Yonkers New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out New York Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children?

Leverage the US Legal Forms and gain immediate access to any form template you need.

Our user-friendly website with a plethora of documents simplifies the process of locating and acquiring nearly any document sample you need.

You can save, complete, and sign the Yonkers New York Living Trust for Individuals Who are Single, Divorced, or Widowed with Children in merely a few minutes rather than spending hours searching the internet for a suitable template.

Using our catalog is an excellent way to enhance the security of your form filing.

Access the page with the form you require. Ensure that it is the template you were seeking: verify its title and description, and use the Preview option when it is offered. Otherwise, utilize the Search field to find the one you need.

Initiate the downloading process. Click Buy Now and select your preferred pricing plan. Then, create an account and complete your order using a credit card or PayPal.

- Our qualified attorneys routinely review all the documents to confirm that the templates are suitable for a specific region and comply with current laws and regulations.

- How do you retrieve the Yonkers New York Living Trust for Individuals Who are Single, Divorced, or Widowed with Children.

- If you have an account, simply Log In to your profile. The Download button will be activated on all the documents you view.

- Moreover, you can find all previously saved documents in the My documents section.

- If you do not possess an account yet, follow the steps below.

Form popularity

FAQ

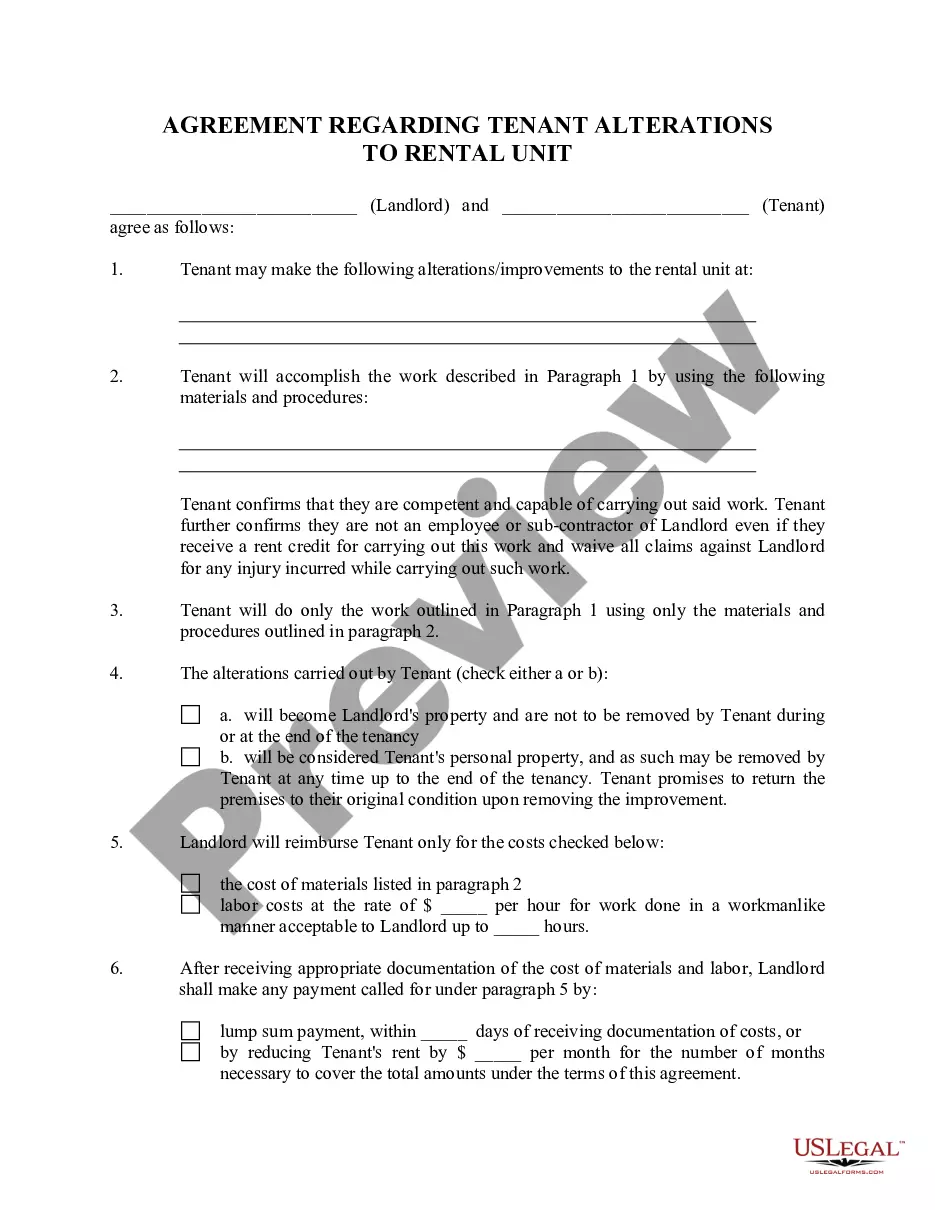

A trust may become irrevocable upon the death of one spouse, depending on its terms. In many cases, the trust transitions to a new structure that cannot be altered. For individuals looking into a Yonkers New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, understanding the implications of irrevocability is essential to ensure the proper management of your estate.

