Kings New York Assignment to Living Trust

Description

How to fill out New York Assignment To Living Trust?

Regardless of social or occupational standing, completing legal-related paperwork is a regrettable requirement in the modern world.

Too frequently, it’s nearly impossible for an individual with no legal expertise to create such documentation from scratch, mainly because of the complex language and legal nuances it entails.

This is where US Legal Forms provides assistance.

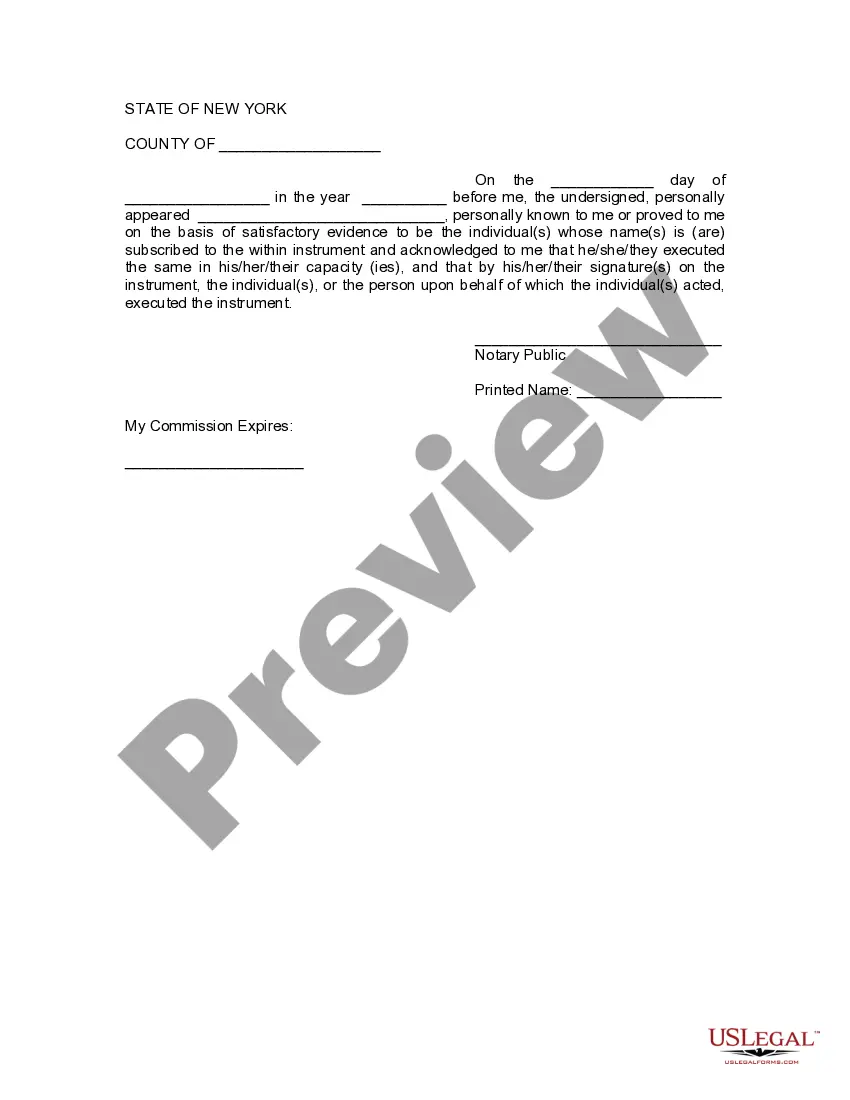

Ensure the template you have located is appropriate for your region as the laws of one state or area are not applicable to another.

Preview the document and read a short description (if available) of the situations where the form can be utilized.

- Our service features an extensive repository with over 85,000 ready-to-use state-specific templates applicable to nearly any legal situation.

- US Legal Forms also serves as a valuable tool for associates or legal advisors seeking to enhance their efficiency using our DIY forms.

- Whether you need the Kings New York Assignment to Living Trust or any other document that will be recognized in your state or area, US Legal Forms places everything at your disposal.

- Here’s how to quickly obtain the Kings New York Assignment to Living Trust using our dependable service.

- If you are already a registered user, you can proceed to Log In to your account to download the needed form.

- However, if you are not familiar with our library, make sure to follow these steps before acquiring the Kings New York Assignment to Living Trust.

Form popularity

FAQ

To transfer property to a trust in New York, complete a new deed that designates the trust as the new owner. Using a Kings New York Assignment to Living Trust can streamline this process. Be sure to consult with a legal expert or access USLegalForms to understand the necessary steps and requirements accurately.

Encouraging your parents to put their assets in a trust, like a Kings New York Assignment to Living Trust, can provide significant benefits. It offers protection from probate and can simplify asset distribution. However, it's important to weigh these advantages against any potential downsides, so consulting a legal professional is advisable.

Placing assets in a trust, such as a Kings New York Assignment to Living Trust, can present challenges, including maintenance responsibilities. There's also the risk of incurring additional fees for management and potential tax implications. Understanding these drawbacks can help you maintain your finances effectively.

To transfer property into a trust in New York, you'll first need to execute a deed that transfers ownership to the trust. Utilizing a Kings New York Assignment to Living Trust makes this process straightforward. You should consult with a legal expert or use resources from USLegalForms to ensure all documents are correctly filled out and filed.

Transferring property to a trust, like a Kings New York Assignment to Living Trust, offers several advantages, including avoiding probate and maintaining privacy. It allows for a smooth transition of assets to your beneficiaries without the lengthy legal process. Additionally, it can offer protection against creditors and provide greater control over how assets are distributed.

To file a living trust in New York, start with drafting a trust document that details your wishes. You can establish a Kings New York Assignment to Living Trust by working with a legal professional or using platforms like USLegalForms to ensure compliance with local laws. Once drafted, the trust must be funded by transferring assets into it.

Family trusts, such as a Kings New York Assignment to Living Trust, may have limitations related to distribution flexibility. If not structured appropriately, they can also create tax liabilities that affect the overall value of the assets. It's essential to carefully plan to avoid these potential pitfalls.

Trust funds, including those established under a Kings New York Assignment to Living Trust, can sometimes lead to family conflicts. These funds may also impose restrictions on asset usage, complicating finances for beneficiaries. Moreover, if not properly managed, they can generate unnecessary tax burdens.

While placing your house in a trust like a Kings New York Assignment to Living Trust can provide benefits, there are some downsides. You might face initial costs associated with setting up the trust. Additionally, there can be complexities regarding property taxes and maintenance, as the trust must be managed properly to preserve financial benefits.

One of the biggest mistakes parents make when setting up a trust fund is not properly funding it. Without adding assets to your Kings New York Assignment to Living Trust, it remains inactive, failing to serve its intended purpose. Additionally, parents often overlook updating beneficiaries, which can lead to confusion and disputes later. To avoid these pitfalls, consider using a comprehensive platform like uslegalforms to guide you through each crucial step.