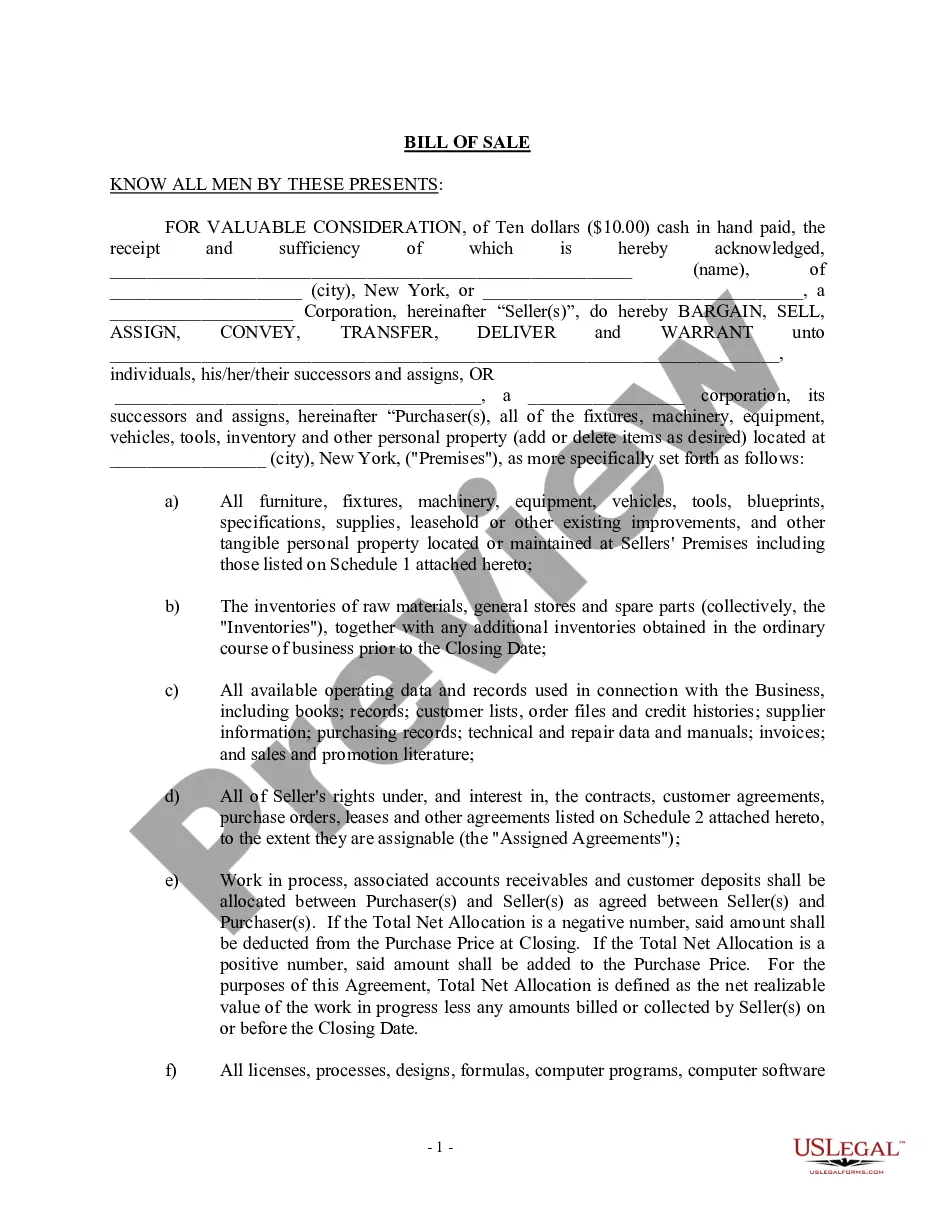

Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out New York Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our helpful website featuring a vast array of documents allows you to effortlessly locate and acquire nearly any document sample you desire.