When one individual in a trust passes away, the trust typically remains valid, but the management may change. The successor trustee usually steps in to handle the trust according to its terms. For those considering a Yonkers New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, this provides ongoing management and protection of your assets for your beneficiaries.

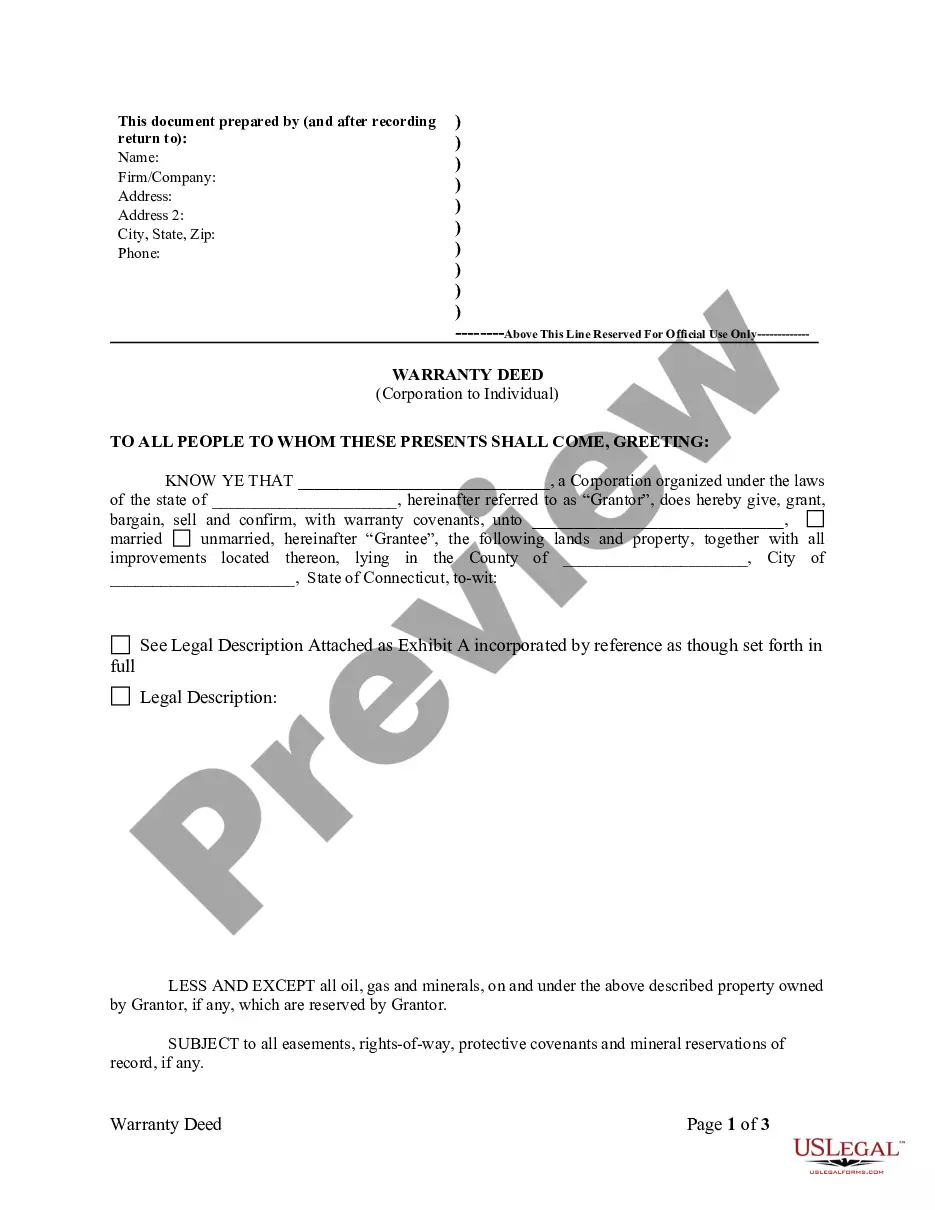

To file a trust in New York, you must first create a trust document outlining your intentions and the assets involved. You may need to sign this document before a notary. Utilizing platforms like uslegalforms can simplify the process of establishing a Yonkers New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, making sure everything is completed correctly.

When one spouse dies, the trust may remain functional depending on its structure. Typically, the surviving spouse continues to manage the trust, which can provide financial security for children. For a Yonkers New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, this ensures that assets are distributed according to your wishes, protecting your loved ones.

After the death of your spouse, it is crucial to avoid making hasty financial decisions. You should not rush into selling joint assets immediately or changing account beneficiaries. It’s wise to consult with a legal professional, especially regarding a Yonkers New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, to ensure your rights and assets are protected.

