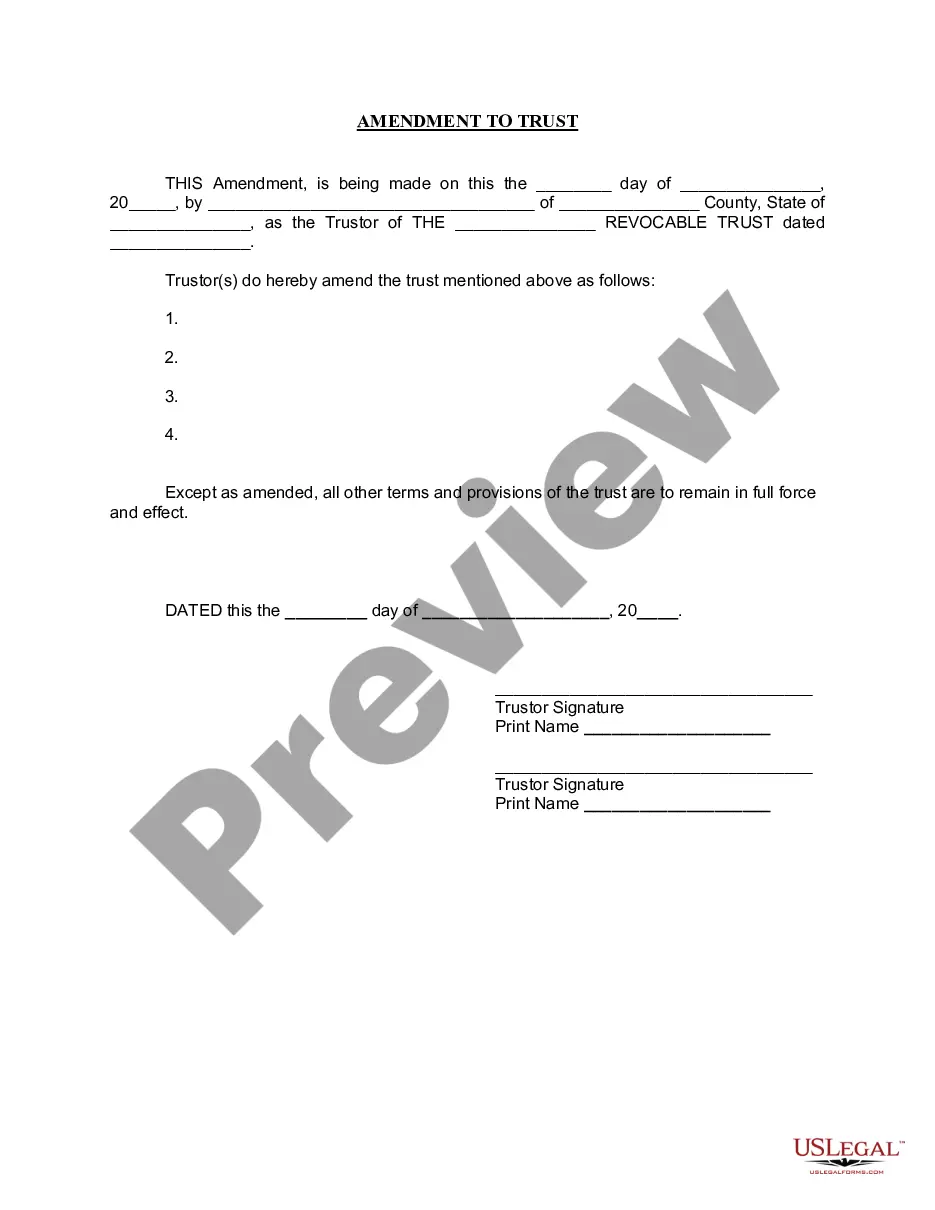

Nassau New York Amendment to Living Trust

Description

How to fill out New York Amendment To Living Trust?

If you have previously utilized our service, Log In to your account and store the Nassau New York Amendment to Living Trust on your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have lifetime access to all documents you have purchased: you can find them in your profile under the My documents section whenever you need to use them again. Utilize the US Legal Forms service to easily find and save any template for your personal or professional requirements!

- Ensure you have found the correct document. Review the description and utilize the Preview option, if offered, to ascertain if it fulfills your requirements. If it does not, use the Search tab above to find the suitable one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Nassau New York Amendment to Living Trust. Choose the file format for your document and save it to your device.

- Complete your sample. Print it or make use of professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To make an addendum to a living trust in Nassau, you need to prepare a document that clearly states your intent to modify the original trust. This document should specify the changes you want to implement, ensuring consistency with the existing trust terms. After drafting the addendum, you need to sign it in the presence of a notary to give it legal validity. Consider using a service like US Legal Forms to access templates tailored for creating an effective Nassau New York Amendment to Living Trust.

