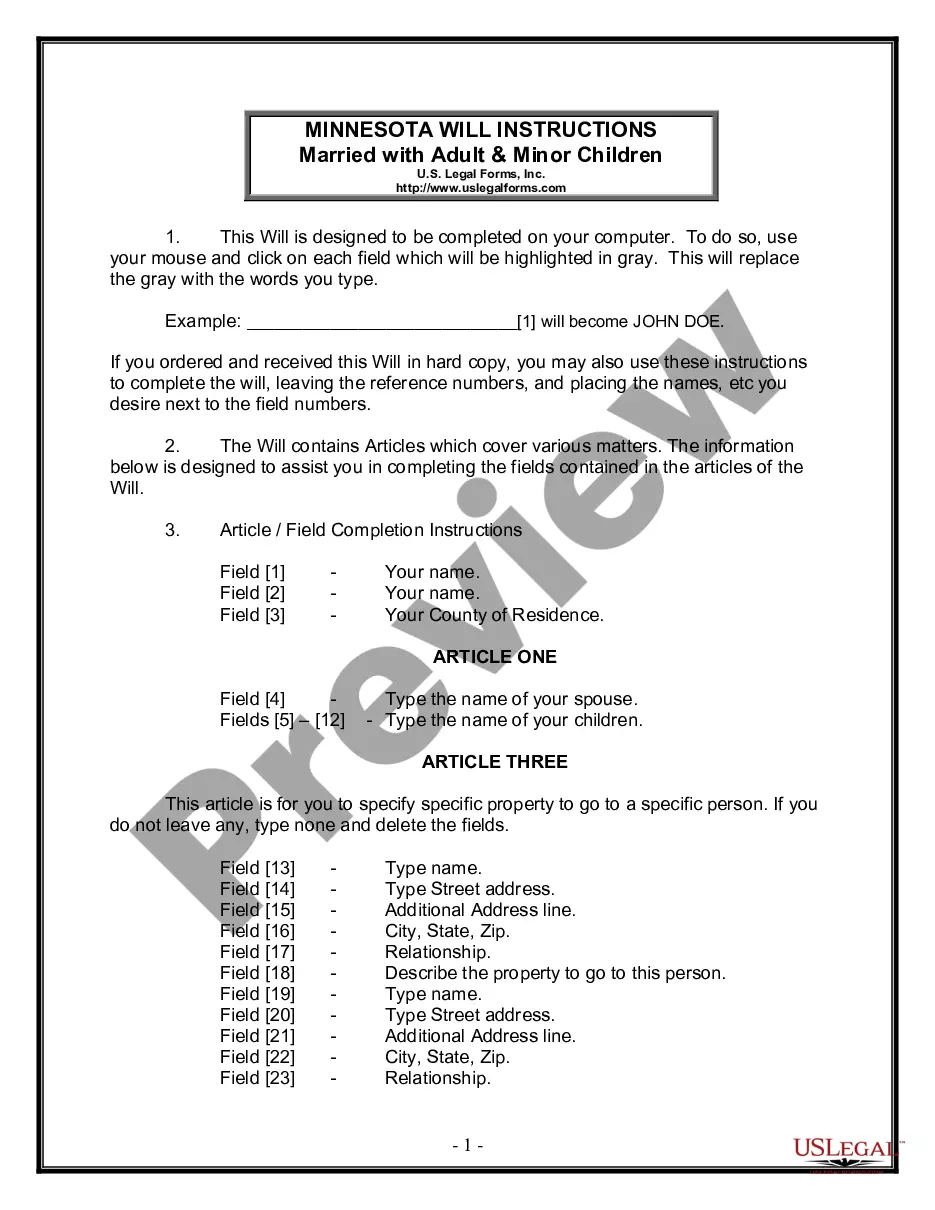

How to fill out New York Pay Notice For Hourly Rate Employees - Notice And Acknowledgement Of Pay Rate And Payday?