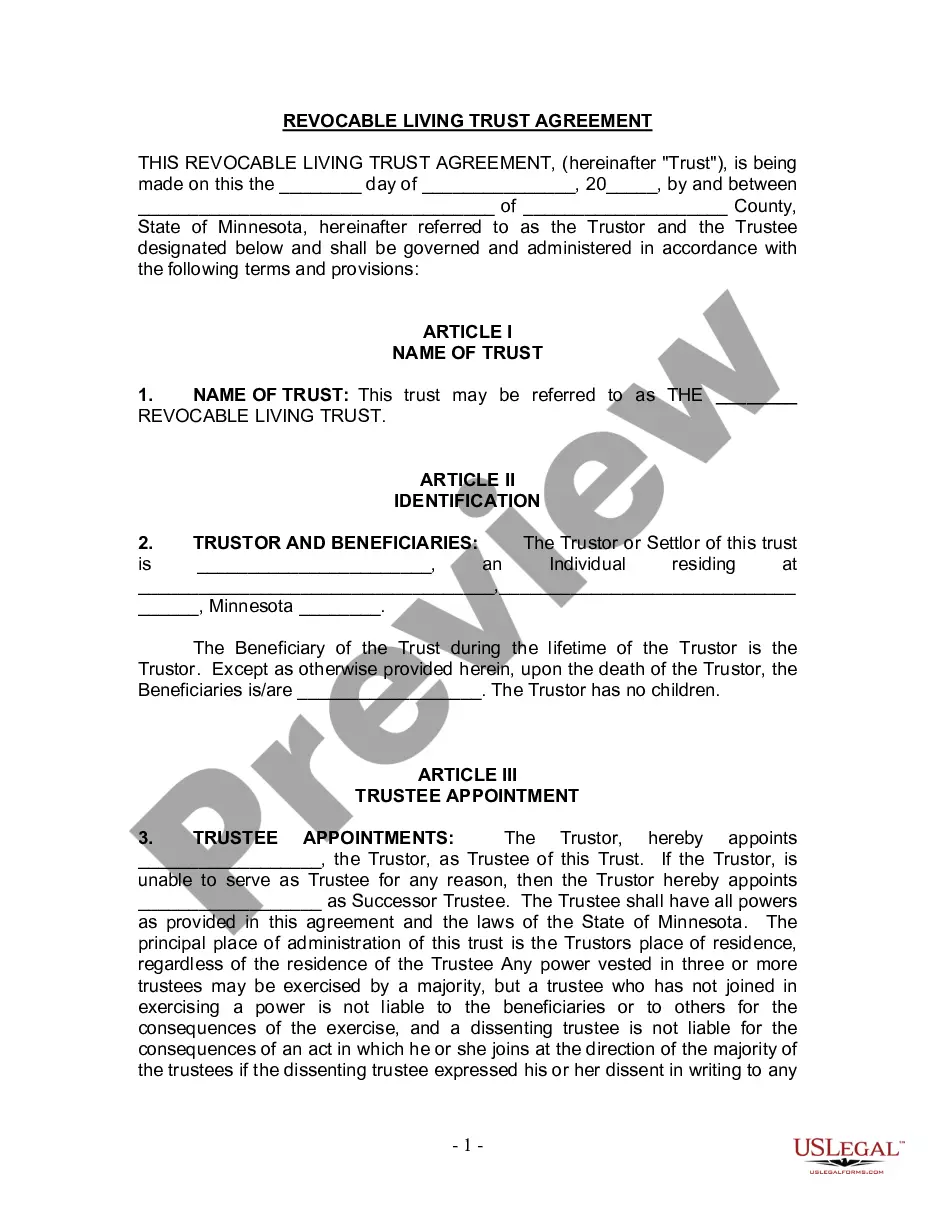

The most economical way to create a living trust is to use an online legal service. Platforms like US Legal Forms offer affordable resources and templates to help you draft a living trust without the high fees associated with hiring an attorney. This approach is especially beneficial for individuals who are single, divorced, or widowed with children in Yonkers, New York, looking to secure their family's financial future.

One of the biggest mistakes parents make when creating a trust fund is not involving their children in discussions about the trust. This can lead to misunderstandings or conflicts later on. Additionally, parents often overlook updating the trust as their circumstances change. For those creating a Yonkers New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, clear communication is essential to prevent such issues.

Obtaining a living trust in New York involves drafting and signing a trust agreement. You can do this by hiring an attorney or by using online resources such as US Legal Forms, which offers templates that simplify the process. Once established, you need to fund the trust with your assets. This approach protects your family and ensures your wishes are honored.

To set up a living trust in New York, start by deciding on the type of trust you need based on your situation. Then, create a trust document that includes details about your assets and beneficiaries, and designate a trustee to manage the trust. You can use platforms like US Legal Forms to guide you through the process, ensuring that your Yonkers New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children meets legal requirements.

A marital trust is created to benefit a spouse and provides financial support during their lifetime. On the other hand, a survivor's trust remains after the marital trust passes, benefiting children or other heirs. For individuals who are single, divorced, or widowed with children, understanding these distinctions is critical in choosing the best option for your estate plan in Yonkers, New York.