You can save, fill out, and verify the Syracuse New York Bill of Sale related to the sale of a business by an individual or corporate seller in just a few minutes, rather than spending hours scouring the internet for an appropriate template.

Using our catalog is an excellent method to enhance the security of your document submission. Our experienced attorneys regularly review all documents to ensure that the forms are applicable for a specific area and adhere to any new laws and regulations.

US Legal Forms is among the most significant and trustworthy template libraries available online. Our organization is always prepared to assist you in any legal matter, even if it is just downloading the Syracuse New York Bill of Sale in association with the sale of a business by an individual or corporate seller.

Feel free to utilize our platform and make your document experience as seamless as possible!

- How do you access the Syracuse New York Bill of Sale in relation to the sale of a business by an individual or corporate seller.

- If you already possess a subscription, simply sign in to your account. The Download option will appear on all the samples you view.

- Additionally, you can retrieve all previously saved documents from the My documents section.

- If you haven’t created an account yet, follow the instructions below.

- Access the page with the template you need. Ensure that it is indeed the template you were looking for: check its title and details, and use the Preview option if available. Otherwise, use the Search bar to find the suitable one.

- Begin the downloading process. Click Buy Now and select your desired pricing plan. Then, create an account and process your order using a credit card or PayPal.

- Download the file. Specify the format to receive the Syracuse New York Bill of Sale regarding the sale of a business by an individual or corporate seller and modify and complete or sign it according to your requirements.

Form popularity

FAQ

A handwritten bill of sale can be legitimate, provided it captures all necessary information and signatures from both parties. When preparing your document, like a Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, make sure it details the transaction accurately. This adds authenticity and can be upheld in legal situations if properly formatted and agreed upon.

Tennessee does require a bill of sale for certain transactions, including vehicle sales and some business sales. While discussing the Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it's essential to consider similar requirements in Tennessee. Each state has unique regulations, so knowing your local laws will ensure compliance and smooth transactions.

For a bill of sale to be legally binding, it must include specific elements: identification of the parties, a description of the item or property being sold, clear terms of the sale, and the date of the transaction. When you create a Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, ensure that all these aspects are covered. This clarity helps protect both seller and buyer in future disputes.

Yes, the West Virginia DMV generally requires a bill of sale for vehicle transfers. Even though this pertains to vehicles rather than the sale of a business, understanding how a bill of sale functions can be helpful in drafting your Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. The bill details essential information about the transaction and can streamline the transfer process.

In New York, a bill of sale does not typically require notarization to be valid. However, having it notarized can add an extra layer of security and legitimacy, especially for significant transactions, such as a Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. This can help prevent potential disputes about the authenticity of the document.

In most cases, the seller initiates a bill of sale. This document outlines the terms of the sale and serves as proof of the transaction. When discussing a Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, the seller drafts the bill detailing the sale of the business and its assets. It is crucial for both parties to agree on the content before finalizing.

To close your business with the IRS, you must officially notify them of your business closure by filing the appropriate forms. If you have an EIN, ensure to cancel it and file your final tax return. It’s also important to maintain records of your last tax filings and transaction documentation. A Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can serve as a key record in this closure process.

In New York, the buyer of a privately sold car is responsible for paying the sales tax. The seller should provide the buyer with the necessary documentation, which includes a signed bill of sale. The buyer can then present this documentation to the Department of Motor Vehicles when registering the vehicle. A well-crafted Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can facilitate a smooth transaction.

To account for the sale of business assets, start by identifying each asset sold and determining its basis. Record the sale prices and resulting gains or losses in your accounting records. Accurate documentation, such as a Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, will help streamline this process and ensure compliance with tax regulations.

Yes, you can write your own bill of sale in New York. While it is recommended to consult a professional for complex transactions, a simple document that meets state requirements will suffice. Ensure you include pertinent details like buyer and seller information, item description, and sale terms. Utilize a Syracuse New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller to ensure completeness and legitimacy.