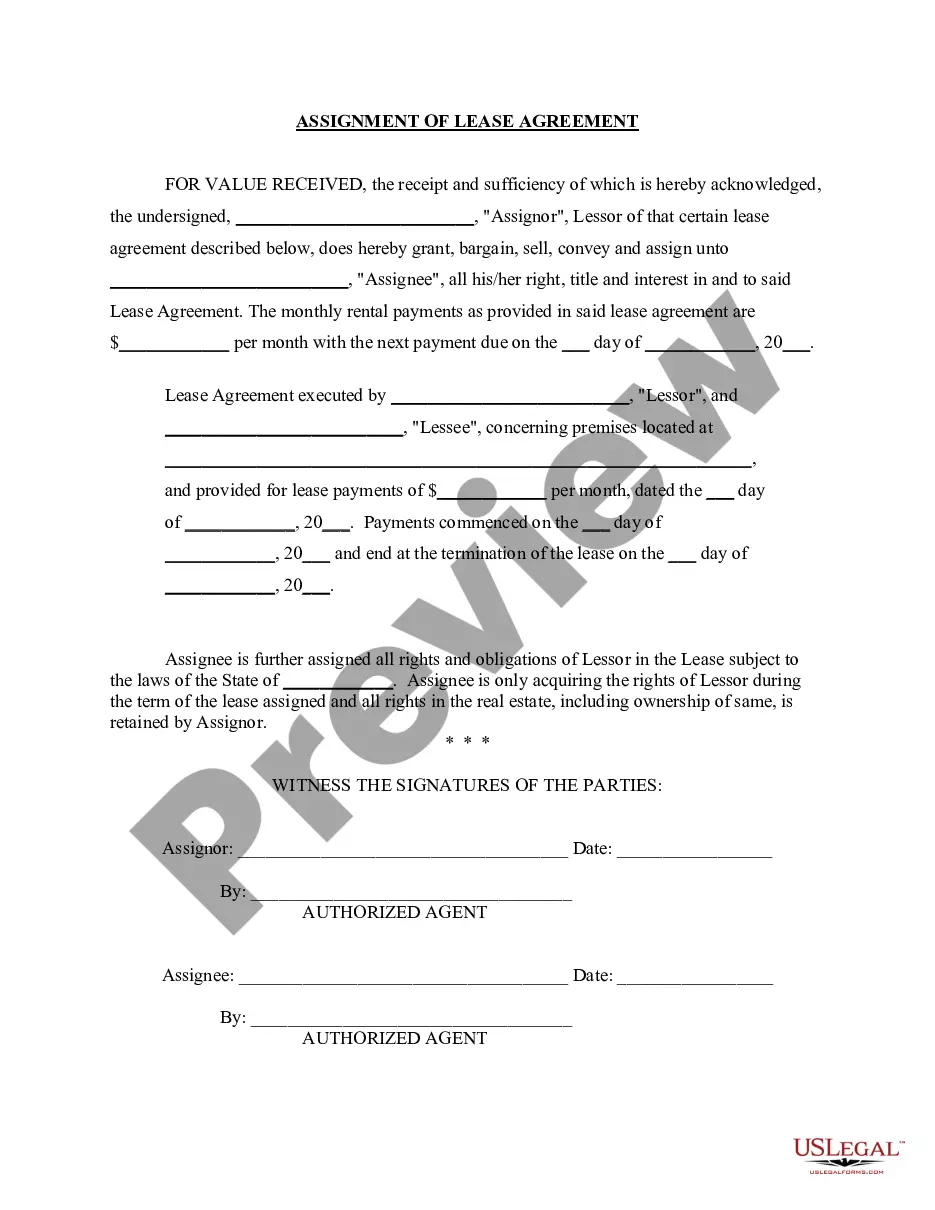

No matter one’s social or career position, finalizing legal paperwork is a regrettable necessity in the current occupational landscape.

Frequently, it’s nearly impracticable for individuals lacking any legal background to generate such documents from scratch, primarily due to the intricate language and legal subtleties they entail.

This is where US Legal Forms becomes useful.

Confirm that the template you have selected is appropriate for your region since the regulations of one state or locality do not apply to another.

Review the form and examine a brief summary (if available) of scenarios for which the document can be utilized.

