Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates

Description

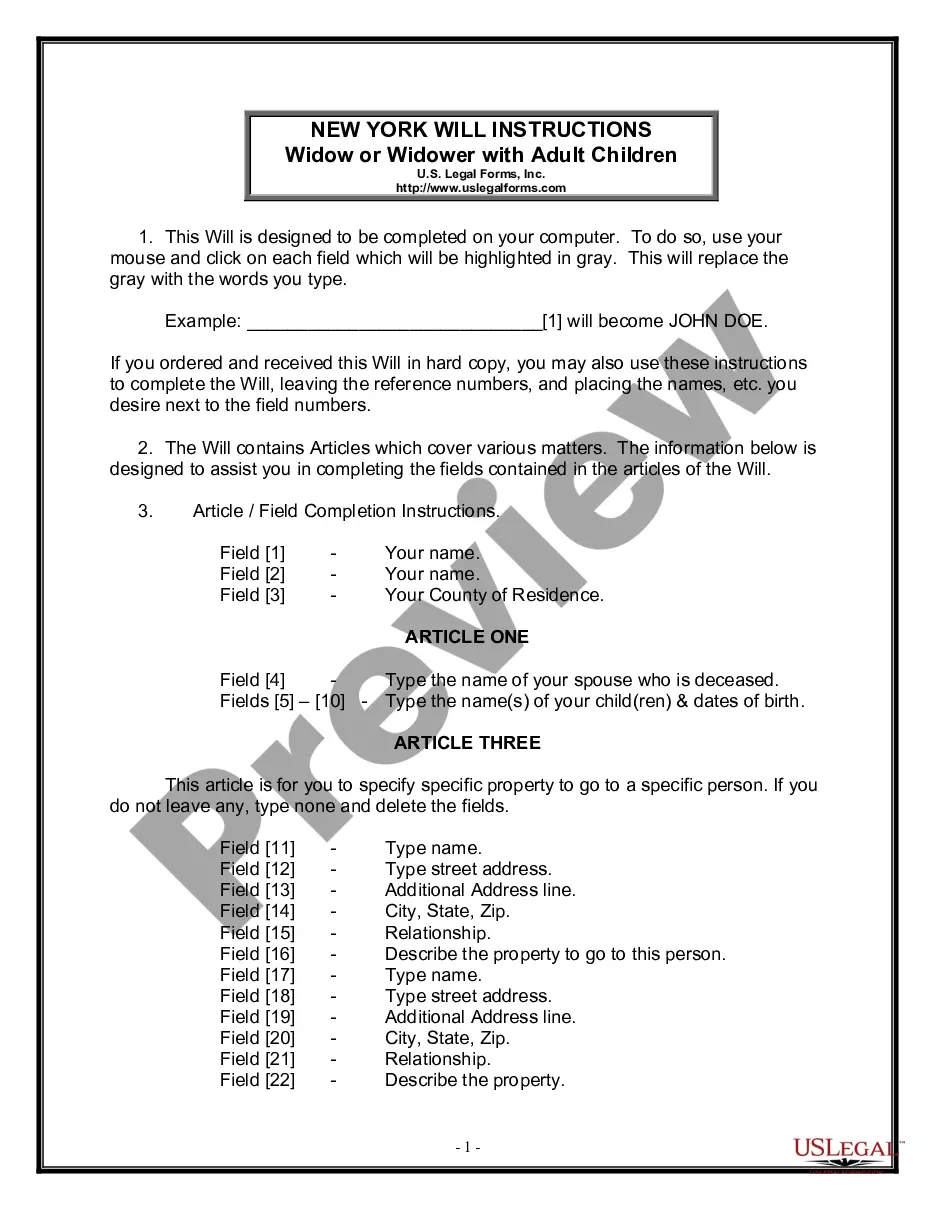

How to fill out New York Complex Will With Credit Shelter Marital Trust For Large Estates?

If you’ve previously utilized our service, Log In to your account and store the Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates on your device by selecting the Download button. Ensure your subscription is active. If not, renew it per your payment agreement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to reference it again. Leverage the US Legal Forms service to easily search for and save any template for your personal or business needs!

- Confirm you’ve found an appropriate document. Review the description and use the Preview feature, if accessible, to verify it aligns with your needs. If it doesn’t match, use the Search tab above to locate the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates. Select the file format for your document and download it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

A credit shelter trust is not the same as a marital trust, though they often work in conjunction. A credit shelter trust allows a married couple to utilize their estate tax exemptions effectively, protecting large estates from unnecessary taxes. On the other hand, a marital trust provides benefits for the surviving spouse and defers taxes until their death. Understanding the nuances between these trusts is essential, especially when creating a Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates, as it ensures effective estate planning for your family.

Choosing the right trust to minimize taxes depends on your unique situation, but typically, a credit shelter trust is highly effective for larger estates. This type of trust allows for significant tax savings by excluding assets from the surviving spouse’s estate. For those seeking guidance, using the services of US Legal Forms can simplify the creation of a Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates tailored to your tax needs.

Generally, assets held in a credit shelter trust do not receive a step up in basis upon the death of the grantor. This means that the market value of these assets at the time of death does not directly affect capital gains for the beneficiaries. It’s crucial to understand this aspect as it impacts tax planning with a Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates.

Upon the death of the individual who established it, a credit shelter trust remains intact and continues to serve its purpose. The assets within the trust are then managed for the benefit of the designated beneficiaries, following the outlined terms of the Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates. This structure helps to protect assets from estate taxes while providing for loved ones.

A credit trust, often part of a Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates, is designed to hold assets for the benefit of beneficiaries while minimizing estate taxes. In contrast, a marital trust allows a spouse to access the income and principal during their lifetime. Understanding these differences helps you choose the right strategy for your estate planning needs.

Income generated from a credit shelter trust is typically subject to taxation at the trust's tax rate. This means that, in many cases, the income is reported on the trust's tax return rather than on the beneficiaries' individual tax returns. Therefore, it's essential to understand how a Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates treats income to effectively plan for tax implications.

Beneficiaries of a trust fund can include family members, relatives, or even organizations, depending on the trust's terms. In a Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates, the designated beneficiaries often include the surviving spouse and children, ensuring financial security for loved ones. Clearly outlining beneficiaries in your trust documents is essential for effective estate planning. If you seek clarity on setting up beneficiaries, consider using platforms like uslegalforms to find the right resources.

A marital trust primarily directs assets to the surviving spouse, providing them with immediate access to the trust's benefits, whereas a credit shelter trust, as featured in a Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates, is designed to protect assets from estate taxes. The credit shelter trust allows the deceased's estate tax exemption to be utilized fully, ensuring that more wealth passes to heirs without incurring tax liabilities. This differentiation is key for those looking to maximize their estate's value and minimize taxes.

In a Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates, the primary beneficiary of a credit shelter trust often includes the surviving spouse. This structure allows the assets in the trust to benefit the spouse while also safeguarding them from estate taxes. By utilizing this trust, individuals can ensure that a significant portion of their wealth is preserved for future generations. Therefore, understanding the role of beneficiaries in these trusts is crucial for effective estate planning.

When the surviving spouse passes away, the assets in a credit shelter trust typically do not become part of their estate. Instead, these assets continue to be held in trust for the benefit of other heirs or beneficiaries as specified in the trust document. This ensures a seamless transfer of wealth and protection from estate taxes, maintaining the intent behind a Suffolk New York Complex Will with Credit Shelter Marital Trust for Large Estates.