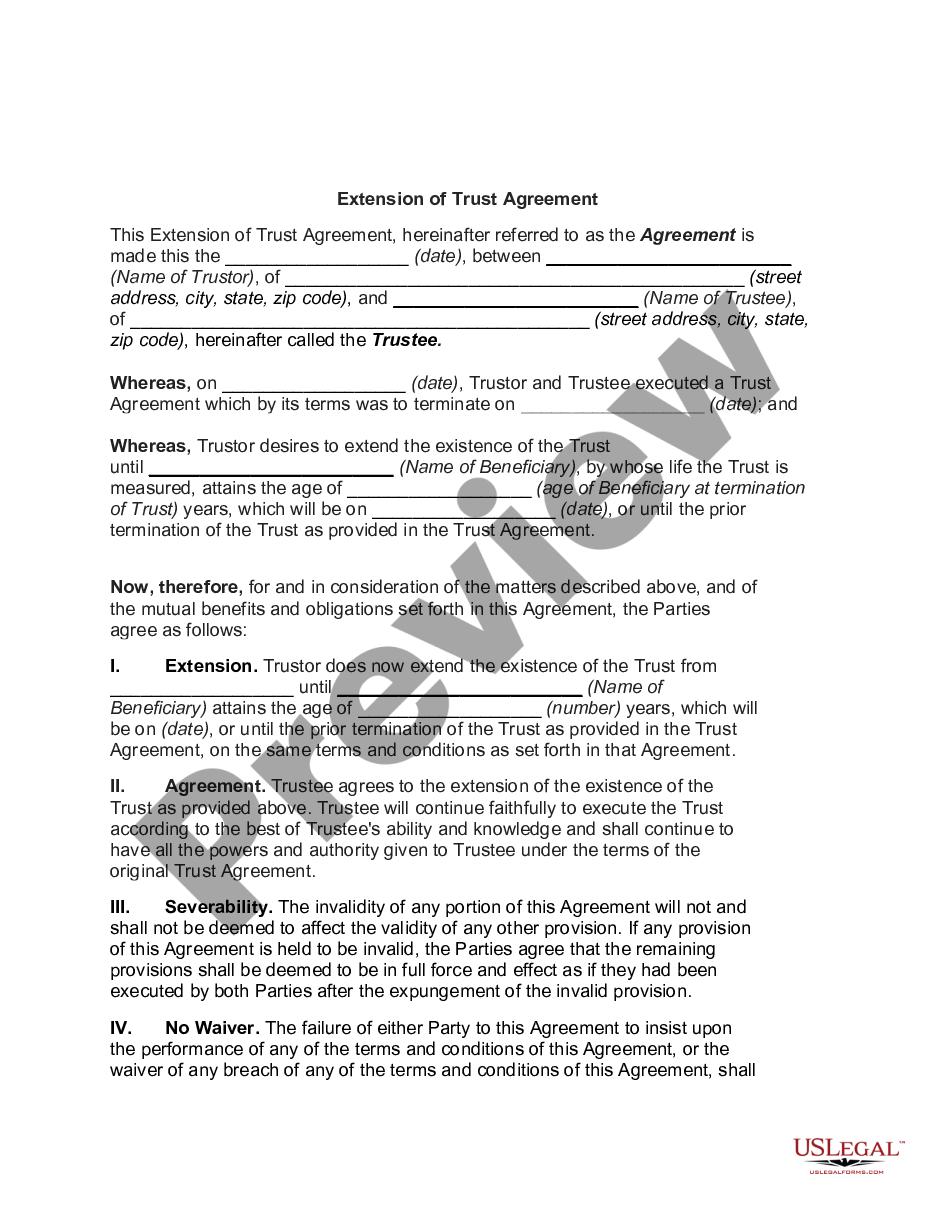

The ability to amend a trust usually lies with the grantor, or the person who created the trust. If the grantor is still living and mentally competent, they can make changes as desired, including a Nassau New York Amendment to Living Trust. If the grantor has passed away, changes can typically only be made through the terms of the trust after consulting with a legal professional for guidance.

Amending a trust is typically a straightforward process, especially if the trust document includes clear provisions for amendments. However, complexity may arise depending on the nature of the changes and state regulations, particularly with a Nassau New York Amendment to Living Trust. Taking advantage of professional legal services or platforms like USLegalForms can help ensure that the amendment complies with all necessary legal requirements.

Writing an amendment to a living trust involves several important steps. You need to clearly state that the document serves as an amendment, reference the specific trust being amended, and outline the changes you wish to make. For a smooth experience, consider utilizing resources from USLegalForms, which offers templates tailored for a Nassau New York Amendment to Living Trust, making the drafting process easier.

A codicil is a legal document that modifies an existing will, while an amendment to a trust specifically alters the terms of a living trust. When considering a Nassau New York Amendment to Living Trust, it's crucial to understand that an amendment updates the trust agreement itself, making it essential for managing assets or changing beneficiaries. Essentially, a codicil applies to wills, whereas an amendment directly affects trusts.

The 5-year rule for trusts refers to the Medicaid eligibility guidelines that affect asset transfers within five years of applying for benefits. If assets are transferred to a trust, such as a Nassau New York Amendment to Living Trust, during this period, it may impact eligibility for Medicaid. Understanding how this rule applies to your situation is essential for effective estate planning. Consulting with an expert can provide clarity and help you navigate these rules.

To amend a trust in New York, one must create a document specifying the changes to be made. This document should be executed with the same formalities as the original trust, ensuring it follows state laws. Additionally, keeping clear records of amendments is crucial for future reference. For further assistance, consider using platforms like uslegalforms, which provide resources for amending trusts.

A common mistake parents make when establishing a trust fund is not updating it regularly. Life changes, like births, deaths, or major financial shifts, can impact their original intentions. If they neglect to amend the trust, the Nassau New York Amendment to Living Trust may not reflect their current wishes. Regular consultations with a legal advisor can help avoid this pitfall.

The downside of placing assets in a trust, like the Nassau New York Amendment to Living Trust, is the loss of direct control over those assets. Once assets are transferred into a trust, the trustee manages them according to the trust terms. This setup can limit personal access or flexibility. It's crucial to consider whether this aligns with your overall financial strategy.

One disadvantage of a family trust, including a Nassau New York Amendment to Living Trust, is the potential for high administrative costs. If family members do not understand the trust's terms, it can create tensions or disputes. Additionally, family trusts might also require ongoing management, which can be time-consuming. It's essential to weigh these factors against the potential benefits.