- Our service offers a vast assortment comprising over 85,000 ready-to-use state-specific forms applicable for almost any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to enhance their efficiency time-wise using our DIY documents.

- Whether you are in need of the Nassau New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday or any other documentation suitable for your jurisdiction, US Legal Forms has everything readily available.

- Here’s how you can obtain the Nassau New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday in just a few minutes using our dependable service.

- If you are already a member, feel free to Log In to your account to acquire the necessary form.

- However, if you are not acquainted with our platform, ensure you adhere to these steps prior to downloading the Nassau New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday.

Form popularity

FAQ

Can they do this? Yes. If you are not in a union and do not have an employment contract, an employer may change the conditions of employment, including salary, provided that he or she pays at least the minimum wage and any required overtime, and continues to follow any other applicable laws.

Employers in New York may not make deductions from an employee's pay unless they are either required by law or allowed by law; if it is only allowed, the employee must agree to the deduction in writing. Deductions are allowed for the following: Insurance premiums. Prepaid legal plans.

Your employer can only make a deduction from your pay if: your contract specifically allows the deduction. it was agreed in writing beforehand. they overpaid you by mistake.

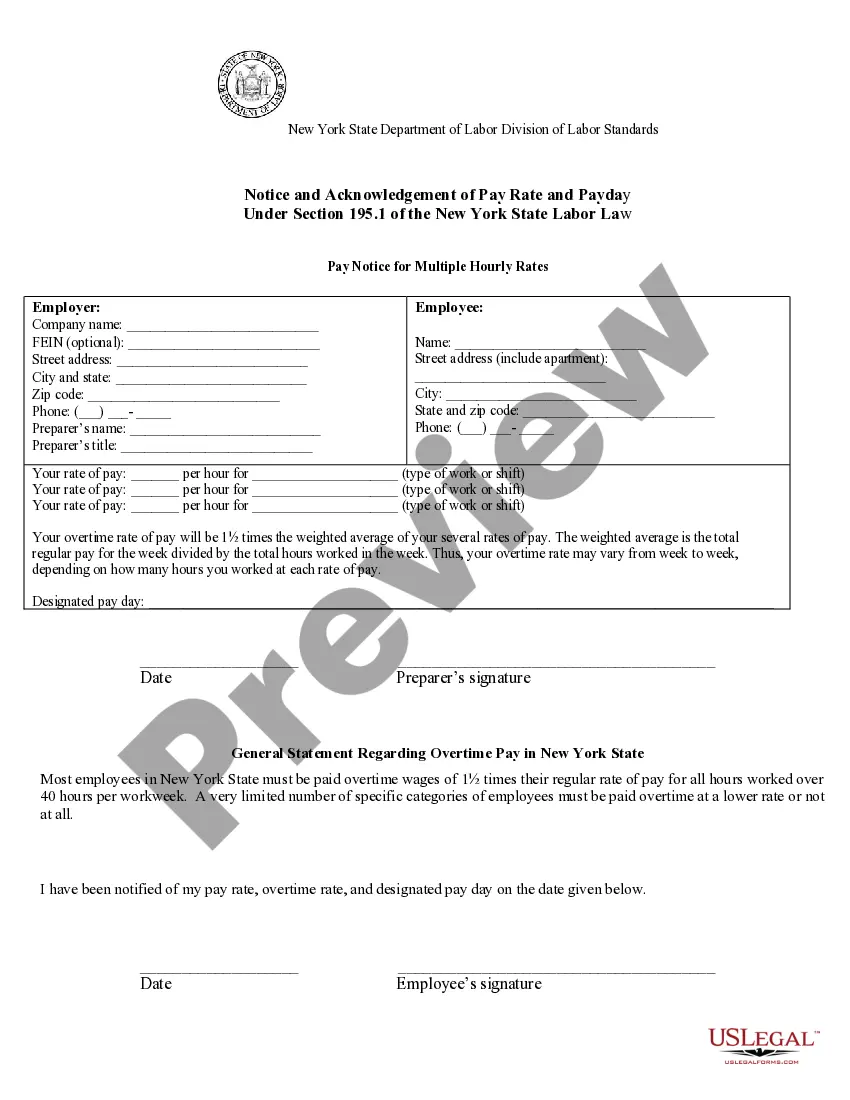

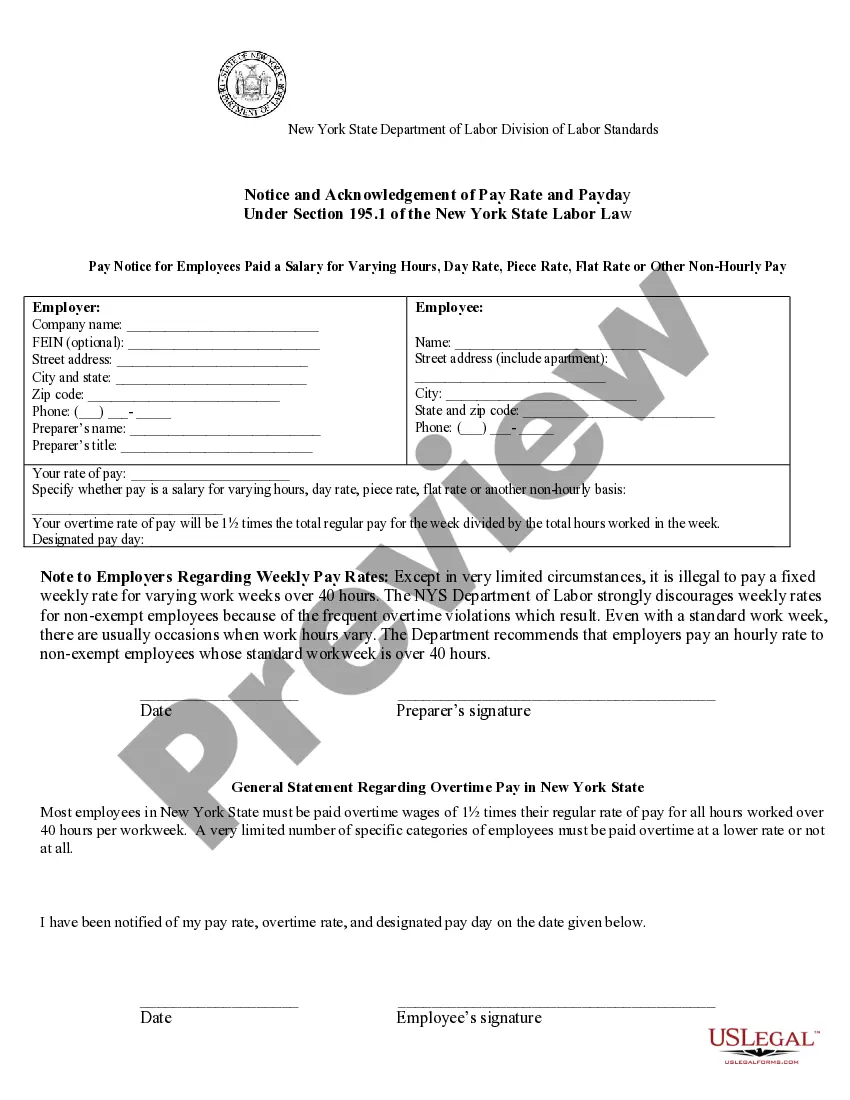

LS 54 Notice for Hourly Rate Employees This form is for hourly employees who are not exempt from coverage under the applicable State and Federal overtime provisions. For example, use for an employee whose regular rate of pay is $10 per hour and overtime rate is $15 per hour.

Rules for making deductions from your pay Your employer is not allowed to make a deduction from your pay or wages unless: it is required or allowed by law, for example National Insurance, income tax or student loan repayments. you agree in writing to a deduction. your contract of employment says they can.

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law.

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

Section 193, subdivision 1(c), of the New York State Labor Law permits an employer to make deductions from an employee's wages for ?an overpayment of wages where such overpayment is due to a mathematical or other clerical error by the employer.? Such deductions are only permitted as follows: (a) Timing and duration.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)